Khanchit Khirisutchalual

Article Thesis

Inflation, as measured by CPI data, continues to surprise on the upside. In June, inflation breached 9%, meaning that holding cash or low-yielding fixed-income investments results in steep losses in real terms. In this article, we’ll showcase five higher-yielding income stocks that offer a solid combination of income and income growth potential and that have some inflation-protection characteristics on top of that.

Inflation: Not Very Transitory

Inflation has now been running ahead of the Fed’s 2% target for some time, and as we have seen in the most recent data release for June, inflation has not peaked yet, as the June reading was the highest in decades and well above the May level.

On a month-to-month basis, inflation was up by 1.3% in June. If that were to remain the case going forward, we would be looking at an annual inflation rate of more than 15%. The month-over-month reading also accelerated on a sequential basis, as monthly inflation was 1.0% in May. At least for now, inflation thus remains very hot and has actually accelerated relative to earlier this year.

Even core CPI, which backs out food and energy, was up by 0.7% during the months — that’s an annualized growth rate of more than 8%. Thus it’s not true that energy was entirely responsible for the high inflation reading, as non-energy products and services are getting more expensive at a hefty rate as well.

With inflation already running at a 6%+ handle prior to the Russia-Ukraine war, it is also questionable when people claim that said war was the main reason for the current high inflation reading — that would make more sense if inflation had been at 2% or 3% prior to the war.

Holding Cash Or Fixed Income Leads To Hefty Losses

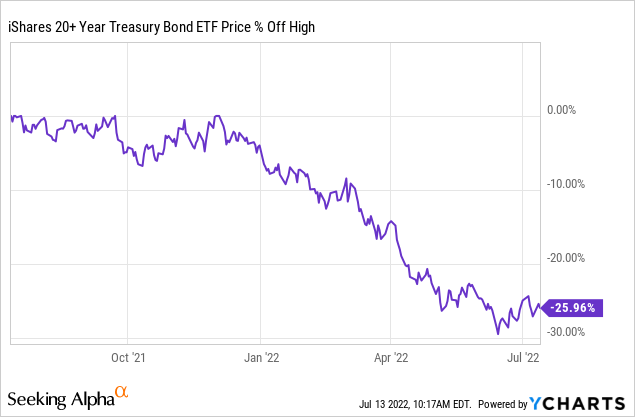

In the current market environment where equities are jittery, some investors may opt for holding cash or treasuries, which are seen as “safe haven” assets by some. But with interest rates rising, which makes treasury prices decline, and with inflation eating into the value of those dollars, cash and fixed-income investments look like surefire ways to lose money:

The iShares 20+ Year Treasury Bond ETF (TLT) has dropped by 26% from its recent highs, which is more than the selloff in the S&P 500 (SPY) over the same time frame. When we factor in that money has lost 9% of its value over the last year, holders of long-duration bonds have experienced hefty losses of 30% and more in real terms. The “safe haven” investment thesis has thus not worked well so far this year, and with the Fed likely continuing to hike rates, more bond losses could be coming. When one holds cash, wealth losses in real terms are more or less guaranteed as well.

1: Enterprise Products Partners

I do thus believe that in a cash-is-trash scenario, holding resilient income-producing equities could be an opportune idea. The first one of these companies is Enterprise Products Partners (EPD), a midstream energy company. Its pipelines, terminals, etc. are needed to provide transportation for the country’s energy needs, and the value of the pipes in the ground actually rises during times of inflation — replacement costs grow higher and higher. At the same time, the debt that is used to finance these assets gets deflated away, making Enterprise Products Partners an inflation beneficiary.

Enterprise Products Partners is currently trading with a dividend yield of 7.5%, which alone already provides for a very solid total return. That dividend has just been raised by 2.2%, following a dividend increase of a little more than 3% in January. In other words, investors have already gotten a 5.5% dividend raise this year, which makes for a highly compelling total return outlook when combined with a dividend yield of well above 7%.

Enterprise Products Partners is trading with an EV/EBITDA multiple of just 9.4, which is a pretty low valuation for a capital-intense business such as a midstream player like EPD. The high energy price environment also means that EPD’s counterparties are highly profitable, which reduces EPD’s counterparty risk and which should allow for more potential fee growth when it comes to future transportation contracts for EPD’s pipelines.

All in all, EPD offers compelling income and income growth while also being relatively well protected from the impact of inflation thanks to its real asset type of business model.

2: Realty Income

Realty Income (O) is a triple-net lease REIT that has an excellent track record when it comes to growing its dividend and generating compelling total returns over time. Like EPD, its real asset business model provides for solid inflation protection. The value of the company’s real estate grows over time, especially when inflation is high, while its debt has been locked in at low rates which means that it gets deflated away, thereby generating equity value for Realty Income’s shareholders.

