simon2579

The Summer Rally

I made an argument on June 27th that stocks are likely staging a sustainable summer rally. The bullish case (at the time) was as follows:

The carnage in commodity prices will likely produce a falling headline CPI inflation reading over the next few months, which will allow the Fed to implement the signaled dovish turn – or pause in September to evaluate the effect of already implemented monetary policy tightening. Thus, the CPI report on July 13th holds the key on whether the summer rally can be sustained.

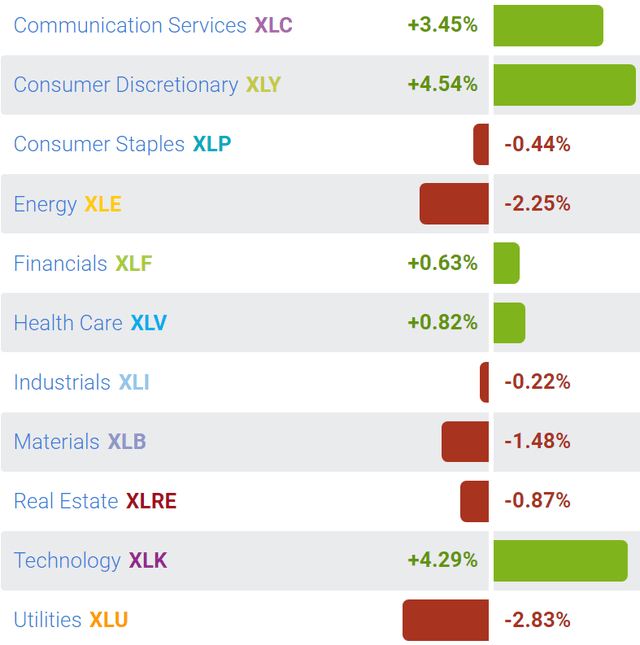

In fact, stocks are well of their lows, and it appears that the summer rally is well underway. More importantly, the recent rally has been led by Tech stocks (XLK), and the tech-like stocks in the Consumer Discretionary (XLY) and the Communication (XLC) sectors. Here is the sector performance over the last 5 days:

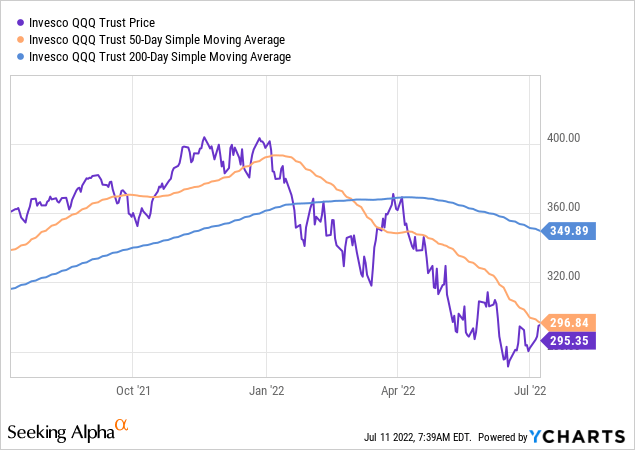

The most efficient and liquid to play the summer rally is by buying the tech heavy Invesco Nasdaq ETF (NASDAQ:QQQ), where investors can get exposure to these large tech stocks expected to lead the bounce, and yet, to avoid the large single-stock exposure risk by stock picking. Here is the chart showing the recent QQQ performance:

At this point, the QQQ chart shows the price is well of the lows, but down more than 26% YTD. More importantly, the chart shows the “higher low” and the bounce to the first and the key technical resistance – the 50dma. The last time QQQ was above the 50dma was on April 8th, and since, the 50dma was the reliable downtrend resistance level. Thus, technically, the 50dma breakout is the necessary pre-requisite to the sustainable summer rally, which could extend to a much higher resistance level at the 200dma (currently around 350).

