Chip Somodevilla

Investment Thesis

Intel Corporation (NASDAQ:INTC) recently reported its Q3 results and Q4 guidance, which were, quite surprisingly, met with relative enthusiasm by the market – for the first time in ages, the stock didn’t decline following the results.

However, even though I have been bullish about Intel, especially at the current prices, I want to warn investors about falling into a bear trap: Intel’s guidance for the next year is very bleak. Intel is now – despite still being in the early innings of the turnaround – having to resort to drastic cost cutting measures in order to leave any sort of resemblance of a bottom line in order to appease investors. Instead of judging Intel on the 5 nodes in 4 years, management has now put forward a “reduce costs by $10B in 3 years” program, effectively undoing the turnaround investments.

The danger here is that investors may be having their cake and eating it too: they are now expecting both the turnaround and the cost savings.

This is jeopardizing the whole thesis that long-term investors were banking on: due to the macro-environment, Intel may not be able to fund its plan to regain leadership anymore. While for the near-term Wall Street is now happy, I am hence turning incrementally more bearish on the stock, since even these cost-saving measures may not suffice to counteract the declining top (and hence bottom) line as the recession unfolds, which may be a harbinger for lower lows ahead (as well as just mentioned jeopardizing the long-term business).

Discussion

Before discussing the latest results, let’s get back to the fundamentals. The semiconductor industry is a very capital-intensive industry. Building and operating fabs requires a lot of money. Never mind the R&D capital in order to stay competitive as Moore’s Law progresses relentlessly. As Intel remains in turnaround mode, it continues to feel the effects of falling behind on Moore’s Law: the company is less competitive, and even if it were competitive, it is not at the industry-leading gross margins it once enjoyed. This has made it vulnerable to competitors like Advanced Micro Devices (AMD), using Taiwan Semiconductor (TSM) (“TSMC”) fabs, which are eroding Intel’s former near-monopoly.

Now, here is the issue. The top-line was already under some pressure due to AMD (as well as the NAND sale), only saved by the COVID-induced semiconductor boom as the PC relived its heydays. However, with AMD still gaining share in the data center, as well as the current PC reversion to the mean and/or recession, as well as with Apple (AAPL) leaving Intel, this means Intel is now facing a lot of pressure to the downside with regards to the top-line, and hence the bottom-line even more as Intel loses leverage from the economics of scale (as the fixed R&D/SG&A costs are spread over lower revenue).

All the while, as discussed extensively in previous coverage, Intel is investing more than ever as it is embarking on a turnaround of unseen scale in order to regain its status as industry technology leader. For example, my article back in 2021 discussing Pat Gelsinger’s IDM 2.0 strategy was called “The Empire Strikes Back.”

The punch line is that given the current contracting financials (whatever the reason, macro or micro), Intel may not have the means anymore to fund its strategy in the first place. Just consider that Intel was supposed to approach $80B in revenue in 2023 when the original funding plan was set up, while currently Intel is hardly on a $60B run rate. Something has to give, and so far Intel has made it clear it won’t be the dividend.

While less demand does mean, as was one of my previous arguments, that Intel has to build fewer fabs (and indeed, nearly half of the $15B top-line contraction in 2022 has been “compensated” for simply through lower net capex; although some of the net capex contraction is due to higher capital offsets as Intel has discussed), the revenue can only decline so much before the reality kicks in where a company will be unable to fund its investments plans – never mind to leave any profits to flow through to the bottom line to actually give value to stock instead of the company being a charity.

Although, obviously, the recession is not Intel’s own doing, it does present a catch-22: the turnaround was meant to get Intel back to a healthy financial and technological position (before it would irreversibly fall so far behind it didn’t have to funds anymore to do so, as AMD became the new Intel), but Intel needs be healthy financially to embark on the turnaround in the first place. Hence, the recession is throwing in a rather unluckily timed wrench into Pat Gelsinger’s plans that is jeopardizing everything.

Today, we are indeed seeing the first signs of what the bears have been warning about for years: Intel would be unable to catch up and hence become a tech dinosaur the likes of IBM (IBM) as it fell into the trenches of irrelevancy.

So, no, Intel did not deserve the 10% stock bump it received to $29 – unless investors were cheering when they read that 20A and 18A are still on track with the first test chips now in the fab, but that wasn’t the reason. Intel is a stock/company where listening to Wall Street will directly lead to bankruptcy sooner or later, since all investors want to see the turnaround without actually having to pay for it, which is simply not how reality goes. Intel catering into the investor pressure to save money directly conflicts with its imperative to embark on the turnaround in the first place.

