JaysonPhotography/iStock via Getty Images

Scary Headlines

The headlines in financial and economic news articles can be scary, especially when the stock market is tanking week after week. Even the Dividend Aristocrat stocks are taking a beating, so we know there must be problems. This is one of those times when cooler heads must prevail. Patience, young padawan, this too shall end, and the market (force) shall once again rise. It always does over time. It is just these speed bumps that prove to be such an almost unbearable nuisance. But bear markets inevitably end up turning into bull markets and this time will prove no different. It is just a matter of time before we can see the light at the end of the tunnel.

Part of the problem is that the scary headlines are warranted today. The stock market has been falling, the economy is slowing, and inflation has gotten the better of the Fed so far. Fears brought on by those three scary words (inflation, stagflation, and recession) are the primary cause of our current bear market. We will discuss each of those words, what they mean, and how scared we should be. This is not the ingredients for a great bedtime story so if it is late, I suggest you might be better off reading this article in the morning.

Inflation

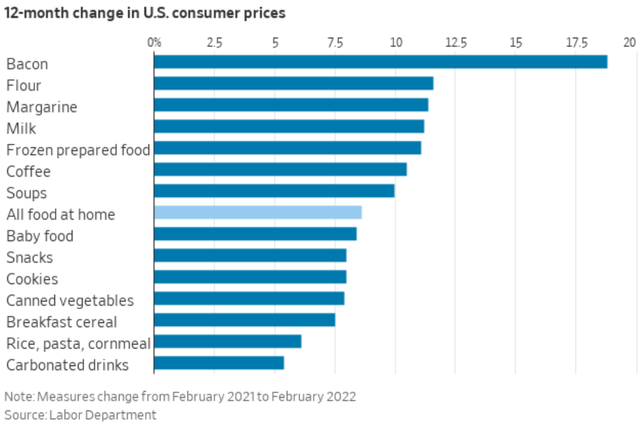

There is no denying that inflation is happening now and will continue until the Fed has gained control of rising prices. The biggest concern is whether the Fed can gain sway since several factors outside its control are contributing to inflationary pressures.

The two most common conventions (versions) of inflation are cost-push and demand-pull. Today’s version is caused by both: demand exceeding supply (demand-pull) in several categories forcing costs and prices to rise; and then, due to scarcity or supply chain disruptions, costs of raw materials are rising and being passed on to consumers (cost-push). But both are typically caused by an imbalance of supply and demand.

In today’s case, shortages in both raw materials and finished products are being caused by many factors. The zero-tolerance (COVID-19) policy in China causes many cities to lock down requiring factories and ports to close. In this case, the movement of both raw materials and finished products are halted until the COVID-19 outbreak has passed causing a backlog of orders and shortage of supply in a broad number of items.

The invasion of Ukraine by Russia has caused shortages of many agricultural goods such as wheat, corn, sunflower oil, sunflower seeds, and fertilizer. Fossil fuel shortages are also an outcome of sanctions against Russia (by the U.S., Europe, and other allies) due to aggressive, war-like policies. Thus, energy costs have risen dramatically causing transportation costs and electricity to rise.

People in Africa are facing starvation while populations in more developed countries will pay more for basic foods, both at home and while dining out. Grains are a source of feedstock for livestock. The lost supply of grains from Ukraine due to a Russian sea blockage of Ukraine ports will cause a rise in prices for not just processed foods that include grains and sunflower oil (that accounts for a lot of food consumed in the West), but also for all forms of meat due to the rising costs of feeding herds and flocks.

The national average of gas at the pump is now over $5 per gallon. Utilities are warning of rolling electricity blackouts this summer because the U.S. no longer has adequate electricity generation capacity to meet peak energy demands of summer cooling. Coal-fired electric generation plants have closed early due to more stringent and costly regulations that made it unprofitable to continue operating, resulting in lower-than-expected electricity generation capacity heading into the hotter than normal summer months. That reduced supply will result in higher prices for electricity this year, even though millions of Americans will be inconvenienced by having to do without for short periods of time.

Pay more, get less. That is another form of inflation. Even when prices for some products do not rise, it is often the case that producers will put less in every package while not changing the price. That has been happening for a long time. I am not sure whether the CPI (consumer price index) captures all such forms of inflation that are borne by consumers. I remember buying a pack of chewing gum for 5 cents when I was a kid!