Realty Income is currently trading with a dividend yield of 4.2% and has raised its dividend by 6% over the last year, which makes for a potential total return of a little more than 10% a year if dividend growth is maintained at the current level and if valuations remain stable. Realty Income has grown its dividend for 25 years in a row, which shows the company’s ability to withstand crises, including the dot.com bubble bursting, the housing bubble bursting, and the pandemic. In fact, Realty Income managed to hit new record-high funds from operations in both 2020 and 2021, as the pandemic did not have a meaningful negative impact on the company. For the current year, Realty Income is guiding for a new record profit as well.

3: TotalEnergies

TotalEnergies (TTE) is a French supermajor that is active across the oil and gas value chain. From exploration and production to refining and marketing, TotalEnergies is making money. It also owns LNG and renewable energy assets. Its exposure to European energy markets, which are especially tight following the Ukraine-Russia war, will have a meaningful positive impact on Total’s profitability this year.

The company is forecasted to earn $12.85 per share this year, which pencils out to a company-wide net profit of around $33 billion. That is easily more than enough to cover the dividend cost of $7.5 billion, as Total will have around $25 billion of surplus profit left over for other purposes. Buybacks will most likely be hefty this year, and when we consider that Total can currently take its shares off the market at an earnings multiple of slightly less than 4, those buybacks should be highly accretive. In fact, for each dollar spent on buybacks, Total gets a 25% return on investment with profits at the current level.

The dividend yield is 6.0%, and it would not be surprising to see TotalEnergies offer a major dividend increase this year. With Total benefitting from high energy prices (and thereby from inflation), and with shares trading at an ultra-low enterprise value to EBITDA multiple of just 2.4, TotalEnergies looks like a compelling income and inflation play right here.

4: Canadian Natural Resources

Canadian Natural Resources (CNQ) is a Canadian oil sands company that has an excellent dividend growth track record. The company has raised its dividend every year (in Canadian Dollars) since the company began making dividend payments around 20 years ago. Today, Canadian Natural Resources is trading with a 4.2% dividend yield. Its dividend growth and safety properties are excellent, the 5-year dividend growth rate of 21% receives an A grade from Seeking Alpha’s scoring algorithm.

This hefty dividend growth throughout the last couple of years, which also included the pandemic and the very low oil prices in 2020, was only possible thanks to a very cash flow-heavy business model. Canadian Natural’s oil sands assets require very low maintenance capital expenditures and have low proportional costs, which is why margins are strong and breakeven prices are low. This allows Canadian Natural to be resilient versus all kinds of crises, whereas other oil companies with higher breakeven prices can run into problems more easily.

Canadian Natural’s hefty free cash flows can be used to finance its dividend, but billions of dollars are left over every year. Canadian Natural utilizes these by buying back shares and strengthening its balance sheet. Today, CNQ is trading with an EV to EBITDA multiple of just 3.4, which is a very low valuation for a company with resilient cash flows, long reserve lives, and CNQ’s great track record. With energy prices being pretty high, CNQ is a clear inflation beneficiary.

5: Energy Transfer

Energy Transfer (ET) is, like Enterprise Products Partners, an energy midstream company. Energy Transfer owns a huge pipeline network that can be seen as the backbone of North America’s energy industry. The company has been under pressure in recent years due to a rather high debt load, which was the result of management’s aggressive growth spending prior to the pandemic.

More recently, Energy Transfer has made a strategic shift. Growth spending has slowed down, and the company has started to pay down debt at a meaningful pace. This should be positive for shareholders, as it reduces future risks and since value gets shifted from debt holders to equity investors over time.

Right now, ET offers a dividend yield of 7%, and there is a high likelihood that the dividend will grow at a meaningful pace going forward. Management has stated that its main goal is to reinstate the dividend at the pre-pandemic level of $1.22 per share per year. For someone buying today, that would mean a dividend yield of more than 12%, which would be quite attractive. The company has raised its dividend twice this year, and further dividend increases this year or next year are very likely. Thanks to strong cash generation, the company has ample funds to increase the payout while continuing to pay down debt. High inflation helps ET get rid of the debt load (in real terms), and high energy prices also reduce ET’s counterparty risk while increasing the value of the company’s pipelines that are in the ground already. This combination makes ET a high-yielding inflation pick with a solid income growth outlook.

Takeaway

Inflation has jumped to a four-decade high, as the CPI rose to more than 9% in June. That hurts everyone that continues to hold cash or treasuries. Equities with certain characteristics, e.g. real asset investments that benefit from inflation, could be the right choice in the current environment. REITs (VNQ), energy midstream (UMI), etc. are worthy of consideration, I believe, for those that want to protect their wealth in the current high-inflation environment.

Be the first to comment