Tashi-Delek

A man might share his wealth, but never his authority. – Amit Kalantri

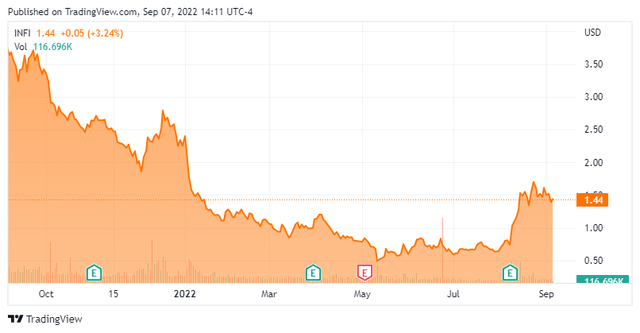

We concluded our last piece on Infinity Pharmaceuticals (NASDAQ:INFI) in November 2021 saying it probably merited a small ‘watch item’ holding, preferably with a covered call position. Today, we follow up and see how this small biotech firm is progressing. An analysis follows below.

Company Overview:

Infinity Pharmaceuticals is headquartered in Cambridge, MA and its main focus continues to be developing novel medicines to treat cancer. This small oncology firm has a market cap of approximately $135 million and the stock trades near $1.50 a share.

Pipeline:

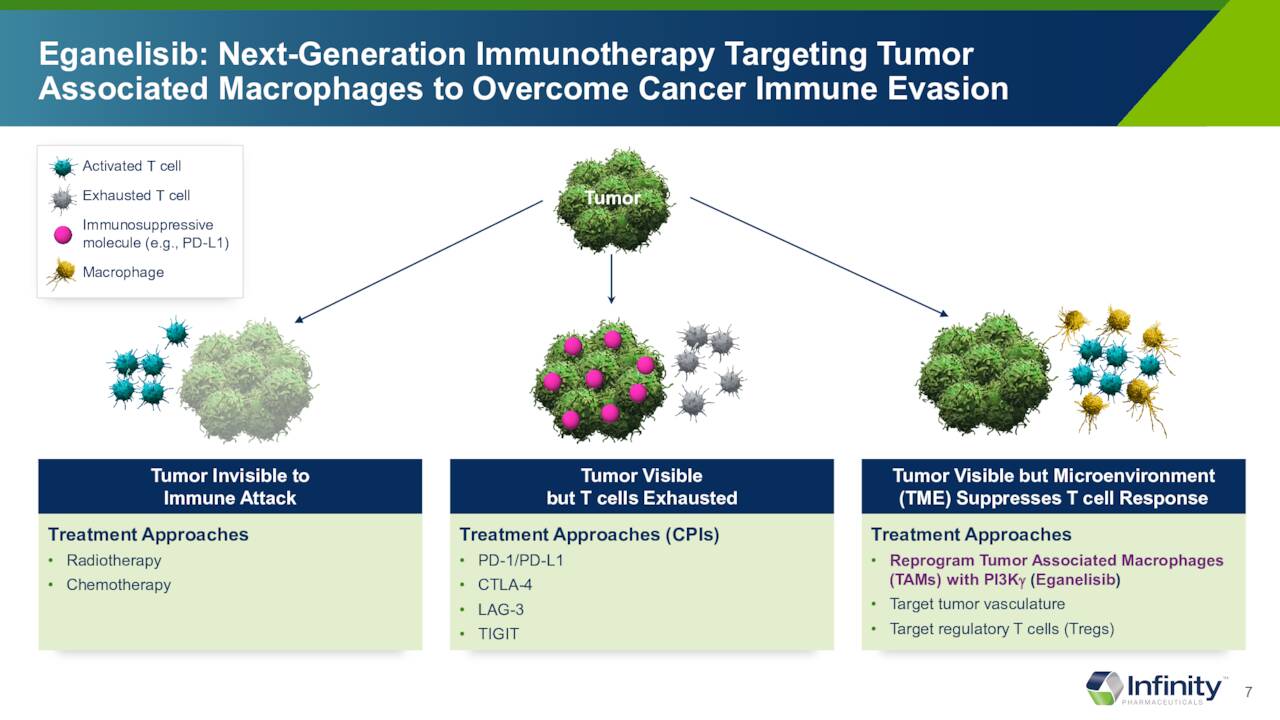

The company’s core focus continues to be to develop its primary drug candidate Eganelisib as part of combination therapies to treat a variety of oncology indications. Eganelisib is a first-in-class, oral, once-daily, immuno-oncology (I/O) development candidate selectively inhibits phosphoinositide-3-kinase gamma (PI3K-gamma). According to the company’s website, Eganelisib works by:

May Company Presentation

Reprogramming key immune suppressive cells (called M2 macrophages or myeloid derived suppressor cells (MDSCs)) within the tumor microenvironment from a pro-tumor function to an anti-tumor function, decreasing immune suppression and increasing immune activation, ultimately leading to the activation and proliferation of T cells that can attack cancer cells.

