-Oxford-

Introduction: Why is Intuit Stock Up?

Intuit Inc. (NASDAQ:INTU) released Q4 FY22 results overnight (Tuesday, August 23). INTU shares are up 6% this morning as of 11 am EST (at around $476).

We initiated our Buy rating on Intuit in September 2019. Shares have since gained 80% (including dividends) in just under three years, though the share price is currently down 14% from a year ago and 34% below its November peak:

|

Librarian Capital’s Intuit Rating History vs. Share Price (Last 1 Year)  Source: Seeking Alpha (23-Aug-22). |

Our investment case is on track. Q4 represented a strong finish to FY22, with revenues and Non-GAAP EBIT both again growing double-digits. Management has guided to another year of double-digit growth in FY23, and raised their long-term revenue growth target for the Small Business Segment. Intuit shares now trade at a 40x P/E (on FY22 Non-GAAP EPS), slightly above our long-term assumption. However, with Intuit’s strong EPS growth, our forecasts still indicate a total return of 63% (14.5% annualized) by July 2026. Buy.

Intuit Buy Case Recap

Intuit is one of the strongest businesses in our coverage, providing mission-critical software and services (with accounting and tax at the core) to small businesses and consumers in the U.S. and selected international markets, on a largely recurring revenue model (including with subscriptions).

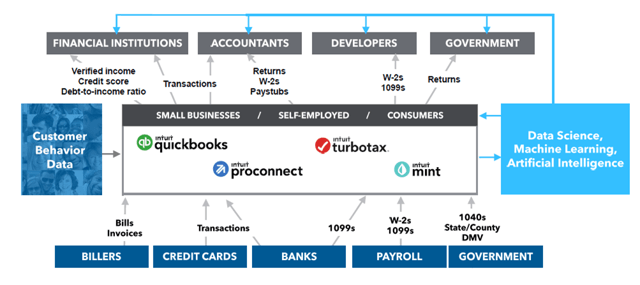

Intuit is also a platform business, enjoying strong economies of scale, operational leverage and the ability to cross-sell. Under the “One Intuit Ecosystem” strategy since 2017, management has enabled the flow of data across its platform as well as opened it to third-party operators, creating a powerful ecosystem of apps, data analytics and referrals:

|

One Intuit Ecosystem (as of 2018)  Source: Intuit investor day presentation (Sep-21). |

Since 2018, Intuit has further expanded its addressable market through acquisitions, including into personal finance products (with Credit Karma) and small business marketing solutions (with Mailchimp).

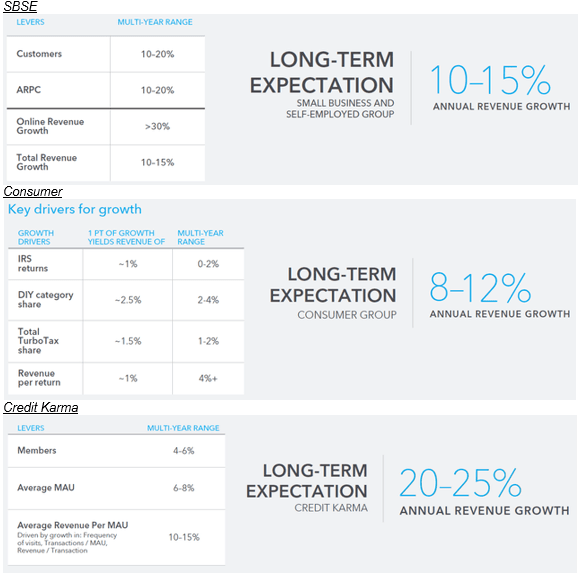

Intuit has historically targeted and delivered double-digit revenue growth as well as an expanding EBIT margin. At its last investor day in September 2021, management reaffirmed these long-term targets, and set out revenue growth targets of 10-15% for Small Business & Self-Employed (“SBSE”), 8-12% for Consumer and 20-25% for Credit Karma:

|

Intuit Long-Term Revenue Growth Expectations By Segment  Source: Intuit investor day presentation (Sep-21). |

Q4 FY22 results showed Intuit meeting or exceeding its growth targets in all segments.

