honglouwawa/E+ via Getty Images

Chimera Investment Corp. (NYSE:CIM) operates a somewhat risky but profitable portfolio of largely securitized mortgage loans. The company has been profitable at a time in which Americans have dramatically reduced their exposure to mortgages, despite mortgage rates falling to historically low levels. As mortgage rates and inflation rises, the temptation is to believe that Chimera’s business model will suffer, but there are reasons to believe that the reverse will happen. Economic data shows some rebounding in the use of mortgages. In this tough climate, Chimera has still managed to reliably distribute dividends to its shareholders. Investor pessimism has resulted in the company trading at its lowest price since 2014. Chimera’s dividend yield is over 11%. The company is currently trading at a 152% discount from its 5-year price/funds from operations multiple, giving investors a large margin of safety to buy shares in the company.

The Business Model

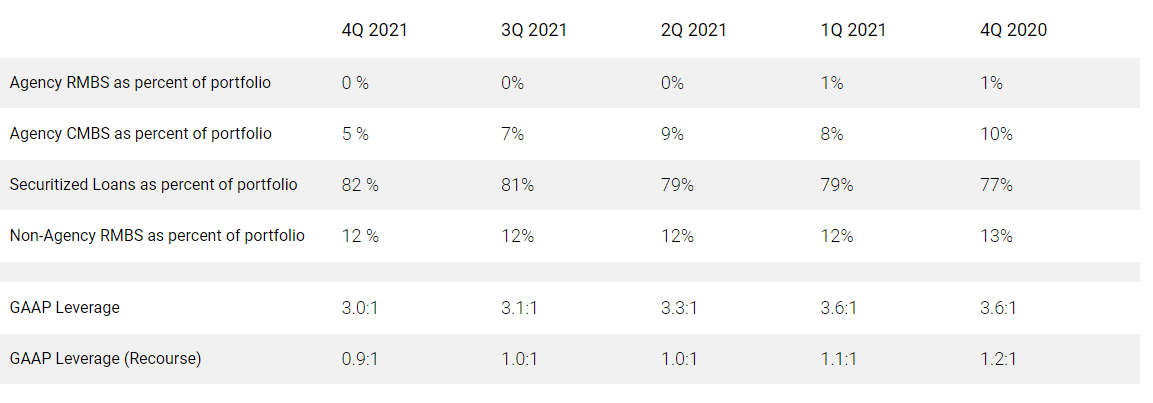

Chimera is an internally managed real estate investment trust ((REIT)). As such, the company aims to earn attractive risk-adjusted long-term returns through dividends and capital preservation. To do this, the company invests, directly or through beneficial interests, in a diversified portfolio of leveraged residential mortgage assets, such as mortgage loans, Non-Agency and Agency residential mortgage backed securities ((RMBS)) and Agency commercial mortgage backed securities ((CMBS)). Mortgage backed securities (MBS) and other real estate related investments may be investment or non-investment grade securities, or even non-rated classes.Typically, about 80% of the company’s portfolio is allocated to securitized loans, with non-agency RMBS making up 12% of the portfolio and the rest going to agency CMBS.

Source: Chimera Key Figures

According to Chimera’s 2021 10-K filing, as of December 31, 2021, approximately 82% of its investment portfolio was residential mortgage loans, 12% non-agency RMBS, and 6% agency MBS.

Securitization of residential mortgage loans is, then, the heart of the company’s business, with the exercise of call options on existing securitizations to buy underlying mortgage loans and use further securitization to refinance the called mortgage loans at lower rates and/or more efficient leverage, used when Chimera feels the conditions are right. The company typically holds the subordinate tranches of the securitized mortgage loans, so that Chimera is the first-loss security holder.

This adds not just the obvious risk to a portfolio, but a further risk: the company cannot, thanks to the Dodd-Frank Act and other laws, quickly exit its positions of most of these subordinate tranches governing credit risk retention. Thus, the company would be obliged to carry assets that it would otherwise sell.

Leverage is used to maximize returns while managing the net spread between income from its investments and the cost of borrowing (from financing sources such as securitizations, warehouse facilities and repurchase agreements). Chimera’s investment strategy encompasses an analysis of expected cash yield, relative valuation, risk-adjusted returns, credit fundamentals, macroeconomic considerations, supply and demand, credit and market risk concentration limits, liquidity, cost of financing and financing availability.

