JHVEPhoto/iStock Editorial via Getty Images

Investment thesis

I recently made the case that Intel (NASDAQ:INTC) has bottomed, or at least it should be close to bottoming. This was based on the insight that Intel’s earnings Intel are getting cut in half due to increased R&D spending and declining gross margin.

However, this was met with widespread skepticism, as if I was promoting some >50x P/E stock. Hence, it seems the market is overly scrutinizing the company, without taking into account the incredible potential that is baked into the roadmap.

The only remaining bastion of the bears is that supposedly Intel wouldn’t be able to execute its roadmap, as if the company only employs incompetent engineers. However, the execution risk has been significantly reduced since Pat Gelsinger was appointed as CEO, as the employee count has increased by nearly 20k.

Overall, Intel’s investments combined with the current macro-environment is reducing near-term earnings significantly, resulting in a perfect bear storm (Intel’s technological and financial bottom is coinciding with the stock market bottom due to inflation/interest rate hikes). But given the long-term trends discussed above, the current stock price offers a generational opportunity.

Stock update

Although the stock has continued to drop a bit further since my call for the bottom, arguably much of this has to do with the overall state of the market. If investors are only willing to pay for current profits, then Intel could drop further, perhaps below $25 or even $20, since even now the forward multiple is still 12x, not that much lower than AMD (AMD) whose estimates are going up a lot more.

Don’t get fooled by this, though, since the thesis is to accept this gift by the market. As described in previous article Intel has multiple levers for earnings expansion, including gross margins and revenue growth. Hence, once Intel starts to gain leverage from its current investments, it won’t be hard for Intel’s earnings to multiply, and hence so could the stock price (at least back to its previous $50-60 trading range shouldn’t be a stretch by any means).

GPU update: insane value

This week at Intel Innovation, Intel finally launched its highly anticipated debut into the discrete gaming market with the A770 for $329.

With that price, it competes against the RTX 3060. However, in terms of performance it actually has 90% of the FLOPS of the RTX 3070, putting it halfway between the $399 RTX 3060 Ti and the $499 RTX 3070. Intel has claimed a significant performance advantage (>60%) in ray tracing compared to the RTX 3060.

Of course, reviews will have to determine whether these theoretical capabilities also translate into real-world performance. Reviews of the initial low-end launch A370 in the last few months have in particular criticized the drivers (confirmed by Pat Gelsinger during the July earnings call), which has already caused enthusiast to have prejudices about the GPU before it has even been independently reviewed.

In any case, the main issue here (besides potentially drivers) is time to market. The GPUs currently being launched were always meant to compete against the GPUs launched two years ago by AMD and Nvidia (NVDA). Indeed, Nvidia has already launched the first parts of its RTX 4000 series, although those parts also carry a much higher price for their higher performance.

Analysis

Industry-leading roadmap

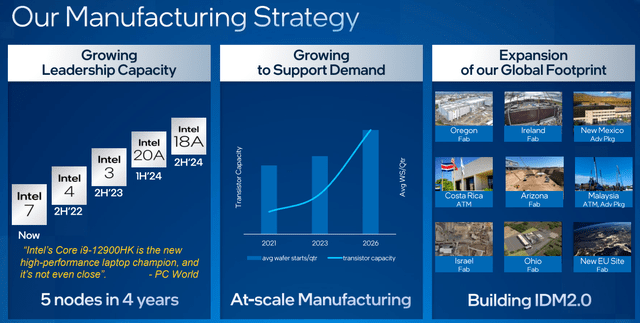

Moore’s Law states that transistor density should double every two years. This provides the roadmap for the industry. So in stark contract, investors should recognize that in the next two years, Intel will be churning not just through one new node, but two full nodes (as well as two intra-node improvements). This is ultimately the key to the kingdom. Two nodes in two years (Meteor Lake in 2023 on Intel 4, Arrow Lake in 2024 on Intel 20A) is unprecedented.

