SergeyMihalenko/iStock via Getty Images

From July 2021 to April 2020, Intrepid Potash (NYSE:IPI) stock price increased by more than 300% to $120 per share. However, despite the incremental potash price trend, the stock’s price dropped to below $40 per share in the last three months. According to the market condition driven by the war in Ukraine & the global food insecurity, and the company’s position to benefit from the high fertilizer prices, IPI stock is opportunistic. Based on my evaluation, IPI is worth more than $70 per share. The stock is a buy.

2Q 2022 results will be strong

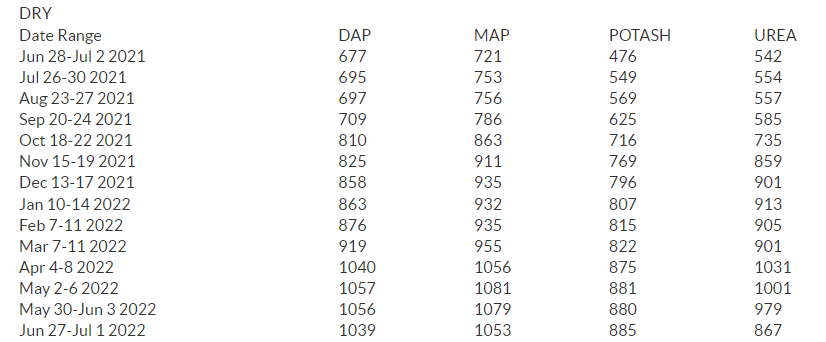

In the first quarter of 2022, IPI’s potash average realized prices increased by 149% to $703 per ton. Also, its Trio average realized price increased by 101% to $469 per ton. IPI’s revenue from the potash segment in the first quarter of 2022 was $51.6 million, compared with 1Q 2021 potash revenue of $37.8 million. IPI reported 1Q 2022 Trio revenue of $39.6 million, compared with 1Q 2021 Trio revenue of $22.5 million. In the first quarter of 2022, IPI produced and sold 103000 (-9% YoY) and 69000 (-41% YoY) tons of potash, respectively. Also, Intrepid produced and sold 65000 (16% YoY) and 71000 (3% YoY) tons of Trio, respectively. A year ago, IPI’s stock price was around $32 per share. IPI skyrocketed to about $120 per share in April 2022 and then, dropped to below $40. On the other hand, Figure 1 shows that the average weekly price of potash has increased continuously from $476 per ton in July 2021 to $885 in July 2022.

Figure 1 – Average weekly retail fertilizer prices

DTN/Progressive Farmer

However, it is worth mentioning that IPI’s potash sales volume decreased by 41% YoY as the company entered 2022 with lower potash inventory and less potash available in its ponds. Why? Because of the below-average 2021 production season. During the summer of 2021, due to the unusually wet, humid weather in Carlsbad (New Mexico), where IPI’s HB solar solution mining facility is located, IPI’s evaporation and extraction rates decreased and caused fewer harvestable tons of potash from the company’s HB solution ponds. What about now?

I mentioned earlier that in the first quarter of 2021, IPI produced 103000 tons of potash and sold 69000 tons of potash. In July, August, and September 2021, Carlsbad had 35 rainy days with precipitation. In July, August, and September 2022, Carlsbad is expected to have 53 days of precipitation. It means that the summer of 2022 is expected to be more humid than the summer of 2021. Thus, I expect that compared with the summer of 2021, IPI’s harvestable tons of potash from its HB solution ponds to decrease in the summer of 2022.

On the other hand, due to the robust global demand and low global supply, I expect the price of potash to remain high for the rest of 2022. According to Bloomberg, Russia was the second largest potash supplier in 2021. After Russia invaded Ukraine, the price of potash jumped due to the Russian fertilizer export ban. Moreover, the sanctions against Belarus potash and the Chinese potash export ban (due to shortage and food insecurity concerns) increased the prices further. There is still no hope for the end of the war in Ukraine. Also, due to the increasing concerns about global food insecurity and inflation, I expect the Chinese fertilizer export ban to continue for the rest of the year. Thus, potash price will remain high. In the first quarter of 2022, the average weekly retail potash price was around $820 per ton, and IPI’s potash average net realized sales price was $703 per ton. In the second quarter of 2022, the average weekly retail potash price was $880 per ton. I estimate an average net realized sales price of $750 per ton in 2Q 2022 for IPI’s potash. With a 2Q 2022 potash sales volume of 65000 tons, I expect 2Q 2022 sales and gross margin of about $58 million and $31 million, respectively (in the potash segment). Thus, even with potash sales of below 70000 tons in 2Q 2022, I expect Intrepid Potash to report strong results in its 2Q 2022 financial report.

