canbalci/iStock via Getty Images

Main Thesis/Background

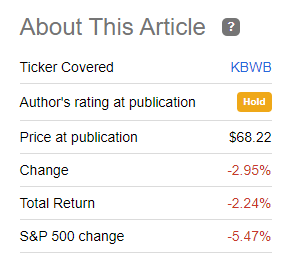

The purpose of this article is to evaluate the Invesco KBW Bank ETF (KBWB) as an investment option at its current market price. This is a sector-specific fund, with a focus on bank stocks exclusively. Importantly, it is heavily weighted towards the biggest banking names, and it is managed by Invesco. KBWB is a fund I have owned for a while, and is my preferred way to own the banking sector. Despite this, I took a more cautious tone during my last review. Given the recent sell-off we have experienced, this caution appears to have been justified in the short-term:

Article Performance

Importantly, while banks (and KBWB) have seen some selling pressure, it is notable that they have still out-performed the S&P 500. This is due to a flee from Tech/growth plays, and speaks to the general strength the Financials/Banking sector had been experiencing in late 2021. With that recent momentum in my mind, I think picking up this fund now that it has dropped a little makes sense.

The reasons are multi-fold. One, earnings came in fairly strong for most of the major banks in Q1. While investors found fault with some of the metrics, I saw underlying strength. Two, there are only a few sectors that actually benefit when interest rates rise, and Financials is one of them. Three, while labor costs are up at large banks, they continue to cut costs through mergers and acquisitions, as well as branch closures. That is a positive. Finally, loan growth is growing for the top U.S. financial institutions. That points to a growing economy, which is support for ignoring the short-term volatility.

The Risk-On Plays Are Getting Punished Most

To begin, I want to look at the broader market picture. As readers are likely aware, this has been a difficult month for most investments. Large banks, and KBWB, have not been immune to this volatility, as evidenced by the fund’s negative return since my last article. Despite these losses, investors in bank stocks can take some comfort in knowing that while their positions are down, they have held up better than other risk/growth/speculative options. To illustrate, consider the graphic below, which shows how Tech (among other names) have been punished as 2022 has gotten underway:

Of course, there are two ways one could look at this. The speculative view is this as a buying opportunity for Tech. After all, the NASDAQ is almost in bear market territory, and that is typically a glaring “buy” signal. But I view this dynamic as confirmation that buying quality and remaining diversified are better ideas.

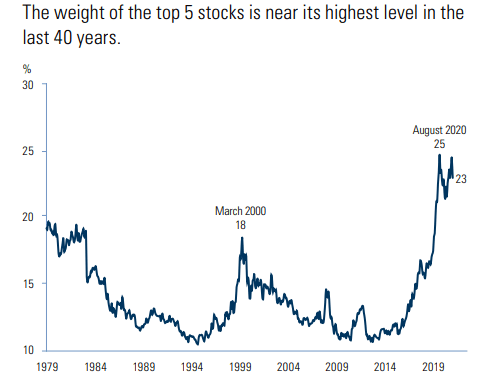

Of course, if one is under-weight Tech, than that outlook changes. I would definitely say to an investor who is lacking U.S.-tech exposure to view this sell-off as a buying opportunity. However, I don’t think that is the case for most investors. For example, if one simply owns the S&P 500, they have a tremendous amount of Tech exposure. Not only that, but the exposure is heavily concentrated in just a few names. To me this limits the attractiveness of buying more of these shares:

S&P 500 Concentration

Simply put, the S&P 500 remains extremely concentrated by just a few names. This increases the inherent risk in index investing, even though that is typically seen as one of the safer ways to invest.

To be fair, I am not advocating against the S&P 500. That makes up the majority of my investment exposure. But because of that reality, I like to utilize sector funds that are not so dominate in the S&P 500 to round out my portfolio. Therefore, as the sell-off materialized, I am looking to add to under-weight names, like Financials (among others) rather than just pumping more money in to my Vanguard S&P 500 ETF (VOO) position. This approach may not be the right move for everyone. But I see it as a good way to pick up a sector that has sold-off and not buy in to the same names that I already have a tremendous amount of exposure to anyway.

Loan Growth Is Strong, Suggesting Underlying Strength

I now want to shift in to look at the broader lending sector, which is very relevant to KBWB. The good news is while this is relevant to the top five holding (which make up just under 40% of total fund assets), and include Wells Fargo (WFC), Bank of America (BAC), JPMorgan Chase (JPM), U.S. Bancorp (USB), and Citigroup (C), it is also good for some of the less talked about names in banking.