Meanwhile, if this wasn’t compelling enough, the competition is actually taking its foot off the pedal. It has been reported that N3E is slated to be TSMC’s (TSM) first high volume 3nm node. The original N3 is likely restricted to just the Apple (AAPL) iPad/Mac silicon. However, the N3E node will land only in the second half of 2023, at best just months before Intel starts shipping its own Intel 3 node. Note that N5 shipped in late 2020, which implies that TSMC is trending towards a 3-year cadence.

Furthermore, while as mentioned Intel will then leapfrog TSMC with its 20/18A nodes in 2024/2025, TSMC will then take another ~2.5 years to move to N2, slated for production in Q4 2025, putting products well into 2026. By that time Intel will be preparing its 14A node.

In other words, the lure of the looming process leadership is real, and with that prospect Intel is also investing to increase manufacturing capacity as it starts onboarding major foundry customers.

Comparison

Imagine you are tasked with analyzing two unknown companies, which are called A and B.

Company A’s roadmap has 5nm in 2020, 3nm in 2023 and 2nm in 2026.

Company B has 4nm in 2023, 2nm in 2024 and 1.4nm in 2026.

You remark that Company A is on a 3-year cadence. Meanwhile, Company B is clearly a bit behind (4nm vs. 3nm in 2023), but has a much more aggressive roadmap.

Hence, you conclude that even if Company B does not execute perfectly, its roadmap is so far ahead of Company A that it can afford pretty much any except the most spectacular mishaps (i.e. another 10nm fiasco), and it would still be competitive or ahead.

Insane

The following article may be worth reading for its technical discussion of what Intel is doing, at least in one aspect. It concerns PowerVia as a major pillar of Intel’s quest to regain process leadership. The TLDR is that Intel’s implementation is both superior than TSMC and will also be around two years earlier to market: Backside Power Delivery and Bold Bets at Intel.

BS-PDN is a huge inflection point. If Intel lost its lead to TSMC when they failed to insert EUV early enough, this is where TSMC could lose its lead in transistor density by not taking aggressive design moves to improve performance. I cannot overstate this specific decision’s importance (along with RibbonFET, but both companies will have GAA at that point).

Implications

Given Intel’s very deflated valuation, the market clearly isn’t taking into account the potential upside this roadmap will most likely provide: the market is simply pricing Intel based on what it currently is, not on what it might become (since in the current macro environment investors have become too risk averse to bet on such things).

Nevertheless, going into 2024/2025, for the first time in literally a full decade Intel will suddenly be able to launch unquestioned leadership products again.

In turn, this will improve the outlook with regards to market share, especially in the data center. In addition, obviously leadership products will also improve Intel’s gross margins, which have declined to multi-decade lows recently. As discussed in the previous article, upside in gross margin alone could improve the share price by up to ~$10.

Execution de-risked

The execution risk, which is pretty much the only remaining credible bear argument, has also been de-risked by literally hiring ~20k net new employees. This is more than the total amount of employees either AMD or Nvidia had until just a few years ago. Correspondingly, the R&D budget has been increased by nearly $5B so far. The process tech budget alone has been increased by $1.5B.

While Intel said it would reduce its hiring plans in the wake of the current downturn, Q2 was probably Intel’s best hiring quarter ever, so it remains to be seen how much the employee count and R&D budget keeps growing.

However, it should also be pointed out that the execution gets further de-risked with every new foundry customer that gets added. Intel said it is now engaging with 6 of the top 10 fabless customers. Key announcements so far include Qualcomm (QCOM), Cisco (CSCO) and MediaTek. Pat Gelsinger also hinted that Nvidia is at least investigating the possibility of using it. The pipeline is over $5B.

Admittedly, Pat Gelsinger said in September that none have made commitments yet for the leading edge nodes like Intel 3 and 18A, as the first test chips will only start coming from the fabs in the coming quarters. So while there are currently no material announcements yet, the engagements levels should be seen as very encouraging.

This simply isn’t the struggling and stumbling Intel anymore as it was in the last two nodes. Intel is internally already firing on all cylinders, it will just take a tad more time for this to show in the market. With this reality changing, arguably investors’ attitude should be changing as well.

