blackdovfx

Investment Thesis

InterDigital, Inc. (NASDAQ:IDCC) is a company that brings forth technology solutions for use in digital cellular and wireless products and networks. In this investment thesis, I will primarily analyze the recent funding secured by IDCC for Europe 6G flagship projects and its impact on the company. I will also talk about its collaboration with Philips and what its benefits will be to the company. After analyzing all the aspects, I will give my views on the future of IDCC.

About IDCC

IDCC is an application software company founded in the year 1972 and headquartered in Wilmington. The company develops and innovates mobile and video technologies that are at the core of networks, devices, and services worldwide. They also resolve many of the industry’s most pivotal and complex technical obstacles, inventing solutions for more efficient broadband networks, better video delivery, and richer multimedia experiences years ahead of market development.

IDCC Secures Funding For The Five Horizon Europe 6G Flagship Projects

The EU’s intelligent networks and services joint undertaking (SNS JU), which is funding 35 6G flagship projects worth €250 million, has awarded funding to IDCC to support five horizon 6G flagship research projects. The five flagship projects include CENTRIC, 6G-XR, PREDICT-6G, 6G-BRICKS, and 6G-SHINE. Each project is committed to enabling progressive technology advancement and experimental infrastructures in 6G. Now let us have a look at the objectives of each of these projects.

CENTRIC project targets the development of radio access technologies towards fulfilling the ultimate vision of a 6G user centric Artificial Intelligence (‘AI’) native air interface.

PREDICT-6G project focuses on laying the foundations of an AI-powered Digital Twin framework to predict the behavior of the end-to-end 6G network and using this framework to enhance the reliability and time sensitivity of the network.

6G-SHINE project in turn focuses on the design of short-range communication protocols that can meet the extreme bandwidth, latency and energy requirements emerging for 6G.

6G-XR project targets the development of an experimental research infrastructure to evaluate and validate the performance of key 6G candidate technologies, components, and architectures, with focus on enabling next generation Extended Reality (‘XR’) services.

6G-BRICKS project focuses on setting up an experimental research facility to evaluate two key 6G candidate technologies, namely Reconfigurable Intelligent Surfaces (‘RIS’) and cell-free massive multiple input multiple output (‘MIMO’).

These five flagship projects are among the 35 6G flagship projects, and their aim is to enable the evolution of 5G ecosystems to promote 6G research in Europe. This funding awarded to IDCC shows the trust international organizations are showing in IDCC. This shows that the company’s management is efficient and on the right track. I think this project will pave the way for more license agreements and projects, which will increase their future revenue and improve the company’s financials. I think this project will improve the reputation and research heritage of the company, which will help them against their competitors in the future.

The chief technology officer of IDCC, Rajesh Pankaj, commented,

We are honored to be awarded five Horizon Europe 6G flagship projects to help shape the 6G vision. Being selected for each of these unique projects will enable us to leverage our research heritage and expertise that will shape 6G development in Europe through the future. A competitive research environment helps drive our industry forward by pushing the limits of what is possible in the wireless technology landscape. These awards demonstrate InterDigital’s continuous contributions to the European wireless research and innovation ecosystem, as we build upon a strong record of engagement in the Horizon 2020 5G public-private partnership program.

Technical Analysis

If we look at the price chart of IDCC on a weekly time frame, we will get to know that the share price of IDCC has fallen about 31% in the last one year, and now the stock has bounced back from the strong support zone of $40. The stock is currently consolidating between the levels of $45-$52. As we can see, IDCC is clearly in a downtrend and trading at a discount price of $48, and there is only one instance in the last eight years that the stock has breached the levels of $40, all thanks to covid which shows the strength of the support zone. According to the price chart, one can initiate fresh buying at current levels because of the discounted price the stock is offering, and those who are extra cautious and don’t want to enter at the current level then they can wait for the level of $40 and buy at that time, but I think this is less likely to happen because the stock is gaining momentum and there is good upside potential from current levels.

