MarsBars

Market uncertainty is a value investor’s best friend, as buying quality companies when they are down drives the potential for outsized gains over the long-run. That’s because quality companies generally have the reputation and resources to help them weather through temporary downturns, in some cases, come out even stronger.

This brings me to Interpublic Group of Companies (NYSE:IPG), whose stock has seen material weakness since the start of the year, returning -23% since January 1st. In this article, I highlight what makes this a great opportunity to layer into this quality stock while it’s down, so let’s get started.

Why IPG?

IPG is an S&P 500 company and is the 4th largest of the Big 5 global advertising conglomerates. Its revenue stream is about equally split between marketing services (i.e. public relations, brand consultancy) and advertising & media services, including TV, radio, and online advertising. IPG is home to a number of global brands, including Acxiom, FutureBrand, FCB, Craft, and Golin, to name a few.

IPG has widened its moat and scale in recent years, by transitioning its business model from traditional advertising into a holistic solutions provider, offering public relations, consulting, and digital services. This was aided by its acquisition of data solutions provider, Acxiom, in 2018.

Moreover, IPG has long had a reputation as being a nimble and entrepreneurial company. This quality has served it well, especially during the onset of COVID in 2020 when IPG was able to quickly adapt its business model to the ‘new normal’, by shifting its focus towards e-commerce and digital services.

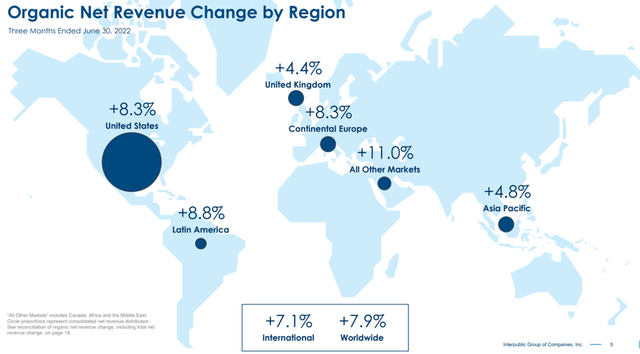

Meanwhile, IPG appears to be weathering recent social media challenges that namely Meta Platforms (META) has seen rather well. This is reflected by IPG’s revenue growing by 4.7% YoY (7.9% on an organic basis) during the second quarter to $2.4 billion. This was driven by strong 8.3% organic revenue growth in the U.S., and 7.1% internationally. As shown below, Latin America and Europe both saw 8%+ organic growth, despite the disruptive effects of the conflict in Ukraine.

IPG Growth by Geo (Investor Presentation)

It’s worth noting, however, that IPG is no stranger to cost inflation, as its staff cost ratio, which is calculated as total salaries and related expenses as a percentage of salary increased to 66.9% in the second quarter, up from 65.4% in the prior year period. This was driven by increases in base salaries and additional hiring to support revenue growth.

While this had an impact on IPG’s adjusted EBITA (IPG carries little to no capital asset depreciation) margin, with it landing at 15.6% during the second quarter, management expects for profitability to improve in the second half of the year, guiding for 16.6% adjusted EBITA for the full year.

Looking forward, I see the recent announcement by Netflix (NFLX) that it’s considering an ad-supported model as being a plus for the advertising giants such as IPG. This could also be indicative of a broader move by streaming companies to become more like traditional media companies. Moreover, Morningstar expects IPG to continue growing through acquisitions and expansion of its presence in digital advertising, as noted in its recent analyst report:

IPG has transitioned from traditional advertising into a complete solutions provider with digital and other services, such as public relations and consulting. We look for IPG to continue its acquisition growth strategy to gain further traction in other faster-growing international markets. Globalization of businesses in various verticals has increased demand not only for vertical-specific advertising expertise, but also for experience, knowledge, and a clearer understanding of different cultures and regulations.

We expect IPG to continue acquiring and to invest in the growing digital advertising space. Clients of IPG and its peers are allocating more ad dollars toward below-the-line, or more targeted, digital campaigns, creating growth opportunities for agencies like IPG’s MRM/McCann and Matterkind. IPG has made headway in providing different components of digital advertising such as programmatic media buying and ad placement, along with data analytics and performance-measurement services.

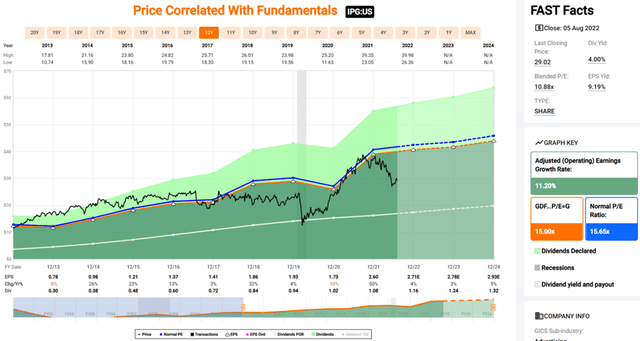

Meanwhile, IPG sports a strong BBB rated balance sheet and pays an attractive 4.0% dividend yield that’s well covered by a 44% payout ratio. The dividend also comes with a 5-year CAGR of 11.2% and 9 years of consecutive growth.

I see value in IPG at the current price of $29.02 with a forward PE of 10.7, sitting well below its normal PE of 15.7 over the past decade. Morningstar has a fair value estimate of $35 and sell side analysts have a consensus Buy rating with an average price target of $33.87, implying potential for double-digit total returns over the next year.

Investor Takeaway

Overall, I believe IPG is a high-quality advertising agency that’s well positioned to capitalize on continued growth in the industry. It’s seeing healthy growth in the U.S. and internationally, and its digital segment offers promising potential. With a dividend yield of 4.0% and plenty of room for further growth, I believe IPG is a great choice for income-focused investors looking for exposure to the advertising industry.

Be the first to comment