Intuit Q4 FY22 Results

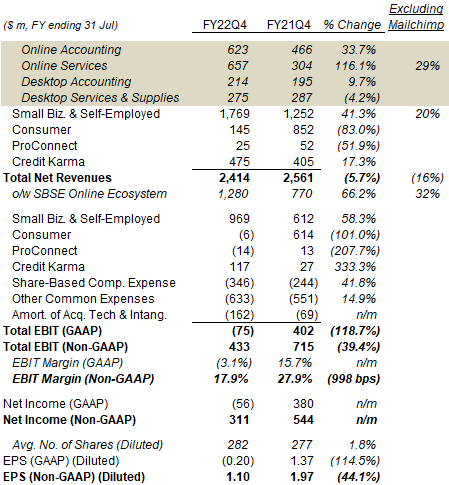

Intuit’s key P&L items for Q4 FY22 are below. Year-on-year comparisons are distorted by acquisitions and seasonality, but where comparable Intuit businesses grew by double-digits year-on-year at rates well above their targets:

|

Intuit P&L (Q4 FY22 vs. Prior Year)  Source: Intuit results materials (Q4 FY22). |

SBSE revenues grew 41.3% year-on-year in Q4, helped by the acquisition of Mailchimp (which closed on November 1, 2021). Excluding Mailchimp, SBSE revenues grew 20%, with Online Accounting revenues growing 34% and Online Services growing 29%, and total international online revenues grew 23% on a constant currency basis.

Consumer revenues for Q4 were down 83% year-on-year, because an earlier IRS filing deadline this year (April 18, compared to May 15 in 2021) shifted revenues from Q4 to Q3.

Credit Karma revenues grew 17.3% year-on-year in Q4, driven by strength in credit cards and personal loans, partially offset by headwinds in auto insurance and home loans. Management observed “increased volatility” in personal loans as higher interest rates made funding challenging for some product partners, but “have not seen any significant impact” in credit cards. (During FY22, “just over a third” of Credit Karma revenues came from personal loans, while “nearly half” came from credit cards.)

Group P&L items for Q4 are not comparable year-on-year due to the shift of Consumer revenues to Q3 described above.

Intuit Full-Year FY22 Results

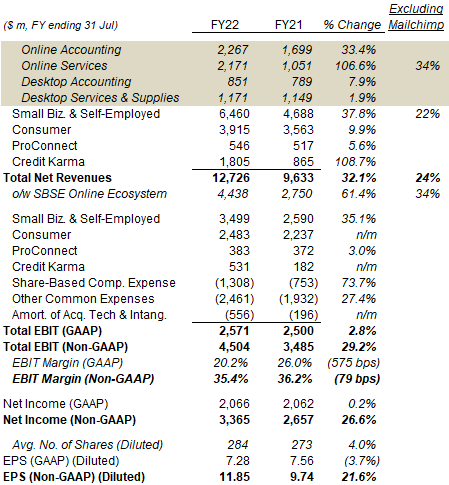

Intuit’s key P&L items for full-year FY22 are below. SBSE and Credit Karma both grew revenues by strong double-digits year-on-year, even excluding Mailchimp, while Consumer revenues grew by just under 10%:

|

Intuit P&L (Full-Year FY22 vs. Prior Year)  Source: Intuit results materials (Q4 FY22). |

SBSE revenues grew 37.8% year-on-year in FY22, or 22% excluding Mailchimp, including Online Accounting revenues growing 33.4% and Online Services growing 34%, and total international online revenues grew 30% on a constant currency basis. Within Online Services, Payment revenues were “growing north of 30%”, a significant acceleration from the low-teens growth rates seen 4-5 years ago.

Consumer revenues grew 9.9% year-on-year in FY22, mainly driven by price and mix. Overall TurboTax unit volume was flat (but up 1% in online) due to the industry number of IRS returns shrinking with the non-repeat of one-time stimulus-related filers in the prior year and a “significant” increase in the number of IRS extensions, offset by Intuit continuing to gain market share (as described in our Q3 FY22 review),

Credit Karma revenues grew 108.7% year-on-year in FY22, as it contributed a full year’s revenues this year compared to just under eight months in FY21 (the acquisition closed on December 3, 2020). On a pro forma basis, Credit Karma revenues grew 58%, driven by the same dynamics described for Q4 FY22.

Group revenues grew 32.1% year-on-year, or 24% excluding Mailchimp. If we further exclude Credit Karma revenues from both periods, then revenue growth was 16%.