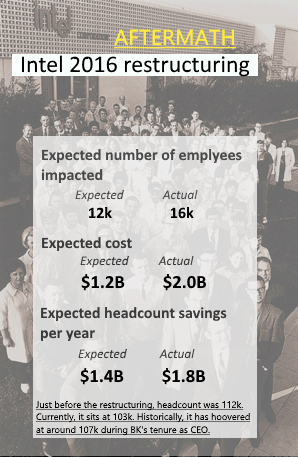

Own work

As a reminder, we have seen this exact same scenario play out before, and we all know how it ended. I am referring to the 2016-2017 reorg that affected 16k employees (in the media often 12k is quoted, but the final tally was actually even worse than what Intel first announced). Note that back then, although 10nm was already delayed, it was not yet affected much by these delays (especially since at that time AMD was still nowhere), so the 2016 reorg was simply the result of the most pure corporate greed out there. As well as the lack of foresight by management and the board that lack of technological progress would eventually lead to the disaster Intel is currently going through.

As case in point, consider that Intel literally said during the conference call that it would slow down its process cadence after it is done with the 5 nodes in 4 years:

“In addition, as we emerge from five nodes in four years and [slow our] technology development cadence, we expect an additional approximately 200 basis points of gross margin after 2026.”

To be sure, when I saw someone comment about this on Twitter, my reaction was to point out that this simply means Intel is going back to its historical two-year cadence, instead of the “accelerated” cadence it is currently going through in order to catch up from the 7nm delay. As Pat Gelsinger literally said a while ago, the nodes are lined up for the rest of the decade.

Nevertheless, the risk here is that Intel may revert back to the trap of only greenlighting what it thinks are the minimally required amount of funds to follow Moore’s Law, scrutinizing every penny spend (like in the Bob Swan days), which significantly increases the execution risk, which is what analysts have been extensively lamenting about in their analysis for Intel in the first place. In addition, being able to follow Moore’s Law faster will always be favorable in the long run, since Moore’s Law is what fundamentally drives down the cost per transistor. Slowing down the process cadence does not bring any long-term advantage.

Ultimately, there is no easy solution for the decline that does not impact shareholders and the stock. While management is marketing the reorganization as a means to “accelerate” the transformation, the reality is that Intel is simply giving into both investor pressure as well as the simple financial reality as discussed: no revenue means no funding to embark on the turnaround, especially if Intel (as it seems) wants to maintain a healthy bottom line and/or cash flow.

For what it’s worth, what I personally would have preferred is that Intel continued to go all-in on its strategy. Something along the lines of (this is not from Intel!):

Hey, as we’ve said before, fixing a decade of mistakes can’t be done in one or two days/years. We’re still all-in on getting Intel back to this place of unquestioned technology prowess, the stewards of Moore’s Law. However, accomplishing this mission takes significant capital, which will be at the detriment of any profits we’re going to be generating in the next half a decade. Like Amazon (AMZN) did in ecommerce, we’re gonna be investing all profits back into our Moore’s Law engine and our six great businesses, before we’re even going to entertain the thought of keeping any profits ourselves. We have to prove out we can execute world-class, reliably and on schedule before patting ourselves on the back. After all, it is only when we have process and product leadership that the benefits of our IDM 2.0 strategy will truly begin to shine.

Now, we’re not just going to spend like a drunken sailor. As we’ve discussed, we have significant leverage and economics that is inherent in our IDM 2.0 model, and we’ve built these wonderful new growth businesses like graphics, foundry and robotaxi that we expect to become significant over time. So, the way we’re going to go about navigating this downturn is that while we’re gonna be a bit more prudent about our costs, we’re remaining relentless in our pursuit of Moore’s Law and funding our businesses to deliver industry-leading products – on schedule – and as we progress, both the lower cost per transistor from Moore’s Law as well as the revenue growth from our new businesses will deliver significant value that will outweigh any shortsighted near-term benefits that layoffs would bring. So after we’ve done 5 nodes in 4 years, we’re gonna do another 5 nodes in 5 years.”

