Artem_Egorov/iStock via Getty Images

Imperial Oil (NYSE:IMO) is a Canadian Petroleum company with a $30 billion market capitalization that’s roughly 70% owned by Exxon Mobil (XOM). That ownership means the company’s share price tends to fluctuate less; however, in our view, given the company’s current valuation, it should be able to generate strong shareholder rewards.

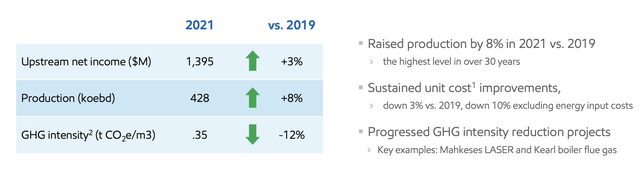

Imperial Oil 2021 Performance

Imperial Oil had some of its strongest performance ever through 2021, with no sign of that slowing down.

Imperial Oil Investor Presentation

The company had almost $1.4 billion in net income from its upstream business, with more than 400 thousand barrels/day in production. That enabled the company to raise production by 8% from 2021 to 2019 to the highest level in over 30 years. While increasing production, the company has managed to consistently decrease its costs.

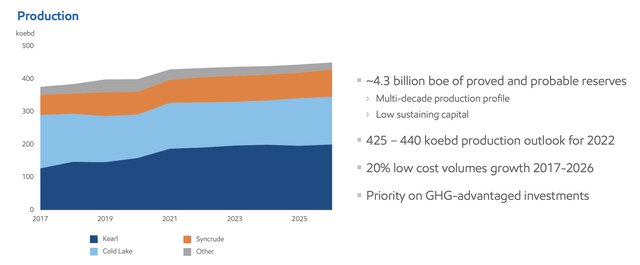

Imperial Oil Asset Base

Imperial Oil is no longer looking to chase production growth, but the company is instead looking to maintain production and focus on low costs and returns.

Imperial Oil Investor Presentation

The company has ~4.3 billion barrels of reserves which, at current production, represents well over 20 years worth of reserves. The company’s 2022 production outlook is roughly 430-435 thousand barrels / day, and the company expects that to remain fairly constant with just a few % annual production growth.

However, the company is looking to opportunistically decrease costs. Kearl unit costs are expected to decrease to a unit cash cost of <$20 USD / barrel. The company expects 15% higher cash earnings at the same oil price, as its portfolio improves, and 9% of that is due to an improving cash cost profile for the company.

It’s also worth noting that the company’s downstream & chemical assets actually earned more in 2022 versus 2021 for the company. The company is one of the smallest integrated oil companies, but it still extracts value at every stage of the process. These assets represent another location for the company to improve its margins

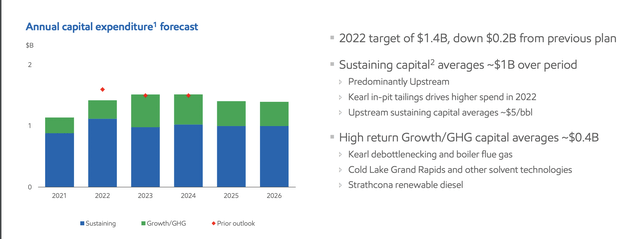

Imperial Oil Capital Spending

From a capital perspective, the company has had incredibly manageable capital spending that will enable future returns.

Imperial Oil Investor Presentation

The company’s 2022 target is for $1.4 billion in capital spending, a $0.2 decline from its previous plan. Long-term, the company expects to be spending roughly $1 billion in annual sustaining capital with roughly $0.4 billion spent on growth / GHG spending. That means the company will target long-term capital in the $1-2 billion range.

That capital spending is something that the company can comfortably cover while achieving shareholder returns.

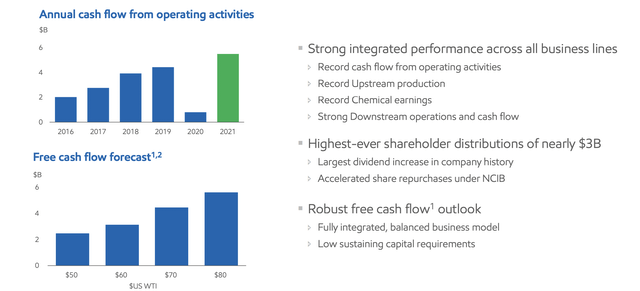

Imperial Oil Shareholder Return Forecast

Imperial Oil has the unique ability to generate substantial shareholder returns, showing the strength of its asset base.

Imperial Oil Investor Presentation

Imperial Oil is rapidly ramping up its shareholder returns, and we expect that doing so will heavily reward investors who invest now. The company has increased its dividend to a ~2.4% yield, a level that is sustainable for the long-term and one that it can comfortably afford. It maintained its dividend through COVID-19, and its new dividend will cost ~$750 million annually.

At the same time, the company is dramatically ramping up its buybacks. Since 2017, the company has decreased its share count from roughly 850 million to 670 million shares, or an almost 20% decline. Last year it decreased its outstanding shares by the high-single digits with billions in share buybacks. We expect that to accelerate.

At $80 WTI, the company generates almost $6 billion in FCF, at the $100 WTI average we expect, that number becomes closer to $8 billion. That’s enough for the company to repurchase more than 30% of its shares in 2022 alone. The company has recently announced a $2.5 billion tender, and Exxon Mobil has consistently tendered a proportional amount.

We expect that to continue driving substantial future shareholder returns. That helps highlight the company’s strength as an investment.

Thesis Risk

Imperial Oil’s strong integrated nature helps to highlight its strength and an investment for interested shareholders. Even at $60 WTI, the company has a more than 7% FCF yield, enabling consistent returns. However, there are still prices where the company is unprofitable. At less than that, the company’s value as an investment begins to decrease. Given the volatility in oil prices, that’s always a risk.

Conclusion

Imperial Oil’s 70% ownership by Exxon Mobil makes the company consistently fly under the radar. The company is effectively a subsidiary of Exxon Mobil, although as of yet, Exxon Mobil has yet to make an acquisition offer. It’s also one of the smaller integrated oil companies in the market, although its integrated assets mean strong cash flow.

The company started an aggressive portfolio of share repurchases during 2017, and it managed to continue these returns through 2020. The company has undergone several substantial share repurchases in 2022 and we expect it to be able to repurchase more than 30% of its shares throughout the year. Exxon Mobil has consistently tended an equivalent portion of its shares.

These repurchases will help drive massive overall shareholder returns, making the company a valuable investment.

Be the first to comment