nevarpp/iStock via Getty Images

For the Lipper Refinitiv fund-flows week ended March 9, 2022, equity funds took it on the chin, declining 2.27%, and on a year-to-date basis, losing 9.73% on average.

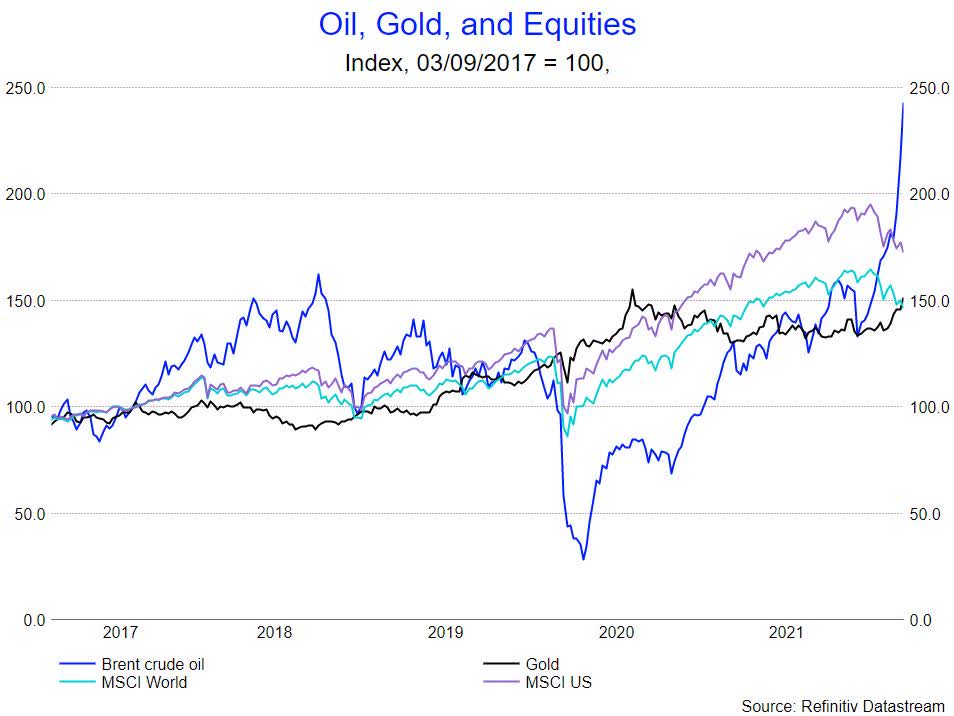

Markets were roiled during the fund flows week as investors considered the impacts that skyrocketing commodity prices, the Russia-Ukraine conflict, and Federal Reserve policies might have on the global economy and markets.

The Dow Jones Industrial Average entered market correction territory, declining 11% from its January 4 record high, while the Nasdaq Composite entered bear market territory, declining more than 20% from its November 2021 highs during the fund-flows week.

Some of those deep losses were partially offset by a strong one-day turnaround for stocks on Wednesday, March 9, as stocks rose, oil declined, and investors awaited news on Ukraine-Russia talks. The one-day rally occurred after the Russian and Ukrainian foreign ministers agreed to meet in Turkey to find diplomatic solutions to the ongoing hostilities.

With gasoline prices jumping 38% in February from a year ago, food prices rising 8.6%, and the February consumer price index rising 7.9% – a 40-year high – it’s of little wonder that investors are focusing on inflation-related products. And while front-month crude oil future prices declined to $108.70 per barrel (bbl) on Wednesday from the weekly high of $123.70/bbl a day before, inflation-sensitive fund classifications thrived during the week.

Oil, gold and equities (Author)

The Precious Metals Equity Funds classification (gold miners and the like) posted the strongest weekly returns in the equity universe, rising 7.04%, followed by Natural Resources Funds (+5.84%), Alternative Energy Funds (+4.24%), Commodities Precious Metals Funds (+3.44%), and Global Natural Resources Funds (+3.33%).

On the flip side, China Region Funds (-7.64%) took the biggest drubbing during the week, bettered by Pacific ex-Japan Funds (-5.05%), Emerging Markets Funds (-4.88%), and Global Science & Technology Funds (-4.67%).

Investors were overall net redeemers of fund assets (including those of conventional funds and ETFs) for the first week in three, withdrawing a net $20.2 billion for the Refinitiv Lipper’s fund-flows week ended March 9, 2022.