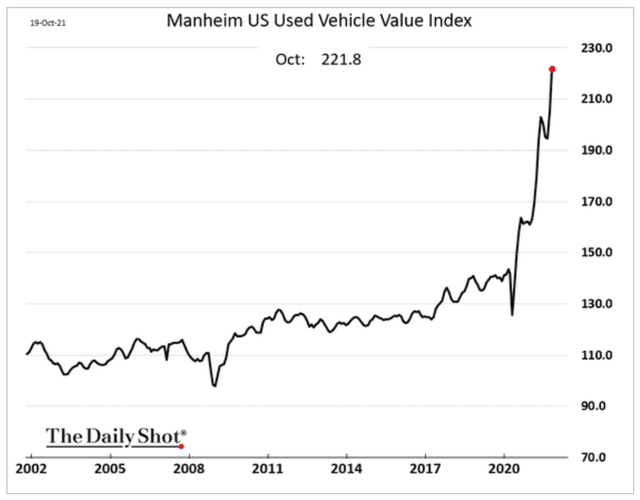

Auto prices have risen dramatically because of the lack of finished vehicles available to sell due to a prolonged shortage of semiconductor and microprocessor chips that regulate a greater share of each vehicle’s systems. I have read that a Taiwan Semiconductor (TSM) executive recently stated that the supply shortage is unlikely to be fully overcome until 2024. The shortage of new autos has caused not only new car prices to surge higher but used car prices have gone up even more. This is one area where price pressures will eventually abate but it is not clear that prices will come down or just rise more slowly.

Airlines do not have enough employees to handle the increased demands of summer vacation travelers. Those companies laid off workers during the 2020 lockdown to reduce costs while fighting for survival. Now those same companies cannot hire enough workers when they are needed. Flights are being cancelled and prices are rising because people are willing to pay more to take those vacations that had to be postponed for two years during the pandemic.

There are many other examples of inflation that we could list but you get the picture. Now let us switch to what other factors are involved besides the obvious ones mentioned above.

Demographics

Demographics have played a significant role in causing this round of inflation, but very few understand that part of the equation. Even without a pandemic or a Russian invasion of Ukraine, we would have had rising pressure from the demand side causing inflation. The millennial generation (Gen Y) has finally reached the stage of full-on consumerism, hitting their stride in household formations, and commanding higher earnings. The peak of Gen Y members has reached 30 years of age in large numbers and are spending in a pattern like what the Boomer generation did during the 1970s. Does anyone remember what happened during the 1970s and early 1980s? I do. Inflation rose in out-of-control fashion and mortgage rates hit 18.5% or more. The real estate industry became stagnant because the Fed was fighting inflation by raising interest rates just like today and housing became unaffordable for many. Sound familiar?

Then came the rush to build apartments to house all the people who could not afford to buy a home. Lenders provided the funding, raising the money through time deposits with high rates which attracted enormous amounts of cash. Of course, all the money available led to overbuilding which, in turn, led to low occupancy rates resulting in bankruptcies by apartment owners and financial institutions which caused a recession or two until the economy had flushed out all the unmanageable debt and became healthy again. The Fed beat inflation back then, finally, and by 1984 the economy was growing again with interest rates coming down making everything more affordable again. But the process was painful; very painful.

The Fed has more tools this time

Today may be different in some respects because the Fed has more tools with which to fight inflation. With a balance sheet of about $9 trillion, the Fed can reduce liquidity thereby decreasing the risk appetite of investors and businesses. Also, by reducing its balance sheet it will be unable to purchase debt from the U.S. Treasury. That means that the Treasury will need to find other buyers for its debt instruments, reducing demand and forcing prices lower which results in higher yields on longer-term bonds. That, in turn, makes borrowing more expensive and should reduce demand for capital projects as well as mortgages.

Residential real estate sales are already slowing but home prices continue to rise at unsustainable rates, at least for now. That brings up another factor that leads to future inflation: rents have not kept pace with home prices. Rent increases tend to lag home prices but eventually catch up and are a major factor included in the calculation of CPI (Consumer Price Index). There is still more upward pressure to come from this area.

The Fed is also beginning its rate hikes from a much lower base and with a much stronger economy than we had back in the 1970s. These two factors alone should mean that interest rates will not need to rise as much as they did back then. But that will be determined by how the Fed proceeds. We are not out of the woods yet.

Some aspects of inflation are likely to continue for a few years more, into 2024 or later. COVID-19 is not over, no matter how much we want it to be. New strains or variants will undoubtedly form and require our attention, which will continue to cause supply chain disruptions for a couple more years. We have no idea how long the war in Ukraine is going to last. As Gen Y continues to grow in its influence over our economy, demand pressures will grow along with it (just like with Boomers – anyone remember the pig in the python?).

So, there will be an overhang of inflationary pressures that the Fed may not be able to manage, but we believe inflation should come down to under 4% over the next two to three years. That will cause some lingering problems which will be addressed later in this article.

