fizkes/iStock via Getty Images

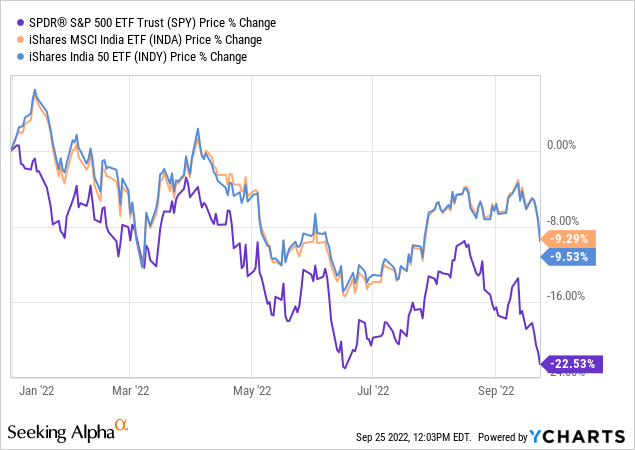

According to the Economic Times of India, overseas portfolio investors have turned positive about the country and invested $7.6 billion in August. The Indian jurisdiction also seems to be taking advantage of the woes impacting China, where the priority remains the fight against COVID. Other parts of the world are not spared either, with Europe facing high commodity prices, while the S&P 500 dropping by more than 22% since the start of this year, shows that economic concerns have taken center stage in the U.S.

This thesis makes the case for investing in Indian equities, considering that the iShares MSCI India ETF (BATS:INDA) and the iShares S&P India Nifty Fifty Index ETF (NASDAQ:INDY) have suffered much less than the SPDR S&P 500 ETF Trust (SPY), as shown in the charts below.

Refraining from advising investors to splurge their hard-earned income on the first related exchange-traded fund (“ETF”) they come across, I opt for a comparison between the two in order to identify the best, especially in these highly volatile markets. For this purpose, this thesis will primarily assess sector weaknesses and strengths as well as provide insights into some of the holdings.

Sector Analysis – Weakness

As I have detailed in some of my earlier theses on Chinese funds, 2021 was painful for portfolio managers as a result of some extreme regulatory measures imposed by the government against sectors such as tech and private education. These have caused considerable fund outflows from the country, with COVID restrictions not helping either. On the other hand, being relatively free from COVID with infection rates dipping across the board throughout the country, India has seen better success at containing the pandemic.

However, to be realistic, the above charts show that the two iShares ETFs have not been immune to the volatility impacting global stock markets. One of the reasons for this is that there is some interaction between the world’s largest economy and Indian companies. One sector which is particularly exposed to the U.S. is information technology or IT, where, faced with a lack of talent in a tight labor market, many North American companies outsource work to Indian counterparts. Hence, downsides in the tech-heavy Nasdaq often reverberate across the stocks quoted on the Bombay Stock Exchange.

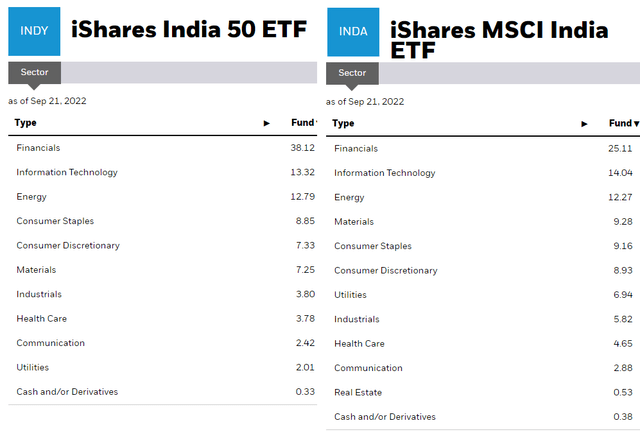

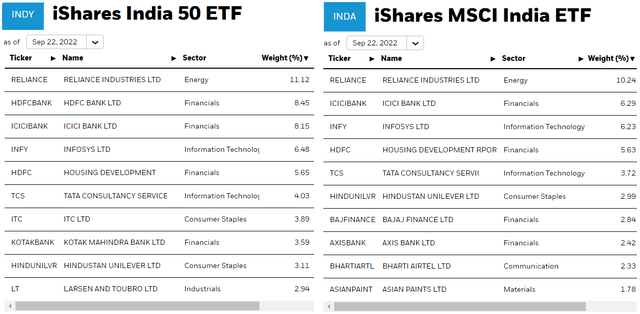

Going deeper, INDY has slightly less exposure to the IT sector compared to INDA as shown in the comparison below, but with above 10% of their respective assets invested in the shares of software services as shown in the table below, both funds are vulnerable to American and European clients tightening budgets because of economic slowdown concerns. In this connection, both Infosys (INFY) and Tata Consultancy Services have recently been downgraded by Goldman Sachs (GS).

Comparing Sectors – INDA and INDA (www.ishares.com)

On the other hand, both ETFs have higher exposure to Financials, which include banking with ICICI Bank and the specialist mortgage company Housing Development Finance Corporation, as shown in the comparison below.

