jhorrocks/E+ via Getty Images

Inflation has likely peaked and will continue moving downward over the next 12 months, with a return to more normal levels of inflation likely later in 2023. Central banks appear to have been unnerved by continued consumer strength though and are posturing to create tighter financial conditions. This is a high-risk strategy with low payoffs, that will likely accelerate and deepen the coming recession. The speed with which the Federal Reserve is tightening financial conditions is also beginning to strain the financial system, creating an elevated risk of a financial crisis.

Throughout 2021 the Fed appeared quite comfortable accepting inflation as a transitory phenomenon that was driven by supply chain issues and abnormal spending patterns. While the Fed has dramatically shifted its tone over the last few months, data continues to point towards supply chain issues and abnormal spending patterns as the primary drivers of inflation, although these are slowly resolving. In hindsight, the Fed should have tightened monetary policy in 2021 to temper demand while supply chains were still fragile, and to cool overheated asset markets (primarily housing).

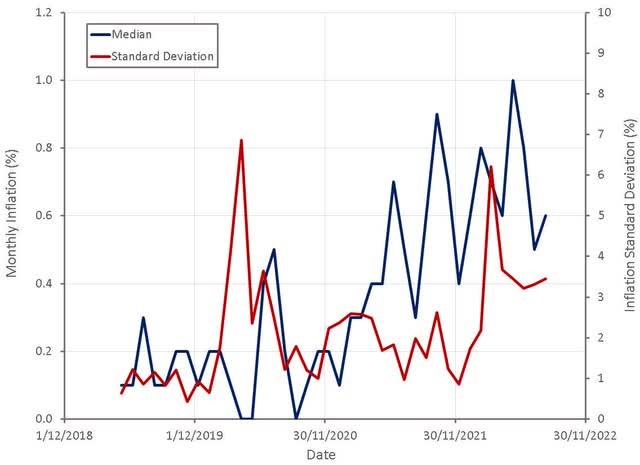

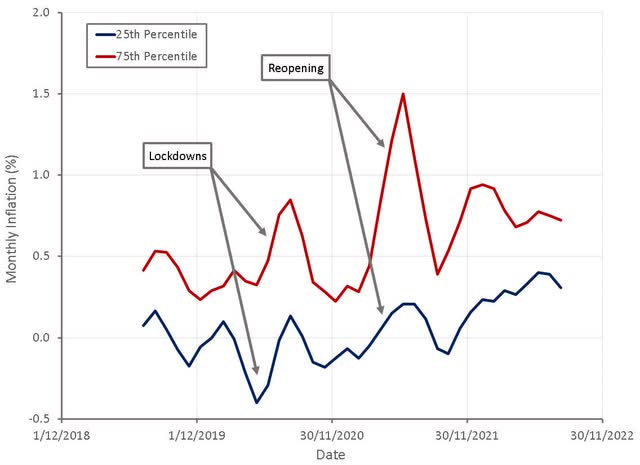

Figure 1: CPI Inflation (source: Created by author using data from BLS)

Figure 2: CPI Inflation by Percentile (source: Created by author using data from BLS)

Some of the uncertainty in regards to the correct policy response stems from the fact that it is difficult to know how much inflation is being driven by supply versus demand. Tightening monetary policy aims to reduce demand, and hence may be fairly ineffective if inflation is driven by supply constraints on goods and services that have relatively inelastic demand.

Analysis indicates that the current bout of inflation is due to a fairly even split between supply constraints and excess demand, with the demand component yet to show signs of easing. This consumer strength, along with continued labor market strength, is likely what has spurred the Fed to dramatically tighten monetary policy. It is estimated that monetary policy tightening, as measured by a 100-basis point surprise increase in the slope of yield curve around FOMC announcements, reduces the demand-driven contribution of inflation by a cumulative 1.5 percentage points over two years. The rapid rise in the Fed Funds Rate is therefore likely to contribute to a significant reduction in inflation, but this won’t occur for some time. It is possible that full impact of the shift in policy will not be felt until inflation is no longer a problem and central banks are again looking to stimulate demand.

