Leon Neal

Meta Platforms, Inc. (NASDAQ:META) reported quarterly results once again and it probably won’t surprise you that these results once again weren’t great. And although expectations had already been lowered, the company missed revenue as well as earnings per share expectations. Meta Platforms (or Facebook) was always extremely controversial for several reasons, but in the last few months, it also became extremely controversial whether Meta Platforms is a good investment or not.

I will argue once again that we are looking at short-term challenges, which will be resolved – and that Meta Platforms is a great investment at current prices – despite the potential for lower stock prices in the short term.

Quarterly Results

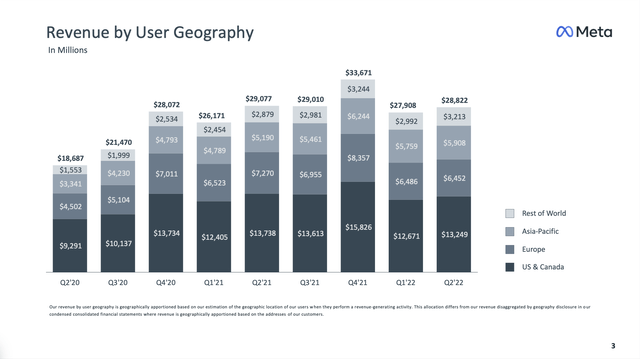

About two weeks ago, Meta Platforms reported second quarter results. And there is no way to sugarcoat it: the results were not good. Total revenue declined from $29,077 million in the same quarter last year to $28,822 million this quarter – resulting in a decline of 0.9% year-over-year. And not only is a declining revenue a huge disappointment for Meta Platforms – a company that reported 50% revenue growth only a few quarters ago – but it is the first revenue decline ever for Meta Platforms.

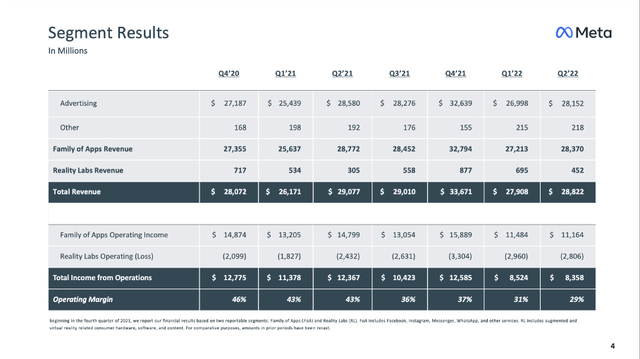

And while revenue declined slightly, total costs and expenses increased 22% which resulted in operating income to decline from $12,367 million in the same quarter last year to $8,358 million in this quarter – resulting in 32.4% year-over-year decline. And finally, diluted earnings per share declined from $3.61 in Q2/21 to $2.46 in Q2/22 – a decline of 33.0% year-over-year.

Meta Platforms Q2/22 Presentation

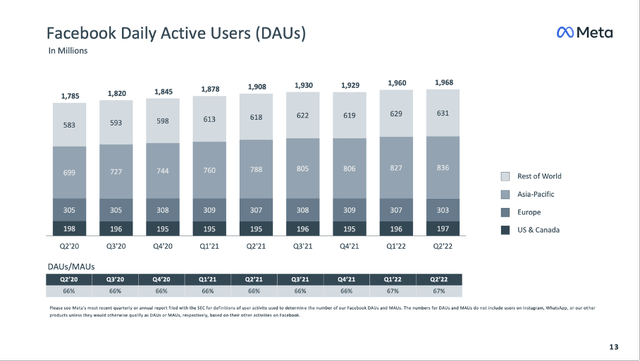

The numbers reported on the income statement were terrible. But there are also metrics that don’t draw the picture of a completely wrecked company. First, headcount increased 32% year-over-year to 83,553 and an increased number of employees should be seen as positive as Meta Platforms is investing in the future and it is also an explanation for the increasing expenses. And we should also mention that Meta Platforms is planning to reduce headcount in the coming quarters. Daily active users for Facebook increased 3.1% YoY and daily active users for the Family of Apps increased 4.3% YoY to 2.88 billion.

Meta Platforms Q2/22 Presentation

And finally, while the average price per ad decreased 14% year-over-year, ad impressions delivered across the Family of Apps increased 15% year-over-year.

And when looking at the segments, the biggest part of revenue is still stemming from advertising, but “Reality Labs” revenue increased from $305 million in the same quarter last year to $452 million this quarter – an increase of 48.2% YoY driven primarily by Quest 2 sales. And similar to the last quarters, Reality Labs is reporting an operating loss, which was $2,806 million this quarter.

