Colin Anderson Productions pty ltd/DigitalVision via Getty Images

Introduction

I’m very excited to use this article to share my thoughts on a very important topic: investing in times of high inflation. While “we” have prepared for higher inflation since 2020, a lot of people are now waking up to the fact that inflation is here to stay. With consumer prices at a multi-decade high, we’re seeing tremendous stress on consumers and the economy as a whole.

In this article, I will explain how I would deal with this and why I believe that Northrop Grumman Corporation (NYSE:NOC) is the go-to stock for investors seeking income, growth, and inflation protection. I will walk you through my thinking process in what I believe is my most important article this quarter starting at the very beginning: inflation.

Inflation Is Here To Stay

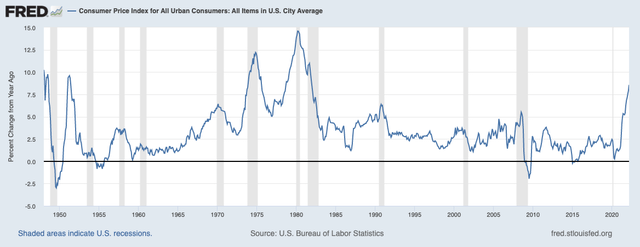

Inflation is one of the most complex and complicated topics right now. It is an issue that began in 2020, when central bankers feared that inflation would be too low over time. Back in 2020, inflation bottomed at 0.2% (year-on-year) as a result of global lockdowns that crushed consumption. Restaurants were empty, people worked from home, and entertainment was entirely online. Nobody knew how bad things would get as we were dealing with a novel virus.

Both fortunately and unfortunately, it turned out that the lockdowns were a massive overreaction. It had a huge impact on supply chains as consumer spending came roaring back. Meanwhile, inventories were empty as companies didn’t bother to restock due to uncertainty. It caused just-in-time supply chains to break. Waiting times increased, and because the Fed had blown up its balance sheet, a much bigger wall of money was chasing a decreasing amount of goods and services: inflation was (re)born.

Now, inflation is running at more than 8% year-on-year as things have only gotten worse. Semiconductor shortages, labor shortages, shipping issues in China, the war in Ukraine, and related food shortages are doing a number on the consumer. Not just in the U.S. This time it’s global.

Federal Reserve Bank of St. Louis

Whether it is in my daily newsletters on Intelligence Quarterly or on Seeking Alpha, I’m in the camp that believes that inflation is here to stay. In this case, I’m not making the case that inflation remains at 8%, but that inflation will remain above average for an extended period of time.

This week, the Wall Street Journal ran a headline that I, unfortunately, have to agree with: “Inflation Hurts. Better Get Used to It.”

The problem, as “The Journal” describes it, is that the market believes that inflation can come down without much Federal Reserve intervention. After all, inflation is mainly caused by supply chain problems the Fed cannot solve anyway:

During the 1980s, when Paul Volcker’s Fed was desperate to avoid a repeat of the inflation of the 1970s, interest rates were on average more than 4 percentage points higher than inflation. Leave aside the fact that at the moment the Fed Funds target rate is an extraordinary 7 percentage points below inflation; markets aren’t bracing for the Fed to be truly hawkish in the long run. Investors still think there’s no need, since in the long run inflation pressures will abate.

There are reasons to believe that inflation is here to stay. According to the same article:

This is probably a mistake. The inflationary pressures from Covid and war will surely go away eventually. But self-fulfilling consumer and business expectations of inflation are rising, and a bunch of longer-term inflationary pressures are on the way. These include the retreat of globalization, massive spending to shift away from fossil fuels, more military spending, governments willing to run loose fiscal policy, and a starting point of an overheated economy and supercheap money.

What we are dealing with are structural issues – both in the US and the EU. Labor shortages, for example, will lead to the “re-pricing” of a lot of jobs in the decades ahead. Globalization is changing as companies are increasingly moving away from China because of human rights and supply chain risk issues. This makes sense, but it means that our economies will not be flooded with cheap products anymore. Moreover, “greenflation” is a thing now as governments discourage oil and gas production. The global move to “renewables” will come with a lasting price tag as oil, gas, and coal are the cheapest ways to fuel our growth.

Moreover, the war in Ukraine and geopolitical uncertainties in Asia (mainly caused by China) ramp up the need for defense spending.

The list is very long, and it surely seems that we’re in a new order that does not allow inflation to run at what used to be common inflation rates close to or below 2.0%.

This means investors need to be prepared.