The company’s strategy is highly reliant on the interest rate climate. Obviously, in a low interest rate environment, people are more likely to invest in real estate and assume mortgages. The company attempts to de-risk itself by shifting its asset allocation across different asset classes, according to the interest rate and credit conditions.

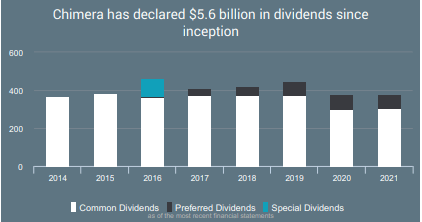

Dividend History

Chimera has been successful in distributing dividends to shareholders, distributing the equivalent of a third of its total assets in the form of dividends since its inception. According to the company’s Fact Sheet, Chimera has returned $5.6 billion in dividends since its inception in 2007. At present, the company has a dividend yield of 11.1%.

Source: Chimera Investment Corp. Fact Sheet

Investors should be aware that Chimera aims to grow its earnings available for distribution (economic net interest income less compensation and benefits expenses, general and administrative expenses, servicing and asset manager fees, income tax benefits or expenses and preferred dividend charges). Earnings available for distribution are how the company measures its portfolio’s income generation ability. Earnings available for distribution differ from REIT taxable income, of which 90% must be distributed to shareholders.

Chimera’s business model is inherently risky, but the company has managed to keep dividends above $0.30 per share since Q3 2020.

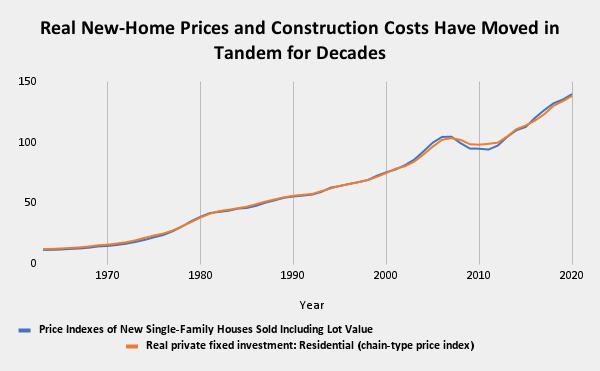

Mortgages Will Bounce Back

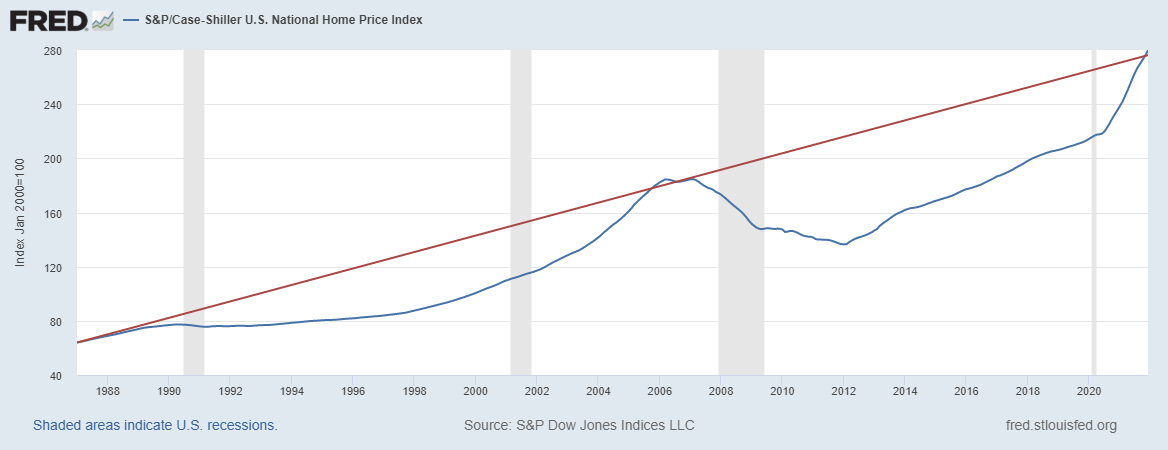

Conventionally, housing is linked to mortgage booms and with looming interest rate hikes, many investors assume that this will put a break on the expansion of the housing market. The link between housing and mortgages was further cemented by the Great Recession. However, empirically, the key driver of home prices is the level of construction prices. In 2021 alone, the S&P/Case-Shiller U.S. National Home Price Index went up nearly 22%, and this dramatized a more long-run state of affairs in which the United States has witnessed a steady appreciation in house prices. Since just 1987, the S&P/Case-Shiller U.S. National Home Price Index has gone up more than 330%.

