gorodenkoff

Investor AB (OTCPK:IVSXF) is trading at close to book value, while the best period to buy its shares is when it’s trading at a discount.

Company Overview

Investor AB is one of Europe’s largest investment holding companies, being based in Sweden. The company invests mainly in Nordic companies and has a portfolio value of about $52 billion. It holds both minority and majority equity ownerships in its investment companies, with a long-term mentality. Its market value is about $57 billion and trades in the U.S. on the over-the-counter market.

Investor AB has a long business history, considering that it was founded in 1916, when a legislative change in Sweden made it more difficult for banks to own stocks in industrial companies, on a long-term basis.

Due to this change, the shareholdings of the Wallenberg family bank, Stockholms Enskilda Bank (OTCPK:SEBYF), were transferred at the time to Investor AB. This was a new holding company, spun-out of the bank to hold industrial stakes, and the Wallenberg family still continues to hold about 20% of Investor AB’s capital and controls some 50% of its voting rights.

This happens because, like many Swedish companies, Investor AB has both A and B share classes, which have different voting rights. This is usual within the Swedish corporate governance model, where typically ‘A’ shares have one vote, while ‘B’ shares only hold one-tenth of a vote. Additionally, board members are usually proposed to the Annual General Meeting by a nomination committee automatically chaired by the largest shareholder, which ensures that the largest shareholder, even if it does not have a particularly large stake, has a lot of influence on the company’s management.

Business Strategy

Investor AB is a holding company with no operational activity, beyond its equity stakes in invested companies. Its investment strategy is based on a long-term view, being an active investor and a structural owner. Its goal is to generate value for shareholders through the long term, by supporting its invested companies through board participation, financial support, and utilization of its business network.

Contrary to private equity companies, that usually invest in companies and expect to exit investments in a defined timeframe (usually within five to ten years), Investor AB is a ‘buy-and-hold’ investor with no specific timeframe to sell its investments. Instead, its approach is to develop its companies over the medium to long term, holding its stakes as long as it still sees further value creation potential.

Taking into account this investment philosophy, it is no surprise that Investor AB’s strategy is to grow its net asset value (NAV) over time, operate efficiently, and provide an attractive shareholder remuneration policy over the long term.

Investor AB’s goal is to grow its NAV over time, operate efficiently and generate and attractive shareholder return. Given that Investor AB is a holding company with no operating activity, its financial performance is heavily related to the performance of its invested companies, with the difference being its own staff and funding costs.

Regarding its investment strategy, Investor AB only invests in sectors that it has a good knowledge of and where it can use its expertise and business network to support its companies, targeting mainly the industrial, healthcare, financial services, and technology sectors. Beyond these core sectorial holdings, it has in recent years diversified across infrastructure and services, even though these sectors still have a relatively small size within its investment portfolio.

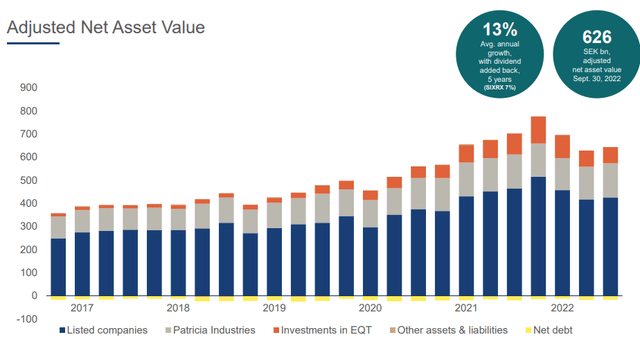

Even though Investor AB has a relatively concentrated sectorial allocation, it has a large investment portfolio, both through listed and unlisted assets. At the end of last September, its total portfolio value amounted to $60.1 billion, of which about 66% was invested in listed equities, and the remaining in unlisted assets. Its track record is quite good over the past few years, given that its NAV has grown at about 13% annually over the past five years, a performance that is above its benchmark index (up by 7% annually during the same period).

NAV (Investor AB)

Among its investment portfolio, some of its largest investments include Swedish companies Ericson (ERIC) and Atlas Copco (OTCPK:ATLKY), and other international companies like Nasdaq (NDAQ), ABB (ABB) and AstraZeneca (AZN). Investors should note that its four largest investments (Atlas Copco, ABB, SEB and AstraZeneca) account for more than 40% of Investor AB’s NAV, being therefore important drivers for its NAV evolution and returns.

Although a large part of Investor AB’s NAV is invested in listed equities, a substantial part is in unlisted assets, namely in Patricia Industries and EQT. The first group is where Investor AB fully owns the invested companies, which have strong long-term growth potential across different industries. EQT is an asset manager in which Investor AB holds 17.5% of its capital and also invests in its funds, focused on active ownership strategies.

Going forward, Investor AB’s strategy is not expected to change much, as the company invests with a long-term horizon and usually maintains its holdings for several years. While the unlisted part of its investment portfolio should continue to increase its overall weight, the vast majority of Investor AB’s NAV is expected to remain invested in listed stocks.

