Eoneren

Happy people produce. Bored people consume.”― Stephen Richards

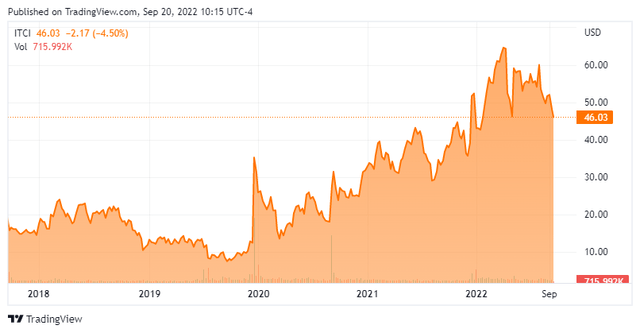

It has been some time since we last looked in on biopharma concern Intra-Cellular Therapies, Inc. (NASDAQ:ITCI). This name comes up from time to time in comments from Seeking Alpha followers. Given that, it seems a good time to revisit this name to see what lies ahead for this mid-cap company. An analysis follows below.

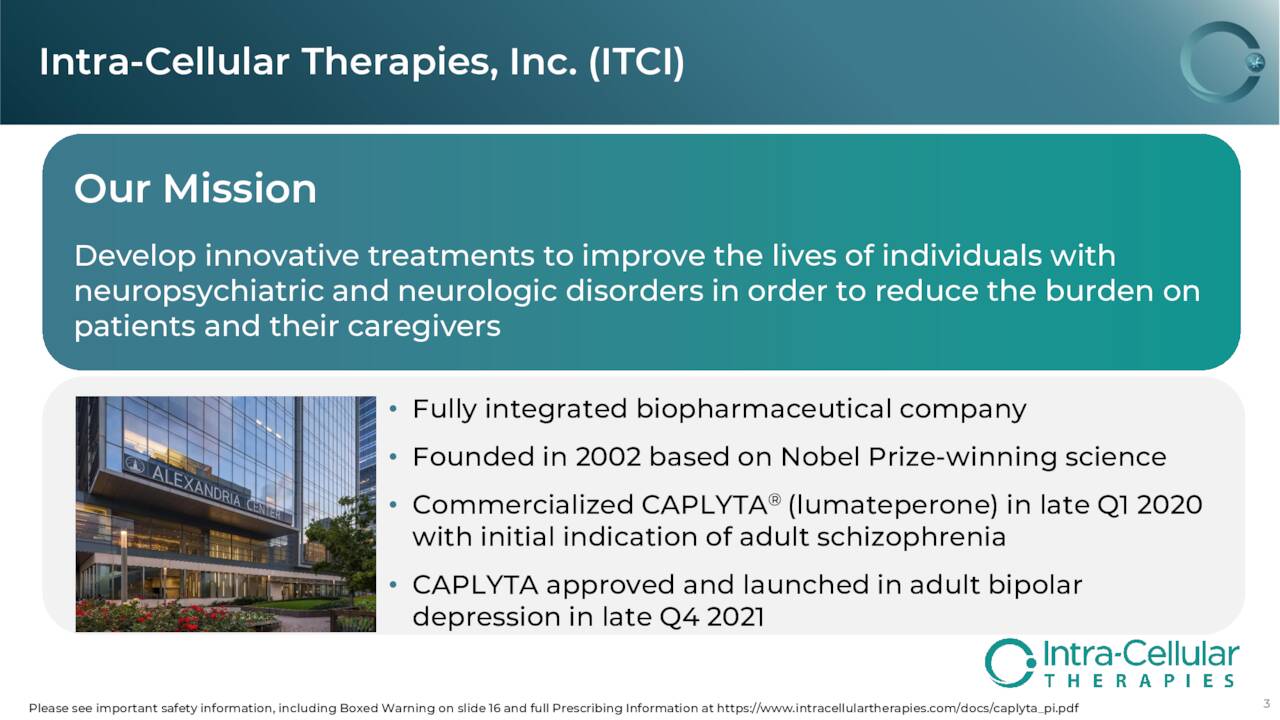

Company Overview:

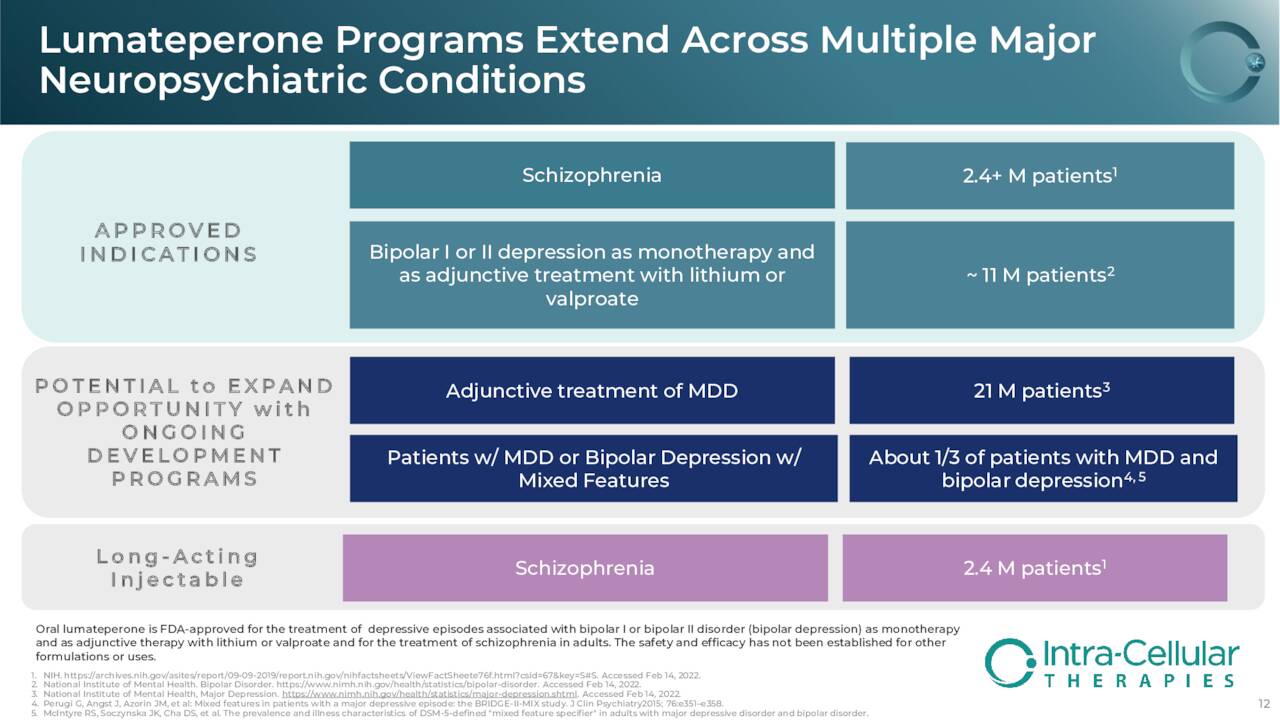

Intra-Cellular Therapies, Inc. is based out of New York City. The company is focused on developing novel drugs for the treatment of neuropsychiatric and neurologic diseases. The firm’s flagship product is CAPLYTA (lumateperone). CAPLYTA was approved for the treatment of schizophrenia in adults in early 2020. The compound then became the first and only FDA-approved treatment for depressive episodes associated with bipolar I or II disorder (bipolar depression) in adults as monotherapy and as adjunctive therapy with lithium or valproate in late 2021.

February Company Presentation

Intra-Cellular Therapies also has a few other drug candidates in development. The stock trades for just above $45.00 a share and sports a market capitalization just north of $4.5 billion.

