peterschreiber.media/iStock via Getty Images

Impel Pharmaceuticals (NASDAQ:IMPL) has been under the radar since its IPO back in April of 2021 despite the company making significant progress in the launch of its flagship product Trudhesa into the growing migraine medication market. I believe this is a great opportunity to establish a position in IMPL while the market is unaware of the ticker’s upside potential.

I intend to provide a brief background on Impel Pharmaceuticals and will discuss Trudhesa’s launch thus far. In addition, I present the current opportunity IMPL offers and my leading downside risk. Finally, I reveal my plan for starting a position in IMPL before the crowd realizes the opportunity.

Company Overview

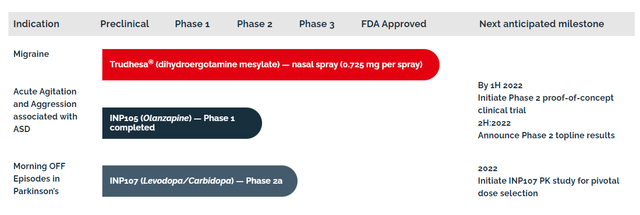

Impel Pharmaceuticals is a commercial-stage pharmaceutical company that develops and commercializes therapies for CNS diseases. The company’s flagship product, Trudhesa, is a nasal spray of dihydroergotamine approved for the treatment of acute migraines. The company is also developing INP105, a nasal spray of olanzapine for acute agitation and aggression in autism spectrum disorder. In addition, Impel is developing INP107, a nasal spray of carbidopa/levodopa for the treatment of OFF episodes in Parkinson’s disease.

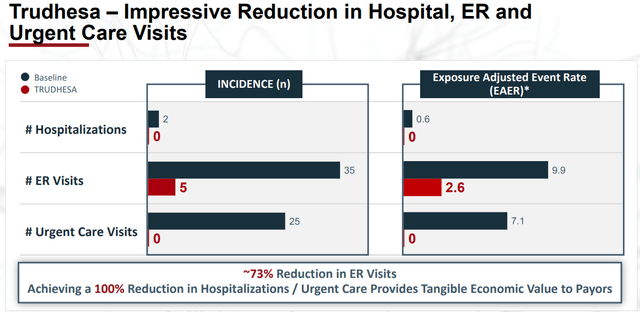

Trudhesa has impressive data that shows its ability to dramatically reduce hospitalizations, ER, and urgent care visits.

Trudhesa Reduction In Hospitalizations, ER, and Urgent Care Visits (Impel Pharmaceuticals)

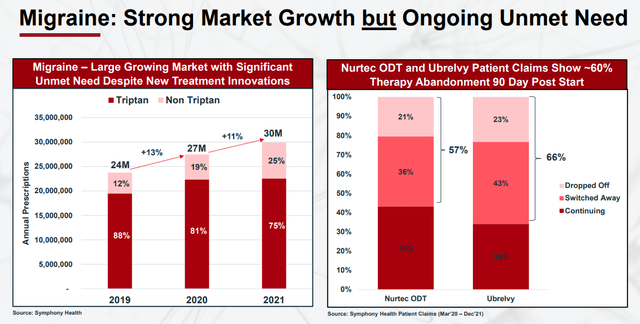

These results will help Trudhesa compete with other top-selling migraine products in a growing migraine market that still has unmet needs.

Migraine Market Growth (Impel Pharmaceuticals)

Underappreciated Performance

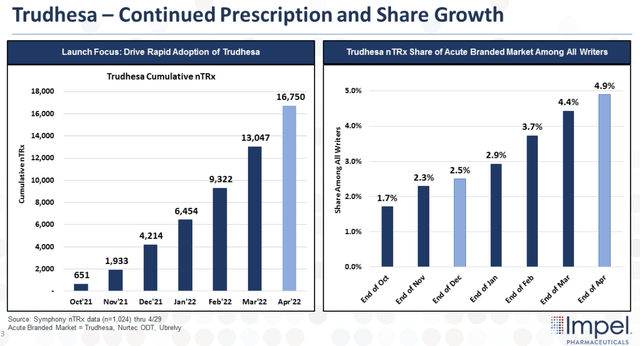

The company has made significant progress with its launch of Trudhesa and continues to make inroads into the large migraine market that continues to deliver robust growth. Despite multiple products on the market, many patients still don’t have reliable and well-tolerated pain relief. The company believes this is an opportunity for Trudhesa to maintain its prescription and market share growth.

