stockcam/E+ via Getty Images

Investment Thesis

Due its financial underperformance, I don’t see a reason for buying Ingredion (NYSE:INGR) for a price that isn’t heavily discounted compared to the competitors.

Introducing Ingredion

Ingredion produces ingredients for industries such as the food, paper, beverage, and personal-care industries.

Sweeteners such as syrups, maltodextrins, dextrose, and polyols make up roughly 35% of sales; starches for food and industrial use make up 45%, and co-products make up the rest. About one-third of sales are made up of specialty, value-added ingredients, with the remainder coming from commodity-grade ingredients.

Ingredion, a multinational company with a strong presence in emerging markets like Latin America and Asia-Pacific, has the majority of its sales outside of the United States.

Ingredion Business (2022 Investor Day Presentation)

Industry Outlook

Ingredion is part of the food ingredients market.

The food ingredients market consists of sales of food ingredients by businesses that create food ingredients used to adjust the flavor, appearance, and texture of food. Food additives are compounds added to food to achieve certain objectives during manufacture, packaging, or storage. These ingredients are added to food to retain its nutritional content as well as enhance its safety and freshness.

A primary trend in the food ingredients market is the introduction of cutting-edge technological solutions. Large food ingredient companies are focusing on creating novel food ingredient solutions to supply the global food industry with next-generation alternative proteins and other ingredients that are desired.

The market for food ingredients is anticipated to be driven by rising health consciousness among consumers and rising fitness awareness among individuals. In order to preserve their health, consumers are adding bioactive food components like omega-3 fatty acids, antioxidants, probiotics, soy protein, and beta-carotene to their meals.

A Research And Markets report expects that the market for food ingredients is anticipated to increase at a compounded annual growth rate of 8.7%, reaching a value of $59.83 billion in 2025.

Competition

The food ingredients industry is fairly competitive, especially in the U.S. I believe that the competition competes mostly on product functionality, quality, and price.

Most of the products sold by Ingredion are looked at as basic ingredients that compete with fairly identical products offered by competitors. This increases the competitive pressure.

Some of the competitors are Archer-Daniels-Midland (ADM), Cargill, Tate & Lyle Ingredients Americas (OTCQX:TATYF), Bunge (BG) and Roquette . There are also smaller local-based corn processors.

|

Company |

Business Description |

Market Cap |

Last Year’s Revenue Growth |

|

Ingredion (INGR) |

Ingredion produces ingredients for industries such as the food, paper, beverage, and personal-care industries. |

6.01B |

15.15% |

|

Archer-Daniels-Midland (ADM) |

Archer-Daniels Midland is a large company processing agricultural commodities such as corn, and wheat. Furthermore, the firm runs an extensive network of logistical assets. |

46.41B |

32.47% |

|

Bunge (BG) |

Bunge was founded in 1818 and is an agribusiness and food company with global operations in the farm-to-consumer food chain. About two thirds of earnings are produced by the agricultural industry, which also has the world’s greatest capacity for processing oilseeds. |