Buying Inflation Protection

In general, buying index funds is a good way to protect your wealth against inflation. Long-term, the 10% average annual return of the S&P 500 has outperformed inflation by a mile. However, as I’m not a big fan of ETFs, I like to find stocks that get the job done for my own portfolio and anyone following me on Seeking Alpha.

In this case, I spent more than a week thinking about a single stock that could get the job done. I read dozens of articles on this website and others and came to the conclusion that I’m not going with the obvious picks.

What are the obvious picks? Energy and basic materials. Both sectors are flying right now due to high commodity inflation and the fact that mining companies and related are in a good place.

I decided to go against commodities (in this article) for one reason only: I want to present a stock that investors can hold throughout many cycles. A lot of high-flying commodity stocks right now will turn into liabilities once inflation comes down. The perfect inflation stock protects people in times of inflation and deflation – I think.

Another category I decided to ignore is consumer staples. These companies are technically able to raise prices because consumers have to buy their products. However, I decided to ignore these companies in this article as inflation is running so hot that consumers are switching brands, which benefits generic brands. Again, these companies are not bad in these times, just not perfect.

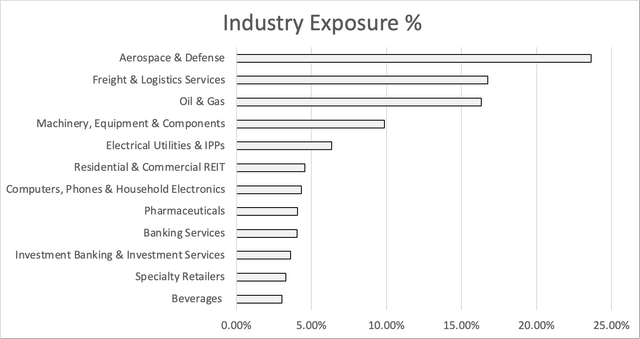

What I decided to go with, as you already saw in the introduction, is defense. I currently have about 24% defense exposure in my portfolio.

But why is Northrop Grumman such a great pick in this industry?

Northrop Grumman Means Long-Term Inflation Protection & Wealth Growth

Northrop Grumman has been in my portfolio since last year with an average entry price of $363.70. In March, I dedicated an article to its qualities as a dividend growth stock.

With a market cap of $69 billion, this Falls Church, Virginia-based company is one of the world’s largest defense contractors. While its products are not that well known like Lockheed Martin’s (LMT) F-16 or F-35, it’s one of the best-positioned defense contractors due to its high-tech exposure.

In my last article, I highlighted this exposure:

What people don’t know is that Northrop produces the fuselages for the F-35 and F/A-18, among others. The company is engaged in all major defense projects and it operates in a number of high-tech areas like defense systems, mission systems, space systems, and aeronautics. Aeronautics includes the soon-to-be-released B-21 Raider.

Northrop Grumman 2022 Investor Presentation

What I like about this is that defense is switching from “old-school” hardware to high-tech solutions. The Telegraph wrote an article called, “Is this the end of the tank?”

While the paper concludes that armored vehicles are needed, it highlights the advanced technologies like Javelins that can take out tanks. The fact that Ukraine has access to them is a reason why Russia has such a hard time advancing.

In my last Northrop article, I highlighted changing defense demands as well:

The last 20 years have been about counterinsurgency and antiterrorism, benefiting ground vehicles, aircraft, drones and missiles. “Now there is a shift to a different adversary: peer-to-peer state actors,” says Patriot Industrial Partners consultant Alex Krutz.

[…] Yet investors are concerned about a deeper-seated problem, too: Defense firms may have stuck too much to their traditional role as steady dividend payers at a time when they need to accelerate investments in technology. – WSJ

Northrop sells 86% of its products inside of the U.S., and 29% of total sales go to classified customers. In Aeronautics, 40% of sales go to restricted customers. In other words, “trust” is important, as it’s hard to judge which projects will do well in the future. What I do know, however, is that the company engages in all areas with growth potential: strategic bombers, supplies for large programs like the F-35, space hardware, and support, (advanced) missiles, hypersonics, computing, autonomous vehicles, and so much more.

The best thing about being dependent on the government is that it comes with pricing advantages. According to the Wall Street Journal, roughly a third of the Pentagon’s biggest deals are agreed on a cost-plus basis, with the price set and the extra expense borne by the Pentagon. This often includes deals longer than one year. In other words, deals that do not include shorter-term spending, which is roughly 70% of its budget.

McKinsey & Company also dove into the impact of inflation on defense buying power. The worst-case scenario used inflation in the 1970s as a basis. As the first graph of this article shows, back then inflation was in the double-digit range. If such a scenario would occur again, real buying power would fall to $543 billion by 2026.

