Investment thesis: International news is still mostly bad. The latest EU PMI data shows a service sector crash. Data from Japan also shows weakness, as do the latest South Korean releases. On the plus side, China was modestly higher this week but it’s still too early to think about taking a position.

Is an oil deal in the works? Emphasis added:

Saudi Arabia called on Thursday for an emergency meeting of OPEC and non-OPEC oil producers, saying it aimed to reach a fair agreement to stabilize oil markets.

Kuwait’s oil minister Khaled al-Fadhel said on Friday he supported Saudi Arabia’s invitation for a meeting between OPEC and non-OPEC oil producers.

and will be held as a video conference, Russia’s RIA news agency reported.

This would be a very positive development if it comes to fruition. However, the parties haven’t even met yet.

The Reserve Bank of Australia issued its latest meeting minutes, which provide a great summation of recent market and economic events. Here’s one of many key paragraphs (emphasis added):

Members discussed how these developments and the rapidly changing situation were affecting the outlook for economic activity. The immediate outlook for the Australian and global economies was highly uncertain, but members viewed it as very likely that most countries would experience a very sharp contraction in economic activity. Members considered the information available for the Chinese economy, which indicated that there had been a large contraction in economic activity in the March quarter. Some indicators, such as coal usage, suggested that economic activity in China was beginning to pick up, although it was too early to assess the extent to which activity would recover in the June quarter.

Key into the phase “Some indicators … suggested that economic activity in China was beginning to pick up.” While there is remarkably little visibility for obvious reasons, also remember that governments have pledged a huge amount of fiscal stimulus on the back end of this situation.

We have the latest round of Markit Economics PMIs. While the data is understandably bad, there is actually a silver lining.

- EU:

- Composite: 51.6-29.7

- Services: 52.6-26.4

- Manufacturing: 49.2-44.5

- Japan

- Composite: 47-36.2

- Services: 46.8-33.8

- Manufacturing: 49.2-44.5

- UK

- Composite: 53-36

- Services: 53.2-35.7

- Manufacturing: 48-47.8

Notice that manufacturing is in fairly decent shape, all things considered. While some subsectors will continue to slow (consumer durables, oil field equipment), some sectors are booming (health care equipment).

The last modestly non-COVID economic data from the EU was positive.

However, the COVID-influenced data was negative.

Initial data from South Korea showed a drop in activity

Japanese data continued to show weakness

- Industrial production declined 4.7% Y/Y

- Retail sales were up 1.7% Y/Y in February (before the virus hit)

- The Tankan survey showed a decline in business sentiment (which had been declining before the virus)

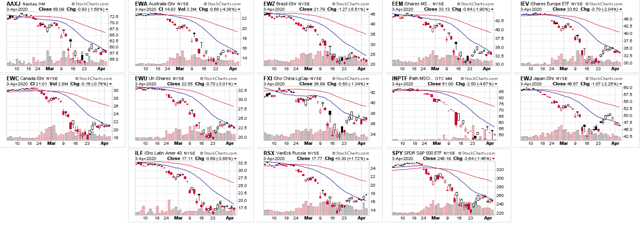

Let’s look at this week’s performance table and charts:Russia caught a strong bid on the back of the news of a possible oil deal. Australia and China were up modestly; the former is a primary trading partner of China and the latter is trying to come out from under the quarantine. At the bottom is Brazil, whose leader remains in complete denial about the virus, and India, which is still under a country-wide lockdown. Japan was also lower due to the possibility of an outbreak.

All of the charts are unimpressive. While each index has rallied from a low, most have hit resistance at the 20-day EMA and moved sideways. While these are all one step removed from a dead-cat bounce, they’re all close enough that they should all be avoided.

All of the charts are unimpressive. While each index has rallied from a low, most have hit resistance at the 20-day EMA and moved sideways. While these are all one step removed from a dead-cat bounce, they’re all close enough that they should all be avoided.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Be the first to comment