Stagflation

Stagflation is when the economy is growing very slowly (or not at all) while high inflation makes everything more expensive. Wages stagnate because businesses are facing narrowing profit margins due to higher material costs. Real income and purchasing power drop. Believe me when I say it is a very painful reality to live through.

The 1970s are a case study in stagflation. Inflation was stubbornly high in the first half of the decade and then began rising to even higher levels in the second half and into the early 1980s. Price controls were put in place by the Nixon administration, but it did not have the desired effect. Costs kept rising and the economy suffered. It was not until the Federal Reserve started raising interest rates to double digits that inflation began to ease and was finally brought under control. Wages could not keep up with inflation, so the average household felt its quality of life suffer.

Everything kept getting more expensive and the cost to borrow skyrocketed resulting in an economy that stagnated. But, at the same time, the baby boomer generation was coming into its own and beginning to consume more. So, the demand was there but companies did not have the capacity to produce enough to meet rising demand. The cost of borrowing being restrictive, companies increased capacity at extremely high capital costs. If that were not enough, with all the new, young workers entering the workforce, productivity took a hit as inexperience took its toll.

Businesses had a rough decade and so did consumers. Stagflation is not something anyone wants to experience. But do we really need to worry about stagflation coming to America again? A recent study from the National Bureau of Economic Research, “Comparing Past and Present Inflation,” indicates that we could be in for a reenactment of the 1970s and early 1980s. In it, the authors suggest that for the Fed to get inflation back down to its target of 2% will “require nearly the same amount of disinflation as achieved under Chairman Volker.” What they are saying is that interest rates may need to rise to double digits again. While that would be painful, for savers and retirees it will be a blessing because we will be able to lock in high returns with long-term bonds.

But if that scenario happens, many bankruptcies will occur because too many businesses have become dependent on cheap debt. It will not be cheap anymore. Even well-managed companies will have trouble maintaining their margins. Stocks could languish for years making investing for growth exceedingly difficult.

But stagflation is not here yet. That is the good news. The sad news is that there are too many similarities between now and the 1970s to write it off as improbable. Again, much of how the economy responds will depend upon how well the Fed manages its tightening regime going forward. More about that later.

Recession

Previously, when asked, I have said that I expect the U.S. economy to fall into recession by early next year (2023). However, I was overly optimistic then. Now I expect a recession to occur in 2022. I cannot say for sure when it will (or has) start(ed), but the mounting number of indicators now flashing a recession warning are too many to ignore.

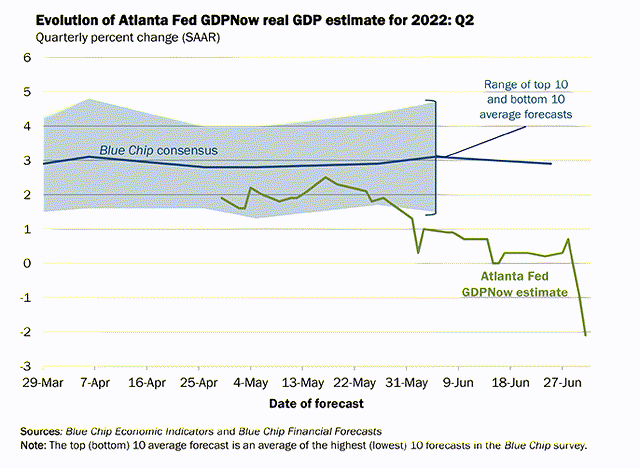

The Atlanta Federal Reserve Bank’s GDPNow, which tracks in real time the components of GDP growth, recently updated its 2nd Quarter GDP forecast. The reading is a negative 2.1%.

The economists at S&P Global Market Intelligence also reduced their estimate for GDP for the 2nd Quarter to negative 1.5%. If these two prognosticators are correct, it could mean that we are already in a recession. The accepted back-of-the-envelope definition of a recession is two sequential quarters of contraction but that is less than fully accurate. The NBER (National Bureau of Economic Research) defines a recession as a significant decline in economic activity spread across the economy, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales.

By that definition, we may be in a recession, or not quite, because employment is still strong and retail sales, while off the peak, are still relatively strong on a relative basis. In other words, to be officially in a recession, unemployment needs to begin to rise and retail sales need to drop further. Retail sales growth has slowed in Q2, so that does not meet the requirement. But if inflation remains elevated enough to keep the Fed on its aggressive path of raising interest rates and removing liquidity from the economy, I believe it is only a matter of time that the NBER declares a recession. But the announcement will come months after the fact. So, it remains to be seen if the U.S. economy is already in a recession now or not.

