Daniel Grizelj

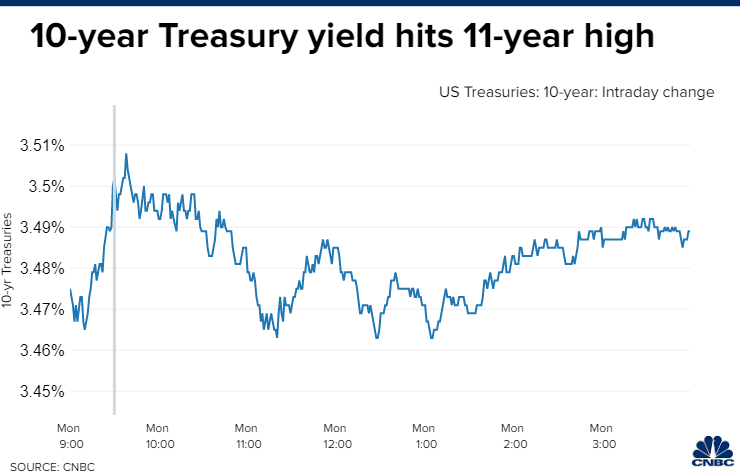

What was support is now most likely resistance, as the S&P 500 rallied back to the 3,900 level in what was a surprisingly strong day for stocks to start the week. This was even more impressive considering that the 10-year Treasury yield rose to a new 11-year high of 3.5%, while the 2-year yield rose to its highest level since 2007 at 3.94%. The bond market now sees the Fed funds rate at approximately 4% over the coming year, according to 2-year yields, which implies another 100 basis points of rate increases following the 75 expected tomorrow. Fed funds futures contracts show the highest probability of a 4.25% rate by the end of this year.

Finviz

The bond market’s outlook and those odds will undoubtedly shift after the Fed’s forward guidance is updated in a new “dot plot,” showing where each member sees rates over time. Chairman Powell will hold his press conference afterwards. I suspect his comments will mark a peak in short- and long-term rates, as he acknowledges the marked slowdown in price increases for the leading indicators of tomorrow’s inflation rate, while at the same time affirming that the Fed will remain vigilant.

CNBC

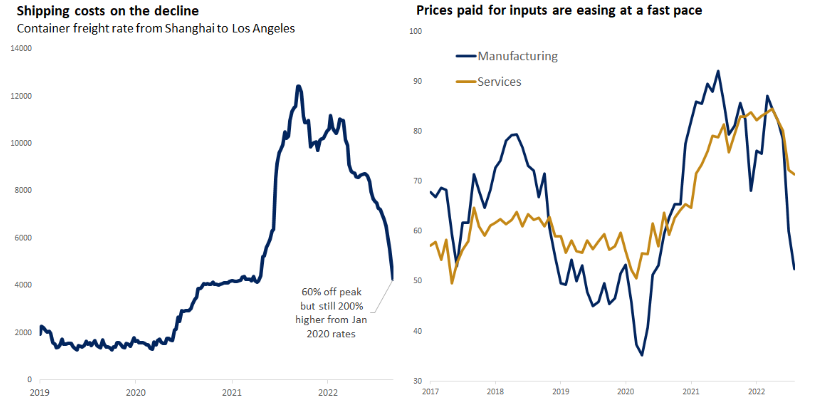

In addition to the decline in commodity prices, led by energy, the increase in input costs paid by producers is falling rapidly. Supply chains are gradually returning to normal, which is reducing the rate of increase in price for transportation costs. These are leading indicators that Powell would be remiss not to acknowledge, as well as the sharp slowdown in the housing market, which is starting to weigh on consumer prices.