14.12B |

42.86% |

Source: Morningstar and Seeking Alpha

Competitive Position

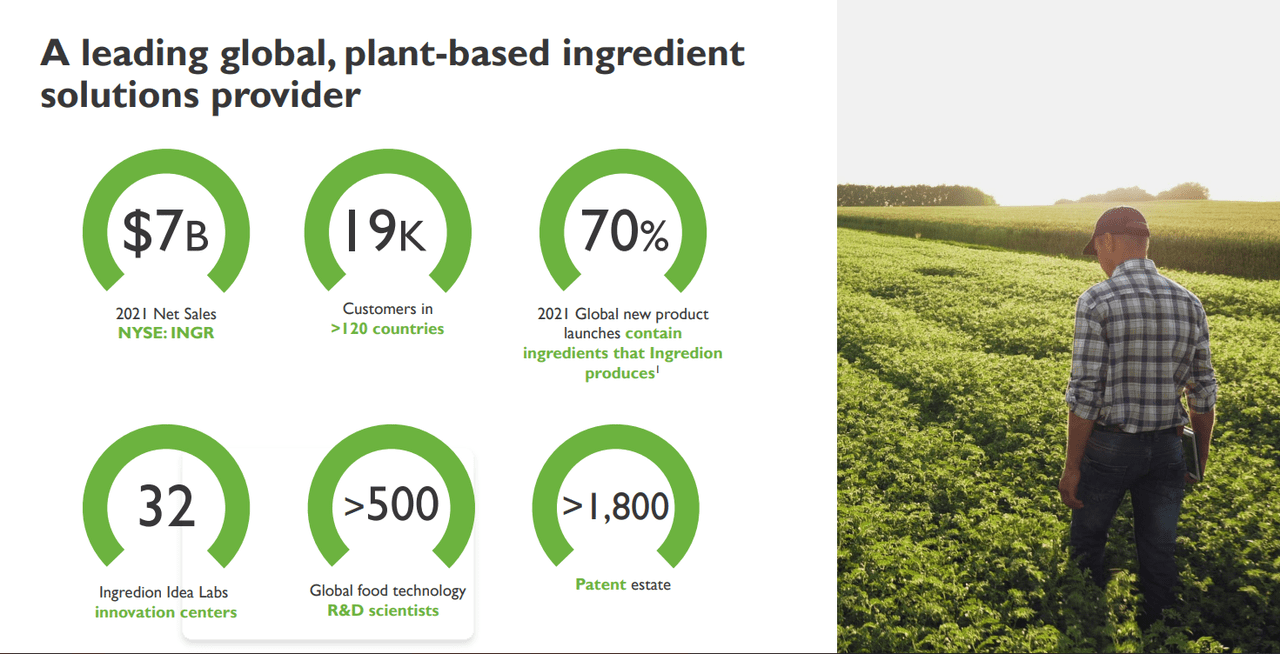

Ingredion has a reasonable footprint in the global food ingredients market. They have customers in over 120 countries and over 7 billion USD in revenue, underlining the trust of its customers. Furthermore, they operate a large R&D department and its own “Ingredion Idea Labs” which are created to stimulate innovation, for instance a new flavor. This is especially helpful in capturing emerging consumer trend opportunities.

Statistics (2022 Investor Day Presentation)

Overall, I believe that these are reasonable competitive strengths.

However, some competitors have much more vertically integrated operations (for instance, Archer-Daniels-Midland). There are some huge advantages to this, such as larger control over its supply chain, more efficiencies, and reduced costs.

Moreover, companies such as Archer-Daniels-Midland and Bunge have much more resources to its use, as they are significantly larger in size than Ingredion.

Financial performance

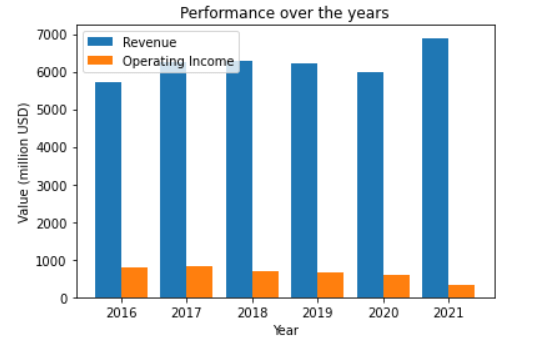

Performance over the years (Seeking Alpha, graph by author)

Its revenue growth was almost non-existent and even negative before 2021. While it’s nice that the company grew its sales a lot in 2021, this was mainly caused by acquisitions and by passing through higher cost of materials, according to its most recent annual report. Due to the rise in material prices (especially corn), its gross margin actually dropped. The operating expenses of Ingredion increased over the years, decreasing the operating income of the company gradually.

Valuation and Financial Performance Comparison

Basic statistics comparison:

|

index |

Forward P/E |

Gross Margin |

3Y sales growth |

3Y EPS growth |

|

Ingredion |

12.5 |

18% |

3.11% |

-34.55%% |

|

Archer-Daniels-Midland |

13.87 |

7% |

9.83% |

14.51% |

|

Bunge |

8.2 |

5% |

8.95% |

102.61% |

Source: Seeking Alpha

It’s noticeable how Ingredion has a rough EPS decrease over the years, and very mild revenue growth rate compared to the other players in the food ingredient market. We saw in the previous bar chart the decreasing income was the harshest in 2021 due to the company’s heavy dependence on corn prices. However, decreasing income was already noticeable before 2021. On the other hand, the other competitors realized very nice EPS growth rates. Furthermore, Ingredion is much high priced than Bunge and only priced a bit lower than Archer-Daniels-Midland.

Final Take

While Ingredion has a reasonable footprint in the attractive food ingredients market, its financial performance is below the performance of some other players in the food ingredient market. I believe that this is mostly caused by lower amount of resources available compared to the other companies, as well as a lack of vertical integrated operations chain unlike its competitors. Furthermore, the corn inflation hit Ingredion hard especially in the last year. Right now I don’t see a reason buying this stock for a price that isn’t heavily discounted compared to the competitors.

Be the first to comment