Meta Platforms Q2/22 Presentation

Two Perspectives: Bearish Side

I don’t think we have to argue about the last quarterly results – they were not great and the previous two quarters were also rather bad. Nevertheless, there seem to be two pretty extreme perspectives when it comes to Meta Platforms – those arguing that Meta Platforms is doomed, and the business model is broken and those arguing the last few quarters being only a short-to-mid-term hick-up that will be resolved, and Meta Platforms will continue to outperform.

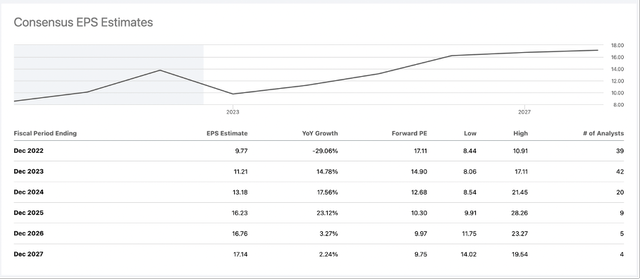

Meta: Consensus EPS Estimates (Seeking Alpha)

These two perspectives also become obvious when looking at analysts’ estimates for earnings per share. It is not unusual that analysts have different estimates for the years to come, but when looking at fiscal 2025 for example, the lowest EPS estimate is $9.91 (below TTM EPS numbers) while the highest estimate is $28.26 – almost three times the lowest estimate.

And when looking at the arguments of the bearish camp, we certainly must acknowledge some risks and headwinds. Apple’s (AAPL) platform policy changes are creating headwinds, and as a result, the operating margin declined from 46% in Q4/20 to only 29% in the last quarter. A stable operating margin is one of the criteria for a wide moat company, which Meta Platforms is not fulfilling right now. Meta Platforms not being able to grow its revenue anymore and earnings per share declining is also not a good sign and the company also had to cut spending for some of its projects.

Two Perspectives: Bullish Side

When just looking at the numbers reported in the last few quarters, we must rather share the bearish vision about Meta Platforms. But investing is about the future and what we expect for the years to come. And when investing in Meta Platforms right now, you certainly should share Mark Zuckerberg’s vision of the Metaverse and be confident to a certain degree that the billions and billions of dollars invested will pay off. During the last earnings call, Mark Zuckerberg talked about the two major trends he is seeing – one being the Metaverse:

To understand where we’re going, it’s important to keep in mind that there are two major technological waves that we’re riding in our business. The first wave of driving our business today is AI. And then the second longer-term wave is the emergence of the metaverse. One of the main transformations in our business right now is that social feeds are going from being driven primarily by the people and accounts you follow to increasingly also being driven by AI-recommending content that you’ll find interesting from across Facebook or Instagram, even if you don’t follow those creators.

But we also must keep in mind, that Metaverse is the long-term vision while Meta Platforms is already an extremely profitable business that is generating about $40 billion in free cash flow annually (even without the Metaverse ever becoming reality). And these high amounts of generated free cash flow as well as the 18-year successful history of Facebook should forbid any comparisons to Myspace or Yahoo.

And the “core business” of Facebook and Instagram is declining a bit right now, which is not surprising as we are headed towards a recession and advertising is usually slowing down before and during a recession. It will be difficult for Meta Platforms (especially Facebook and Instagram) to fight this trend and during the last earnings call, Mark Zuckerberg stated:

That said, we seem to have entered an economic downturn that will have a broad impact on the digital advertising business. And it’s always hard to predict how deep or how long these cycles will be, but I’d say that the situation seems worse than it did a quarter ago.

And we don’t have any real data for the performance of Facebook or Instagram during a recession as the last recession doesn’t count (Meta Platforms was one of the companies profiting from the pandemic) and while Facebook already existed during the Great Financial Crisis, we don’t have reliable numbers. But we can expect ad spending to increase again and Meta Platforms increasing revenue again although we should not expect high double-digit growth rates for Meta Platforms in the foreseeable future.