Trudhesa Prescription and Share Growth (Impel Pharmaceuticals)

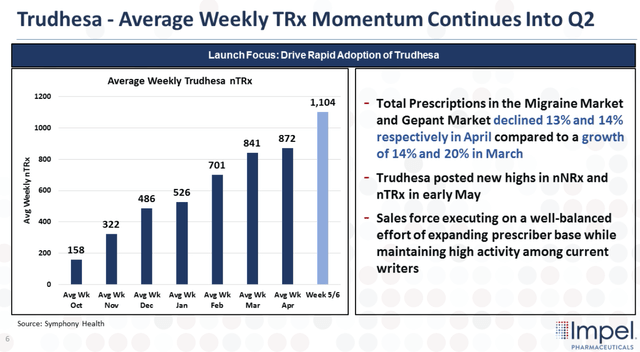

Looking at the figure above, we can see the sustained growth in total prescriptions with cumulative prescriptions reaching 16,750 by April of this year. Moreover, Trudhesa’s acute branded nTRx share among writers has doubled since Q4 to around 5% at the end of April. The company also reported that the average number of prescriptions per week is displaying steady month-over-month growth.

Trudhesa Weekly Trx Momentum (Impel Pharmaceuticals)

What is more, Trudhesa’s growth outpaced the overall migraine market including Nurtec ODT from Biohaven (BHVN).

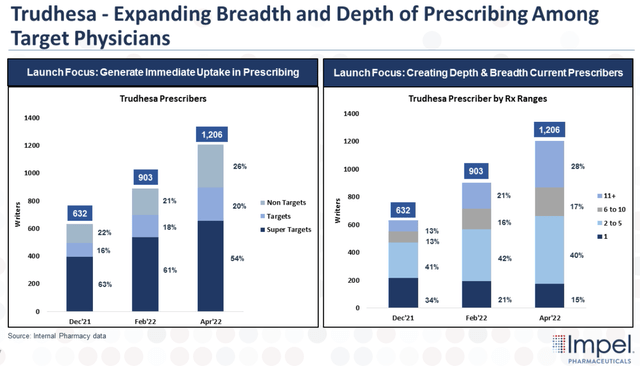

In terms of Trudhesa’s prescriber base, Impel has been able to add new prescribers including its high-volume Super Targets and Targets.

Trudhesa Target Prescribers (Impel Pharmaceuticals)

In Q1, Impel just about doubled the company’s total prescribers and increased the company’s Super Target and Target groups by 66% and 138%, respectively. Furthermore, Impel has seen an increase in Non-Target prescribing, with over 40% of the Non-Target prescribers being in a Target or Super Target account.

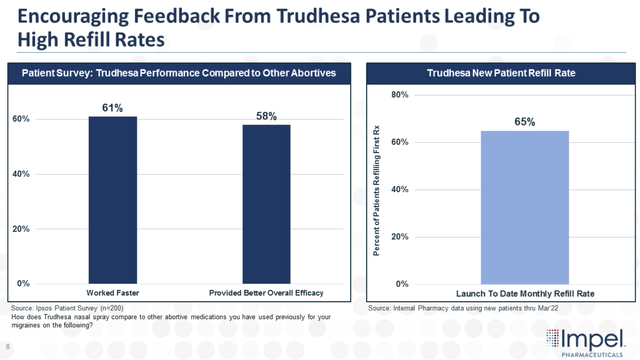

Not only are we seeing new patients and prescribers, but Impel has shown that patients remain on Trudhesa with refill rates around the 65%.

