BalkansCat

Although there was a lot of skepticism from the Seeking Alpha investors community, we decided to overweight Intesa Sanpaolo (OTCPK:ISNPY) with a publication called a Clear Buy at this price. Since then, the Italian leading bank is up by more than 28% (including the generous dividend payment which was offered in the period) compared to a negative return from the S&P 500. Today, we are going back to comment on two of ISP’s risks: 1) the company’s Russian exposure and 2) its non-performing loan (NPL) and unlikely to pay (UTP) debt development. Here at the lab, we already partially covered this topic, and we emphasized our Macro view with scenario analysis and a bottom-down approach in which we reported Intesa Sanpaolo NPL exposure deleveraged and extremely low cost of risk.

Mare Evidence Lab’s previous publication

ISP’s Russian Exposure

Yesterday, according to Russian financial sources, Intesa Sanpaolo has started advance negotiations with Gazprombank to sell its local subsidiary. The indiscretion was released; however, Intesa Sanpaolo declined to comment for the moment. Also, because the discussions would still be in their initial stages and would present a certain level of complexity.

Like many other European institutions, Intesa Sanpaolo has also made contacts in recent months to exit from the Russian market. However, the process is complex, especially in light of recent initiatives by the Moscow government. After the decree that in August heralded a temporary ban on the sale of Western financial assets, the Kremlin published the list of 45 institutions involved in the measure. In addition to northern European groups such as BNP Paribas, Deutsche Bank, Credit Agricole, and Credit Suisse, the list available on the government’s website includes the Russian businesses of UniCredit and Intesa Sanpaolo. The provision effectively freezes the sale of local subsidiaries in the context of the exits prepared after the start of hostilities in Ukraine. A measure that should be read as a retaliation against the sanctions launched by Europe and the United States.

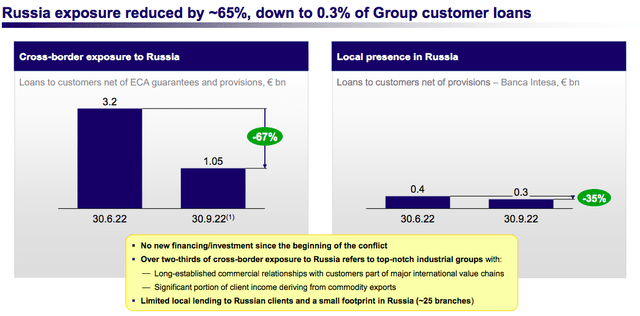

Going into the details and in light of the third quarter analysis, Intesa Sanpaolo reduced its exposure to Moscow by approximately 65% to €2.3 billion and dropped to 0.3% of the total bank’s customer loans. We can clearly consider Intesa Sanpaolo as a bank with zero exposure to Russia, and the CEO was clear that they are continuously working to reduce the limited residual exposure. In short, Intesa’s choice was to neutralize the problem in a single solution, while UniCredit’s approach has so far been more gradual and would be the subject of close confrontation with the ECB. Here at the Lab, we also cover UniCredit and the company’s Russian exposure is now approximately 2% of total loans. You can also have a look at our publication on UniCredit called ‘No Gift For Russia‘.

ISP Russian exposure (Intesa San Paolo Q3 results presentation)

NPL and UTP Evolution

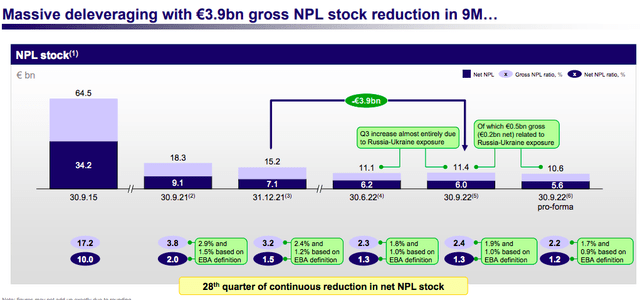

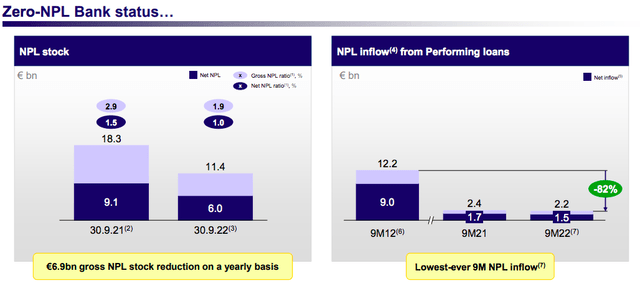

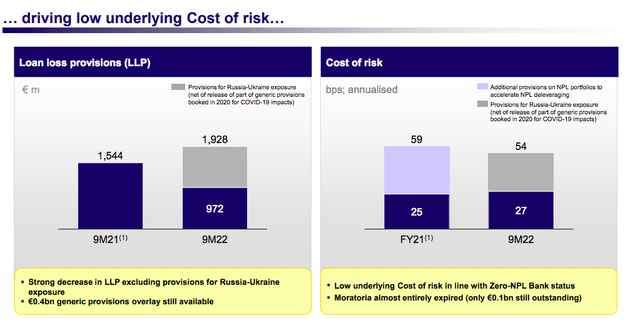

Over the years, the Italian leading bank has clearly transformed itself. In 2012, the company’s NPL inflow was exceeding €12 billion, and now we can almost say that it is a zero non-performing bank (Fig 1) coupled with an extremely low cost of risk (Fig 2) and solid CET1 capital requirements. This evolution was even more pronounced during the Italian sovereign financial crisis in 2015, and the bank clearly outperformed the whole market (Fig 3). In this scenario, even in the latest quarters, ISP confirmed this positive trend. The company just announced another agreement for the assignment of credits connected to building works and energy efficiency. One of these latest operations was carried out yesterday with Unoenergy, an operator active in the supply of natural gas, electricity, and energy efficiency services for a value of €500 million. Considering this latest agreement, the total amount of tax credits released by Intesa Sanpaolo rises to €3.2 billion over this year.

Fig. 1

Fig. 2

Fig. 3

Q3 NPL (Intesa San Paolo Q3 results presentation)

Conclusion and Valuation

To sum up, we decided to maintain our target price set at €2.4 per share versus the current stock price of €2.08. We analyzed two major risks that the company might face in the upcoming quarters; however, we believe that ISP will navigate the short-term market turbulence. As a memo, here below is our main upside:

Be the first to comment