Specifically KBWB holds 25 of the largest banks in the country and, according to a recent report by Bloomberg, collectively the 25 top commercial banks have seen strong loan growth heading in to the new year. This bodes well for both the banking sector and for those looking for reasons for optimism regarding the current state of the U.S. economy:

Loan Growth At US Banks

The conclusion I draw here is this is good for two reasons. One, it signals an expansionary economic environment, which is great for large banks. Two, with an expectation for yields and rates to rise this year, lenders should have the ability to meaningfully improve their net margins is this loan growth continues. Of course, if loan growth stalls once rates rise, that negates the benefit, but I don’t see that happening to a substantial degree. Even if the Fed hikes rates this year, which is almost a certainty, interest rates will still be low by historical measures. The economy is growing, a .50-1% move in rates should not bring things to a standstill. If loan growth does continue, as rates rise, lenders are going to profit in a way that is unique to most other sectors. This is bullish for KBWB.

Market Excess Is Not Coming From This Sector

I will now shift to another reason I see merit to putting some cash in to this sector/fund right now. Clearly, when the market sells off, it can difficult for investors to want to dive right in. While it is a winning play longer term to buy on down days like what we have seen recently, it is easier said than done. To alleviate some of the stress of doing so, I tend to focus more on value opportunities to play rebounds, just in case the risk-off sentiment is not done yet. I rarely time to the bottom with my purchase decisions, so focusing on relative value helps me sleep well at night knowing relative downside should also be limited.

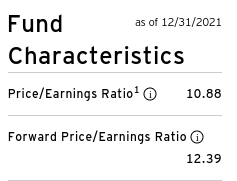

To see why this favors KBWB, consider the fund has a current P/E and forward P/E in the 11-12.5 range, which is fairly cheap:

P/E Ratios

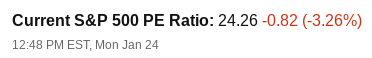

This ultimately suggests the fund (and underlying stocks) are well supported by earnings. This is especially true when we compare these multiples to the P/E of the broader S&P 500, which is still at a very lofty level:

S&P 500 P/E Ratio

This is a very simplistic rationale for buying Financials/Banks, and I would not advocate buying on this reason alone. However, the point remains this is a very attractively valued sector. If I saw a lot of underlying weakness and headwinds, I would say this valuation is justified and a potential value trap. But that is not the environment I am seeing – I see 2022 as a potentially strong year for banks. Therefore, with this valuation spread sitting where it is, I view that as support for a bullish take on KBWB.

Branch Closings Continue

Another point on the broader banking sector has been their focus on cost cutting. This has been a challenging area, as many banks have shifted to hybrid work environments, forcing them to pay for under-utilized office space as many associates still have an office presence but use it less frequently (if at all). Further, GS made headlines last week when it discussed how employee compensation was driving up operating costs, hurting the stock. Importantly, this is not a unique trend, according to a report from Reuters:

Bank Compensation

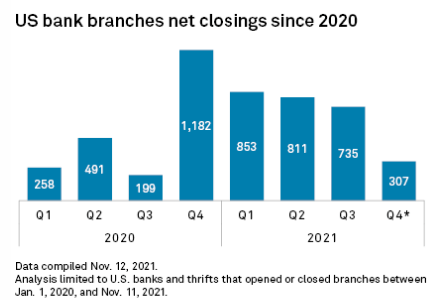

Certainly this presents a headwind for the banks as the struggle with a tight labor market. However, readers should note this is not unique to just banks, as many firms are being forced to raise compensation to attract workers. Further, on the plus side there has been a continued focus on cost cutting by banks big and small. A primary move has been to continue the trend of shuttering branches, which accelerated after the pandemic hit:

Branch Closures S&P Global

The takeaway to me is that banks have done a great job at working on ways to control expenses. Wage inflation is hitting corporate America hard, but banks are able to take some steps to mitigate that impact. Ultimately, the environment will remain challenging, but it is a positive to see such a continued, focused approach on generating savings where they can.

Bottom line

With every sell-off comes an opportunity, and I see an opportunity in KBWB right now. The fund has been caught up in the recent market weakness, but I expect a turnaround is eminent as there is plenty of underlying strength in this sector. The major banks have had a strong Q4 in terms of earnings, the sector is poised to benefit from rising interest rates later this year, and loan growth signals an economy that is willing and able to borrow. All of these are positive catalysts for KBWB. For me, I am using the recent drop as a chance to buy quality stocks for a discount, and this is a fund I will be adding to this week. As a result, I will be building on this core position, and I would suggest readers give this fund some consideration at this time.

Be the first to comment