Trudhesa Refill Rates (Impel Pharmaceuticals)

This high refill rate for Trudhesa “is higher and more consistent than what you would see with other competitive products at this stage in the launch.”

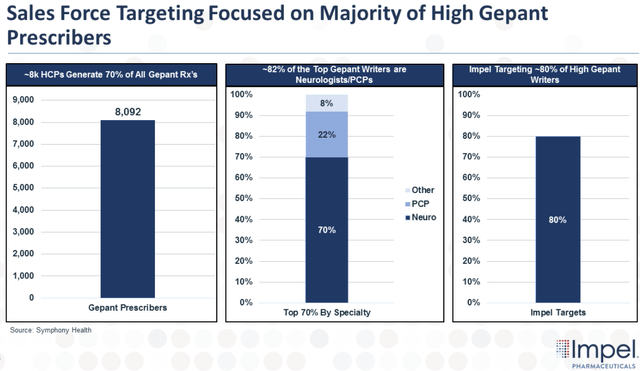

It looks as if the company’s disciplined commercial strategy for Trudhesa is yielding great results. Impel has focused its efforts on 8K target physicians that make up over 70% of all gepants prescriptions.

Sales Force Targeting Gepants Prescribers (Impel Pharmaceuticals)

Therefore, we can say that the company’s decision to focus on these high-volume writers is the most cost-effective approach.

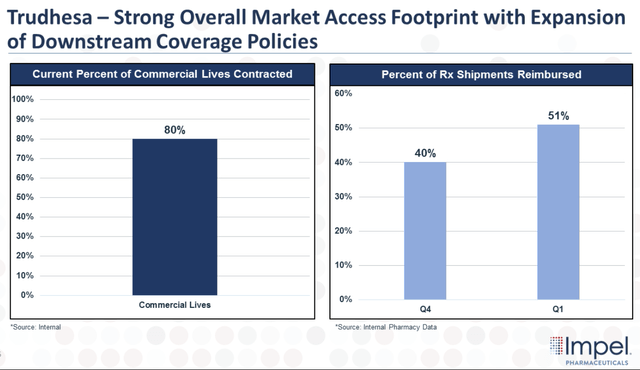

The company has been working with payers and has made excellent progress with market access to secure contracts that cover around 80% of commercial lives.

Trudhesa Coverage and Reimbursement (Impel Pharmaceuticals)

What is more, Impel reported that prescription shipments that have been reimbursed grew to 51% in Q1 and it expects these metrics to improve as we move into the second half of this year.

To recap, Impel is seeing strong growth in Trudhesa scripts and prescribers thanks to its targeted commercial strategy. In addition, Trudhesa’s refill rate and coverage will help ensure that growth trends are durable.

Pipeline Progress

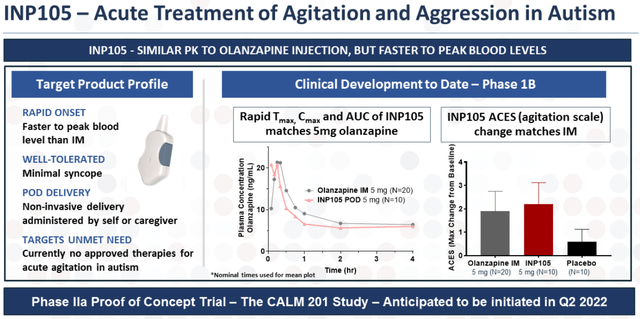

In addition to Trudhesa’s commercial launch efforts, Impel has been working on the development of INP105 for acute agitation and aggression in autism.

INP105 Overview (Impel Pharmaceuticals)

INP105 consists of a directed formulation of olanzapine, which is the most utilized treatment for acute agitation and aggression; however, it is currently limited to intramuscular injection. Impel believes that INP105 could significantly reduce emergency room visits for patients with autism spectrum disorder, which accounts for at least 220K ER visits per year.

