Chip Somodevilla/Getty Images News

Oh, how the mighty have fallen. Intel (NASDAQ:INTC), once synonymous with absolute semiconductor domination, has fallen hard and fast from investors’ graces in the last decade.

The company, once considered the gold standard for all things semiconductor, is currently relegated to mostly the PC and certain sectors of the data center markets. While these markets are certainly large and highly profitable, the company has almost completely missed out on the last decade’s historic bull market in GPUs, mobile processors and next generation chip fabrication markets.

New CEO Pat Gelsinger has quite an ambitious plan to turn around the company and to regain leadership in key growth markets, much of it focused on regaining manufacturing technology leadership.

The Plan

The main aim of Mr. Gelsinger’s plan is certainly focused on rebuilding Intel’s manufacturing prowess. This manufacturing lead was ceded to Taiwan Semiconductor Manufacturing Company (TSM) years ago by his predecessors in part through sheer apathy and in part by aggressive incentives given by foreign governments to encourage leadership, primarily in Asia.

As a result of this technological leapfrogging, many of Intel’s customers of the past such as Apple (AAPL), Amazon (AMZN) and Microsoft (MSFT) have decided to design their own chips to be manufactured by TSM. Intel has finally taken note.

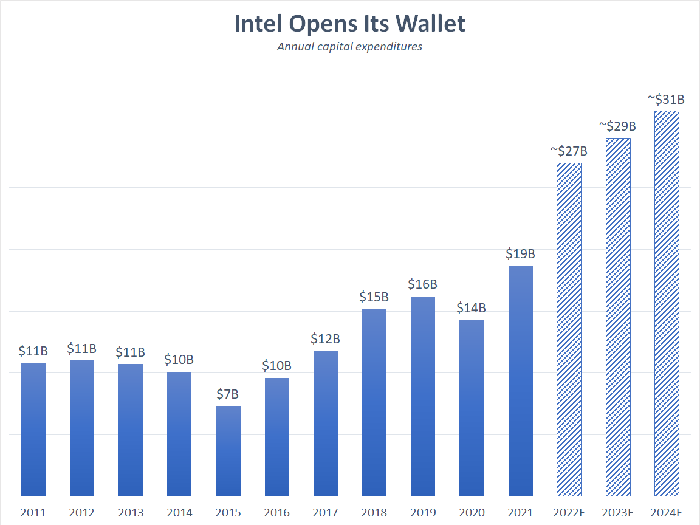

The company plans to invest an additional $80 billion over the next 3 years in its attempt to level the technological playing field with manufacturers TSM and Samsung (OTC:SSNLF).

Fool.com

These expenditures are being made at great expense to current and near-term financial results as the company expects to be free cash flow neutral or even negative over this time period.

| Investment Phase Model 2023-2024 | Non-GAAP |

| Revenue growth YoY | Mid-to-High single digits^ |

| Gross margin | 51-53% |

| Operating expense2 | 28-30% |

| Net capital intensity3 | ~35% |

| Adjusted free cash flow2 | ~neutral |

Source: Intel

Mr. Gelsinger, to his credit, has realized that Intel needs bold and immediate actions to survive and thrive in the current market and the company is finally open to taking risks, which is the backbone of all successful technology companies.

Intel realizes that the trend of companies such as Apple, Amazon and Microsoft designing their own chips is likely here to stay and the key to capturing the next wave of semiconductor growth will rely on Intel’s ability to become a chosen partner to manufacture the next generation of chips, while focusing on retaining leadership in markets such as the data center and PC markets.

That being said, the company does need significant help from legislators for this plan to become a reality.

CHIPS Act

One of the key reasons for Intel’s predicament has been the rapid and significant investment in semiconductor manufacturing technology by foreign governments.

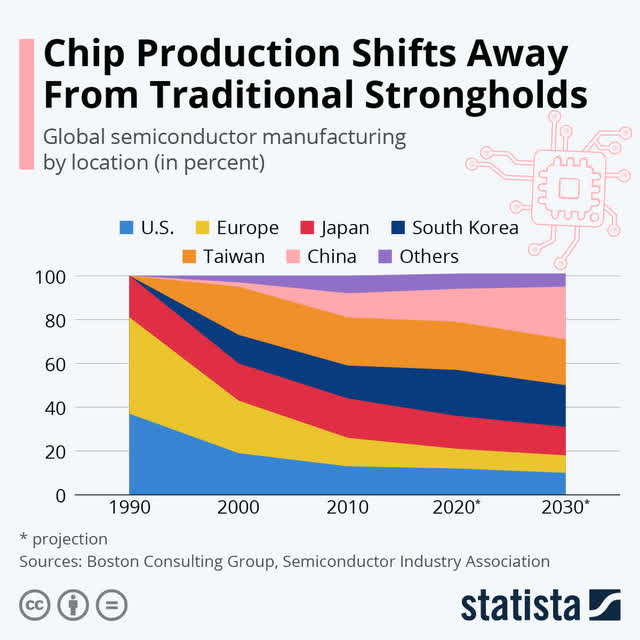

In 1990, the USA and Europe combined produced nearly 80% of the world’s semiconductors. In 2022, this number currently sits at a paltry 20%.

Currently, nearly 80% of all chip production worldwide resides in Taiwan, South Korea, Japan and China. The main reason for this concentration in Asia comes down to simply the cost of building and running fabs in the USA or Europe.

The Semiconductor Industry Association has stated the following regarding the costs advantages of operating a fab outside of the USA:

The ten-year total cost of ownership of a new fab located in the U.S. is 30-50% higher than in competing countries – and 40-70% of this cost is attributable to foreign government incentives.

With the above information, it is no secret as to why the USA and Europe have lost so much manufacturing capacity over the years, yet it has now reached such a point that it has become a clear national security issue.

Semiconductors are the lifeblood of modern technology, including defense applications. As we have seen over the last few years during the semiconductor shortages, current supply chains and a host of seemingly unrelated industries can be completely ground to a halt when this chain of chips is disturbed even in the slightest.

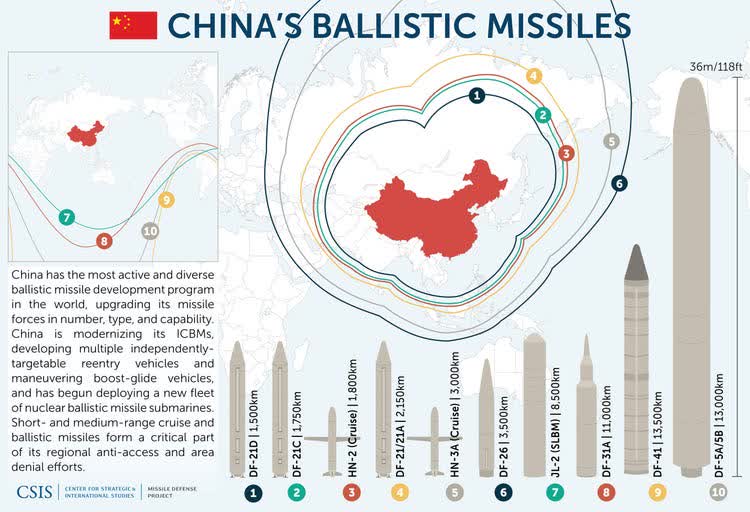

The unfortunate reality is that China and the United States are unlikely to become allies in the near future and look to be dancing into perhaps a 21st century cold war. By having over 80% of the world’s vital chip supply directly in China’s backyard, this does not seem like a wise status quo to maintain in order to assure supply chain stability, nor national security for the United States or Europe.

Business Insider

You do not necessarily have to master The Art of War, nor attend West Point to comprehend that China could effectively bring the world to its knees by using the country’s advanced ballistic missiles to target vital fabs in South Korea, Japan and Taiwan. Chips are the 21st century equivalent of oil for industries worldwide. Currently, the new Middle East is in Asia with its fabs, however, unlike oil, this can be changed.

Because of the importance to economies worldwide, it is vital for both the United States and its partners in Europe to pass legislation that levels the playing field to encourage domestic production.

Thankfully, both the United States and its European partners, appear to understand the potential threat and have proposed similar bills to begin the process of increasing domestic chip production.