Edward Jones

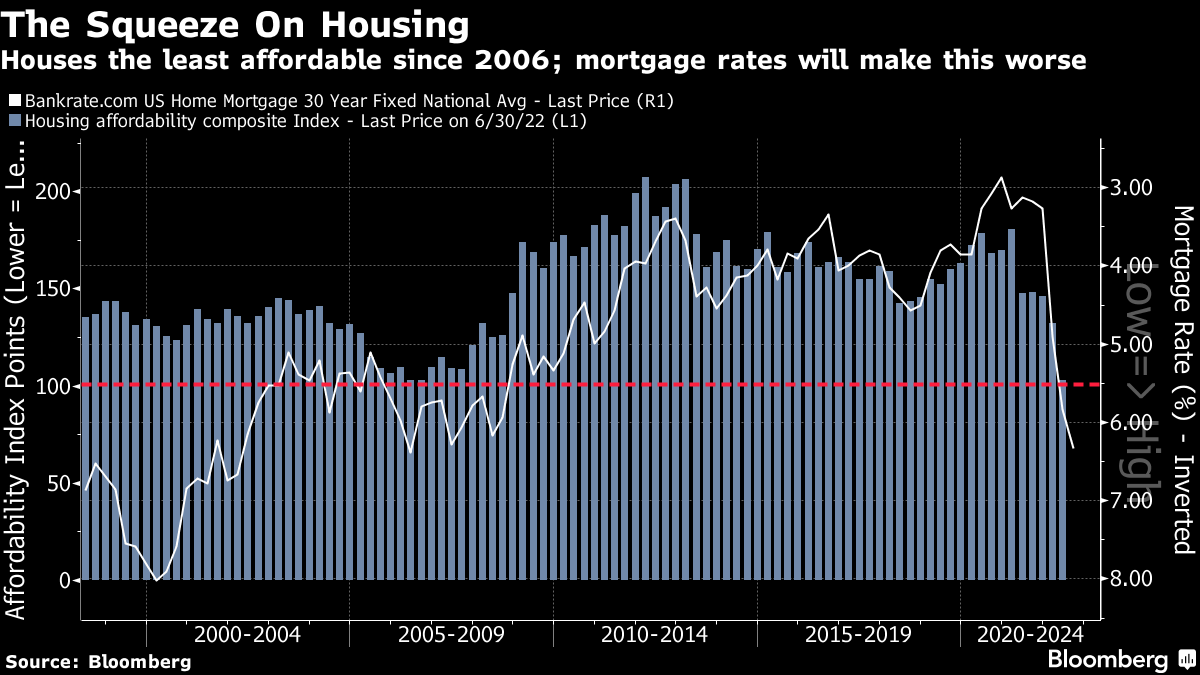

Home price affordability has cratered this year, which is slowing existing home sales, capping prices, and beginning to weigh on sales and prices of furniture, electronics, and appliances. According to the retail sales report for August, sales at home furnishing and furniture retailers fell 1.6% over the past year, while electronics and appliance retailers saw a 5.7% decline. The prices for appliances fell during the month of August by the most in two years. While home prices adjust daily, rents typically reset on an annual basis, which is why it takes much longer to see rent increases subside. Yet today’s housing market activity tells the Fed that rent inflation should subside dramatically by next summer with the tighter financial conditions that are already in place.

Bloomberg

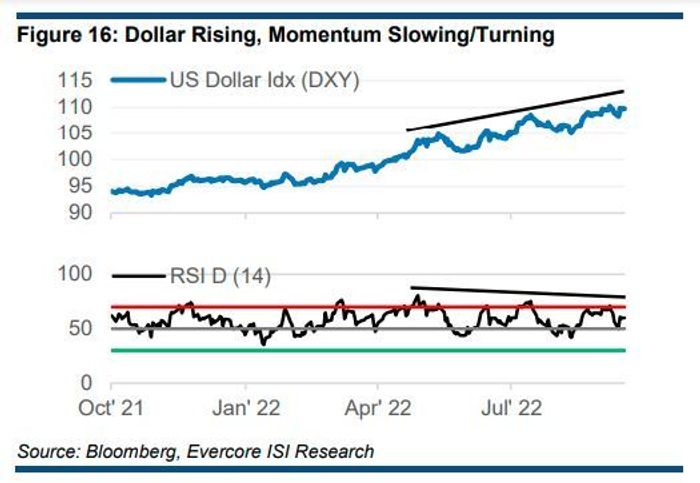

If the Fed acknowledges these signs of slower growth and the eventual impact it will have on inflation in the months ahead, it should ease the upward pressure on interest rates. That would also slow, if not reverse, the upward momentum in the dollar, which has been a headwind for U.S. multinational profits this year. Foreign central banks are also playing catch up with the Fed in terms of tightening monetary policy, which should further slow the dollar’s upward momentum.

Yahoo Finance

A peak in interest rates combined with a weaker dollar could provide a potent tailwind for risk assets in the fourth quarter of this year, as the market gains conviction that the Fed is on track to rein in inflation without driving the economy into a recession in 2023.

Lots of services offer investment ideas, but few offer a comprehensive top-down investment strategy that helps you tactically shift your asset allocation between offense and defense. That is how The Portfolio Architect compliments other services that focus on the bottom-ups security analysis of REITs, CEFs, ETFs, dividend-paying stocks and other securities.

Be the first to comment