Although Meta’s business model is far from broken, the company also must adapt to a changing environment. About ten years ago, Meta Platforms had to adapt to the shift towards mobile as more and more users started using the app. And like Facebook had to work out how to be profitable in a “mobile world”, Meta Platforms must adapt to the trend towards short-form videos. Although Reels engagement is growing quickly (Reels is now making up 30% of time spent on Facebook and Instagram compared to 20% in the previous quarter), it doesn’t monetize at the same rate as feed or stories. And although management is quite aware that a higher engagement with Reels will pull off engagement from stories and feed (which will lead to lower revenue), Meta Platforms is pushing forward for better long-term results. Mark Zuckerberg during the last earnings call:

Our work on ads monetization efficiency for Reels is actually making faster progress than we’d expected. We’ve now crossed a $1 billion annual revenue run rate for Reels ads, and Reels also has a higher revenue run rate than Stories did at identical times post launch. So the bottom line is I think we’re on track here and we just need to push through this one.

While I don’t know if the vision of the Metaverse will become reality and could be monetarized, I am confident about the “core business” and Instagram as well as Facebook being able to shift to short-term videos and monetarizing that shift.

Bonds, Share Buybacks and Cash

A few days ago, Meta Platforms surprised the investing world by announcing it will issue bonds for the first time. Apparently, Meta Platforms was one of just 18 companies listed in the S&P 500 (SPY) without any debt, but will now raise $10 billion in debt.

There has been a lot of speculation about what the cash will be used for – with some speculating that Meta Platforms will use the amount for share buybacks. In the last four quarters, Meta Platforms spent $53.3 billion in share buybacks. While Meta Platforms also spent huge amounts on share buybacks when the stock was trading above $300, I think it is a good idea to buy back shares right now – as long as management is confident about Meta Platforms’ long-term path and potential. And although repurchasing shares is a good idea, I don’t think it is a good idea to use debt for repurchasing shares – even when the stock is extremely undervalued.

To be honest, I don’t get why Meta Platforms is issuing debt at all. Without much doubt, building the Metaverse is expensive, and the company should continue to repurchase shares. But Meta Platforms still has about $40 billion in liquid assets (cash, cash equivalents and marketable securities) and is generating about $40 billion in free cash flow annually (it might be a bit lower in the next few quarters) and I don’t get why Meta Platforms needs these additional $10 billion in debt.

The issuing of new debt also led to a statement from Moody’s Corporation (MCO) about Meta Platforms:

The A1 debt rating assignment is based on Meta’s strong credit profile which reflects the leading global position of its platform brands in social networking, supported by its extensive user base of 2.88 billion and 3.65 billion family daily active people (DAP) and family monthly active people (MAP) worldwide, respectively. The company’s vast unparalleled global base of users, compelling user experience, and its unique and efficient ability to finely target pools of consumers on a mass basis make the company’s platforms highly attractive for global brand, national, regional and local advertisers. Moody’s believes that the company will continue to be an innovative leader by developing and applying artificial intelligence and refined data analytics to improving ad performance and platform engagement. The company is investing heavily to move beyond 2D screens toward immersive experiences like augmented and virtual reality to help build the next evolution in social technology.

And while we should not trust rating agencies blindly, it should make us confident that Meta Platforms is a solid investment.