Fund investors were net purchasers of equity funds (+$12.5 billion) while being net redeemers of money market funds (-$26.2 billion), taxable bond funds (-$5.8 billion), and tax-exempt fixed income funds (-$662 million) for the week.

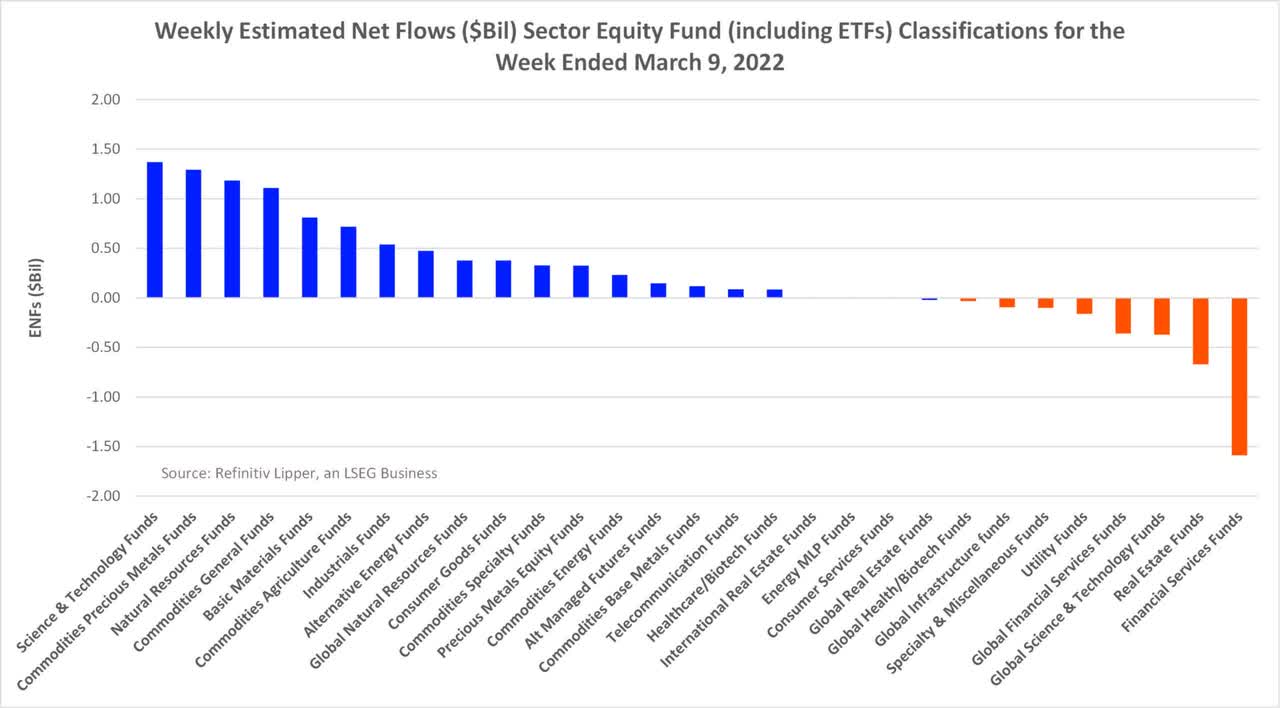

While both ETF and mutual fund investors collectively padded the coffers of large-cap funds – injecting a net $5.5 billion – with SPDR S&P 500 ETF (SPY, +$4.0 billion) attracting the largest net inflows for the flows week of all the individual funds, the commodities heavy sector other macro group took in the next largest sum, attracting a net $5.3 billion, bringing its weekly net inflow streak to five consecutive weeks and its second largest weekly net inflows on record extending back to 1992.

Weekly estimated net flows (Author)

Despite a late-week spike in the 10-year Treasury yield (a rise of 10 basis points to 1.86% on Wednesday, March 9), which of late has been an antagonist to fund flows into tech-related funds, Science & Technology Funds (+$1.4 billion, including ETFs) witnessed the largest net inflows of the sector equity funds macro group for the flows week, followed by Commodities Precious Metals Funds (+$1.3 billion), Natural Resources Funds (+$1.2 billion), Commodities General Funds (+$1.1 billion), Basic Materials Funds (+$810 million), and Commodities Agriculture Funds (+$720 million).

Most pundits feel that inflation is here to stay, at least for a while. With the rise in demand post-COVID, continued supply chain bottlenecks, and the Russia-Ukraine conflict providing an extreme amount of pressure on oil, gas, grain, and basic materials, along with the humanitarian concerns, investors are likely to continue to keep a keen eye on these inflation-sensitive securities.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment