Justin Sullivan

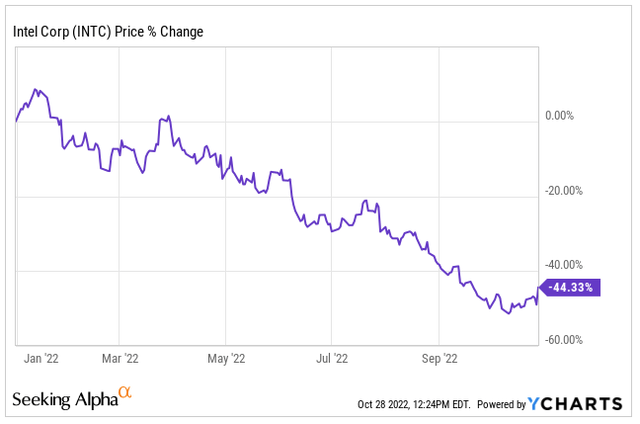

Intel (NASDAQ:INTC) shareholders have had a rough go at it in 2022 with shares down roughly 45% on the year, even after the strong surge we saw on Friday. The negative performance in the share price is not only related to concerns about a slowing economy but also due to failed company initiatives.

This week was a busy one for the company and will hopefully provide a little clarity on the road ahead.

During this week, Intel spun off its 2017 acquisition of Mobileye Global (MBLY) into a separate company that IPO’d at a valuation of $17 billion. The good news: the $17 billion valuation is higher than the $15 billion they paid for it a few years back; the bad news: Intel was seeking over $50 billion last year, so the IPO valuation is a far cry from the hopes they had for Mobileye in 2021.

On Thursday last week, Intel reported their Q3 earnings and also laid out some plans for the next few years, which we will cover below.

Intel Initiates Cost-Cutting Measures

Intel reported Q3 earnings last week that beat on both the top and bottom lines.

- Adjusted EPS: $0.59 vs $0.32 expected

- Revenue: $15.34 billion vs $15.25 billion expected

Although we got results that were not as bad as feared, we still see declines across the business. Intel’s company revenues dropped 15% year over year, which followed a 22% decline in the previous quarter.

Net income during the quarter came in at $1.02 billion, down a staggering 85% from the same quarter a year ago.

After a year plus of surging PC sales driven by the pandemic and a shift to work from home, all that is coming to a halt. We have seen a softening in PC sales from a number of earnings reports the past few weeks, so much of this was not a surprise. The Client Computing Group segment, which includes PC chips, was down 17% year over year.

Here are the results from a few other segments within the business:

- Datacenter: $4.21 billion, down 27% year over year

- Network and Edge: $2.27 billion, up 14% year over year

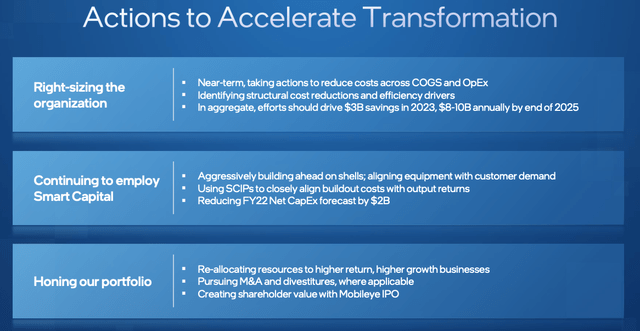

Given the weakness in the PC market and the uncertainty we face in terms of the economy, Intel had to find a way to cut costs, and they laid out a plan to do just that.

In 2023, Intel plans to reduce cost of sales and operating expenses by $3 billion, which they believe will reach up to $10 billion in savings by the year 2025. The big piece of this will come by way of layoffs, something CEO Pat Gelsinger has warned company employees about already.

A Turnaround Story or a Falling Knife?

Above we have already seen the decline in the share price during 2022, but Q3 results that were “better than feared” is not something that tells me there is no more downward pressure ahead.

If you go through the past few years of Intel’s history, it is muddled with poor management decisions. More recently, you can see how they have fumbled the Mobileye IPO.

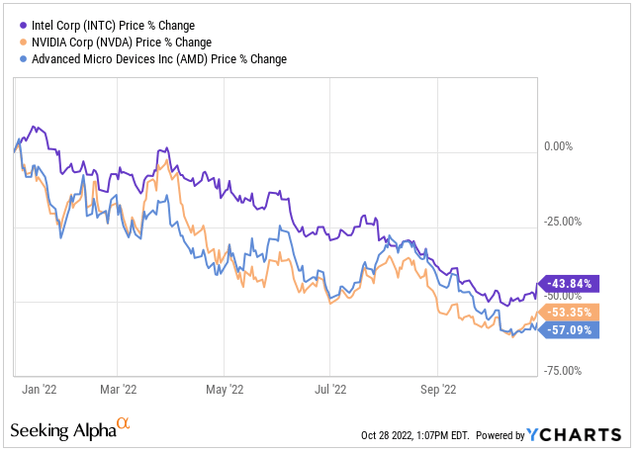

In addition, competitors such as NVIDIA (NVDA) and Advanced Micro Devices (AMD) have continued to take market share. Now, both of those stocks have been under intense pressure of late as well, but for different reasons in many ways. If you look at where valuations went for both NVDA and AMD in 2021, both of those were far too high, as it was less about results at both those companies. However, all three companies are feeling the pain in terms of demand.

