marchmeena29

A new “savings” environment is taking place. Things are not like they have been. World economies are taking a hit; therefore, personal finance comes under the spotlight. Expenses are stacking up by reason of inflation. Energy prices are untamable as energy scarcity and geopolitical behavior become a problem. I am still witnessing a low percentage of investors in my age category (22yo), particularly in Europe. That being the case, I’ll cover why you should put your money to work, rather than leaving all your money into a savings account.

What offers a savings account right now?

First, it is important to know what your savings account offers. My bank offers a 0.01% base rate and a 0.10% loyalty bonus. So, in total, I receive 0.11% annually on the money in my bank account. I am a customer of a large bank, which typically offers lower rates. On the other hand, high-yield savings accounts also exist. Most of the time, they offer an annual percentage yield (APY) around 2%. Although some savings accounts are yielding more than others, be careful with other costs involved and the transfer time of your money. The yield on my savings account is substandard, but that aside, a savings account is not a money maker. Your savings account is an account where you can pull out money if you need it for an emergency or to save up for a short-term expense or investment.

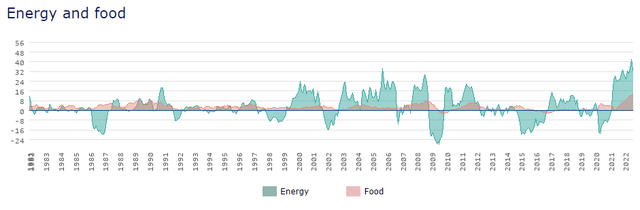

The way to grow money or to put your money to work is by investing. Contrary to your thought, your “savings account” will lose you money over time. The cost of living is always increasing, economies grow and demand increases, better known as inflation. The average inflation over the last years has been between 2-3% each year. As a result, I lost between 1.89% and 2.89% annually over the last years, with my savings account. People with a high-yield savings account have barely been able to break even. Nonetheless, inflation is now peaking even higher. The current inflation rate is around 8%, so everyone is losing a lot more money now. Both energy and food prices are skyrocketing, damaging the personal finance of the low- and mid-class population. That’s why you should consider starting to invest, if you haven’t already.

Energy and food inflation (worlddata.info)

Investing

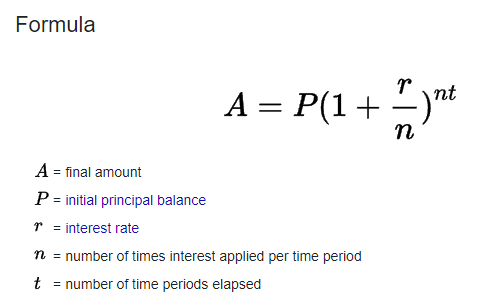

By investing in real companies that earn real money, you are eligible on a part of the earnings of the company. Most companies pay out dividends that will instantly reward you as a shareholder in cash. Dividends can be received monthly, quarterly or annually. The cash received could be used to reinvest or to fund your high energy and food expenses. In addition, your dividend income can grow over time as the company increases their earnings. That’s when you start getting interest on increasing interest, which is even more advanced than compound interest. Compound interest has a formula with a fixed interest rate, you on the other hand can enjoy growing interest rate in a well-balanced portfolio. That’s how wealth is built over the years: increasing dividend yields and reinvestments. But that’s not all there is.

Compound interest formula (Wikipedia)

Next to income, your investments can grow over time together with the businesses that you invest in. This is called: stock appreciation. When companies earn more money, they will get more valuable. After your stock appreciates in value, you can sell it for a higher price. Of course, there is the risk that your company loses value over time and made the wrong investment. Some strategies discussed later will decrease this risk dramatically. On the other hand, your savings account will only depreciate, since you are losing purchasing power gradually.