IDCC Collaboration With Philips

IDCC collaborated with Phillips on video-based immersive codec research to enable XR opportunities. I think with the collaboration, the impact of IDCC will only amplify in their industry, help them leverage their research expertise, and give the company an edge over their competitors in the future. Now talking about the collaboration in detail, both partners jointly are going to develop MPEG visual volumetric video-based coding (V3C) immersive codecs to the benefit of telepresence and XR-driven experiences. The MPEG V3C standard defines the general mechanism for coding and streaming volumetric content. Volumetric video is an important component to create and enjoy increasingly immersive experiences made famous through XR applications. Unlike traditional video, volumetric video is comprised of a sequence of frames, where each frame is a 3D representation of a real-world object or scene captured from a moment in time. Volumetric content requires significant bandwidth, and compression is crucial to achieve data rates that are sustainable and economically viable for the industry. MPEG V3C plays a crucial role in reaching this reality and ensuring interoperability for new and emerging experiences. I think this approach to innovation and research adapted by IDCC paves the way for a great future for the company.

Financial Analysis

The company beat the market revenue estimates by $1.30 million and market EPS estimates by $0.28, but I think IDCC has slightly underperformed in this quarter. The total revenue for Q3 FY22 was $ 114 million, which is 20% less than the revenue of Q3 FY21, which was $143.5 million. I think the main reason behind this decrease was due to the decline in the non-recurring revenues. The non-recurring revenues for the Q3 FY22 was $13.7 million, down by 72.6% compared to $50 million in the corresponding quarter last year, but the recurring revenue increased 8% to $101 million compared to the recurring revenue of $93.4 million in the third quarter of 2021. I believe the primary reason behind the increase in recurring revenue was because of the renewal of the license with Apple (AAPL) and new agreements signed by the company.

IDCC reported a net income of $22.2 million, down by 15% compared to the corresponding quarter of last year. The EPS (Diluted) was reported at $0.74, down by 10.8% compared to Q3 FY21. I think the quarterly results do not justify the potential of the company. It sure has underperformed in this quarter, but I am optimistic that the company’s financials will show improvement in the coming quarters, given the projects undertaken by IDCC and collaborations done by the company.

My Take On IDCC

Currently, IDCC is trading at a P/E (‘TTM’) ratio of 13.78 compared to the sector P/E ratio of 17.10, which shows that the company is currently undervalued.

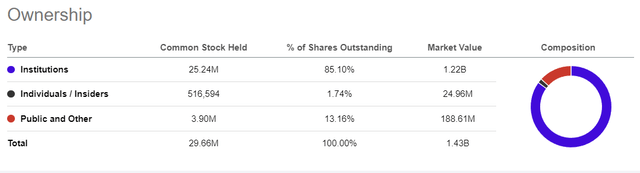

Another great parameter that says a lot about the company is the shareholding pattern of the company, so let’s take a look at IDCC’s shareholding pattern. Institutions own 85% of the company’s shares, which is a great sign, and it shows that the large institutions most likely trust IDCC.

With the recent collaboration and securing funding for European research projects, IDCC is looking good for the future. Compared with its competitors, I think IDCC will have the edge over them and perform better than its peers in the future. The company also renewed its license with Apple till 2029, strengthening its business. In addition, the company has signed sixteen agreements over the last eighteen months with a total estimated contract value of $1.5 billion.

Main Risk Faced By IDCC

Ability To Enter Into New License Agreements And Renew Existing License Agreements

The company faces challenges relating to the ability of its to enter new license agreements and renew existing license agreements could cause its revenue and cash flow to decline. Many of their license agreements have fixed terms, and they try to renew the contracts prior to their expiration due to various factors like business needs and the competitive positions of the licensees, and if they are unable to renew the license before the expiration of the license, then there could be a gap in time during which the company may be unable to recognize revenue from that license or they could be forced to renegotiate and renew the license agreement on terms that are more favorable to such licensee. As a result, the company’s revenue and cash flow could be adversely affected.

Bottom Line

According to my analysis, after looking at all the parameters, I am definitely long on IDCC. IDCC has corrected more than 31% in the last one year and is currently trading at a discounted price. After analyzing their Europe research project and their collaboration with Philips, I believe the company is on the right growth track. IDCC is getting new license agreements, and the contract renewal with Apple should help them increase revenue. So, I think IDCC has good potential, and I assign a buy recommendation for IDCC.

Be the first to comment