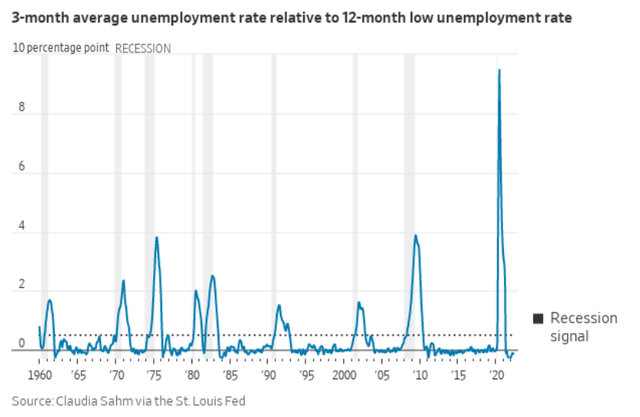

One of the best indicators for predicting a recession is imminent is called the Sahm Indicator, named after Claudia Sahm (an economist at the St. Louis Federal Reserve Bank), which shows that since 1960, every time the unemployment rate rises by 0.5% off its bottom a recession occurs.

Notice that the predictive value has been 100% accurate thus far. Also notice that when the indicator is triggered the economy is either in a recession or a recession is just starting. It is something to watch.

The Fed is trying to reduce demand for jobs (job openings) without forcing layoffs. It would be a neat trick if it can be successful, but I have major doubts about the Fed’s ability in this matter. Apparently, so does Fed Chairman Powell. (Click on the link to view short video of Chairman Powell)

“Economists surveyed by The Wall Street Journal have dramatically raised the probability of recession, now putting it at 44% in the next 12 months, a level usually seen only on the brink of or during actual recessions.” – WSJ

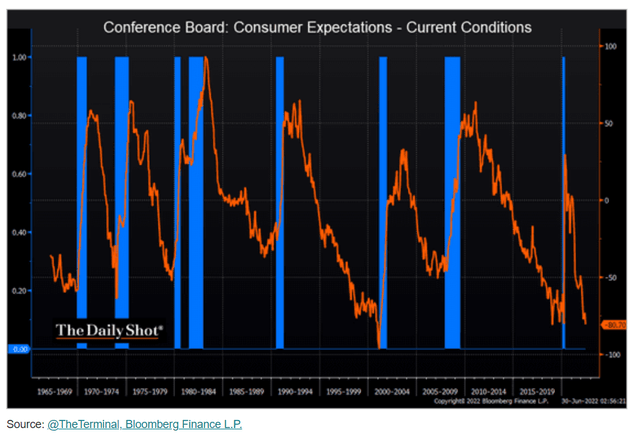

Yet other indicators that bode ill for the U.S. economy are consumer sentiment and consumer confidence. Both are trending down to levels indicative of a recession brewing. One specific indicator is the spread between consumer expectations and current conditions from the Conference Board.

Notice that this indicator bottoms near the beginning of each recession on the chart above. We are already at about the same level as in Spring of 2020 and below all but the level preceding the 2001 tech bubble recession.

In some ways it does not feel like we are in a recession yet, but the writing is on the wall: a recession is either here or coming soon. It appears that if we are in a recession already it could be shallow and not last long. But how bad it gets and how long it lasts depends on how well the Fed handles inflation. As Chairman Powell indicated, some things that are adding to the inflationary environment are outside the Feds control: war in Ukraine and supply chain disruptions.

Conclusion

Well, I told you it would be bleak right from the beginning. I believe a recession is imminent (within the next six months), elevated inflation is going to be with us for several years, and that a prolonged period of stagflation could be in the cards. If stagflation occurs, I expect the stock market to trade in a broad range for several years, until inflation is back under control and the economy is in recovery mode. Of the three, I consider stagflation to be the least likely because of the underlying strength of the economy.

In the coming conditions it will be paramount for investors to hold onto quality stocks and dump those with excessive debt. Quality, in my book, means excellent management able to deliver superior results in any environment, strong free cash flow and a pristine balance sheet. Those are the types of companies we continue to hold in our model portfolios. We also hold a lot of cash in anticipation of exceptional bargains that will appear when the bear market has run its course.

Please remember that the stock market is forward looking and will begin to turn up before the economy has recovered. We are not there yet, but we will be watching the indicators for bottoming. We cannot pick bottoms, but we can pick bargain prices. Market tops and bottoms are easier to see in the rear-view mirror. Once a market bottom is clearly formed, there is plenty of time to pick up the best stocks at opportunistic prices.

Be the first to comment