Outlook

To come full circle, we can now, with the benefit of hindsight, see how Intel got where it is today. First, former CEO Paul Otellini couldn’t see the mobile revolution, which would transform phones into computers that everyone carries in their pockets. Then, Intel tried to spend billions to enter this market anyway, and failed. Then, Intel tried to find various new “data-centric” growth businesses like Optane, NAND and modems, all of which failed. All the while, as Intel didn’t have pressure from a near-bankrupt AMD and so didn’t have to be paranoid anymore, it was pressured by investors to also reduce costs (from 36% of revenue all the way down to 30% and then 25% of revenue under Bob “bean counter” Swan, first as CFO and then as CEO), as evidenced by the massive 2016-2017 layoffs even in the wake of the 10nm delays. This means that Intel likely may not even have had enough funding for its core businesses (as evidenced by the 10nm and data center disasters), never mind the new businesses.

The point here is that for more than a decade now, Intel has tried – so far unsuccessfully – to find new big markets to pursue further growth, with questionable funding available at best. Besides the data center, which did grow but also not as much as Intel had been expecting (Intel’s goal for many years was to grow this business at a 15% CAGR, which it accomplished only a few times), most of these efforts either failed or simply didn’t become material enough to the top line.

So now that other companies like TSMC, AMD, Nvidia (NVDA), Samsung (OTCPK:SSNLF, OTCPK:SSNNF), and even Qualcomm (QCOM), have caught up in scale to Intel, and Intel itself is now significantly contracting, in the worst-case Intel may be unable to ever get its previous Tick-Tock flywheel back where it is seen as being “years” ahead of all competition.

While its progress with RibbonFET, PowerVia and high-NA is compelling and encouraging, admittedly one can’t make the argument anymore that Intel could simply outspend the competition since only it has the required scale. It comes down to excellence in innovation, and people will remain wary that it still is an innovation powerhouse until Intel actually delivers the goods and blows the competition away.

Simply put, becoming an innovation powerhouse to dominate (new) markets requires significant investments which Intel in the wake of the current revenue contraction is acknowledging it is not capable to invest in anymore, definitely not without significantly affecting the bottom line on which the stock is judged. While every company can cut costs in the near-term to bolster earnings, for the long-term it does raise the question to what extent the upcoming reorganization will hinder Intel’s ability to execute (which was the issue Pat Gelsinger was brought into fix).

Near-term conclusion

Although things like market share and pricing, which are influenced by technology, obviously play a role, philosophically once there is a certain amount of cash that comes in from sales, this puts a cap on what a company can do. Obviously some portion of the revenue is mandatory (cost of sales/cost of goods sold), the rest can be split “freely” between R&D, SG&A and profits (which can then be distributed through dividends and buybacks).

While obviously lower revenue also means to some extent lower cost of sales, given that Intel can’t save too much on R&D (otherwise it will fall behind on technology again, which is the catch-22), and given that SG&A efficiency was already a strong focus of previous management (in their effort to optimize EPS), it follows that EPS (and hence shareholders) will be the primary victim of the revenue contraction/recession.

Silver linings and internal foundry model revisited

Notwithstanding the discussion so far, not everything is as bleak as it seems or portends, for one because of the 5 nodes (4 nodes remaining, including Intel 4 which will go online in the coming months). While obviously spending more (funding more teams to work on more projects to avoid delays) is one possibility, not everything and not every mistake Intel made simply comes down to money. So, admittedly, in the analysis above I may have been a bit superficial in saying Intel is at risk of not investing enough anymore as it starts its cost saving strategy over the next year and beyond – reversing the significant increase in funding made available previously. As a reminder, even in Q3 Intel continued its hiring spree, having now added over 20k employees since Pat Gelsinger joined. So even if Intel fired 10k employees, it would still have significantly more employees to work on its projects.

More specifically, while it is easy to say in hindsight that the 10nm, 7nm and data center delays could have been avoided or reduced with more spending, one must admit that it may simply have been poor technical decisions. As case in point, I have detailed extensively how 10nm represented Intel’s big bet against the now heralded EUV lithography technique from ASML (ASML). On the data center side, Sapphire Rapids needing well over 12 steppings to resolve all bugs and issues is simply awful engineering – the opposite of what Intel once stood for.

For example, obviously Intel was already trying to regain process leadership under Bob Swan, but this was at a ~$13B R&D budget and failed given the 7nm delay. Currently, Intel is on a nearly $18B R&D budget. Even if there is some decline to reach those $3B 2023 and $10B 2025 targets, it is not sure if critical areas like process development will see significant layoffs (the rumors pointed to areas like sales and marketing).