In fact, in the year, both NVDA and AMD are down more in terms of share price.

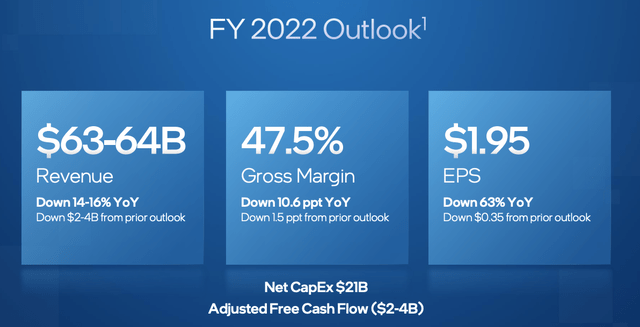

Here is where the company sees 2022 ending:

As you can see, if the company meets its Q4 goals for this year, it will round out the year with revenues between $63-$64 billion, which is good for a 14-16% drop year over year, a drop in the gross margin to 47.5%, and EPS down 63% on the year. In addition, the company will have NEGATIVE free cash flow of up to $4 billion.

When you look at a company that pays dividends, cash flow is key, as this is directly where those dividends are paid. Far too often, investors focus on net income, which is fine to some degree, but when assessing the safety of a dividend, you want to zone in on free cash flow. As such, negative free cash flow in 2022 means that debt is likely to rise OR the dividend is in need of a cut. I am not sure the management team is quite there yet, but if performance does not turn around soon, that discussion will become top priority.

All in all, the cost-cutting measures are desperately needed as the company is not meeting its initiatives when it comes to sales.

Intel Is Cheap For A Reason

As we have seen shares of Intel only move in one direction, the valuation has fallen with it. However, there is a difference between a cheap stock and a falling knife. Intel has proven nothing to us in the most recent year that can tell investors a turnaround is in store.

Sure, they are cutting costs, which is needed, but I need to see growth turnaround for key areas of the business.

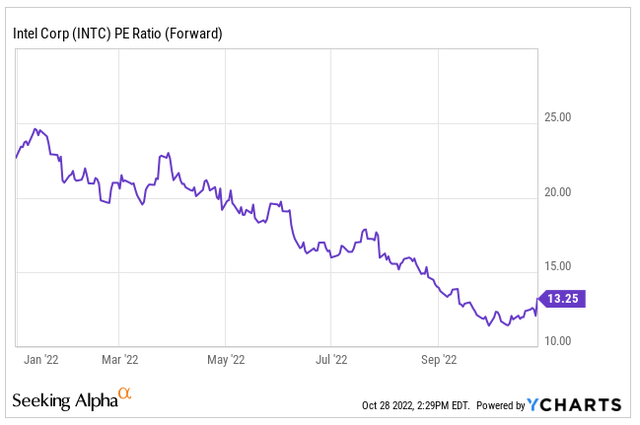

Here is a look at the company’s P/E Ratio falling during 2022.

Sitting at a forward P/E of 13x after the revenue declines, EPS declines, Free Cash Flow Declines, it does not seem all that cheap.

Look at a company like QUALCOMM (QCOM) or Broadcom (AVGO) that are trading at forward Price to Earnings multiples of 9x and 11x, respectively. Both of these cheap stocks are well diversified away from PCs, have diversified portfolios, and strong management teams.

Strong Management is not something we could associate with Intel for some time now. Can current CEO Pat Gelsinger turn things around, sure, but it seems like a big uphill climb.

In fact, when you look at the earnings estimates that are out there right now, Intel is not expected to grow earnings until 2024 at the earliest.

Investor Takeaway

PC demand combined with poor management decisions and economic headwinds is making things rough for Intel moving forward. The company is making the proper cost-cutting measures, which is a step in the right direction, but they need to find a way to regain market share that has been lost to the competition over the years.

Negative free cash flow for 2022 is putting plenty of pressure on management to really look at its current dividend. I am a dividend investor, and a 5.5% dividend seems great, but you must assess the safety of the dividend, and right now, there are some red flags. Investing in a stock for yield alone can cause destruction to a portfolio.

I do not believe Intel is out of the game completely and should be tossed aside, but I want to wait for them to prove it to me before they earn my investment.

Be the first to comment