The United States has proposed a $52 billion bill aimed at encouraging the manufacturing of high-tech semiconductors in the country through the following measures in the CHIPS Act:

- Creates a 40-percent refundable ITC for qualified semiconductor equipment (placed in service) or any qualified semiconductor manufacturing facility investment expenditures through 2024. The ITC is reduced to 30 percent in 2025, 20 percent in 2026, and phases out in 2027.

- Directs the Secretary of Commerce to create a $10 billion federal match program that matches state and local incentives offered to a company for the purposes of building a semiconductor foundry with advanced manufacturing capabilities.

- Creates new R&D streams to ensure U.S. leadership in semiconductor technology and innovation is critical to American economic growth and national security:

- $2 billion to implement the Electronics Resurgence Initiative of the Defense Advanced Research Projects Agency.

- $3 billion to implement semiconductor basic research programs at the National Science Foundation.

- $2 billion to implement semiconductor basic research programs at the Department of Energy.

- $5 billion to establish an Advanced Packaging National Manufacturing Institute under the Department of Commerce to establish U.S. leadership in advanced microelectronic packaging and, in coordination with the private sector, to promote standards development, foster private-public partnerships, create R&D programs to advance technology, create an investment fund ($500M) to support domestic advanced microelectronic packaging ecosystem, and work with the Secretary of Labor on establishing workforce training programs and apprenticeships in advanced microelectronic packaging capabilities.

This bill has broad bipartisan support from both Republicans and Democrats and lines up nearly perfectly with Intel’s planned CAPEX expenditures in the United States. Currently, this bill is currently paused due to the usual political rankling on Capitol Hill, however, vital and broadly supported legislation such as this nearly always passes once each party extracts concessions and scores some political points.

Likewise, in Europe, the CHIPS Act announced in February of 2022 provides an additional €15 billion in funding to further the goal of doubling domestic chip production by 2030. This act will also provide for more R&D into advanced technologies along with building partnerships with likeminded countries to strengthen supply chains.

Intel looks primed to benefit directly from both the US and European CHIPS Act passage given that the company is the western world’s only serious competitor to both TSM and Samsung and the company appears to have designed its recent CAPEX push to line up directly with these bills passage.

Intel’s CAPEX plan includes a ‘megafab’ in Columbus, Ohio, which the company believes could eventually become the largest facility of its kind in the world with a potential $100 billion total investment, along with a $33 billion investment in two advanced fab facilities to be built in Germany beginning in 2023, in addition to new R&D facilities in France, Ireland, Spain, Italy and Poland.

Each of these potentially massive investments would immediately benefit from the investment credits and federal local incentive match program proposed by the US government, along with the R&D incentives granted by the EU.

Bottom Line

Intel has been a victim not only of its own apathy, but in the apathy of lawmakers in both the United States and Europe. These missteps by the company have forced Intel to begin this turnaround from a position of weakness compared to the competition.

However, the company is not going into this turnaround alone. Both the United States government and the European Union have a significant vested interest in the company’s success given the simply massive stakes involved in the global semiconductor supply chain.

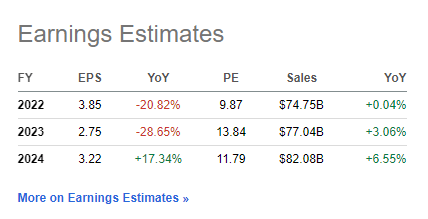

The next few years are likely to produce bottom line results that only a mother could love, however, most of this is likely priced in to the stock as shares currently trade at bargain bin valuation levels.

Seeking Alpha

I would argue that the best time to buy a company such as Intel, as a long-term investor, is precisely when things look the worst, which is undoubtedly now. Once the political sideshow passes, along with the CHIPS act, the company looks to have a solid plan in place to capitalize on the rather obvious need of supply chain diversification among potential customers.

This one will require some patience as headline risk over the next few years will likely lead to volatility, however, the pieces appear to be in place for revitalization of this once great company. Until that time, a well-covered and growing 3.84% dividend will suffice to soothe my tears.

Let me know your thoughts in the comment section. Thank you for reading and good luck to all!

Be the first to comment