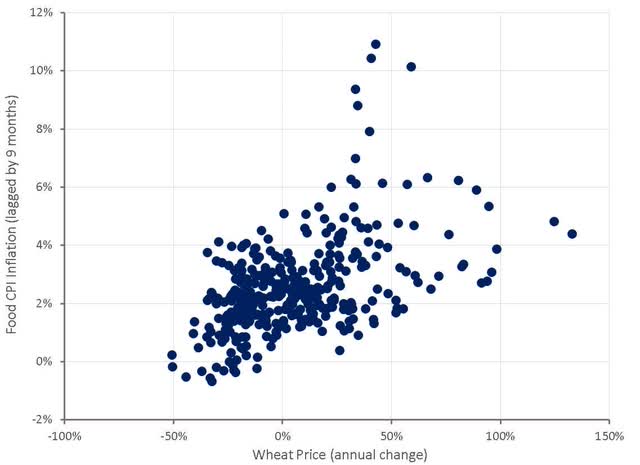

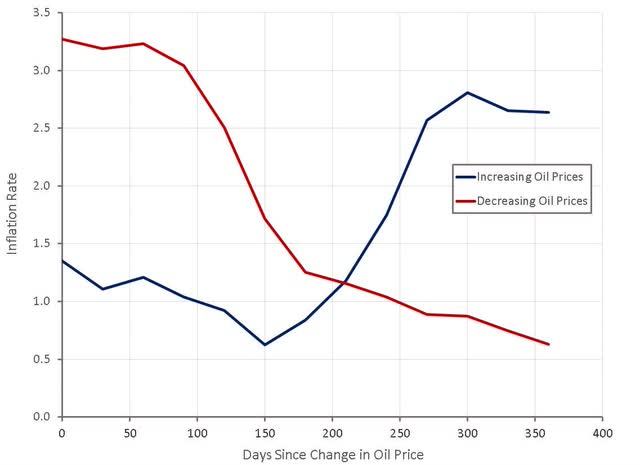

Trying to correct a past mistake makes little sense at this point though, and risks creating a major problem to solve a relatively minor one. Deflation is already beginning to show up in a number of areas that have been impacted by the pandemic and the war in Ukraine. Prices for commodities like oil, lumber, copper, iron ore and corn are down significantly from their peaks. Some of this likely reflects a shift in sentiment rather than a fundamental change in supply and demand and it would not be surprising to see continued volatility in commodity prices. For example, drought and extreme weather in the US have caused poor yields for corn, wheat and other agricultural commodities. The American Farm Bureau Federation estimates yields could be down by as much as a third compared to 2021. Without a resolution to the war in Ukraine, energy prices are also likely to remain high and volatile, with feedthrough effects on the rest of the economy.

The recent decline in commodity prices is likely yet to fully feed through to the rest of the economy though. It often takes 6-9 months before this process occurs, meaning that current inflation data is still reflecting the spike in commodity prices at the start of the year. Towards the end of 2022 and into 2023 it is likely that lower commodity prices will start dragging inflation lower.

Figure 3: Wheat Prices and Lagged Food CPI Inflation (source: Created by author using data from The Federal Reserve)

Figure 4: Impact of Oil Price Changes on Inflation (source: Created by author using data from The Federal Reserve)

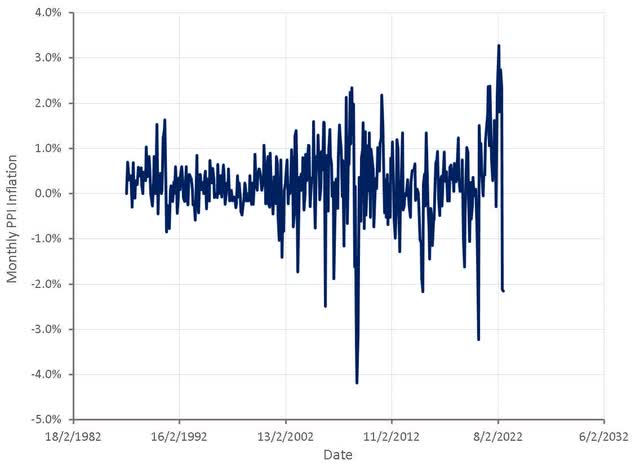

Producer prices have also been down month over month for the past two months as demand normalizes and supply increases. The combination of lower input prices and less excess demand is likely to continue driving producer prices lower, which will in time feed through to lower consumer prices.

Figure 5: Monthly PPI Inflation (Total Manufacturing Industries) (source: Created by author using data from The Federal Reserve)

A number of categories that were most heavily impacted by the pandemic are also beginning to show signs of normalization. For example, as supply chains and demand have normalized, used car prices have begun to fall, with Manheim’s used vehicle value index down by 12.8% this year. The drop in used car prices is only beginning though and will be a drag on inflation for some time going forward.

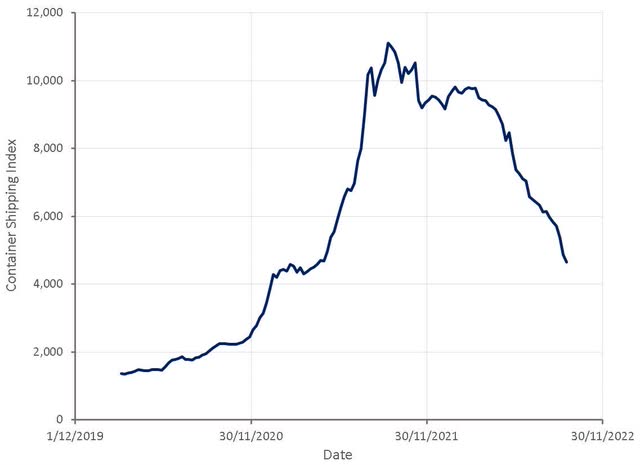

Excessive freight rates have also contributed to inflation, but are now in freefall as demand normalizes. While some have been quick to try and pin this on lockdowns in China, this is unlikely as it is a global phenomenon and the impact of lockdowns was minimized by rerouting freight. China also put in place closed-loop working arrangements which have helped to limit the impact on production levels.

More than 75% of container freight is related to consumer spending, and the drop in freight rates is merely a reflection of excessive inventories and weakening demand. This problem is illustrated by Nike (NKE), where North American inventories surged 65% in the most recent quarter and markdowns are pressuring gross margins. This is likely to be an increasingly common problem over the next 12 months, particularly for companies that have benefited from a surge in demand over the past two years. Freight companies are likely to try and support rates by canceling sailings, but the combination of new capacity and weak demand will continue to depress freight rates going forward.

Figure 6: Container Shipping Index (source: Created by author using data from freightos.com)

Inflationary pressures have already peaked, but inflation is a backwards looking measure and it will take time for inflation to move lower. This will be exacerbated by the shelter component of inflation, which is slow to adjust due to the way it is calculated. Supply chains also remain vulnerable due to the war in Ukraine, which could create further inflationary pressure. Central banks appear intent on tightening as much as possible, or at least appearing as hawkish as possible, to dampen demand until they are forced to pivot. The global economy is already showing signs of stress, but it may still take time for labor markets to weaken enough for the Fed to shift its policy stance. An easing of monetary policy may not provide markets with much reprieve at this point though, as many companies are facing a significant fall in profitability going forward, which is yet to be reflected in share prices.

Be the first to comment