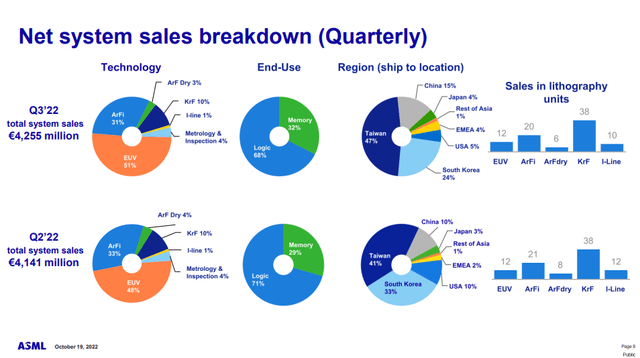

Case study: Taiwan (read: TSMC) still is by far the largest customer of EUV tools, with Intel (EMEA/USA) obviously still not in production so not needing a lot of those tools yet.

In that light, although in my initial discussion I had relegated the new “internal foundry model” to just another accounting gimmick serving no real purpose, together with reinstating things like OKRs and Tick-Tock, it should bring back some accountability and focus on engineering excellence. For many years, “improving execution” was just one of the bullet points on the earnings slides every single quarter, without actual measures, but now Pat Gelsinger is actually doing things to address these issues (besides just hiring more employees).

So recognizing that 10/7nm and Sapphire Rapids were partly just stumbles (similar to AMD’s Bulldozer for example), perhaps Intel doesn’t need to hire another 20k employees to get back on track, but just needs to start solid projects based on sound engineering – while innovation will always be required, one can’t just put unproven research projects into the roadmap like Intel did at 10nm.

With that said, this is where reality kicks in. In the previous section I discussed how cost measures may (theoretically) impact Intel’s ability to execute its turnaround, but the reality is that we already know a few things about the competitive landscape, TSMC in particular.

If TSMC had said over the last year that N2 was going to deliver a 2x scaling and would launch two years after N3 (ramping in late 2024), i.e., what Moore’s Law dictates, then this would have presented a completely different scenario than what we actually got. As discussed previously, what TSMC instead announced was a three year cadence and a minuscule “>1.1x” (non-)scaling: see “Taiwan Semiconductor Is Likely Finished.”

So ultimately, while Intel no doubt needed more funding, as evidenced by the many systematic delays (ranging from 10/7nm to data center and graphics) which it has put in place over the last two years, if some of the prior stumbles can be attributable to poor decision-making, then putting more competent management and engineers in place, which Pat Gelsinger has also done, could also improve Intel’s ability to deliver on schedule.

Then, once the core businesses and technologies are healthy again, the key issue that remains is what to do about the declining financials. Although as mentioned modems, NAND and Optane all failed, the next businesses to take over the torch to drive growth are much more promising: graphics and AI; robotaxi and consumer AV; and foundry.

Stock implications

If my rating history of Intel over the last year seems a bit inconsistent, it is because ratings do not have an explicit target date. As a reminder, I posted my first-ever explicit downgrade of Intel at the beginning of the year. Although the downgrade was only from buy to hold, in hindsight it was a decent move.

As I currently see it, there are two ways Intel could move in the near to mid-term (next 12-18 months). First, given the still massive revenue, that could give investors some floor for their valuation, which may limit downside even if earnings and free cash flow (“FCF”) continue to be mediocre at best in the near-term. As case in point, I recently saw a tweet of Intel’s EPS this year, and it showed that literally all of Intel’s approx. $2 EPS this year was earned in Q1. Since then, as the downturn begun, Intel has basically earned nothing. As such, and this is the second possibility, the EPS for next year could have easily dropped another 50%, which means the stock could as well. Of course, the $3B in savings that Intel is touting are worth about 75 cents in EPS, showing why Intel has chosen this route to maintain any sort of earnings.

Q3 results

Given the length of the discussion so far, I will have to cut my earnings analysis into two parts. Bear with me (pun maybe intended).

Common misconceptions

Below my Q3 preview, one commenter stated:

indeed the outlook will get much uglier and share price possibly dives to 22 or below unless the market extends the current rally.

Interestingly no one wants to discuss the alarmingly deteriorating fundamentals of Intel. Margins, revenues and cash flow are in free fall and debt is piling at record levels. And the worst thing management seems in total denial. Very concerning and there is no indication of a proactive strategic pivot to narrow the focus on the areas that stand a chance to win and are still profitable.