Performance outlook

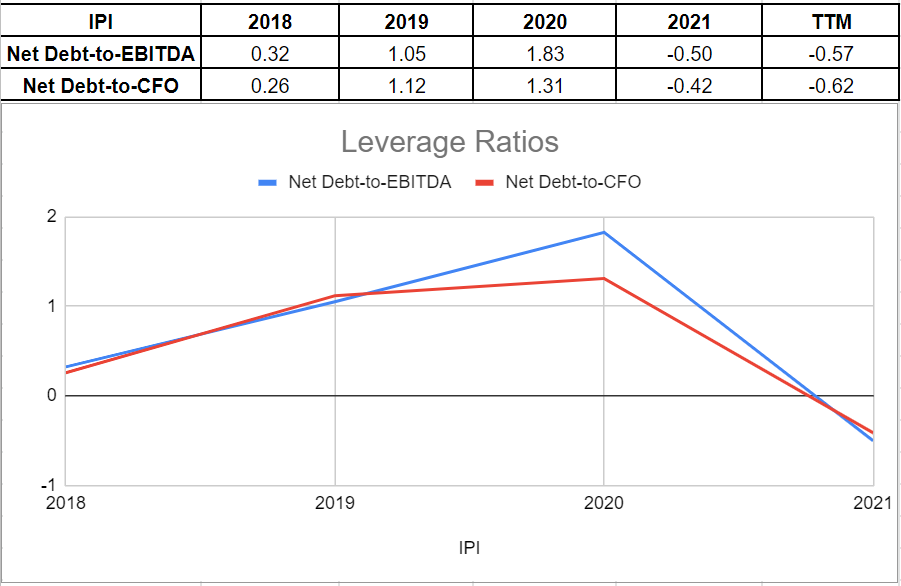

As I mentioned in my previous article, Intrepid Potash performed strongly in 2021. Following its lower net debt, it is not surprising to see its leverage ratios decrease across the board in net debt-to-EBITDA and net debt-to-operating cash flow. IPI’s negative net debt caused negative leverage ratios, and that is because the company possesses more cash and cash equivalents than its debt. The net debt-to-EBITDA and net debt-to-CFO ratios fall to (0.57) and (0.62), respectively. Hence, Intrepid Potash is showing financial stability under the lenses of leverage ratios (see Figure 2).

Figure 2 – IPI’s leverage ratios

Author (based on SA data)

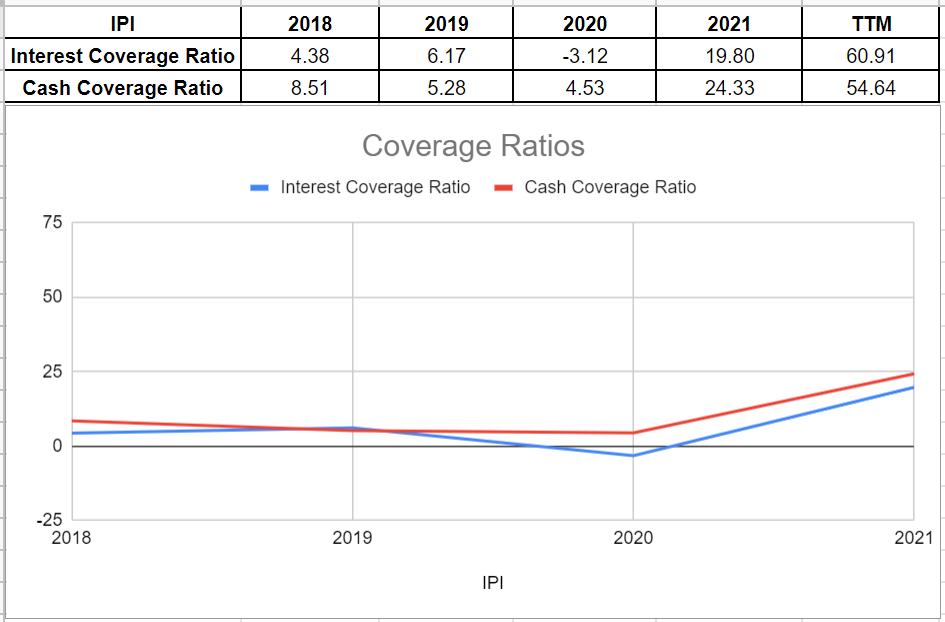

Moreover, we can analyze IPI’s coverage ability across the board of its interest-coverage ratio and cash-coverage ratio. Currently, its ICR is 60.91, which indicates the company’s ability to pay its interest expenses on its debt with its operating income. Also, as a conservative metric to compare the company’s cash balance to its annual interest expense, IPI’s cash-coverage ratio has more than doubled versus its previous level of 24.33x at the end of 2021 (see Figure 3).