Financial Overview

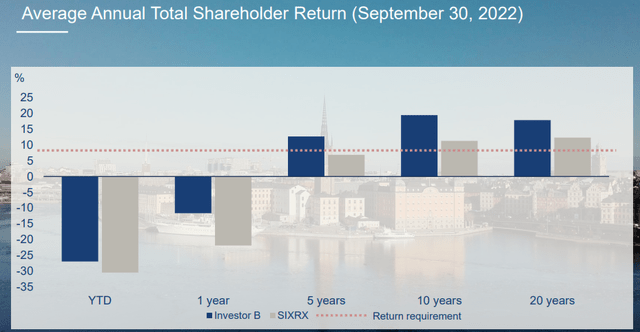

Regarding its financial performance, Investor AB’s main financial metrics are related to its NAV growth and portfolio returns compared to the stock market, as the company’s assets are mainly listed equities. As can be seen in the next graph, while its track record over the long term is quite positive and above the benchmark index, its returns in recent months have been negative due to overall weakness in the stock market.

Returns (Investor AB)

Since the beginning of 2022 and until the end of September, Investor AB’s asset return was negative by about 25%, a slightly better performance than the market, showing the quality profile of its portfolio.

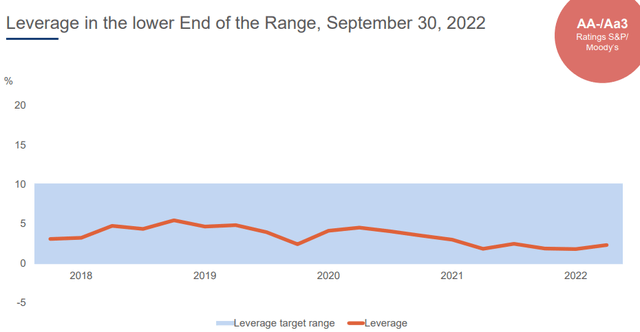

Regarding its financial profile, Investor AB has historically used very low levels of leverage, financing its investments mainly through cash. This is a conservative approach, but positive both for creditors and shareholders, as higher leverage levels could put the company at risk during bear markets. Reflecting this conservative profile, Investor AB has a credit rating of AA- by S&P, and doesn’t have any debt maturities until 2029. This means that it does not need to raise cash to pay debt for many years, allowing it to hold its investments throughout the economic cycle and not be a forced seller.

Leverage (Investor AB)

Indeed, its net debt to equity ratio was close to 2% at the end of September, which is very low and close to the bottom of its target range, showing a very robust balance sheet. Moreover, Investor AB’s operating costs have been historically more than covered by cash flow provided by its wholly-owned subsidiaries and the dividend income stream coming from its investment portfolio, thus the company doesn’t need to raise debt to finance its operations.

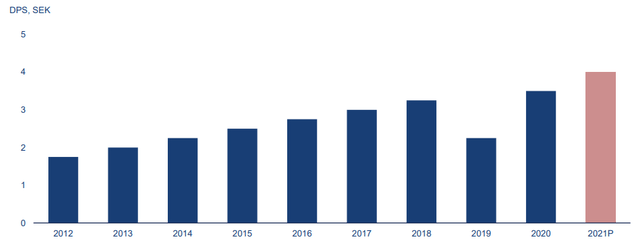

This strong financial profile allows the company to provide a regular dividend, even though its dividend history is not perfect as Investor AB cut its annual dividend related to 2019 earnings. Its last dividend was SEK4 ($0.38) per share, the highest level over the past decade, representing a dividend payout ratio of just 5% of its annual earnings.

This means that, at its current share price, Investor AB offers a dividend yield of about 2.10% based on its last dividend payment. Investors should note that Investor’s dividend policy is to pay two dividends per year, one in May (it was SEK 3 – $0.29 – in 2022) and an interim dividend in November (SEK 1 – $0.10, which was already paid to shareholders), thus the next dividend is expected to be distributed in May 2023.

Dividends (Investor AB)

Going forward, Investor AB’s dividend policy is to provide a steadily rising dividend, which is covered by cash flow generated from its three business areas.

Conclusion

Investor AB is a holding company with a strong investment track record over the long term, showing that its long-term mentality and conservative financial profile create value for shareholders over the long haul. For retail investors, an investment in its shares are a good way to have exposure to several European companies through a single investment, ‘outsourcing’ to some extent the investment process.

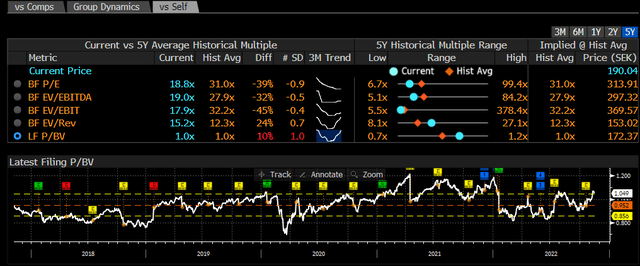

However, the best period to buy Investor AB’s shares is when they are trading at a discount to book value, which usually happens during periods of lower liquidity in the stock market. As shown in the next graph, Investor AB is currently trading at close to book value, in-line with its historical average over the past five years. Therefore, investors should wait for a period in which Investor AB is trading at a discount to book value to buy its shares, and remain on the sidelines for the time being.

Valuation (Bloomberg)

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Be the first to comment