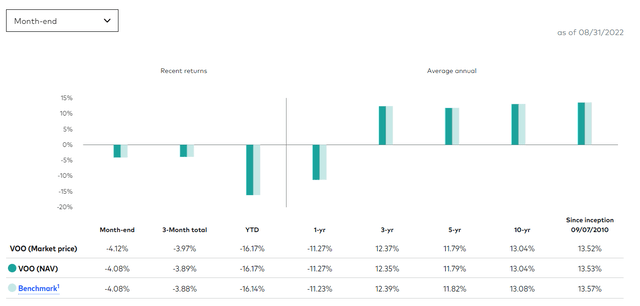

The market (or the S&P 500, the 500 largest U.S. companies) returns on average 11-13% of your money invested annually, which is more than enough to beat the record high inflation. Once inflation settles down, generational wealth can be built.

Performance of S&P 500 (Seeking Alpha)

Generational wealth does come with strict rules to follow. A process made from habits is needed to protect you against human emotions and unexpected variables. While investing is sometimes seen as relatively risky or gambling, neither is the case. On the contrary, a savings account poses the biggest threat, since it is losing the battle against inflation year in and year out. Therefore, investing should become a way of life. In Europe, investing is still highly underrated. The culprit is the pension that is given after a certain number of working years to allow you to retire with ease. As a consequence, saving for later is not yet as efficient as in America, where people have to secure their own retirement.

Retirees should keep more cash in their savings account to prevent being out of cash in a market crash. They can also focus more on income ETFs, REITs or dividend stocks, which are also relatively safe and provide cash to cover expenses.

Short-term pain is long-term gain

When I ask others of my age (22): “Have you been started with investing?” I always get the same responses: “I am scared.”, “I don’t like the feeling of putting my money somewhere else.”, “It is too risky.”, “I am trying to get started.”, “I have a lot of expenses.” and so on.

Although, in theory, these excuses do not make much sense, I can understand why they are feeling like this. No one has ever taught them how to invest and how to do it safely. However, investing should be on your list of important things to do, next to finding a job. Since, investing will outperform the addition of wealth by your job over the course of your lifetime. In addition, investing is relatively safe, if you do have a time horizon of at least 5 years. The time horizon is extremely important, since stocks go up and down every day. Nonetheless, short-term volatility is not a risk on condition you have an emergency fund ready and only invest a percentage of your income to leave room for daily/monthly expenses. Whether you start with a low percentage of your income is not a problem, as long as you get started. Investing is a process of slow and steady growth. You can always make changes appropriate to your situation.

Low risk investing

Proven by time and past – performance investing in the S&P 500 has been the way to go for passive investors. Passive investors do not have to manage or understand anything. You buy stocks of the S&P 500 monthly and forget about it. By investing in the S&P 500, you invest in the 500 biggest companies in the United States. The risk is low because you are not timing the market (monthly purchases) and you have a high diversification (500 companies, different sectors). If one of the companies goes bankrupt, you will only lose 0.2% of your portfolio. The chance that all 500 companies go bankrupt is rather low, when you own companies like: Apple $AAPL, Microsoft $MSFT, Coca-Cola $KO, Disney $DIS… An important criterion to be included in the S&P 500 is that the company must be profitable in its trailing four consecutive quarters. Reducing the risk of flawed business models in the index. The S&P 500 survived multiple recessions, crashes and economic nightmares.

One of the best S&P 500 trackers that you can buy right now is VOO. It has been mimicking the S&P 500 almost perfectly. Additionally, this ETF has one of the lowest expense ratios you can find. So, although you must pay 0.03% in annual fees to own this ETF, you have a high chance to receive around 12% annually on your money invested. This seems like a fair deal to me.

VOO vs S&P performance (Vanguard)

For people in Europe, you can buy the VUSA (S&P 500) or VWRL (All-world) alternatives. They have a slightly higher expense ratio of respectively 0.07% and 0.22%, but it can definitely get the deal done.