Intrinsic Value Calculation

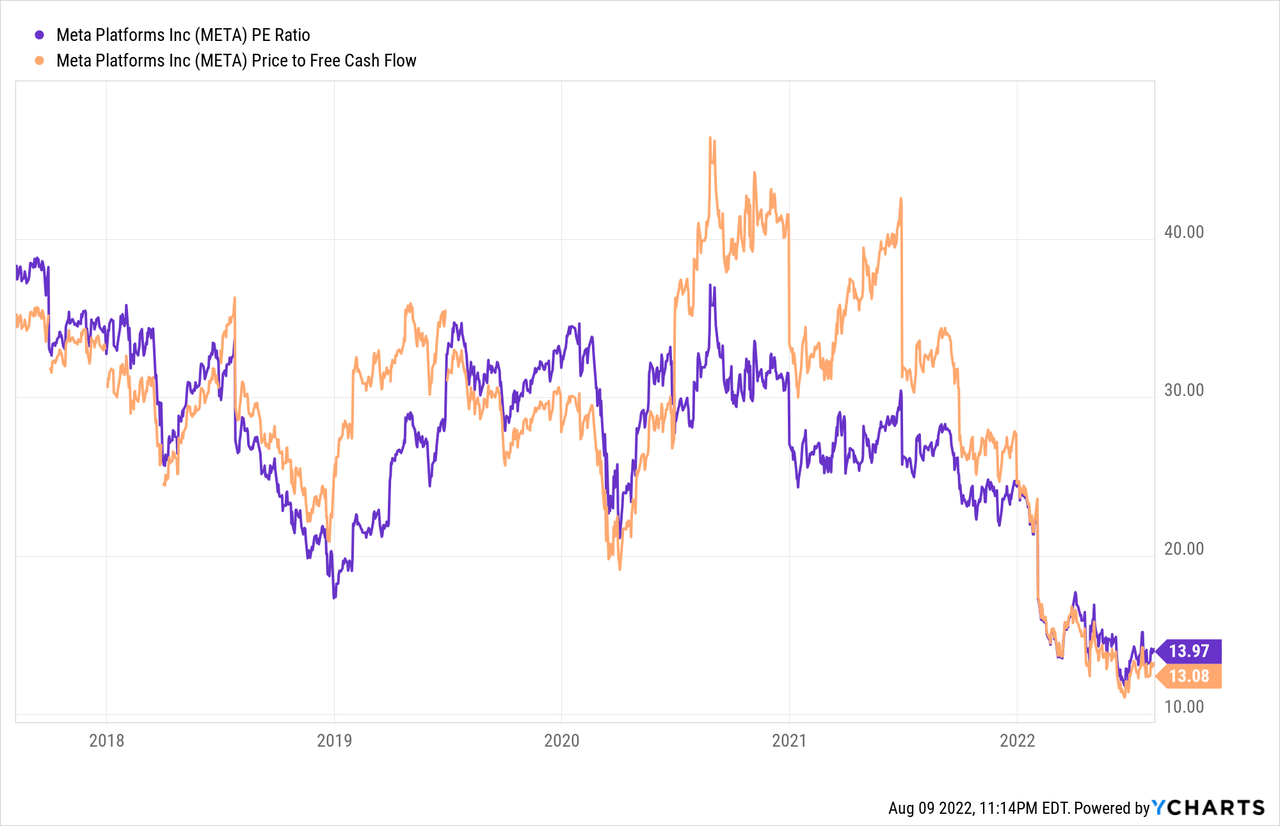

I still did not get used to META trading for such low valuation multiples. When using the TTM numbers, META is trading for 14 times earnings and 13 times free cash flow. And although META has been trading for a P/E ratio in the teens before (in late 2018) it seems like the business should deserve a higher valuation multiple.

Of course, if we assume Meta Platforms won’t be able to grow again, the business is most likely fairly valued and when operating under the assumption of Meta Platforms being a declining business the stock might even be overvalued. But when assuming just low growth rates for Meta Platforms in the years ahead, the stock is undervalued.

When using an intrinsic value calculation, we can take the free cash flow of the last four quarters as basis and calculate with different growth rates. This leads to the following intrinsic values for Meta Platforms.

|

Growth till perpetuity |

Intrinsic Value |

Growth till perpetuity |

Intrinsic Value |

|---|---|---|---|

|

0% |

$129.33 |

3% |

$184.76 |

|

1% |

$143.70 |

4% |

$215.55 |

|

2% |

$161.66 |

5% |

$258.66 |

It is enough for Meta Platforms to grow slightly above 2% to be fairly valued and it is enough to grow in the low-to-mid single digits to be undervalued. And although we must be assuming declining numbers in the next few quarters, I consider a growth rate of 4% to 5% more than realistic for Meta Platforms. In my last article, I wrote that Meta Platforms could be worth as much as $500 per share and although we should be a little cautious right now as we don’t know how steep the recession will be and how well Zuckerberg’s vision of the Metaverse will work out, I think Meta will trade for a much higher price in a few years from now.

Technical Picture

From a fundamental point of view, there is no reason for the stock to go any lower (despite the headwinds and struggles Meta Platforms is experiencing right now). However, fundamentals are not what is driving the stock price in the short term. And when looking at the chart right now, I can’t identify much support levels, and considering the negative sentiment, a declining stock price seems likely.

META could easily fall to its next support level around $140 (where we can find the COVID-19 lows) and the stock might also decline to the lows of December 2018 when it was trading for $122 and correct the last entire upward wave. And although this would mean Meta is trading for 10 times earnings (which is extremely cheap), it seems not unlikely for Meta to decline to that level. We also must expect the trailing twelve months’ earnings per share to decline further in the coming quarters and Meta Platforms would probably trade for a P/E ratio of 12 or 13.

Conclusion

I understand the arguments made against an investment in Meta Platforms based on recent quarterly results and Meta Platforms seems to struggle like it has never struggled in its history. However, Meta Platforms (or Facebook and Instagram) never had to experience a real recession and the stock lost already 60% of its value and most of the negative news seems to be reflected by the stock price already. And as a long-term investor, we should be more interested in the long-term vision than in quarterly results and I believe Meta Platforms will perform well over the long run.

Be the first to comment