Note on QQQ, the top 4 stocks account for almost 40% of the index, so QQQ is heavily concentrated on big-tech leaders. The broader market simply cannot bounce without the significant participation of these stocks, so the exposure to QQQ gives the direct but diversified participation to the market cap leaders. Here is the table of the top 4 QQQ stocks:

| Apple (AAPL) | 11% |

| Microsoft (MSFT) | 10% |

| Amazon (AMZN) | 8% |

| Alphabet A and B (GOOG) | 8% |

Fundamental triggers to watch

So far, I explained that technically the QQQ is at the important resistance, and the break above the 50dma is likely to propel the index towards to 200dma. Also, note that the technical breakout above the 50dma could trigger short covering, which by itself could sustain the summer rally.

However, the summer rally can be cut short by renewed selling by fundamentally driven investors, which could push the index to new lows. Thus, it is important to consider the fundamental triggers.

The bearish case:

The bearish case is simple, every recession since 1945 has been preceded by the Fed’s monetary policy tightening cycle. Thus, the market participants expect the current Fed’s monetary policy tightening cycle will also cause the next recession, and the recessionary bear market.

In other words, the bearish investors expect the Fed-induced recession, and with that the significant downgrade in corporate earnings, and possibly the increase in credit risk leading to more corporate bankruptcies. Higher multiple tech stocks are particularly vulnerable in such environment.

The bullish case:

Note, there were 13 Fed’s interest rate hiking cycles since 1945, which caused a recession 10 times with 3 exceptions: 1994-95, 1983-84, 1965-66. The bulls argue that the nearly 30% correction since Jan 4th has removed the speculative excess from tech valuations, and if the Fed is able to engineer a soft-landing (another exception), the QQQ has likely already bottomed, and it’s time to start buying.

In other words, the bullish investors do not expect the Fed-induced recession, or possibly expect a very shallow and short recession that has been already priced in.

The key disagreement: the recession expectations

Thus, the bulls and the bears disagree whether there will be the Fed-induced recession, and if yes, the depth and length of such recession. Obviously, the key to the eventual resolution of this disagreement is heavily dependent on the actual Fed tightening policy.

Specifically, the recession will be very likely if the Fed inverts the 10Y-3mo spread. Currently, the spread is at 1.11%, but it’s narrowing quickly, and it’s expected to invert by the end of 2022. Practically, if the yield on 10Y Treasury stays around 3%, the Fed would have to exceed the 3% level on the Federal Funds rate. Currently, the Fed is expected to hike to 3.49% by the end of 2022. Thus, the market expects the recession sometimes in the second half of 2023.

However, the depth and the length of the expected recession is the function of whether the Fed causes the bust of the housing bubble and, thus the increase in the credit risk. At this point we don’t have enough information to forecast the credit risk in 2023.

What to watch next?

Obviously, the Fed’s monetary tightening path is the key on whether the recession occurs next year, and whether the recession causes the spike in credit risk.

The Fed has indicated that it does not intend to cause the recession, and the desire to pause the monetary policy tightening in Sep of 2022 to evaluate the effects of higher interest rates on economy before deciding on the next policy action.

However, the surprise in the May headline CPI caused the significant hawkish repricing of monetary policy tightening and led to an actual oversized 75bpt hike in June, with another 75bpt or 50bpt excepted in July. However, note, the Fed indicated that it needs to see “several months” of declining headline CPI to consider the dovish turn.

That brings us to the July 13th CPI inflation release. The current expectations are for 8.8% headline CPI or the new cycle high! However, given the correction in oil prices, as well as prices of other commodities, it is likely that the headline CPI could surprise to the downside – which could be the trigger to push the QQQ over 50dma and propel the summer rally.

Thus, at this point, I recommend the hold on QQQ, but the 50dma breakout with the downside surprise in the headline CPI on July 13 will trigger the tactical buy. Will update accordingly.

Be the first to comment