Group Non-GAAP EBIT grew 29.2% ($1.02bn) year-on-year to $4.50bn in FY22. However, GAAP EBIT grew by just 2.8% ($71m) to $2.57bn. More than half of the gap between the two dollar growth figures can be attributed to Share-Based Compensation (“SBC”) costs, which grew $555m year-on-year to $1.31bn.

The average number of shares grew 4.0%, as dilution by equity issued in the Mailchimp acquisition ($6.3bn) more than offset share repurchases ($1.9bn) during the year.

Double-Digit Growth Track Record

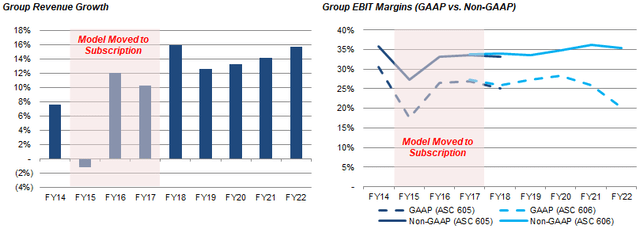

FY22 represented a continuation of Intuit’s record of growing revenues at double-digits. Even if we exclude the newly-acquired Credit Karma and Mailchimp businesses, revenue growth was 16%, even better than the past few years, which were consistently in the double-digits:

|

Intuit Group Revenue Growth & EBIT Margin (FY14-22)  Source: Intuit company filings. NB. FY21 and FY22 revenue growth rates exclude Credit Karma and Mailchimp. |

Non-GAAP EBIT margin shrunk by about 80 bps to 35.4% in FY22, likely due to the acquisitions. (Non-GAAP EBIT margin rose 65 bps to 63.4% in the Consumer segment.) GAAP EBIT margin has shrunk by about 800 bps since FY20, largely due to SBC costs and amortization of acquired intangibles.

Intuit FY23 Guidance

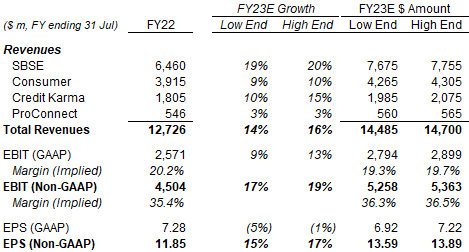

Intuit issued guidance for FY23 for the first time, with another year of strong double-digit growth expected, including revenue growth of 14-16%, Non-GAAP EBIT growth of 17-19% and Non-GAAP EPS growth of 15-17%:

|

Intuit FY23 Guidance  Source: Intuit results materials (Q4 FY22). |

For individual segments, Intuit expects revenue growth of 19-20% in SBSE, 9-10% in Consumer and 10-15% in Credit Karma. Credit Karma’s expected FY23 growth rate is below its long-term 20-25% target, which management explained was the result of its growth having exceeded target so much in the past two years (58% in FY22, 37% in FY21).

GAAP EBIT growth is expected to be much lower at 9-13%, again due to SBC costs, which are expected to rise 39% to $1.8bn. However, 25% of the SBC costs are associated with Credit Karma and Mailchimp, and management expects “stock-based compensation as a percentage of revenue to flatten over the next few years.”

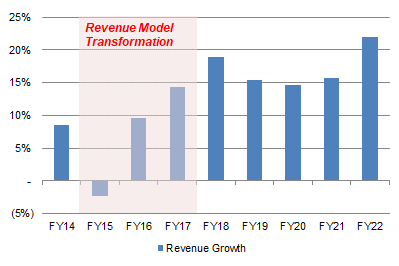

Raising Long-Term Target for SBSE

Intuit is raising its long-term revenue growth target for SBSE, the segment that contributed 51% of its revenues in FY22, from 10-15% to 15-20%.

We believe this is reasonable given the acceleration in the growth of SBSE’s non-accounting services (Payments, Payroll, Capital and Time Tracking) as well as the addition of the fast-growing Mailchimp business. SBSE revenue growth had been at around 15% in FY19-21 (despite COVID-19) and was 22% in FY22 (excluding Mailchimp):

|

Intuit SBSE Revenue Growth (FY14-22)  Source: Intuit company filings. NB. FY22 growth rate excludes Mailchimp. |

Mailchimp itself grew revenues by 20% year-on-year in 2020, though it is currently performing below expectations.

Mailchimp Temporarily Below Expectations

Intuit described Mailchimp revenues as “slightly below” expectations and attributed this to weaker-than-expected products and processes that led management to reduce marketing and focus on product enhancements first. As Intuit CEO Sasan Goodarzi explained on the call:

“There are conversion gaps in the product that we felt like were critical to address … And specifically, those were things like coming to the website and the number of people that we saw falling off versus what we would expect based on our experience with … what we believe are some best-in-class engagement and conversion. Then when you get into the product, we measure active use and making sure that you’re getting into the features that you really wanted to get into and hence why you signed up for Mailchimp and even our checkout process. So those are just three illustrative examples of what I would say just basic blocking and tackling product conversion that we really wanted to double down on to make sure that we are ready for busy season.”

The underperformance is expected to be temporary. Intuit expects to complete the needed product enhancements soon and to ramp up marketing in September. Their view on Mailchimp’s long-term potential is unchanged.

Valuation – Is Intuit Stock Overvalued?

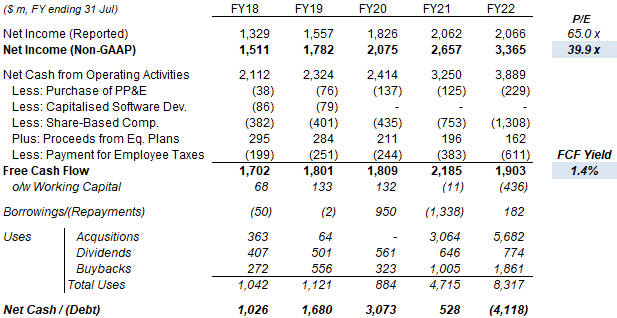

At $476, relative to FY22 Non-GAAP EPS, Intuit stock is trading at a P/E of 40x; however, relative to GAAP EPS, Intuit’s PE is about 65x:

|

Intuit Earnings, Cashflows & Valuation (FY18-22)  Source: Intuit company filings. |

FY22 SBC costs of $1.31bn substantially equals the gap between GAAP and Non-GAAP Net Income that year.

Free Cash Flow (“FCF”) Yield, which we calculate after deducting SBC costs, is just 1.4% on FY22 financials. FCF was reduced by an atypically high working capital cash outflow of $436m, which included a $287m increase in accrued compensation and related liabilities.

Relative to FY23 guidance, Intuit’s P/E is approximately 35x on Non-GAAP EPS and 67x on GAAP EPS.

Intuit has a Dividend Yield of 0.7%, from a dividend of $0.78 per quarter ($3.12 annualized), which has just been raised by 15% with FY22 results.

Intuit repurchased another $508m of its shares during Q4, taking the FY22 total to $1.9bn. A new $2bn program has just been approved by the Board, taking the total authorization to $3.5bn, or 2.6% of the current market capitalization. Management stated their “aim is to be in the market each quarter” and had stated in the past they aimed to use buybacks to, “at a minimum”, offset dilution from share-based compensation over a 3-year period.

Intuit Stock Forecasts

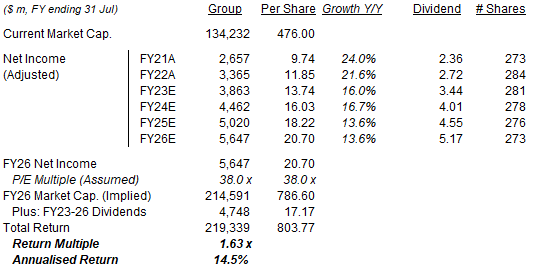

We have updated forecasts with new FY23 guidance and also extend them by a year. We now assume:

- FY23 EPS of $13.74 (was $13.66), mid-point of the new guidance

- In FY23 and FY24, Net Income growth of 15.5% each year (unchanged)

- In FY25 and FY26, Net Income growth of 12.5% (unchanged)

- From FY23, share count reduction of 1.0% each year (unchanged)

- From FY23, dividend to be based on a Payout Ratio of 25% (unchanged)

- P/E of 38x at July 2026 (unchanged)

Our new FY25 EPS forecast of $18.22 is 0.6% higher than before ($18.11):

|

Illustrative Intuit Return Forecasts  Source: Librarian Capital estimates. |

With shares at $476, we expect an exit price of $787 and a total return of 63% (14.5% annualized) by July 2026, in just under four years.

Is Intuit Stock a Buy? Conclusion

We reiterate our Buy rating on Intuit stock.

Be the first to comment