I do want to mention that you must be careful with actively managed ETFs. Mostly, the expense ratios are way too high, and as a result, it can lose you a lot of money over time. Secondly, almost none of them can outperform the S&P 500 or VOO with expense ratios included.

DIY – Do It Yourself

When you want to learn more about businesses and investing, you can always start picking stocks yourself. A profession in a certain sector could be another reason to handpick the good businesses yourself. The market is not always 100% efficient, knowledge and strong emotional endurance can beat the market. There are two popular strategies: a hybrid strategy with ETFs and handpicked equity or 100% handpicked equity investing.

Hybrid ETF/handpicked equity investing

A common strategy where people invest the largest part of their income in ETFs. Alongside the ETFs, you can handpick some additional stocks. Possible reasons can be getting a feel for investing or having a lot of knowledge on a certain sector/specific company. This style of investing is less risky, as you have a strong core of ETFs to hedge against the risk of one company performing badly. If you want to start picking stocks yourself, this could be a strategy to dip your toe in the water.

100% handpicked equity investing

Furthermore, selecting only stocks is another strategy practiced by plenty. However, more risks are involved. This strategy requires due diligence, maintenance of your portfolio and emotional endurance. If inadequate time goes into your stock picking, things can go south really quickly. Further, there is also less diversification compared to an ETF. You have to decide for yourself, if you want to put in the work, or if the risk/reward balance is something for you.

Cracking the code

1. Earn more than you spend

Optimizing personal finance is the first step to become successful in investing. Increasing income or decreasing spending will allow higher deposits on your investing account. Spending money on things you don’t need can be a serious problem.

2. Invest regularly

By investing regularly, you avoid timing the market. Sometimes you buy at a high price, sometimes at a low price. This gives a great average buying price for the long term. The market can always go lower, don’t try to catch a falling knife.

3. Gain knowledge

If you have spare time, gaining knowledge can never hurt. My favorite source of knowledge can be found in books. Fortunately, a few super investors wrote down their way of investing. Some interesting reads are:

– The Intelligent Investor by Benjamin Graham (mentor of Warren Buffett)

– One Up on Wall Street by John Rothchild and Peter Lynch

– Margin of Safety by Seth Klarman

4. Reinvest

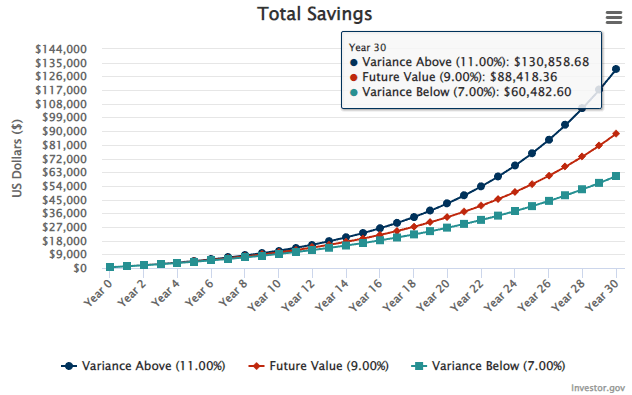

Reinvesting dividends can change the outcome of your portfolio by a great margin. Let’s assume you invest $50 monthly for 30 years with an initial investment of $500. Without reinvestment of the dividend, you gain 9% interest on your capital. With reinvestment of the dividend, you gain an additional 2% interest each year (dividend increases not accounted). In total, you would lose more than $40k by not reinvesting dividend. Use the calculator yourself to see where investing will bring you.

Compound interest calculator (Investor.gov)

5. There is not correct way

Find a process that works for you. People have different stations in life, therefore risks, the savings amount and strategies can differ. Be critical and do not just copy others.

Takeaway

In summary, your savings account can and will ruin your long-term prospects if you see it as a money maker. A savings account will mostly have fixed rates and has no steady income growth. Investing has the upper hand as it can exponentially increase your savings over time. Act in accordance with your capabilities. The right time to start investing has always been in the past.

Be the first to comment