Source: FRED S&P/Case-Shiller U.S. National Home Price Index data

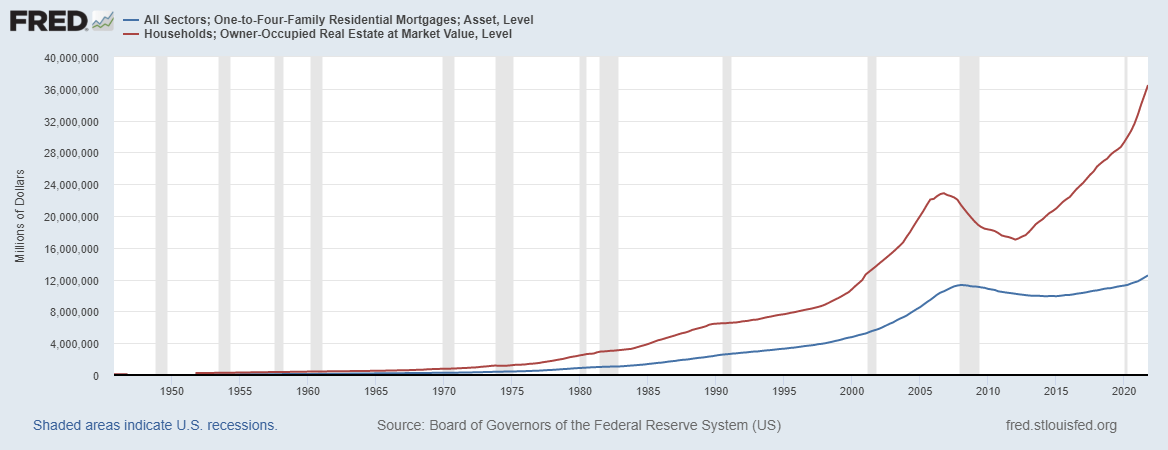

Since the peak of the last great housing boom, in March 2007, the index has risen by nearly 50%. What is striking about this is that the present housing boom has occurred in an era characterized by a decline in the value of home mortgages owed by households, even as the value of household real estate portfolios has increased, as the chart below from the Federal Reserve Economic Data ((FRED)) shows.

Source: FRED

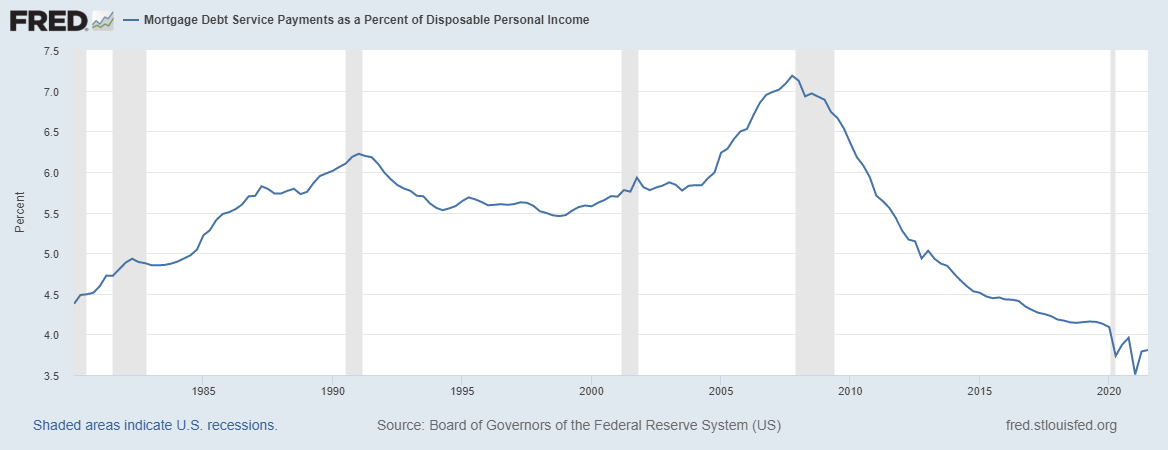

Rather than taking up more mortgage debt during a period of historically low mortgage rates, households have chosen to reduce the size of their outstanding mortgages, as an analysis of the share of mortgages in disposable income shows.