Sector Analysis – Strength

There is also the Kotak Mahindra Bank which should benefit from an increase in interest rates as India’s central bank has no choice but to hike interest rates to support the rupee against an increasingly strong dollar. This optimism stems from the fact that this is a country where the commercial banking system holds above 64% of the total assets held by the financial sector, in contrast to the U.S. where it is the investment banks like JPMorgan (JPM) which hold most of the money.

Moreover, the Indian banking sector which is expanding rapidly, both through new entrants and incumbents extending their services, should also benefit from a strong rebound in the economy, after the 7.3% fall in GDP suffered over 2020-2021 caused by the pandemic. Thus, the country is expected to see a growth of 9.4% over the 2021-2022 period. Again, adopting a cautionary posture, this expansion, even if it falls slightly off target, remains in sharp contrast to the U.S., where there are risks of a slowdown as a result of the Fed aggressively increasing interest rates to tame persistently high inflation, and Europe where the energy crisis could result in a “winter recession.”

At the same time, the development of infrastructures like roads, bridges, etc., favors the construction and materials sectors comprising companies like Tata Steel and Asian Paints.

Comparing First Ten Holdings – INDA and INDA (www.ishares.com)

Coming to energy, India is bearing the brunt of the rise in the price of oil because the country is a net importer of the commodity. Thus, the recent fall in the price of crude oil, in case it is sustained, should prove beneficial, not only for the country’s external trade balance but also as margin expansion for companies operating as part of the industrial sector.

Furthermore, both of the two ETFs do have exposure to the energy sector, at less than 13% of their overall portfolio respectively, but, compared to the U.S., different industry dynamics are at play here. First, India’s oil companies mainly refine imported crude oil in contrast with those in the U.S. which also extract and export it. Second, according to one source, Indian oil refineries could benefit from cheaper Russian oil, conversely resulting in higher margins.

Comparing the Two ETFs in Light of Risks

Continuing on a positive note, consumer spending which is viewed as the backbone of the economy slowed in the second quarter of 2022 but is still amid the post-COVID recovery, which augurs well for discretionary and staples, comprising 16.2% and 18.1% of INDY and INDA respectively. For this purpose, India has a huge population and 450 million to 550 million people are expected to join the middle class by 2030, according to Bain Research.

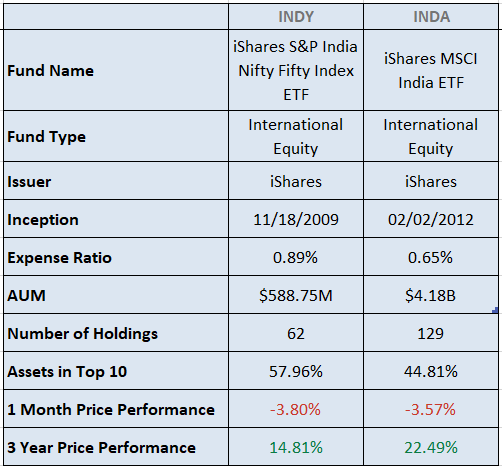

Therefore, both funds look appropriate for investors wishing to diversify part of their funds away from the U.S., but, income seekers are warned that despite paying dividends on a semiannual basis, distributions are not regular as none was effected in June 2022.

Looking at the comparison, INDA with an expense ratio of 0.65% and providing for better insulation against concentration risks with 129 holdings has performed much better for the last three years and is more appropriate. Consequently, I consider it a buy, and it could flirt again with the $45 level, but, only following a succession of favorable news about falling commodity prices and GDP news.

Comparing Key Metrics (www.seekingalpha.com)

This said, I have no bullish position currently as the SENSEX, which is an index composed of the top 30 stocks listed on the Bombay Stock Exchange, fell for three consecutive days last week after the latest interest rate hike by the Fed, possibly because of foreign money outflows following the U.S. dollar appreciating beyond the 80 rupee level. Thus, there could be further short-term pains till the Reserve Bank of India (“RBI”) brings some clarifications on monetary policy on September 30.

Conclusion

This thesis has made the case for investment in INDA following an analysis of sector strength and primarily addresses the needs of investors looking for geographical diversification. To this end, the ETF provides significant exposure to financials, a key sector of India’s domestic economy, where automakers that are primarily focused on meeting internal demand, are more insulated from international economic downturns than those in Japan for example.

On the other hand, the country faces a high external trade deficit and is largely dependent on commodity prices fixed by the international market. In this respect, India, in contrast to China, remains an importer of some of the most important raw materials for its manufacturing sector, namely industrial metals, semiconductors, and oil.

Continuing along the same lines, due to its proximity to Russia, the Indian leadership could take some flak from diplomats from Western countries as the Ukrainian conflict lingers on. Also, with borders with China on the East and Pakistan on the West, there is no shortage of ingredients to ignite geopolitical tensions. Therefore, invest with caution.

Still, given the resilience of the domestic economy, uncertainties in other major economies should help in sustaining inflows into Indian equities, in contrast with other countries.

Finally, there will be times when the central bank’s accommodative policy will be tested, especially when the local currency touches new lows against the dollar and the RBI will have to intervene to stop the decline, just like other central bankers throughout the world have to do. However, contrarily to other central bankers, including the Federal Reserve who are registering very high inflation, India has seen lower rates, implying that its central bankers may have relatively more room to maneuver.

Be the first to comment