Christian Feldhaar

Investment summary

We rate Inspire Medical Systems, Inc. (NYSE:INSP) buy following its Q2 FY22 earnings. With upside in both revenue and the bottom line versus consensus, the stock is well placed to drift north post-announcement, after having caught a bid since May.

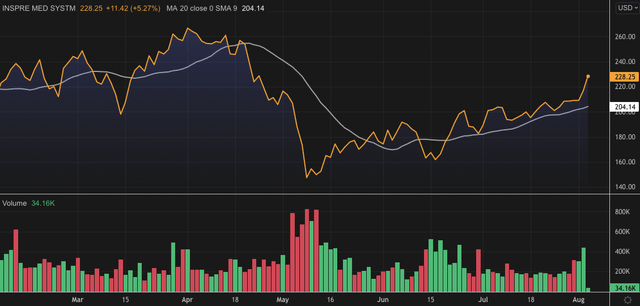

Exhibit 1. INSP 6-month price action

We note a number of earnings and regulatory catalysts look yet to be priced into an already strengthening stock price, and observe the market’s price of INSP shares is currently fair and reasonable. Here’s the moving parts of the INSP investment debate.

Q2 earnings add to further upside potential

Second quarter earnings came in strong with upsides versus consensus at the top and bottom line. Quarterly turnover saw a 73% YoY gain to $91 million and 32% on a sequential basis. The bolus of revenue stemmed from US sales of ~$88 million, up 78% YoY from ~$50 million. Management noted that growth was underpinned by higher device utilization at existing sites, helped by the addition new implanting centers and greater number of territory managers. Ex-US revenue saw ~700bps of YoY growth in constant currency terms, however declined 300bps due to an 11% reduction in forex rates.

The company realized an ~80bps pricing tailwind with an average US selling price of $24,100 in the period. This is the pull-through of price increases that management started in May. Management project the average selling price to curl up throughout FY22 and FY23 to a level of $24,900. Moving down the P&L, OPEX printed at ~$92 million and was up 57% for the year. The growth in operating spend falls in line with figures we’ve observed in those of INSP’s peers who’ve reported Q2 earnings.

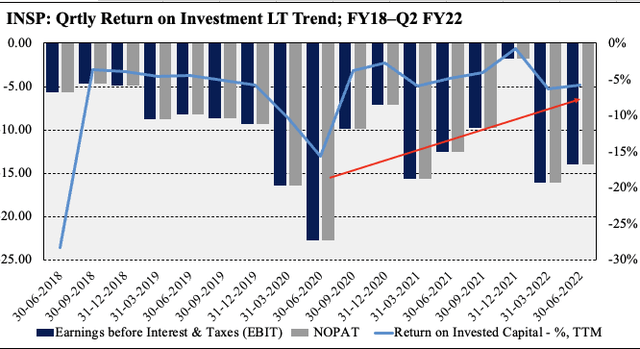

The lift in OPEX is tied to an increase in the salesforce headcount, increased marketing spend and product development. In fact, the uptick in operating spend signifies the company’s stance on investing into its core business and working towards obtaining a positive return on this allocation. As seen on the chart below, quarterly return on the company’s invested capital, whilst still in the red, has pushed upwards since FY20 and looks to surface into the black over the coming periods.

Exhibit 2. Return on investment curling up since FY20 and looks to print a positive return in coming periods on this trajectory

Data: HB Insights, INSP SEC Filings

INSP bought this down to a $14.5 million net loss for the period which is a regression from last year’s $13.1 million. This led to a loss per share of $0.53 vs. $0.48 in Q2 FY21.

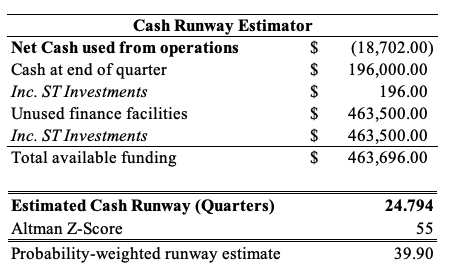

The momentum enabled management to revise guidance upward. It now expects top-line growth of ~52% YoY, calling for $354-$362 million at the top, up from $344 million at the upper end. Despite the uptick in revenue guidance, the company also forecasts gross margins to tighten by ~100-200bps and come in at 83-85%, down from 85-86% previously. It also left the quarter with $196 million in cash on a $28 million cash burn for the year to date. On the most recent figures, INSP’s cash position looks to provide more than adequate runway of almost 24 quarters at the current run rate, and around 40 quarters on a blended analysis, as seen in the table below.

Exhibit 3.

Data: HB Insights Estimates; INSP SEC Filings

Finally, management commented on its decision to introduce new silicone leads and the new Bluetooth enabled remote. To that, CFO Rich Bucholz said:

“[The changeover could lead to] a potential inventory obsolescence charge on any remaining stimulation and sensing leads and patient remotes may occur in the second half of 2022.