McKinsey & Company

The good news is that the government tries to maintain steady buying power, which means incorporating inflation. On average, the defense budget has used inflation of 20 basis points above CPI to incorporate higher-than-average defense-related inflation.

In the case of Northrop, it helps that the company is high-tech focused. This means long-term projects that require inflation protection. In March, during the JP Morgan Industrial Conference, the company commented on inflation:

Much of our fixed price contract portfolio is repriced annually. For those programs and others that are repriced less often, we work to have contract clauses that enable things like price adjustments if inflation reaches a certain point or reopeners under certain conditions. So these of types of tools available in our industry to mitigate risk associated with inflation and we’re doing everything we can to do so.

Again, the company is responsible for two legs of the nuclear triads while being supportive of the third. The company is a key supplier of the F-35 and F-18 projects, a major drone producer, and the home of the new B-21 Raider. These projects are great for inflation protection.

Moreover, I found a comment in NOC’s 2021 10-K, which highlights its ability to fight inflation:

We have generally been able to anticipate increases in costs when pricing our contracts. Bids for longer-term firm fixed-price contracts typically include assumptions for labor and other cost escalations in amounts that historically have been sufficient to cover cost increases over the period of performance.

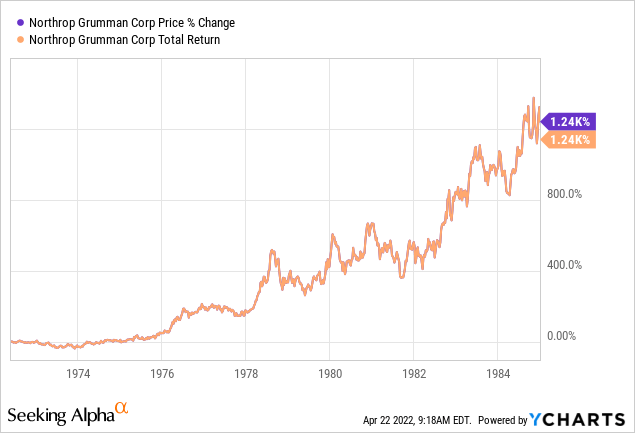

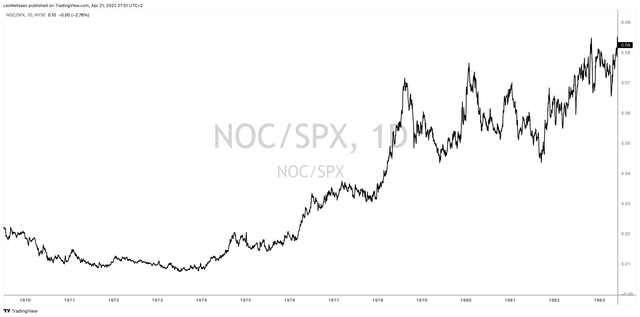

Now, remember that the 1970s were the last time that inflation was really bad. It was consistently in double-digit territory, triggering 4 recessions within 15 years. Back then, it was really hard for defense companies to maintain steady purchasing power, as the McKinsey data showed. Yet, NOC outperformed by a mile. The graph below shows the ratio between NOC and the S&P 500 (excluding dividends). In the early 1970s, there was no outperformance. Yet, going into the second half of the 1970s, NOC accelerated.

Between 1970 and 1985, NOC returned 1,240%, which not only beat sky-high inflation but generated a lot of wealth even for people who had a relatively small position back then.

With that in mind, let me reiterate again why it also matters from a dividend growth point of view.

