skynesher/E+ via Getty Images

Thesis

Taiwan’s MediaTek and Intel Corporation (NASDAQ:INTC) announced back in July the formation of a strategic partnership. MediaTek will have Intel’s Foundry Service (“IFS”) produce its chips above Intel 16 nm, approximately equivalent to 22nm at Taiwan Semiconductor Manufacturing Company Limited’s (TSM). Intel has previously announced deals with major names including Qualcomm (QCOM) and Amazon.com (AMZN). However, this recent deal with MediaTek is one of its most significant so far (as elaborated on below in the second section).

For investors who are uncertain about INTC’s future (and there are plenty of uncertainties ahead), this major deal provides a test to provide clarity in about 1 year and a half – one way or the other – about INTC’s IFS initiative. MediaTek’s orders are expected to come at the end of 2023 and to begin contributing to IFS revenues sometime in 2024.

Therefore, potential investors could wait till then, see the results, and decide. If the partnership is a success, the MediaTek-INTC alliance might lead to more win-win collaborations. MediaTek could have a cost-effective foundry provider to diversify its manufacturing risks, and INTC could accelerate its IFS ramp-up and better diversity its own revenue streams.

MediaTek Basic Info

For readers unfamiliar with MediaTek (“MTK”), the key message is that it is NOT a small fish in the chip space. It is Taiwan-based fabless semiconductor company and is publicly traded on Taiwan Stock Exchange. It designs system chips for a range of applications including wireless communications, high-definition television, and potentially PCs and servers (if the partnership with INTC further develops).

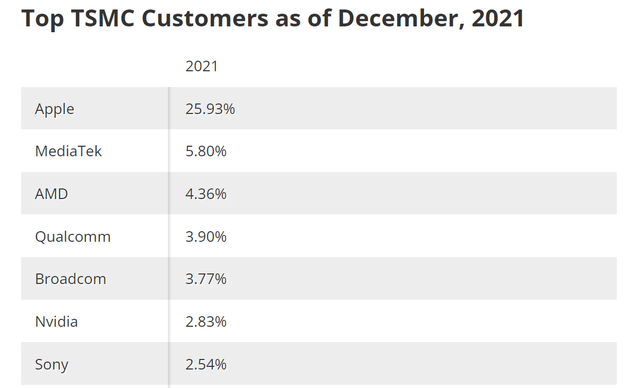

As of December 2021, MediaTek was TSM’s second largest customer (only after AAPL) contributing 5.80% of its total revenues. It actually contributes substantially more to TSM than more familiar names such as AMD (AMD) (4.36%) and Nvidia (NVDA) (2.83%).

Market obsession with 7 nm is misplaced

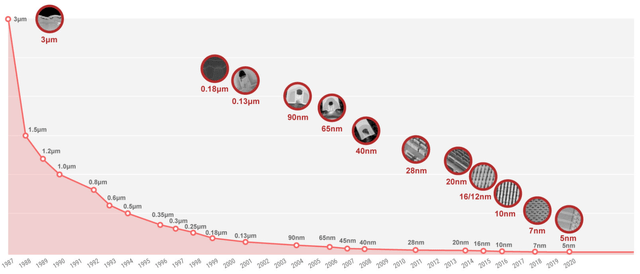

One argument I hear often against INTC IFS is that its technology is so behind in the 7 nm or below space. It is certainly an argument with some validity. INTC IFS foundry unit is scheduled to start with a 22 nm process, then followed possibly by a 14 nm process, and then finally by 7 nm. In contrast, as you can see from the following chart, TSM has already matured 7 nm and below technology.

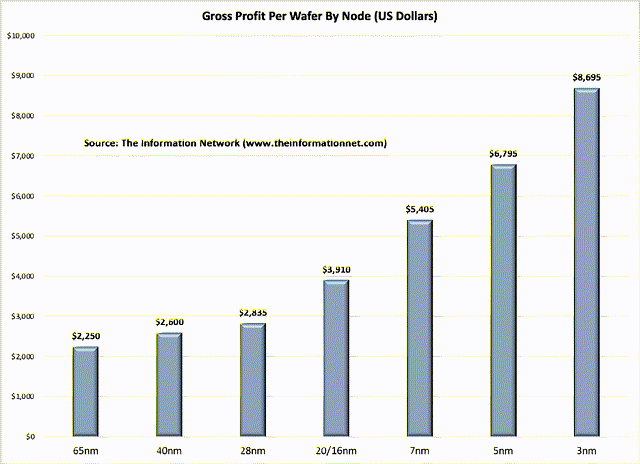

And it is also no secret that more advanced node brings higher profits. As the following Chart (taken from The Information Network) shows, the gross profit increases monotonically as node size shrinks. Particularly, gross profits per 300-mm wafer are about $3,910 for the 20/16 nm node, while about $5,405 for the 7 nm node.

