Andres Victorero

Inflation is the most lagging of all economic indicators. That is not up for debate. Therefore, the seeds of yesterday’s disappointing number were planted more than a year ago, while the seeds of tomorrows have barely emerged. That fell on deaf ears yesterday, as investors sold stocks in a panic after the Consumer Price Index increased 0.1% for the month of August instead of declining 0.1%, as the consensus expected. The annualized rate fell from 8.5% in July to 8.3%, affirming that June’s 9.1% rate was the peak, but the core rate that excludes food and energy rose 0.6% in August, which was double expectations. The annualized core rate rose for the first time in six months to 6.3%, but that was still below the peak of 6.5% in March. Food, rent and housing inflation have reignited the debate about whether the peak rate is behind us, but yesterday’s numbers have not altered my conviction that we will continue to see a gradual decline in the headline numbers over the next 12 months.

Finviz

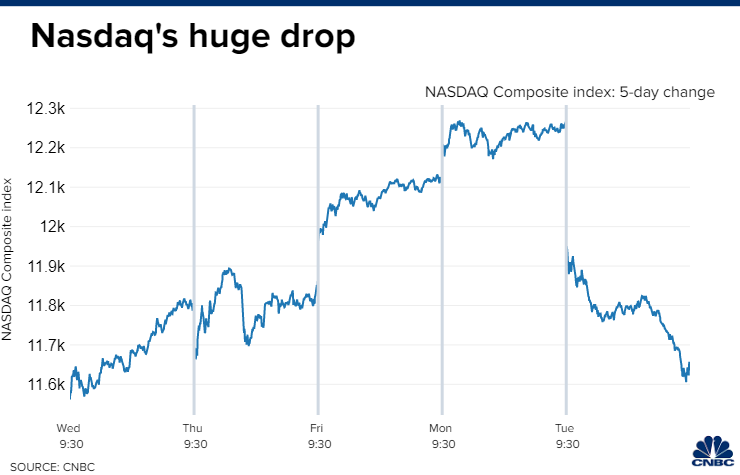

The surge in energy prices was the primary inflationary concern six months ago, but as oil approaches levels where the annual change will fall to zero, investors have shifted their focus to other categories. The plunge in commodity prices has also been ignored, despite the fact that these feed into the producer prices and transportation costs that fueled price increases we are still seeing in other categories today. It takes time. The 5% decline in the Nasdaq Composite was the largest one-day sell off since June 2020, but the reality is that the index simply gave back the prior four days of gains. This looks like another pullback to refresh.

CNBC

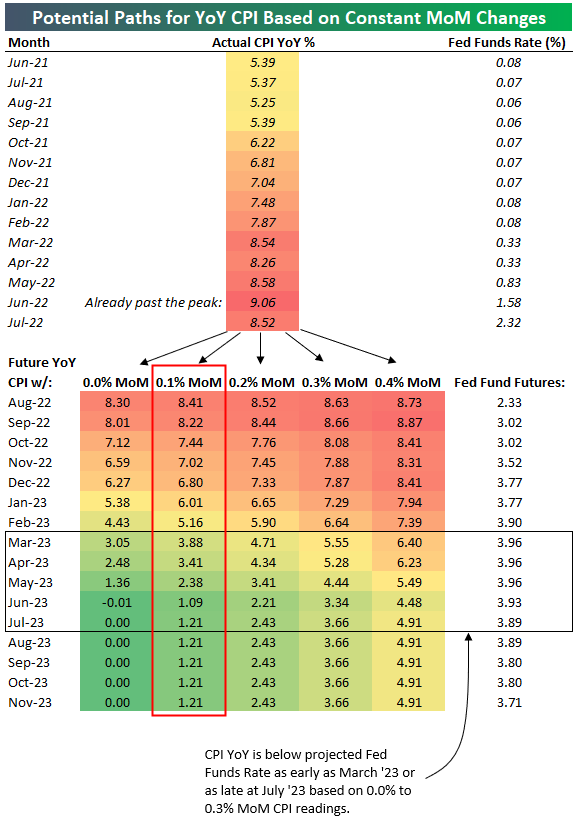

I think the greatest driver of lower price increases, which the consensus is ignoring, is the math behind base effects. The current double-digit price increases we are seeing in specific components of the inflation index are unsustainable. For example, the typical rent in the U.S. in August was approximately $2,090, according to the Zillow Observed Rent Index. That was a 12.3% increase over the past 12 months, but down from the peak of 17% in February. Multifamily rents averaged $1,718 in August, which was a decrease from the prior month, realizing its first monthly decline since June 2020. Energy was the tip of the spear on the way up, and now it is the tip on the way down. Other categories will follow.

Bespoke Investment Group provided the excellent chart below to show how the base effect will bring the inflation rate down to the Fed’s target by simply repeating the 0.1% increase in the headline number we saw last month between now and next May.

Bespoke

My greater concern is how the Fed responds to this lagging indicator. It irresponsibly waited until the CPI hit 8.5% to start raising short-term interest rates under the guise that the increase in prices was transitory. Now its rhetoric suggests it will raise interest rates too much under the guise that the current rate of inflation is entrenched when it is not. It needs to allow what will soon be 300 basis points of rate increases over the past six months to filter through the economy. That will slow the rate of economic growth over the coming year. In combination with the base effect, it should be enough to realize its target of 2-3%. I think any hawkish talk we see moving forward is designed to keep inflation expectations capped at levels where they currently stand. The Fed has won that battle.

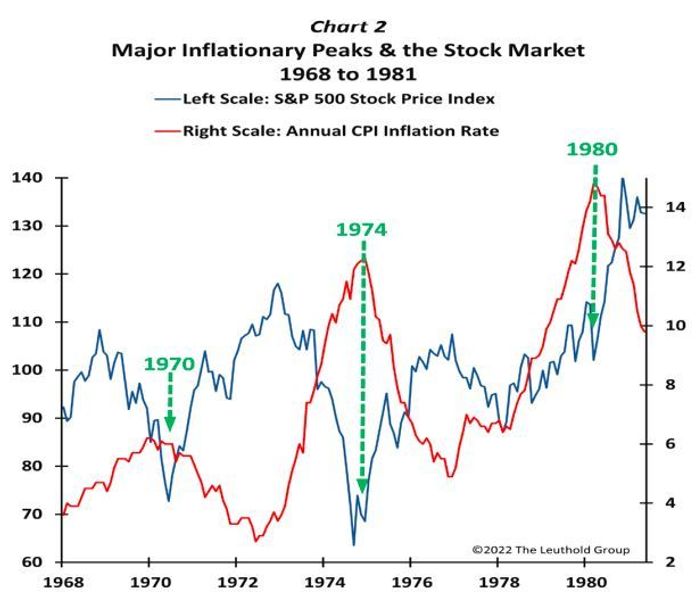

As I mentioned yesterday, provided we have seen the peak in the annualized rate, which is my base case, the S&P 500 should post gains over the coming year. That is the powerful precedent from prior inflationary periods.

Yahoo Finance

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment