PeopleImages/iStock via Getty Images

Infinera Corporation (NASDAQ:INFN) expects an increase in the demand for its network technologies as the use of 5G technologies and smartphones continue to change our lifestyle. In my view, with sufficient improvement in customer expertise and economies of scale, profitability and revenue growth will likely increase. Under normal conditions, I believe that the fair price is close to $7 per share, which is higher than the current price mark.

Infinera Corporation

Infinera Corporation supplies networking solutions, software, and services. The company’s most relevant products include optical transport platforms, packet-optical transport platforms, and compact modular platforms.

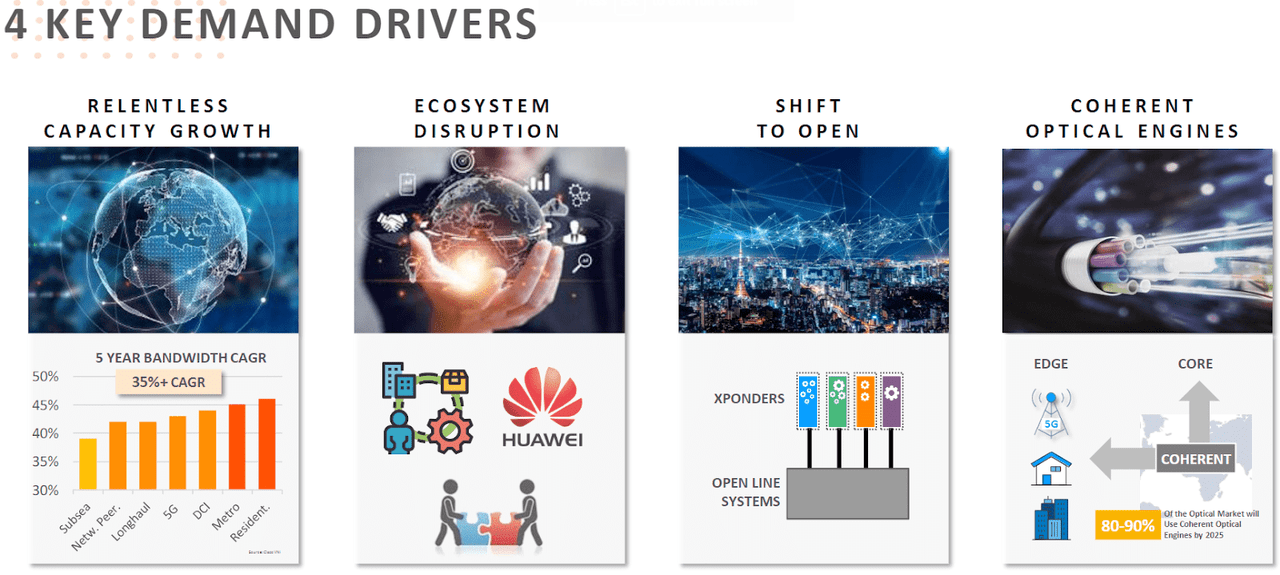

I think that it is a great moment to study INFN’s strategy and expectations. Keep in mind that management expects 5-year bandwidth growth close to 35%, new disruptions in the industry, and demand for coherent optical engines. If new drivers improve demand in the industry, INFN will likely enjoy sales growth.

Source: Presentation

In the most recent annual report, the company provided a list of devices and clients that may evolve significantly thanks to INFN’s technologies. In my view, new apps in smartphones and open RAN initiatives for 5G are the most relevant changes:

Examples of this trend include separation of compute, storage, and networking in data centers, the separation of hardware, operating system and apps in smart phones, hardware/software separation in network function virtualization and hardware and software routing stack routers, and open RAN initiatives for 5G. Industry evolution is now enabling optical networking to leverage these same principles of openness and disaggregation. Source: 10-k

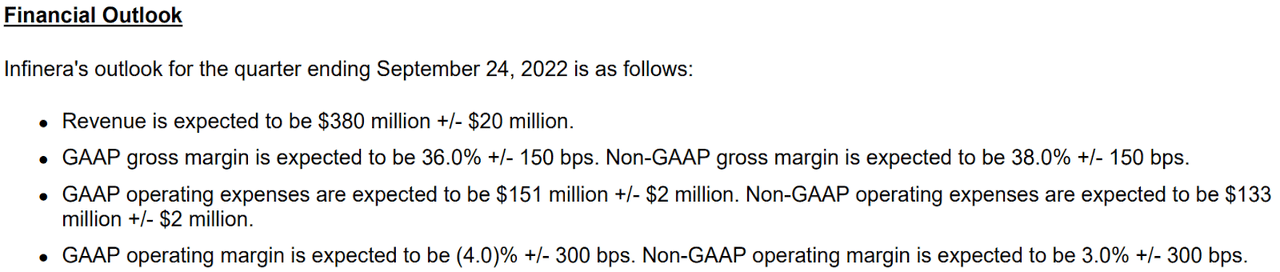

In line with the above mentioned facts, management has already identified strong demand in the last quarterly report, and provided beneficial guidance for next quarter. The company expects GAAP gross margin of 36% and quarterly revenue of about $380 million.

Strong demand resulted in greater than 80% year-over-year growth in total backlog, which includes product backlog growth exceeding 100%, and a quarterly book-to-bill ratio above 1. Source: Earnings-Release_07.28.22

Source: Earnings-Release_07.28.22

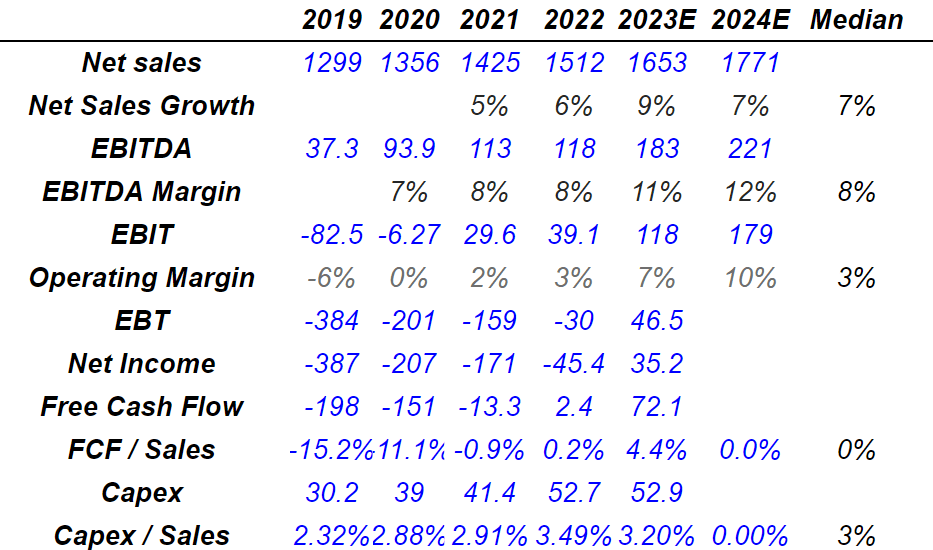

Expectations From Other Financial Analysts Include 5%-9% Sales Growth And Growing EBITDA Margin

With sales growth around 5%-9%, investment advisors are expecting 2024 net sales close to $1.7 billion. They also believe that an increase in EBITDA margin would take place from 2022. In 2024, market estimates include as much as 12% EBITDA margin. The net income would also become positive from 2023, and FCF would stand at $72 million in 2023.

Finally, INFN is expected to deliver an increase in capital expenditures, so that capex/sales would stand at 3.2%. I do welcome the increase in capex. Managers that are optimistic about the future of their industry usually make larger capital expenditures over time.

Marketscreener.com

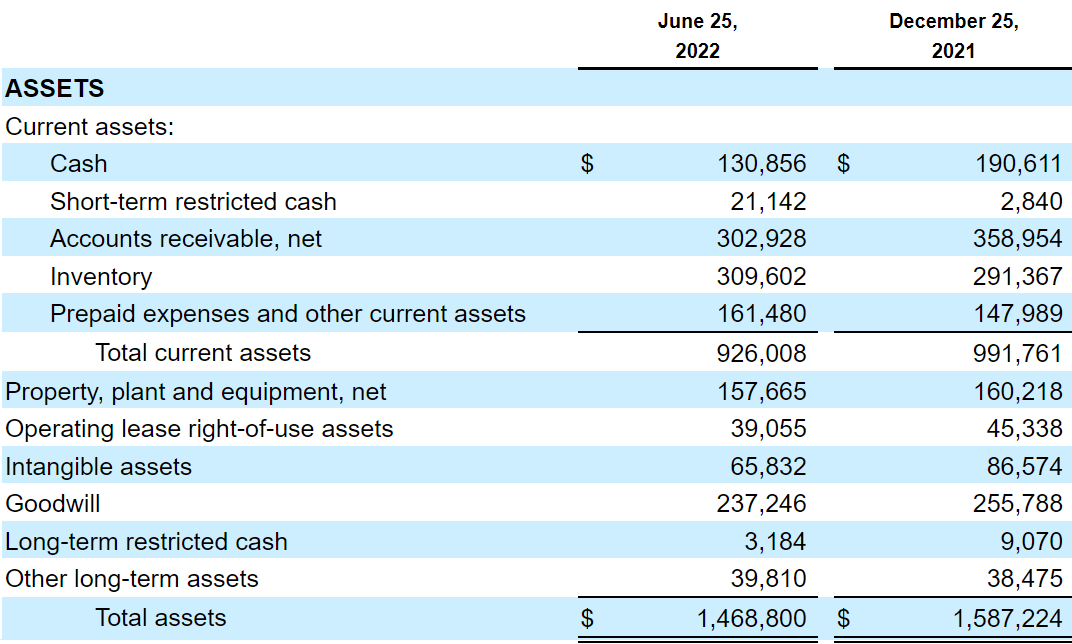

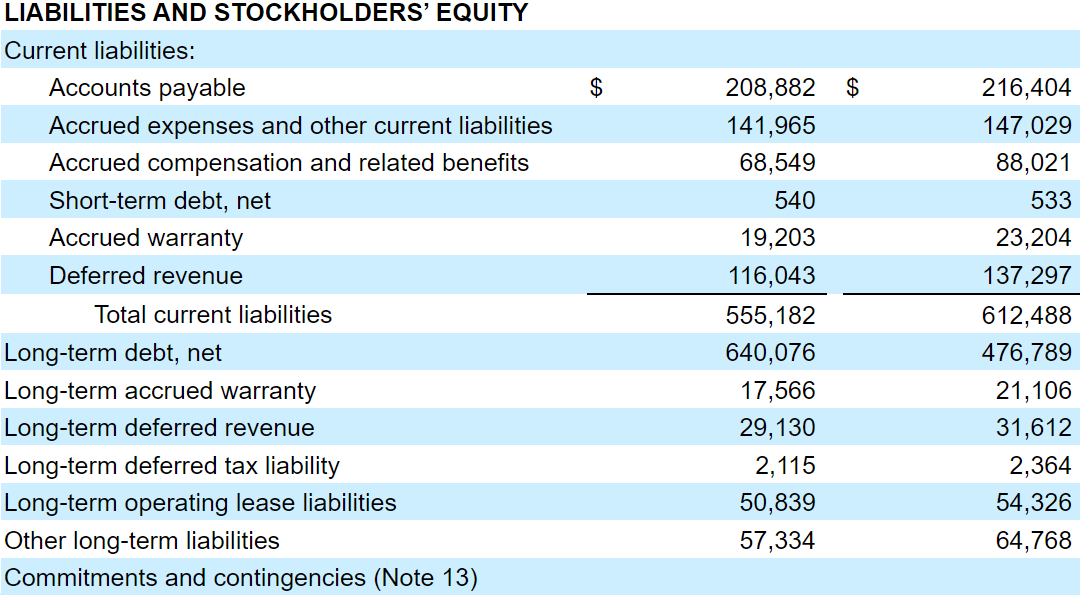

Balance Sheet

As of June 25, 2022, INFN reported cash worth $130 million and $1.46 billion in total assets. With that amount of cash in hand, I think that management will be able to make meaningful capital expenditures. If the company is correct and we are in a period of disruption in the industry, INFN will be able to design new optical transport platforms and other tools. At least, management has a lot of cash in hand to do so.

10-Q

With long-term debt worth $640 million and my expected 2026 EBITDA of $200 million, I am not afraid of the company’s total leverage. In my view, with sufficient free cash flow in the future, management may reduce its net debt.

10-Q

My Base Case Scenario Would Lead To $7 Per Share

Considering the reports delivered about the Optical Communication And Networking Equipment market, I believe that INFN could grow at a CAGR close to 6%-7%. At least the market is expected to grow at that pace, so I used revenue growth close to that in my financial model.

According to Verified Market Research, the Optical Communication And Networking Equipment Market size was valued at USD 19.2 Billion in 2021 and is projected to reach USD 40.10 Billion by 2030, growing at a CAGR of 6.10% from 2022 to 2030. Source: Optical Communication And Networking Equipment Market size

With that, in my view, we could see sales growth even larger than that of the market because INFN works for industries that expect significant growth. Ultimate users of INFN use technologies like 4G/5G mobile broadband, cloud-based services, and the Internet of Things:

These end-user services and applications include, but are not limited to, high-speed internet access, business Ethernet services, 4G/5G mobile broadband, cloud-based services, high-definition video streaming services, virtual and augmented reality and the Internet of Things. Source: 10-k

In my view, if management successfully evolves its technology with higher speed, and integrates vertically integrated optical engines across different networking systems, efficiency will likely increase. As a result, high-performance transport technologies will likely bring new clients and revenue growth:

Our strategy is to continue to evolve our unique optical technology with higher speed and increasingly efficient capabilities. Source: 10-k

I also think that the company’s vertically integrated in-house manufacturing capabilities will serve as a competitive advantage. In my view, in the near future, it may help management report higher profitability and better margins than competitors. If INFN also achieves cost advantages of scale, the FCF/Sales margin will likely improve, and the company’s implied valuation would most likely increase.

Finally, under this scenario, I also assumed that INFN will improve its customer experience with new high-quality products. In particular, I am quite optimistic about the company’s usage-based bandwidth provisioning and service agility. New improvements will likely enhance revenue generation and the INFN’s stock price.

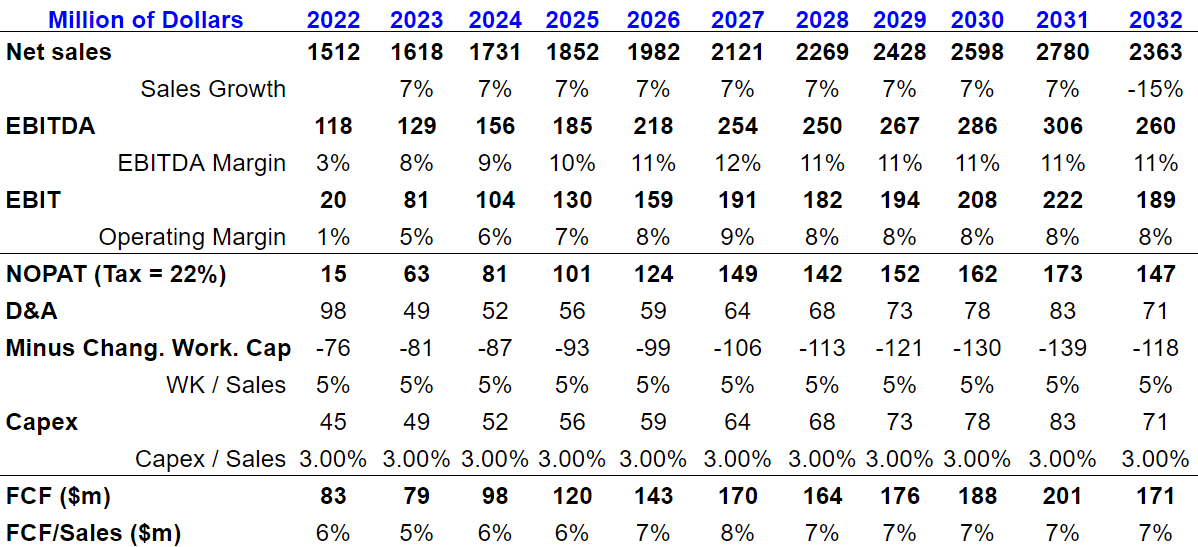

If we assume a conservative sales growth of 7% from 2023 to 2032 and an EBITDA margin around 8%-11%, the NOPAT wouldn’t be far from $63-$147 million. With a working capital/sales ratio of 5% and capex/sales of 3%, the free cash flow will likely grow from $79 million in 2023 to $171 million in 2032. The FCF/Sales margin would therefore stand at close to 5%-7%.

Author’s DCF Model

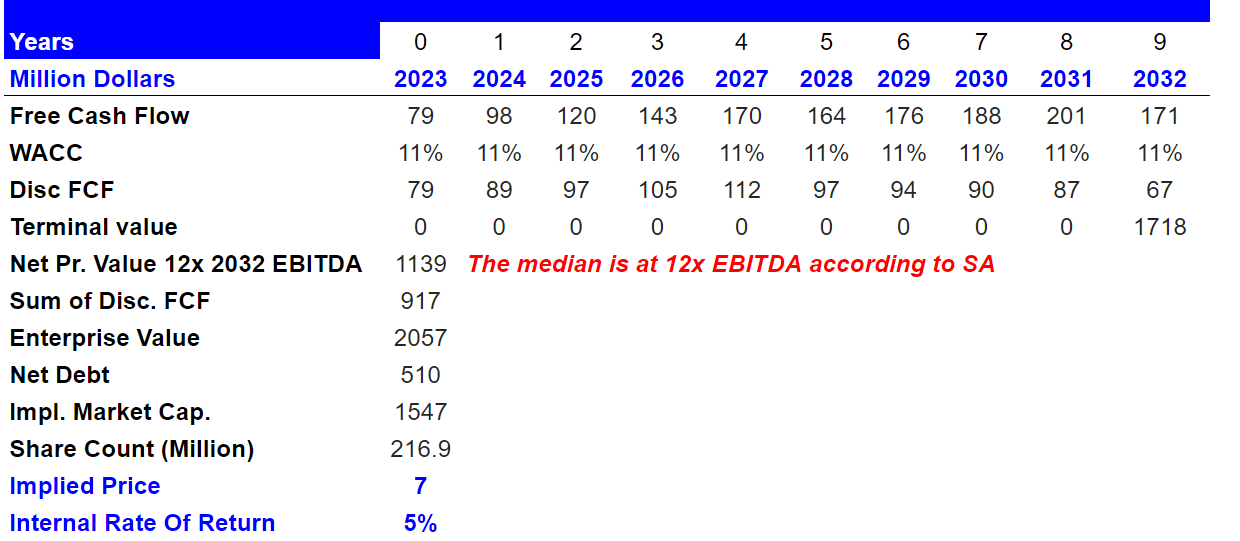

If we sum the FCF from 2023 to 2032 with a discount of 11%, the sum would stand at $917 million. I also used an exit multiple of 12x EBITDA, which is close to the median in the sector, and implied an enterprise value close to $2 billion. If we also assume a net debt of $510 million and share count of 216 million, the implied price would be $7 per share, and the IRR would stay at close to 5%.

Author’s DCF Model

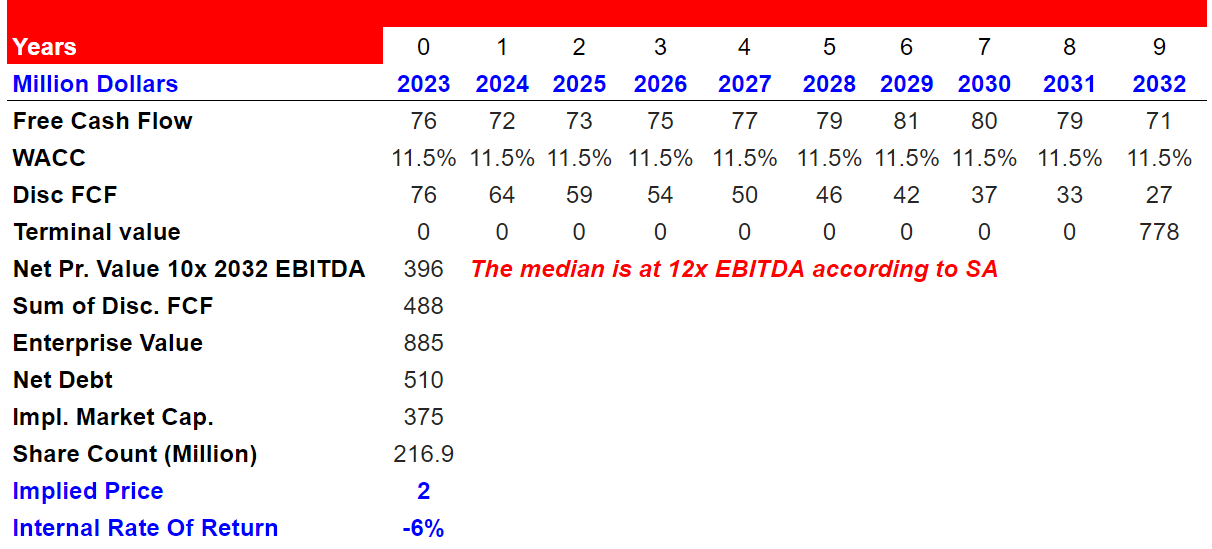

My Bearish Case Scenario Includes A Fair Price Of $1.5-$2

Considering the expectations of market participants and securities analysts, I believe that lower revenue growth than expected would lead to significant stock price declines. Let’s note that management warned about these risks in the last annual report:

If our revenue or operating results do not meet the expectations of investors or securities analysts or fall below any guidance we provide to the market, the price of our common stock may decline substantially. Source: 10-k

INFN develops sophisticated PICs, DSPs, specialized ASICs, and other technologies that require suppliers from third parties. Investors may also expect production declines. The development of these optical engines is also lengthy, and new development costs may arise, which may lower the company’s FCF/Sales.

Our products are based on complex technologies, including, in many cases, the development of next-generation PICs, DSPs and specialized ASICs, each of which are key components of our optical engines. The development process for our optical engines is lengthy, and any modifications entail significant development cost and risks. Source: 10-k

INFN competes in a market with several large players that offer similar products. Some of the competitors are ADVA Optical Networking (OTCPK:ADVOF), Ciena Corporation (CIEN), Cisco Systems (CSCO), Ribbon Communications Inc. (RBBN), Huawei Technologies Co., Ltd., and Nokia (NOK). Some of these companies have more resources than INFN, and may develop better technologies than INFN. If INFN loses clients or reduces its prices, the company’s profitability may lower.

We also could encounter competitor consolidation in the markets in which we compete, which could lead to a changing competitive landscape, capabilities and market share, and could impact our results of operations. Source: 10-k

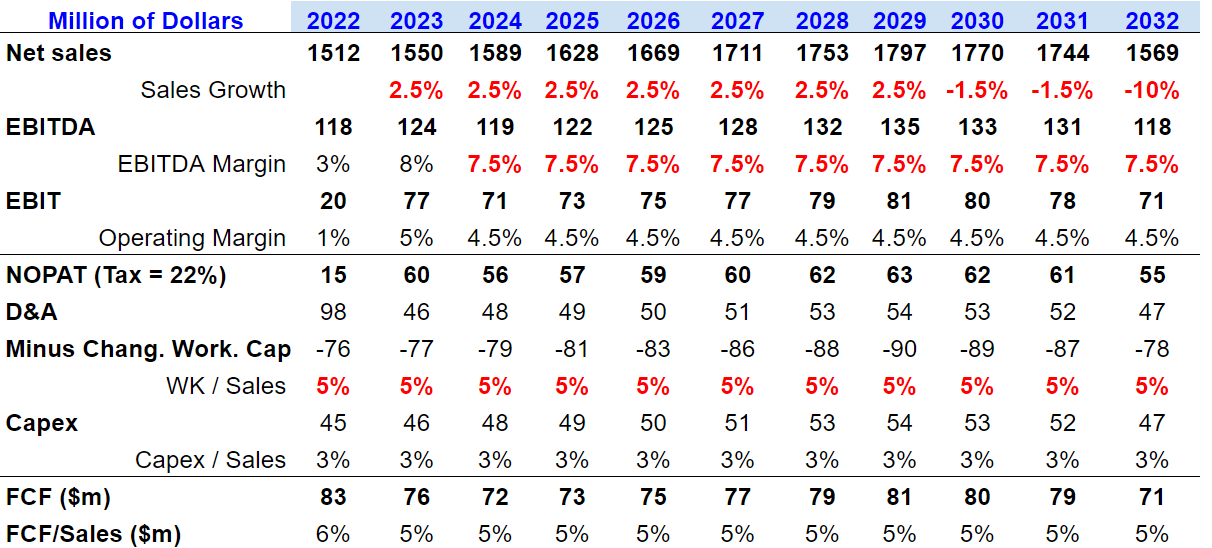

With sales growth around 2.5% and -1.5% and an EBITDA margin close to 4.5%, the NOPAT would be close to $60-$55 million. With an effective tax of 22%, capex/sales close to 3%, and working capital/sales of 5%, I obtained free cash flow around $80 million and $75 million.

Author’s DCF Model

Now, in this case, I assumed a discount of 11.5% and an exit multiple of 10x, which resulted in a market capitalization of $375 million, and a fair price close to $1.5-$2 per share. I do believe that this case scenario is likely.

Author’s DCF Model

Conclusion

Under normal circumstances, INFN will likely benefit from the demand for new networking solutions generated by more apps in smartphones and 5G technologies. If the company successfully manages to offer beneficial customer expertise, and economies of scale emerge, free cash flow will likely increase. Under my base case financial model, conservative estimates lead to a valuation of more than $7 per share, which I consider the most likely scenario. Even taking into account risks from competitors, lack of supplies, or production decreases, in my view, the stock price remains undervalued.

Be the first to comment