Shareholder Value & Valuation

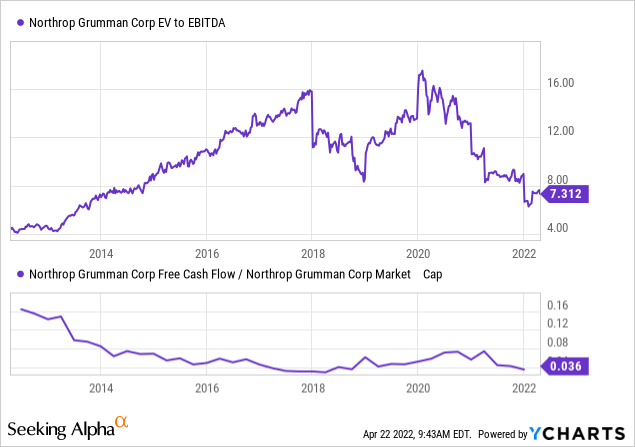

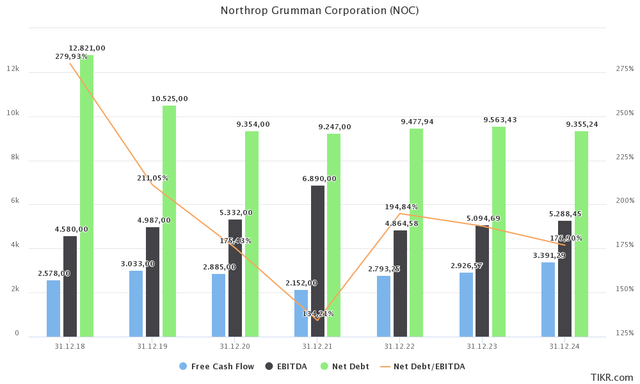

I’m not going to make this segment long as you just had to read close to two thousand words on inflation. However, I wanted to make the case again for NOC as a dividend growth stock. The company is generating accelerating free cash flow used to boost its dividend and buybacks. Meanwhile, it maintains a net debt level of roughly $9.5 billion. That’s less than 2x expected EBITDA, which indicates a healthy balance sheet.

In this case, the company is doing close to $5.3 billion in expected 2024 free cash flow. This implies a 7.7% free cash flow yield. In other words, if the company were to spend all of its free cash flow on dividends, that’s the yield one would get. That’s not happening, but it shows what the company is capable of in terms of shareholder distributions.

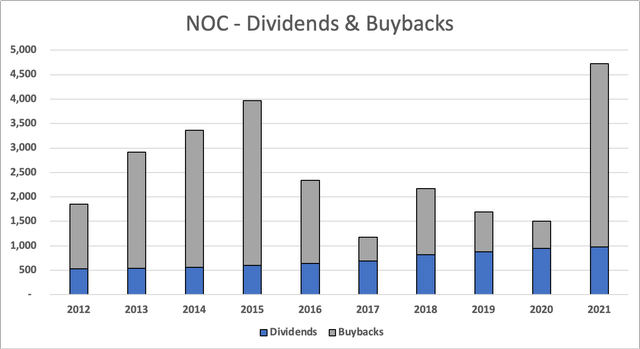

Between 2017 and 2021, NOC bought back roughly 8% of its shares outstanding. Dividend growth over the past 10 years averaged 12% per year. This number declined to 9.4% over the past 3 years, but I have little doubt that it will return back to double digits as free cash flow is now expected to accelerate again.

The most recent hike was on May 18, 2021. Back then, the company hiked by 8.3%, resulting in a $1.57 quarterly dividend. This translates to $6.28 per year per share, which is a 1.4% yield using the current $450 stock price.

That’s not a high yield by any means. If anything, it’s average, as it’s in line with the current S&P 500 yield. However, I think it’s a good deal. With double-digit dividend growth, this quickly turns into a satisfying yield on cost. And if investors require a high yield in the future, they can always sell NOC (most likely at a big profit a few decades from now) and put money into high yield stocks.

In terms of valuation, we’re dealing with a stock that’s up 15% year-to-date due to inflation and the war in Ukraine. Yet, I still like it. The implied (future) free cash flow yield is at a multi-year high in the company’s historic FCF/market cap range (lower part of the graph below), which means investors are not overpaying for future free cash flow. That’s absolutely key in dividend growth investing. Moreover, the enterprise value is roughly $81.8 billion, which is based on a $69 billion market cap, $9.5 billion in net debt, as well as $3.3 billion in pension-related liabilities. That’s more or less 16.0x the average EBITDA rate for the next 3 years ($5.1 billion). That’s not cheap. However, I added all pension liabilities and we need to keep in mind that free cash flow conversion is more important than EV/EBITDA. Also, I expect that EBITDA will accelerate after 2024 due to some major projects like the B-21 Raider.

With that said, here are my final words.

Takeaway

I think this is one of my most important articles of this quarter as we discuss a very important topic: investing in times of high inflation and uncertainty.

Northrop Grumman is one of my favorite dividend growth stocks and I believe it will protect investors in times of high inflation.

The company is in a good spot to offset rising inflation due to the structure and nature of its contracts as well as its position in the (NATO) defense supply chain. Even in the 1970s, the company not only protected investors but it generated a lot of wealth for everyone lucky enough to hold shares back then.

Moreover, the company is able to generate strong free cash flow, which supports high dividend growth, buybacks, and future investments.

If anything, this stock isn’t just great to combat inflation, but a stock that investors should own regardless of the economic outlook. The valuation is fair and I recommend everyone reading this to consider making NOC a core part of their portfolios.

(Dis)agree? Let me know in the comments!

Be the first to comment