Company Website

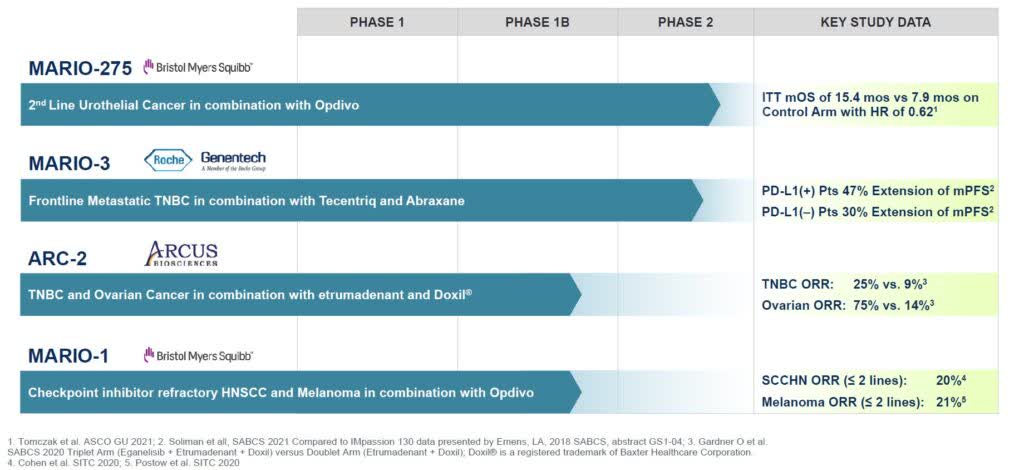

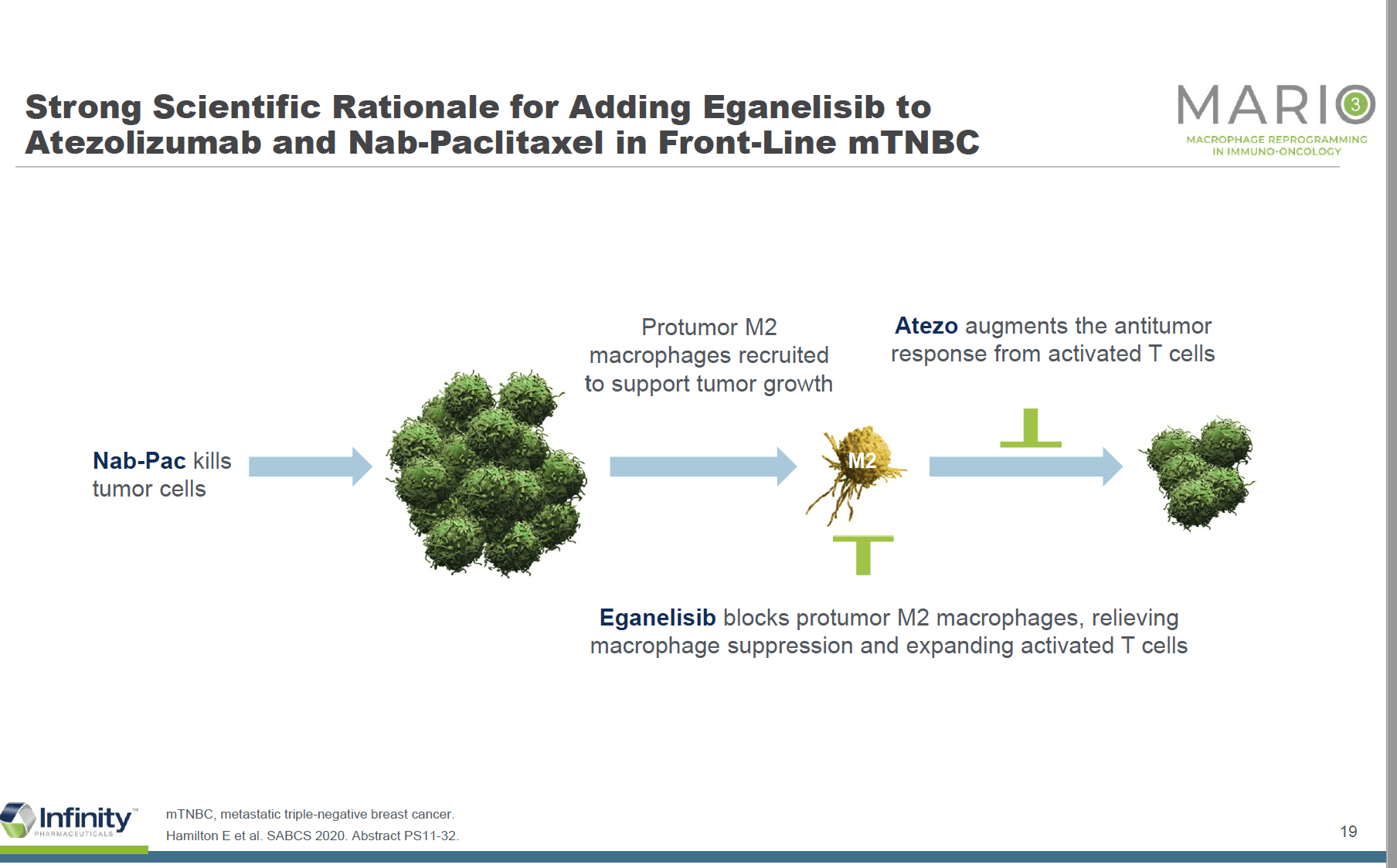

Since our last update around Infinity Pharmaceuticals, the company has disclosed some trial results. In December of last year, Infinity posted some updated data from its ongoing MARIO-3 study. This Phase 2 trial was designed to evaluate Eganelisib in combination with Roche’s (OTCQX:RHHBY) atezolizumab (Tecentriq) and chemotherapy nab-paclitaxel (Abraxane) in frontline metastatic triple-negative breast cancer (TNBC). According to the lead scientist on the results showed ‘Tumor reductions in 88.6% of evaluable patients were associated with a disease control rate of 81.4% in patients with PD-L1 negative tumors who are among the most challenging to treat‘. The company should review updated PFS data from this study by the end of this year.

Company Presentation

Then a month ago, the company posted data from its two-year analysis of its phase 2 MARIO-275 study. This trial is evaluating Eganelisib in combination with Bristol-Myers’ (BMY) Opdivo for the treatment of second line urothelial cancer. A key conclusion of the analysis was that 45% of patients in the Eganelisib combination treatment arm were alive compared to 24% of patients in just the Opdivo arm. In addition, this improvement was also seen in the PD-L1 negative tumor subgroup, with 38% of those patients alive at two years on the Eganelisib plus Opdivo arm versus only 17% on the Opdivo arm. These encouraging results are the key factor behind the recent rally in the stock.

The only other active study is MARIO-1, which is in a far earlier stage of development, so is not germane to this analysis.

Analyst Commentary & Balance Sheet:

Over the past six months, five analyst firms including Piper Sandler and Oppenheimer have reissued Buy ratings on the stock. Albeit, three of these contain downward price target revisions. Price targets proffered range from $3 to $9 a share. JonesTrading maintained its Hold rating on INFI on August 12th.

Less than two percent of the outstanding shares are currently sold short. The Chief Scientific Officer of the company sold just less than $10,000 worth of shares in early August. That has been the only insider activity in this equity so far in 2022. The company ended the second quarter with just over $55 million in cash and market securities on its balance sheet. At the time, management stated that was enough to fund at least the next 12 months of operations.

Verdict:

The company is actively looking for a strategic partner to move into late-stage developmental studies. This will lower cash burn and stretch funding needs into 2024. Recent results have garnered considerable interest in such an agreement and the company is negotiating with multiple parties, according to the company’s second quarter earnings call.

Of course, until that partnership is solidified, shareholders are left in a bit of a limbo. Given the company’s small market cap and the potential of Eganelisib, I still believe INFI deserves a small ‘watch item‘ holding until a strategic partnership is agreed to and late-stage registrational developmental studies can begin. I am keeping my small holdings in INFI within covered call positions for the risk mitigation this simple options strategy provides.

Anybody remotely interesting is mad in some way or another. – Steven Moffat

Be the first to comment