Sad to see once a great company fall this way. Source: “Intel Stock: The Bad Can Get Better.”

In fact, I have discussed these topics extensively. Gross margin and free cash flow, per management guidance, are bottoming in 2022-2023 before recovering. So they are not in “free fall.” Revenue, too, is bottoming and unlikely to drop much further (while Q4 guidance was worse than expected, it is an incremental decline, not another nosedive). Management has extensively discussed these topics, so clearly they are not in denial. Furthermore, some investors or analysts act like Intel is to blame for everything, while not recognizing the macro environment, which is likely to improve at some point. (At the start of the year, Intel was on track for another record or near-record year.)

Finally, with regards to the “proactive strategic pivot,” this is exactly what Pat Gelsinger did already in 2021 when in he came in. He has focused on his six businesses, shedding things like the Optane business in the process.

Lastly, though, and this is a valid point that was discussed above: the reason cash flow is in free fall is because as Intel has increased its investments (which was a necessity), and the revenue has declined, it has lost significant leverage. But note that this leverage was built under Bob Swan by arguably not investing enough in the business, which in part led to its awful execution. So what I disagree with is that there are actually all that much things Intel can do to “narrow the focus”. However any investors imagines Intel, it would still need massive investments in process technology as well as the PC and data center roadmaps. Although Intel does not break out its exact R&D spending, it would be surprising it those areas do not represent the majority of its investments, combined with some incremental spending to enter graphics/AI, autonomous driving and foundry.

Another commenter:

There is no sign that INTC can surpass TSM in semiconductor manufacturing technologies. Intel Stock: The Bad Can Get Better.

This is incorrect, as Intel showed an 18A test wafer in February and just announced that is has taped out the first real internal and foundry test chips. 18A is the node that Intel will regain process leadership with in 2025.

Summary

The following link provides a concise summary of the quarter: Question – Intel Q3 Results.

Besides the results, the investment thesis is that even the $3B savings in 2023 may not be enough to prevent earnings from further declining as Intel will still (need to) spend a lot in both R&D and capex to execute its 5 nodes in 4 years roadmap. Hence, I agree with the bears the stock is at risk of further downside in the near-term (despite the earnings pop). Although with the roadmap for now still on track, in the long-term Intel should still emerge a lot stronger (likely even world-class), which will provide the rising tide to lift all Intel boats (businesses) that Pat Gelsinger talked about. The main question mark is the impact of the upcoming layoffs.

Investor Takeaway

Not all is doom and gloom, but the near-term certainly is, and the downturn-induced reorganization is also increasing the uncertainty about the longer-term – which for many investors never had been that certain in the first place given the very ambitious process roadmap.

As I have warned in recent coverage, with the stock tending to simply follow the financials (more so than the “5 nodes in 4 years”, although at least some investors are likely banking on this for substantial alpha), and with the financials still not showing signs of bottoming, the recent pop could prove to be rather temporary as estimates may further adjust downwards over time. Beware the bear trap.

More philosophically, given the prolonged weaker demand in both PC and data center, more than in my previous coverage I have started to question Intel’s ability to fund its strategy in the first place, especially if the dividend will not be adjusted. Note Intel has acknowledged this question mark by announcing the reorganization. Also note that the turnaround does not simply entail getting back to leadership, but also to reignite the revenue growth in order to gain the leverage Intel needs to offset the massive R&D investments, to deliver substantial profits that will drive the stock sustainably upwards.

In any case, even despite the reorganization, there will not be a lot of profits left for investors if there is no recovery towards the $80B order of revenue in the next few years. And as argued, if the layoffs are substantial (in order to deliver more substantial near-term profits), then that will simply bring back Intel to where it started when Pat Gelsinger joined (hiring 20k, then laying off 20k), which was in a state of disillusion after having to announce that 7nm was Intel’s third consecutively delayed node.

For now, Intel is stuck between a rock and a hard place, and the only solution is to deliver the 20/18A nodes that will catapult Intel back to industry-leadership (without delays on the product side *cough* Sapphire Rapids *cough*). The good news is that those nodes still remain on track with the first test chips now going through the fab. The bad news is that products are still two to three years away from launching (Arrow Lake in 2024, but Diamond Rapids in the more crucial data center segment only in 2025). Together with the absence of substantial graphics/AI, robotaxi or foundry revenue in the near-term, this means there are no short term catalysts (beyond the questionable reorganization) that will make Intel go unaffected through the downturn.

Be the first to comment