February Company Presentation

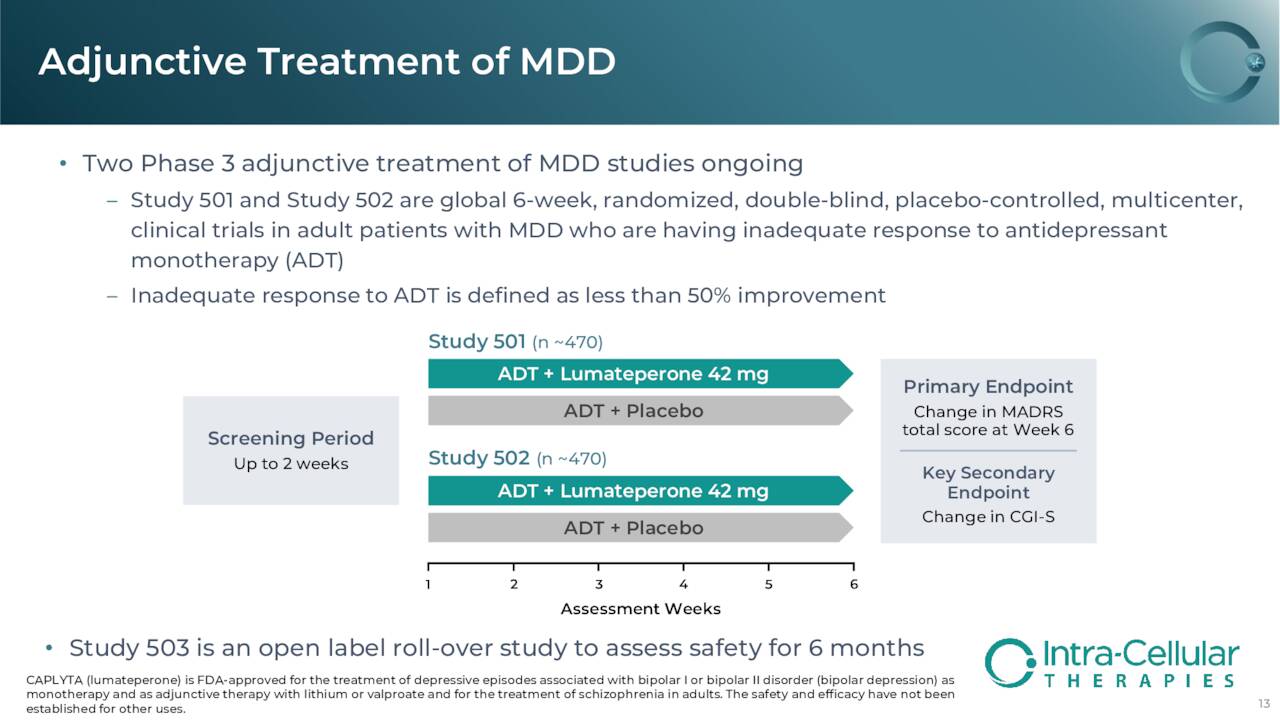

The company also has a couple of Phase III trials ongoing to evaluate lumateperone as a potential treatment for major depressive disorder, or MDD. If all goes well, management expects to file a supplemental new drug application, or sNDA, with the FDA for approval of lumateperone as an adjunctive therapy to antidepressants for the treatment of MDD in 2024.