Revenue

While there might be weakness in the next few years on the PC side giving the strength during COVID-19, unless the most pessimistic scenario would happen, with PC sales dropping from over 300M to under 200M, then ultimately downside should not be endless. In other words, as Intel has claimed it is currently (Q2/3) the bottom.

On the data center side, investors might also be overly pessimistic. Intel’s market share held up relatively well from 2019 to 2021 despite that AMD was shipping 64-core high-end parts during this whole time, while Intel only had 28-core parts. This changed last year with a healthy ~40% increase in core count to 40 with Ice Lake, with another ~50% increase in core count coming up with Sapphire Rapids, and then another nice jump with Granite Rapids in 2024. So overall, Intel is already getting more competitive, even before it really regains process leadership in 2025 as discussed above.

In addition, the ASP (average selling price) of both Intel and AMD is well below $1000, which suggests that most of the significant volume is, in fact, not at those ultra-high core counts. So while technically Intel may not have an answer to AMD’s upcoming 96-core Genao CPU, the importance of being less competitive in the ultra high-end segment could be overblown. (Of course, in order to compete against the 5nm node in the lower-end segments, Intel would likely have to compete more on price, sacrificing gross margin.)

Lastly, the data center segment in particular is expected to continue to show decent (up to double digit) growth, which can (partly) offset some of the ongoing market share declines.

Besides the PC and data center, the Network and Edge (NEX) group should be highlighted, which comprises the former Networking and IoTG segments. Both IoTG and Networking have a long history of growing at double digits (well above the corporate average), and this remains the goal going forward. In particular, NEX revenue was $2.3B in Q2, up 11% YoY. Giving this scale, growing at double digits means adding on the order of $1B revenue annually.

In conclusion, Intel’s different businesses each have vastly different profiles (PC TAM is declining, but there Intel’s competitiveness is strongest with Alder/Raptor Lake; DC TAM is moderately growing, but weakest competitiveness; the other 4 businesses are smaller, but not insignificant, and also have the strongest growth), which should ultimately provide a cushion against severe downside. As such, Intel’s statement that revenue is bottoming in Q2/Q3 is indeed credible.

For one more remark, while Pat Gelsinger did recently say that revenue was trending around the lower-end of the guidance, which may signal that there might not be a quick V-shaped recovery, this does not means the upcoming Q3 results will necessarily result in more downside, as Intel had already reset all expectations with regards to guidance during last (kitchen-sink) quarter, and the stock had a full quarter to digest the new guidance.

Worst-case

In the worst-case, let’s say PC revenue gets halved. This would wipe out $20B revenue, likely leaving Intel at around $55B, a further $10B below the current forecast. In a more realistic scenario where revenue drops from ~$40B to ~$30B, which is probably a decade low, then this would align with Intel’s guidance of at least $65B revenue.

To be sure, since Intel shed ~$5B revenue due to the NAND sale, it will still be recording revenue not that far from its all-time high, in a year plagued by macro concerns. For a company that has been compared to dinosaurs, whose days supposedly were numbered due to things like Apple silicon (another ~$5B Intel lost in recent years) and AMD grabbing so much market share, Intel is actually holding up relatively well. At least compared to how Intel tends to be portrayed.

Possible trading strategy

Some investors still aren’t convinced and need more assurance that Intel will really deliver on its roadmap. Since this is understandable, one possible strategy hence could be to dollar cost average into the stock. By initiating a small position at the current levels, investors could get some exposure to the lowest stock valuation the stock might see if Intel delivers on its plan, while the downside risk is reduced by virtue of investing only a small amount.

This strategy is also in line with the above observation that the recovery might not be V-shaped, which means Intel might be reporting weak quarters for the next year or so.

The big picture

In previous article some investors commented that I had been bullish on the stock since it was at $60. That is indeed correct, as no one could have foreseen the 2020 delay of 7nm, which set the Intel bull thesis back by a few years (until that delay Granite Rapids launch was expected in early 2022, but currently not even its predecessor Sapphire Rapids has launched). I admit that.

Nevertheless, the reason for remaining bullish was because:

- Intel had credible mitigation strategies in place, such as outsourcing, which are currently indeed being confirmed by multiple products that are produced by TSMC.

