Nattakorn Maneerat

Thesis

Innovative Industrial Properties’ (NYSE:IIPR) stock has recovered remarkably from its July lows. We highlighted in our previous article urging investors to add exposure, as we gleaned that it had been consolidating constructively. Therefore, we postulate that the market forced panic selling resulting in a dislocation of its valuation.

Accordingly, IIPR consolidated for nearly four months, likely drawing in long-term dip buyers. President Biden’s recent move to decriminalize federal convictions of simple marijuana possession likely helped spur a liftoff in IIPR stock, as short interest as a percentage of its float reached nearly 8.5% in September.

Notwithstanding, while management highlighted that it was a positive development toward the legislative process, it’s still too early to assess its material impact. Investors are also urged to observe the cannabis legalization ballots, with Maryland voters favoring legalization. Still, industry analysts do not expect the outcome from the state ballots to be significant as the market is looking at federal legalization.

IIPR has gained nearly 20% since our previous update, outperforming the broad market significantly. Despite that, IIPR’s YTD total return of -56.2% is still well below its all-time average of 38.9%.

We assess that the near-term upside from the recent recovery has likely been reflected. While IIPR remains close to its long-term bottom, we expect some near-term digestion of its recent momentum spike.

Also, the company’s operating performance is expected to come under pressure in 2023, as its investment cadence has been curtailed given the Fed’s rapid rate hikes, impacting its cost of financing. Also, the operating performance of its tenant base could come under more pressure in 2023 if a worse-than-expected recession were to occur.

Coupled with a more well-balanced valuation relative to its broad Industrial REIT peers, we urge investors to bide their time for a deeper pullback to improve their reward/risk before adding exposure.

Given this, we are revising our rating from Buy to Hold for now.

IIPR: Held Its July Lows Despite Slashed Estimates

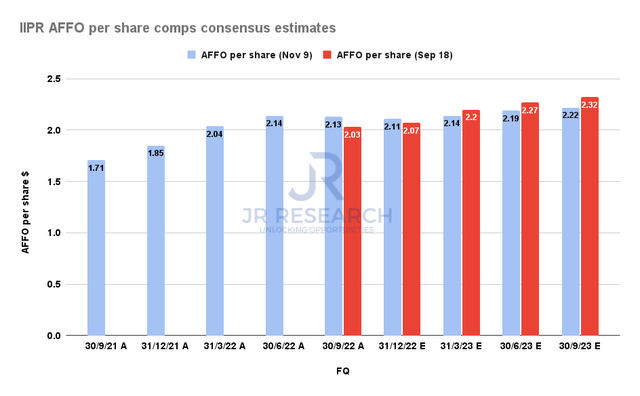

IIPR AFFO per share comps consensus estimates (S&P Cap IQ)

As seen above, the consensus estimates (bullish) were downgraded since our update in September. Furthermore, the revisions suggest the impact on IIPR’s AFFO per share could be material through FY23.

Despite that, the REIT outperformed in FQ3, delivering an AFFO per share of $2.13 (Vs. $2.03 consensus). Accordingly, the market had already anticipated the impact on its bottom line and didn’t react negatively to the slashed forward estimates.

Furthermore, IIPR highlighted that its YTD investments reached $369M through FQ3, up just $19M from FQ2’s $350M. As such, the deceleration in its investment momentum was significant and should remain relatively tepid through FQ4. Management was also not keen to discuss its outlook for 2023, given the current volatility, as Executive Chairman Alan Gold articulated in response to an analyst’s question on its guidance:

Unless your crystal ball is much clearer than mine and that you could actually tell me what’s going to happen in 2023 in the first quarter. Because if you can, we should take that offline and have a really good conversation. But we just believe that there’s a lot of uncertainty in the market and we think that it’s going to take some time for that uncertainty to become more clear. And then once that happens, we can certainly discuss our acquisition pace at that point. (IIPR FQ3’22 earnings call)