Figure 3 – IPI’s coverage ratios

Author (based on SA data)

IPI stock valuation

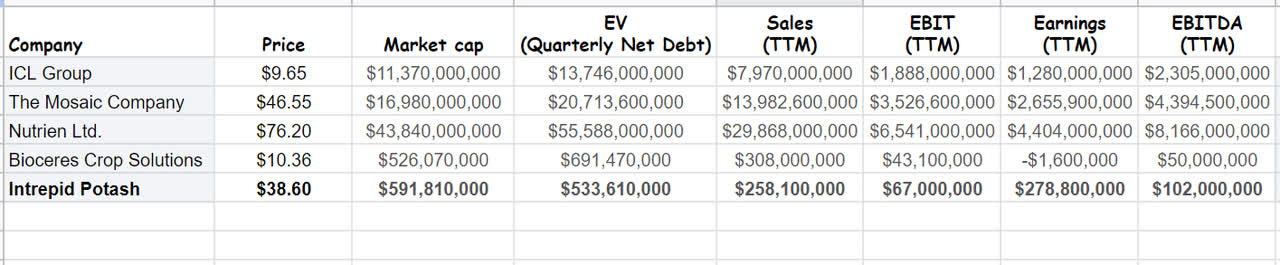

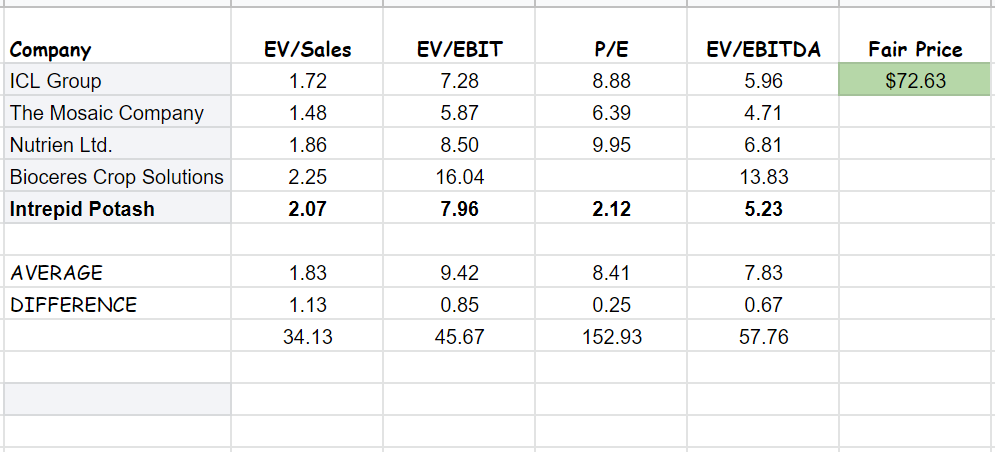

Updating and analyzing my valuation on Intrepid Potash represents that the stock is still a potential investment choice. Albeit with adjustments to the crisis scenario of the market, the CCA method evaluates a fair value of $72.6 per share. This method uses real market data and compares IPI with its peers. Therefore, it is kind of sensitive to comparable companies’ financial ratios. All in all, IPI has performed well among its peers, and it is in a healthy position (see Table 1).

Table 1 – IPI financial data vs. its peers

Author (based on SA data)

Comparing IPI’s ratios with other peer companies, I observe that despite a high EV/sales ratio, the stock is undervalued. IPI’s EV/sales ratio is 2.07x, 13% higher than the peers’ average of 1.83x. However, the company’s EV/EBIT ratio is 7.96x, which is 15% lower than the peers’ average of 9.42x. Most importantly, IPI’s P/E ratio is 2.12x, which is far below the average of 8.41x. Finally, the company’s EV/EBITDA ratio is 5.23x, which is lower than the average of 7.83x. Thus, when all was said and done, we can see that almost all metrics show a good position for Intrepid Potash and indicate that the company is attractive as a potential investment (see Table 2).

Table 2 – IPI stock valuation

Author

Apart from Intrepid Potash, I did some analysis on the competitors as well. Nutrien’s (NTR) P/E ratio is 9.95x, quite higher than the average. Also, its EV/Sales and EV/EBITDA are 1.86x and 6.81x, respectively, which are very close to the group’s averages. Moreover, ICL Group’s (ICL) metrics show that the company is undervalued. Its EV/EBITDA and EV/sales are 23% and 6% lower than the averages, respectively.

Summary

Under the lenses of leverage ratios, Intrepid Potash is showing financial stability. Moreover, the company’s ICR ratio indicates that it can pay its interest expenses on its debt with its operating income. High potash prices led to IPI’s strong performance in 1Q 2022. There is still no hope for the end of the war in Ukraine. Also, due to the increasing concerns about global food insecurity and inflation, I expect the Chinese fertilizer export ban to continue for the rest of the year. Thus, the potash price will remain high. The CCA method evaluates a fair value of $72.6 per share for IPI stock. The stock is a buy.

Be the first to comment