The amount of the charges, if any, will depend on the timing of the introduction of the new leads and remotes, both in the U.S. and outside the U.S. which is uncertain at this time. For this reason, along with the higher cost of certain component parts, we are lowering our full year 2022 gross margin guidance to between 83% and 85%. Longer term, we expect gross margins to return to the prior guidance levels of about 85%.”

Earnings catalysts for post announcement drift

The company added another 52 implanting centers to its US accounts, now booking revenue from 785 centers. It did note the 52 is slightly behind cadence, as new center openings were delayed due to regulatory headwinds. Despite this, it projects to add another 52-56 new centers per quarter for the remainder of FY22. Another key highlight is that utilizations at existing centers underscored revenue growth last quarter. It created an additional 17 new sales territories for its US sales team, and brought the total number to 191 territories. This is actually ahead of previously outlined guidance, and management guide an additional 11-12 new territories each quarter until year’s end.

With that, it added another 7 field clinical reps bringing the number to 100. It intends to size up the headcount of its sales and training teams. There is risk in this strategy, as there’s no guarantee in the quality of reps or that they will perform to standard. It has already expanded the US sales leadership team to 30 regional managers. As a result, to get to its guided $362 at the upper end, each field clinical rep needs to generate $3.62 million in gross sales for FY22. Hence, this is one litmus test we will hold the company to in the remaining two earnings reports for FY22.

With respect to reimbursement, recall that CMS has recently announced its revised payment codes for physicians, hospitals and ambulatory surgical centers (“ASCs”) earlier this year. On the physician level, RV use in Inspire procedures will realize a slight increase, whereas hospital rates should remain flat YoY in FY23. However, ASC reimbursement rates are proposed to rise by ~400bps to $25,744. Each of these increases the length of the tail of returns from Inspire’s procedures and serves as an earnings tailwind looking ahead.

On the clinical trial front, management continues to add to the ongoing ADHERE cohort, that currently stands at over 3,000. It will continue enrolling patients to a cap of 5,000, and will then transpose over to the ADHERE 2.0 trial. Due to the extensive data recorded (the trial has been on registry since FY14) INSP now has a plethora of data that it’s provided to the FDA in formalizing its PMA supplements. The FDA has already reviewed the data, management said, thereby speeding up the process. Finally, the STAR trial got a mention. Management expect success in this segment to add a 20% increase to the company’s overall target market.

Valuation

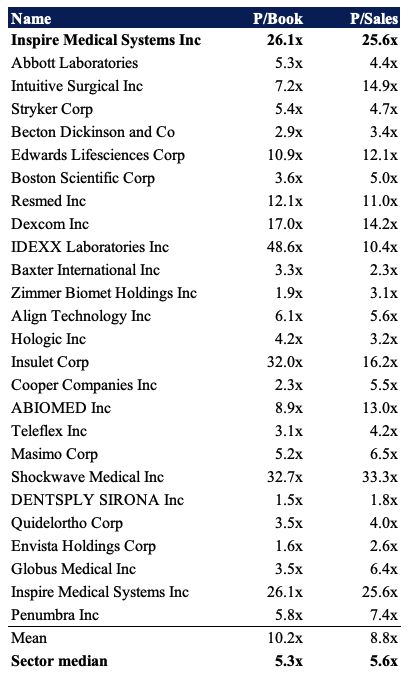

Shares are trading at ~26x book value and more than 25x sales, each substantial premiums to the GICS Industry peer median. There’s a number of high quality names within the peer group, and therefore it’s hard for INSP to justify such a premium given its lack of profitability below the bottom line.

Exhibit 4. Multiples and comps

Data: HB Insights

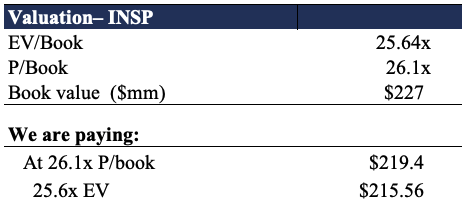

However, further examination reveals INSP offers a deep value proposition. As seen in Exhibit 5, the company also trades at ~25.6 turns its enterprise value (“EV”) to book value [in addition to 26.1x price to book]. Here we examined if the price we’d pay is worth the value we’d pay. On both of these multiples, we’d theoretically be paying $215-$219 respectively, implying that INSP is undervalued by ~$8 per share. Hence, we price the stock at a 6-month price target of $230 and note we’d be paying more than fair value on these calculations.

Exhibit 5.

Data: HB Insights,

In short

We rate INSP a buy following its Q2 FY22 earnings. A good show of fundamental momentum and top-line growth were key takeaways from the quarter, whilst the company has more than sufficient cash to continue its operations. We also note the stock has caught a bid since May and is well positioned to benefit from regulatory tailwinds with recent clinical trial submissions.

In addition, we’ve identified the price we’d pay to enter a position in INSP that is fair and reasonable relative to our valuation. With the market rewarding idiosyncratic risk factors in FY22, we feel INSP exhibits these and look forward to further coverage this year.

Be the first to comment