fdastudillo/iStock via Getty Images

The Sith investor does like to keep things simple, and it is mostly about power. Ideally unlimited power, but there are also multitudes of overlapping spheres of influence, and the ability to make a show of force. In 2022, the Sith investor jumps into the dark pools of the market in order to amass hydrocarbons, uranium, droids, and space-age weaponry.

Power

The oneness of the universe appears undeniable to the Sith investor. Hydrocarbons are not hated or shunned. Neither is uranium. What really matters is the cost to acquire that power that you know you want, so you have it before you must get it at any cost. We are now in a world where the cost of power is on the rise, and the need for power becomes far more apparent as the cost increases.

The easiest way to gain broad access to the hydrocarbon markets is through an ETF, where I believe the best passive energy ETF for 2022 is likely Fidelity’s MSCI Energy Index ETF (NYSEARCA:FENY), though the Energy Select Sector ETF (NYSEARCA:XLE) is another reasonable way to play the counter trend rally that is occurring within the oil and gas markets. Both of these ETFs have substantial positions in Exxon Mobil Corporation (XOM) and Chevron Corporation (CVX), followed by many other large hydrocarbon companies.

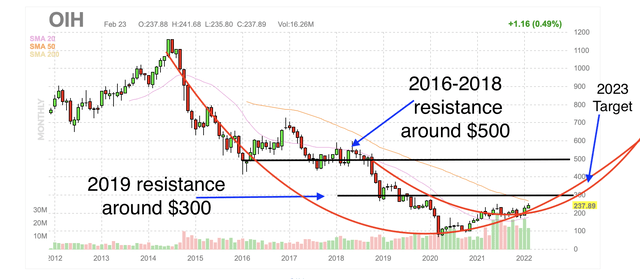

It also continues to appear likely that oil services companies are in the early stages of a break out and melt up. I believe the most reasonable way to get broad exposure to US listed oil services companies is the VanEck Oil Services ETF (NYSEARCA:OIH). This recent move looks, to me, like it could continue through 2023, and is proceeding as I had foreseen back in February.

Feb 24 OIH breakout expectation (by Zvi Bar using Finviz)

Some of the larger individual entities in the hydrocarbon services business make up the biggest constituents of the ETF, such as Schlumberger (SLB), Halliburton (HAL), and Baker Hughes (BKR). Don’t you actually wonder how long these companies may have been under Sith influence? Were you clouded to the obviousness?

Uranium will execute orders over $66

The world of new alternative energies is mostly aspirational, with problematic yield and questionable sourcing, among other issues, including cost. The bastard child of the group is the only one that is worth a damn, or a perhaps worth dam in this case. Nuclear power provides substantial power and while it is not unlimited power, it is rather intense. Moreover, it is an existing and working solution that requires uranium as a fuel source.

I believe the best way to get broad exposure to the uranium and nuclear power markets is through the Global X Uranium ETF (NYSEARCA:URA), but that companies such as Cameco (CCJ) and Uranium Energy Corp (UEC) are also rather interesting equities that appear to be breaking out.

Also, for individuals that want physical uranium as an investment, there is now the Sprott Physical Uranium Trust (OTCPK:SRUUF) that holds substantially all of its assets in uranium in the form of U3O8, which is a popular type of yellowcake. Yes, uranium is a yellow metal, several of which are apparently investable.

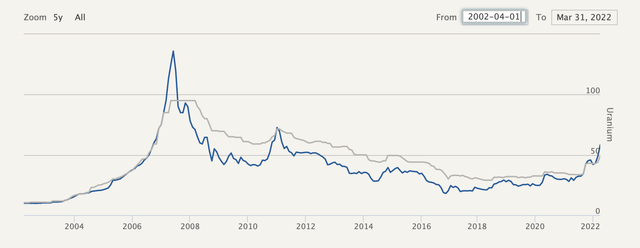

Uranium prices are in an apparent break out. The price of the commodity is historically volatile, but the cost of the commodity is less material to the power production than is the case for facilities that run on hydrocarbons. Most nuclear plans would be able to sustain a significant increase to the cost of uranium before it was material to the margins as compared to what would happen if hydrocarbons substantially spike from current levels.

Uranium had been in the lurch since Fukushima, but I think it just climbed out.

uranium spot prices 20-year chart (Cameco Corp.)

Uranium now trades in the low $60s per pound and appears likely to go up and through the mid-$60s in the near term.

Looking for droids

There can be no doubt that droids are often helpful, but one must understand that a droid is only as good as its battery pack and your ability to recharge it. For this reason, and at this time, it appears that the cost of energy and components are likely to be headwinds for the robotics industry. As result of these issues, as well as many macro forces affecting the market at the moment, many robotics manufacturers are not doing very well. The mid-term chart of the Global X Robotics & Artificial Intelligence Thematic ETF (BOTZ) shows the weakness seen across the industry.

The Global X Lithium & Battery Tech ETF (LIT) indicates similar weakness, largely due to higher oil and gas costs, as well as supply chain issues, and the sanctioning of a substantial portion of productive capacity. The battery technology appears to be holding up better than the robotics tech so far.

Should this headwind lead to a capitulation, the Sith investor would see that as an opportunity to accumulate a long term position in droid manufacturing capacity, as well as battery element mining and production capacity.

Ships, rockets, and energy weapons

Most defense companies are breaking out and have been since war broke out in Ukraine. If one already had an investment in such companies, that would have been fortunate. At this present time, it is probably best to listen for the information that should be forthcoming from these companies, and see how they react to the data.

In particular, I would point to Lockheed Martin (LMT) which is set to report its quarterly earnings on Tuesday, April 19. It appears as though Lockheed shares are breaking out and have the potential for a strong continuation on and following a well received report, but also the possibility to cool off upon the laying of an egg. Lockheed’s results and guidance could easily push the industry around, and possibly generate some short term opportunities in peers whose reporting is later in the quarter.

Any substantially negative reaction without the addition of information material to the future sales and profitability of the business would likely be a buying opportunity. Similarly, a significant breakout above $480 would strongly indicate the start to another upward move.

There are several decent aerospace and defense ETFs, including the iShares US Aerospace & Defense (ITA), the Invesco Aerospace & Defense ETF (PPA), and the SPDR S&P Aerospace & Defense ETF (XAR).

Conclusion

The Sith investor is enjoying 2022 on the strength of the performance of hydrocarbons, uranium, and defense stocks. Oil services appear likely to perform well over the next several quarters, and potentially outperform the underlying commodity on a continuing break out. Similarly, uranium appears to be in the early stages of a new upward price cycle.

Defense companies have performed exceptionally well, and that performance may continue. Lockheed Martin’s earnings report early this week may be a possible catalyst to investing in defense companies, depending upon the market’s reaction to guidance. Speculation should be limited until that material information is received and market forces have reacted.

Be the first to comment