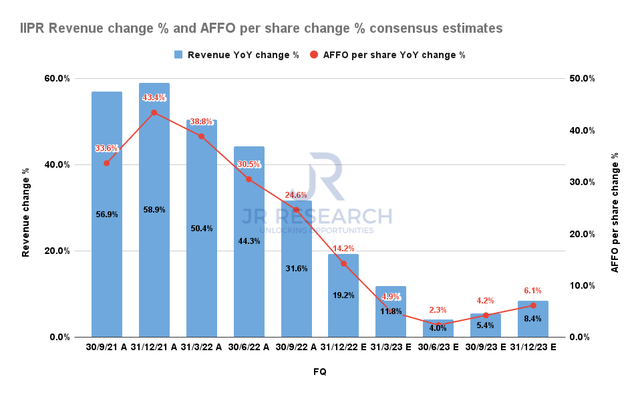

IIPR Revenue change % and AFFO per share change % consensus estimates (S&P Cap IQ)

Therefore, investors expecting a quick reacceleration of its growth momentum could be sorely disappointed. Moreover, given the higher risk premium embedded in IIPR’s tenant base, its growth algorithm would likely be parsed carefully by investors.

The downgraded estimates suggest a growth inflection from Q3’23, even though the projected pace of recovery was slashed markedly from September estimates.

Therefore, we urge investors to pay close attention to the Fed’s positioning in the upcoming December FOMC meeting as the Fed unveils its dot plot along with the summary of economic projections. In addition, the forthcoming October CPI print to be released on November 10 should provide first-hand insights on the Fed’s rate-hike cadence moving ahead.

Hence, we believe the market is unlikely to re-rate IIPR significantly higher from here, as we think it has already reflected its near-term upside. The market needs to be convinced that the pressure on its tenant base and IIPR’s investment cadence could be lifted before we see a more sustained recovery.

Is IIPR Stock A Buy, Sell, Or Hold?

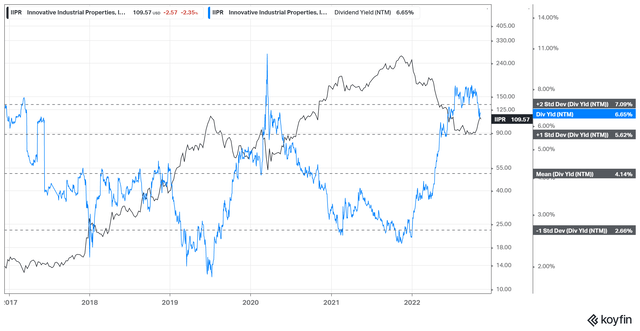

IIPR NTM Dividend yields % valuation trend (koyfin)

With the sharp recovery from its recent lows, IIPR’s NTM dividend yields have also retraced below the two standard deviation zone over its all-time average, as seen above.

We believe the positioning is appropriate and don’t expect a re-rating that could normalize its dividend yield further for now.

Also, IIPR’s NTM AFFO per share multiple of 12.7x has recovered significantly from its recent lows of 10x. It has closed the gap with its broad Industrial REIT peers’ median of 13.9x. We believe the slight discount is appropriate to reflect the increased risk premium required by the market, given its underlying tenant base.

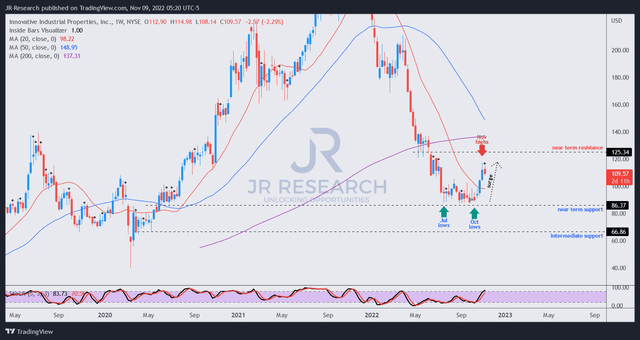

IIPR price chart (weekly) (TradingView)

With a rapid surge that brought IIPR close to its near-term resistance, we believe investors should be cautious here.

We don’t expect IIPR to be re-rated markedly higher above its peers, as its growth could slow materially for a while with elevated interest rates. Hence, we encourage investors to wait for the next pullback and assess the consolidation zone from there before deciding whether to pull the trigger.

Revise from Buy to Hold.

Be the first to comment