However, what the above arguments missed are two crucial factors. Firstly, the market size for nodes at different sizes. And secondly, the marginal benefits of each node size. More specifically, while it is true that the most advanced chips have a higher margin, there is plenty of demand (or perhaps even more) for mature sizes. As the following DBS report pointed out (abridged and emphases added by me), the demand for mature nodes will actually rise faster than more advanced nodes driven by EV and IoT:

In particular, global mature nodes (40nm to 0.5 micron and above) semiconductor market is enjoying higher shipment growth than advanced nodes (7-32nm, excluding the most advanced technology nodes), as rising demand from IoT and automotive has enlarged the application span of current mature node platforms… The projected 2020-2027 CAGR for mature node shipment is 6.2% while that for advanced nodes is only 2.4%.

Source: The Information Network

At the same time, just purely from the perspective of profit-cost analysis, 22 nm may be a sweet spot too for many foundry customers. Customers have to consider not only the benefits but also the so-called marginal benefits. It is true that small nodes are more profitable, but many customers at 28 nm and above are hesitating to move to 14 nm or below because at those sizes, the manufacturing options are limited (to the so-called finFET transistors) and the costs are also significantly higher than traditional planar transistors at 22 nm.

INTC IFS outlook and return projections

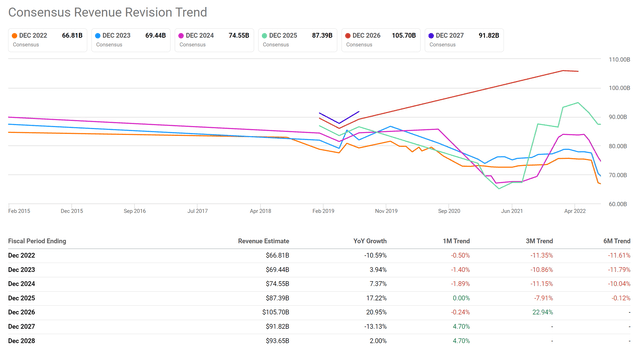

2022 and 2023 might be the darkest time for INTC. Its latest Q2 earnings reported a series of headwinds such as the downturn in the PC market, inflation, delays of its server processors, et al. Its Q2 revenue declined sharply to only $15.3 billion, a decrease of 22% YoY. And as aforementioned, MediaTek’s orders won’t start contributing until ~2024. You can see from the consensus estimates below that the market does not expect substantial growth till 2024 as well.

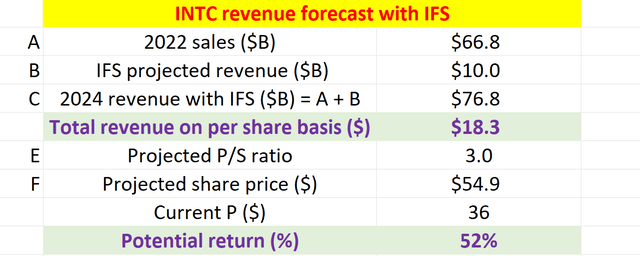

My projections are summarized in the table below and are a bit rosier than the above consensus estimates. I project INTC’s IFS to reach a revenue of about $10B considering by 2024 considering the customers that it has signed on and also the average asset turnover rate for a foundry business (around 0.5x for TSM). Therefore, even assuming its current businesses stagnate at the 2022 revenue level (the lowest level since 2018), the total revenue is projected to be $76.8B, about $2.2B or 3% higher than the above consensus estimates.

Assuming a 3.0x P/S multiple, the projected share price would be about $55, a 52% potential upside from its current price.

Final thoughts and other risks

There are plenty of reasons for investors to feel uncertain about INTC’s future. Its Q2 revenue declined sharply by 22% from last year. The PC market slowdown may continue and persist for a year or even two more years. Its market share has been under pressure and continues to be pressured, by AMD, especially in the server and data center segment. At the same time, its IFS initiatives are still in the early phases.

This is where its recent deal with MediaTek could help to provide clarity in about a year and a half. If the partnership progress successfully, the MediaTek-INTC alliance might lead into other more strategic alliances and benefit both.

Therefore, potential investors could wait and see the progress of this deal. In investing, once the uncertainties are gone, a good portion of the return potential will also be gone too. But capturing the smooth ride afterward alone is often enough to provide satisfactory results in the long term (plus much better sleep if your risk profile is more conservative).

Be the first to comment