February Company Presentation

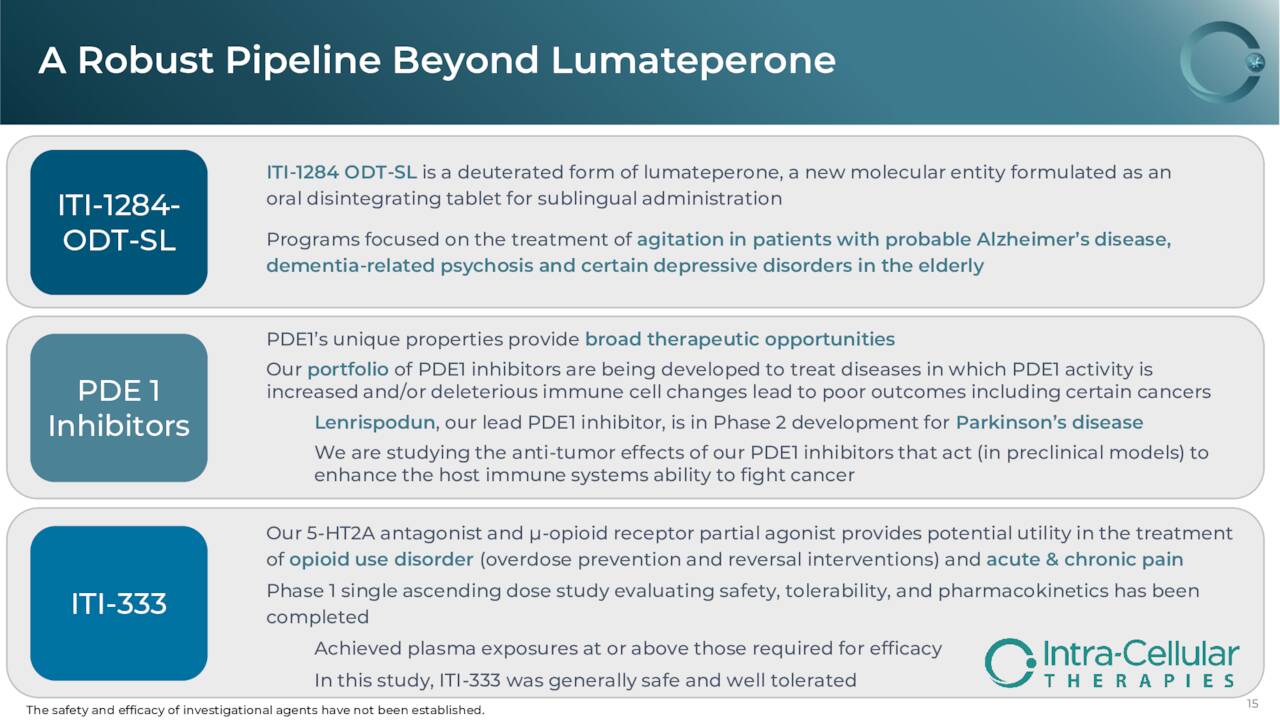

In addition, the company as previously mentioned, has a couple of other candidates in its pipeline. However, they are too early stage to be germane to this analysis.

February Company Presentation

Second Quarter Results:

On August 9th, the company reported second quarter numbers. Intra-Cellular Therapies had a GAAP loss of 92 cents a share in the quarter, 15 cents a share worse than the consensus. Revenues did rise over 175% from the same period a year ago, to $55.6 million, which was nearly $7 million under expectations. CAPLYTA total prescriptions were up 191% from 2Q2021 and 51% sequentially from this year’s first quarter.

Selling, general and administrative (SG&A) expenses rose sharply to just over $100 million for the quarter compared to just under $70 million in the same period a year ago. This was primarily due to upticks in marketing and advertising expenses as well as labor related costs. Research and development (R&D) expenses for the second quarter of 2022 also rose substantially, to $38.5 million. This compares to $17.3 million for the second quarter of 2021. The increase was a result primarily of higher lumateperone clinical trial and non-clinical related costs.

Analyst Commentary & Balance Sheet:

Since second quarter results hit, five analyst firms including Needham and Jefferies have reissued Buy ratings on ITCI. Price targets proffered range from $67 to $90 a share. However, Goldman Sachs downgraded the stock to Neutral and reduced its price target $15 a share to a $49 price target citing:

Slowing drug prescription volume growth and pointing out that ITCI has already used the main growth drivers to speed up volume growth. While widespread antipsychotic medications indicate a potentially manageable generic competition for the indication, “a new generic entrant nonetheless poses an incremental competitive threat to Caplyta in our view,” Goldman expect the market entry of generic Latuda to change market dynamics in BPD.“

The stock saw some heavy insider selling in March and April in the low $50s to $60s range as insiders disposed of more than $15 million worth of shares those two months. Since then, they have sold just under an additional $3 million worth of this equity. Less than four percent of the outstanding float is currently held short. At the end of the second quarter, the company held nearly $680 million worth of cash and marketable securities after posting a net loss of $86.6 million in the quarter. The company has no long term debt.

Verdict:

The current analyst firm consensus has the company losing just over $3.20 a share in FY2022 even as revenues surge 180% to around $235 million. In FY2023 they expect an 80% rise in sales to just over $420 million as Intra-Cellular Therapies, Inc. cuts is loss to around $1.70 a share.

February Company Presentation

CAPLYTA (lumateperone) has significant potential across multiple indications. Sales traction seems solid for an early stage rollout, even as the company missed expectations with its latest quarterly numbers. Unfortunately for Intra-Cellular Therapies shareholders, profitability is years away. At over ten times next year’s projected revenues, ITCI is not cheap yet on a price to sales ratio either. In addition, this is not exactly the type of company whose stock is getting rewarded in the turbulent market of 2022 as interest rates continue to rise.

In addition, insider selling this year is a minor red flag and Goldman’s recent downgrade of ITCI is also a negative. This is a good story to keep an eye on, but I am personally holding off making any investment into the stock until Intra-Cellular Therapies reduces its cash burn rate significantly

It still holds true that man is most uniquely human when he turns obstacles into opportunities.” ― Eric Hoffer

Be the first to comment