- Just one quarter after the delay Bob Swan already expressed optimism by the “very strong” progress Intel had made, and indeed since then Intel hasn’t had to further delay 7nm.

- Most importantly, the delay seemed isolated to 7nm, which meant that 5nm might be relatively unaffected. For a long time, this was just speculation on my part, but this indeed turned out to be case, as the whole point of “Intel Accelerated” (5 nodes in 4 years) was to quickly move from 7nm to 5nm in an unprecedently short timespan. So the 7nm delay has hardly impacted the 5nm schedule.

In addition, though, the lack of execution in the data center has more recently turned out to be another unforeseen setback.

However, philosophically this issue isn’t actually all that different from the original 10nm delay issue: Intel was taking too many steps in just one node without appropriate funding. Due to the 10nm delay, Intel basically canceled its Tick-Tock methodology in order to catch up: Ice Lake (which itself was already delayed) was a Tick and a Tock simultaneously. Sapphire Rapids is also pretty much a Tick (moving to a chiplet paradigm) and major Tock (moving to PCIe 5.0, CXL and DDR5) simultaneously.

Also note that Sapphire Rapids is a pre-turnaround product anyway, so it doesn’t really change the overall thesis.

Intel’s disclosures indicate that Granite Rapids will again be a Tick and Tock simultaneously, and Granite Rapids is also delayed by two years compared to the original schedule, just like Sapphire Rapids.

Nevertheless, if the thesis is that all these projects were delayed because Intel was underfunded due to excessive cost cutting under prior management, then the thesis should also be that these issues can likewise be fixed by adding more spending, which Intel is doing.

Enormous opportunity: more insanity

In Q2, TSMC reported revenue of $18.2B, eclipsing Intel for the first time in its history. Even ignoring the trailing edge (which Intel is acquiring Tower for), 65% of its revenue ($11.8B) was on 16nm and below, with another 10% on 28nm. This means around $50B annually, and since TSMC has less than 60% foundry market share, the overall market is even bigger. The market is also expected to keep growing, so it will be even larger by the time real IFS volume starts running through Intel fabs.

Given how much revenue is at the N-x (lagging edge) nodes, Intel doesn’t even necessarily need process leadership to potentially become decently successful in this market, so its upcoming Intel 3 node should already be able to address at least some (potential) demand from most of the largest fabless customers, with 18A just a year later.

Of course, process leadership will make it easier to lure customers. In the bull case, there is no a priori reason why Intel couldn’t grab a substantial double digit market share. Process leadership is something rare, so it should be no surprise that Intel would have a very valuable asset that, with the IFS foundry business, it can finally start to fully monetize.

This isn’t just about losing a few points of market share to AMD, as Pat Gelsinger saw it is tens of billions of the foundry market that are at stake.

Risks

One risk is that just by solving its technology issues, this does not necessarily mean the financials will suddenly become stellar. For example, Intel is simply investing more in R&D to create these leadership products.

Clearly, though, regaining process leadership should result in rising gross margins and, to some degree, average selling prices as products improve. In addition, improved competitiveness should benefit market share trends. Lastly, it could serve as a differentiator in businesses with a lower market share (like GPUs, NPUs, IPUs and switches, although many of these products actually use foundry processes currently).

Overall, though, aside from gross margin these improvements are quite hard to quantify.

Investor takeaway

The takeaway is simply what was explained in the big picture section: the execution risk with some projects unfortunately materialized, which did indeed set the bull thesis back by a few years. In retrospect, though, what is different now is that previously Intel (its former CEOs) only said it was going to do things differently, without actually doing anything differently.

This is exactly what has changed: no more stock buybacks, and much more investments in the company itself. Hence, since the facts are slowly changing, so might investors’ attitude towards the company and the stock. If not, then of course the proof will ultimately be in the pudding.

Since as discussed the process roadmap remains unchanged, so is the premise for regaining process leadership. While this does not mean there could not arise any more delays in the future, investors should at least not slip into losing their conviction just because the stock price has deteriorated. Instead, the market is currently offering an insane opportunity.

Be the first to comment