Source: FRED

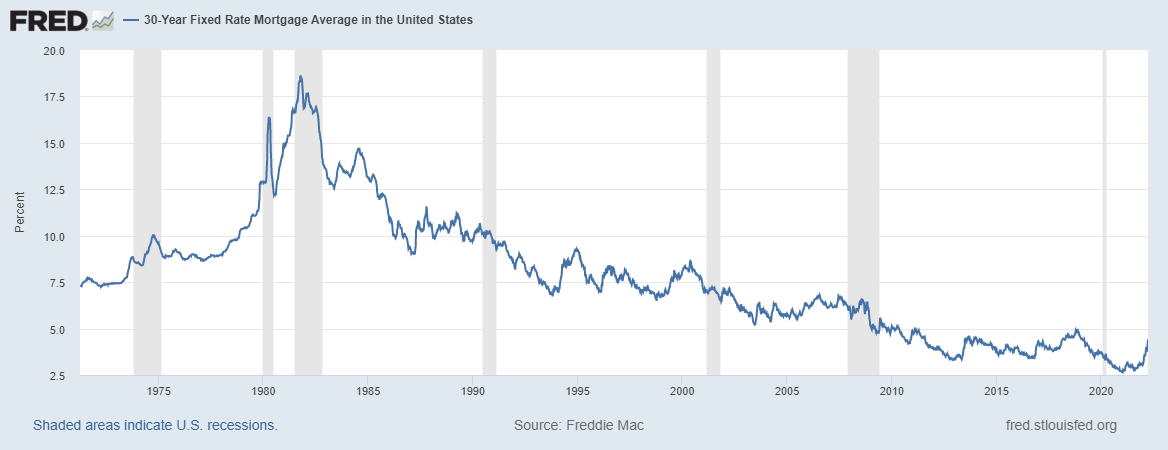

In the near-term, mortgage debt service payments increased from their pandemic lows. Mortgage debt service payments are at historically low levels at a time when the 30-year fixed rate mortgage average is also at its lowest ever levels.

Source: FRED

This suggests that as interest rates rise, the consequences for Chimera may not be as negative as they would be in the past. They will remain historically low and most households are not encumbered by high levels of mortgage debt. In addition, higher inflation may erode the impact of proposed interest rate hikes so that real rates decline faster than nominal rates rise.

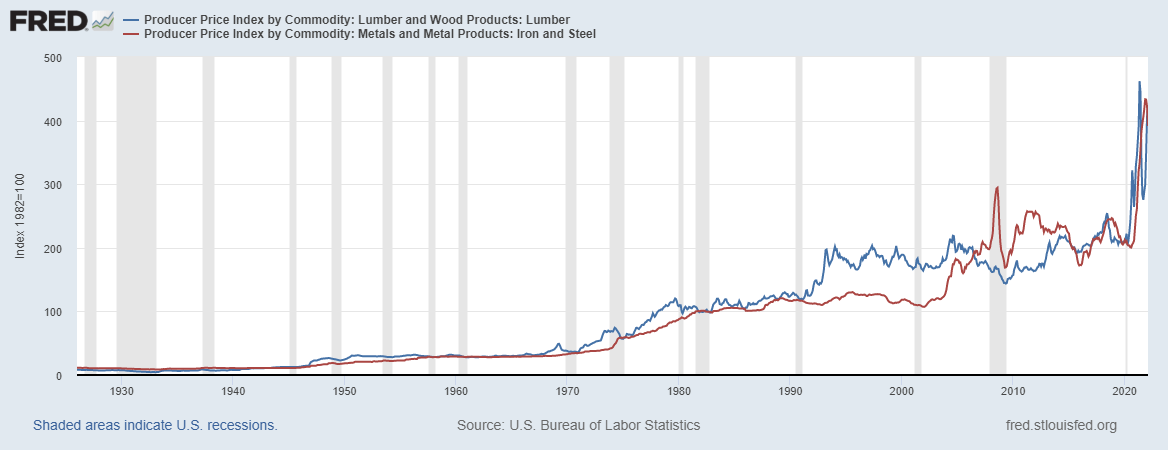

In 2021, although home prices skyrocketed, this was partly offset by low mortgage rates. In 2022, both home prices and mortgage rates are on the rise, leading to fears that the housing boom will pop. However, housing inventories remain low, and the price of inputs such as lumber and iron and steel, remain elevated:

Source: FRED

Construction costs have driven home prices for decades. Consequently, we should expect that in an inflationary environment, home prices will rise, and households will be forced to turn, more and more, to mortgages.

Source: FRED and the Census Bureau

With inflation and economic uncertainty, households will be less able to finance home purchases through savings. In addition, the value of collateral underlying loans will increase, rather than decrease.

A Fundamentally Profitable Business

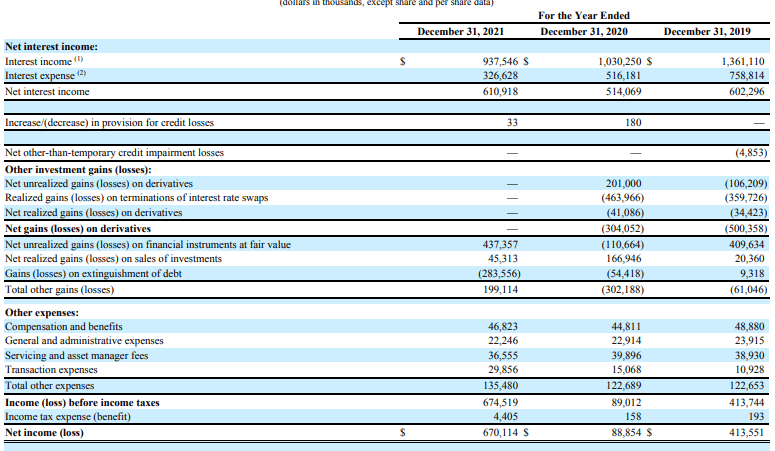

The company earned a profit of over $670 million in 2021, compared to just $89 million the year prior and $413 million in 2019. This is because in 2021, the company did not make use of any derivatives instruments, which had weighed down its results in prior years.

Source: Chimera 10-K

Consequently, net income per share rose from $1.82 in 2019, to $2.55 in 2021, despite the company raising the number of outstanding shares by nearly 25%.

Chimera has grown funds from operations (FFO) per share from $0.39 in 2020 to $2.73 in 2021. However, on a 5-year basis, FFO per share has declined somewhat, from $2.79 in 2017, to $2.73 in 2021.

The company earned a return on equity (ROE) of 15.87, after a 2020 in which it earned an ROE of 0.39%. Chimera’s 5-year average ROE is 10.68%, compared to its peers who have an average ROE of 29.13%.

The company’s cash and cash equivalents have risen from nearly $110 million in 2019 to over $385 million in 2021. The company now has approximately $520 million in free cash flow ((FCF)), compared to around $260 million the year prior.

This suggests that Chimera is in a position to increase its dividend in the next quarter and possibly for the whole of 2022, although the company could decide to reduce its dividend payout in response to any loan repayment issues that arise as a result of economic turbulence this year. However, Chimera’s biggest issue is likely to be the impact that inflation has on its loan investments, rather than loan repayment issues. Regardless of how that goes, Chimera’s dividend yield is likely to remain very high.

Valuation

With funds from operations of $2.73, Chimera is trading at a price/funds from operations ((P/FFO)) multiple of 4.43 for a nearly 152% discount to its a 5-year average of 11.16. The company’s ability to extract cash flows from its properties will increase in 2022, and this, weighed against Chimera’s dividend yield of 11.1%, makes the REIT’s valuation all the more attractive.

Conclusion

Chimera’s portfolio tilts heavily toward securitized mortgage loans, with some exposure to non-agency RMBS and agency CMBS. This is an inherently risky portfolio and subsequently, investors should expect some volatility. The company is also a first-loss security holder, which adds a further layer of risk. Nevertheless, the company has reliably distributed dividends to its shareholders, with a present yield of over 11%. There are good reasons to believe that households will increasingly turn to mortgages to buy homes and as collateral for debt, given the inflationary environment. Mortgage payments have never been such a small part of disposable incomes and that is likely to change. If the company can manage the risk of eroding repayment values, this will increase their opportunity and income. Chimera is historically undervalued and this at a time when its fundamentals are better than they have been for several years. COnsequently, investors have a significant margin of safety to buy shares in the company and enjoy its dividend yield.

Be the first to comment