So far, INP105’s Phase I study results revealed that INP105 reached peak plasma levels roughly 2x as fast as IM olanzapine and 10x as fast as oral tablets. Obviously, the quicker the uptake, the quicker the patient is tranquilized.

Impel is planning to start the CALM 201 Phase II proof-of-concept study in the first half of this year with topline data coming in the second half of this year.

Impel Pharmaceuticals Pipeline (Impel Pharmaceuticals)

The company is also looking to initiate INP107’s PK study for a pivotal dose selection for Morning OFF episodes in Parkinson’s patients at some point this year.

The Opportunity

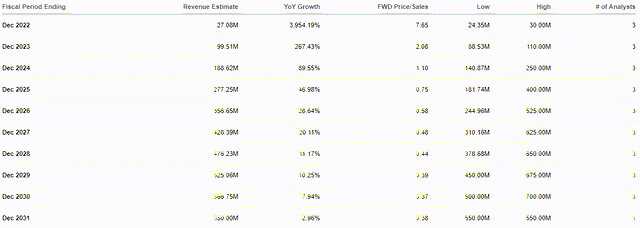

Impel has made a lot of progress with Trudhesa, and reported solid prescription growth and market share penetration along with excellent physician and patient interest in the drug. As a result, the company expects to hit its full-year guidance and deliver between 70,000 and 85,000 prescriptions. If all goes well, Impel will be reporting around $27M in revenue for 2022, which will be roughly a 4,000% increase over 2021.

Annual Revenue Estimates (Seeking Alpha)

This would be a forward price-to-sales of around 7.65x, which is above the sector’s average of 5x. However, the Street expects Impel to report robust revenue growth that will sustain into the next decade and top out around $567M, which is a 0.37x forward price-to-sales. Using the Street’s $567M revenue estimate for 2030 and the industry’s average price-to-sales of 5x, we get ~$122 per share for 2030. Admittedly, it might be hard to imagine the company going from pulling in $27M to $567M in less than a decade, and IMPL hitting $122 per share in eight years. However, the global migraine market is expected to grow at a CAGR of 9.9% and hit $12B in 2030. $567M in revenue would be less than 5% of the estimated migraine market in 2030… and that is excluding any potential contribution from INP105 and INP107. INP105 would be launching into an ASD global market that is expected to grow at a CAGR of 7.4% and hit roughly $3.17B by 2029. INP107 would be launching into a Parkinson’s Disease global market that is projected to grow at a CAGR of 6.2% over the remainder of the decade and hit about $8.4B by 2030. $567M would be less than 2.5% of the global markets for Trudhesa, INP105, and INP107. So, I don’t see those estimates to be extremely hyperbolic or unobtainable.

What is more, the company’s recent financing agreement with Oaktree Capital, in conjunction with its roughly $130M cash and cash equivalents, is expected to fund operations into 2024. This is significant because the revenue projections for 2024 are around $188M, which could be enough to bring the company to profitability, or at least very close. Therefore, it is possible that Impel might only need to execute one more secondary offering or take on a little more debt to fund the company until Trudhesa is able to pick up the bills.

Indeed, these are just estimates and we don’t know how much cash the company is really going to burn through, or if the company will hit those revenue projections. Moreover, we cannot bank on IMPL hitting $122 per share in 2030. However, these estimates do illustrate the possibility that Impel could experience significant growth over the remainder of the decade and is possibly only a couple of years away from profitability. For that reason, I believe IMPL is heavily discounted at its current prices and offers a great opportunity to establish a position ahead of this anticipated growth and before the company can fully leverage their POD technology with additional drug products.

Downside Risks

Of course, IMPL is not risk-free and investors need to be cognizant of the risks associated with cash-burning biotech and pharma tickers. The company only pulled in $1.8M in net product revenue for the first quarter of 2022, while reporting a net loss of $27M, so the gap between burn and earn is still immense. The reality is that Impel is going to burn through cash at a solid rate to fund Trudhesa’s commercial launch and keep the pipeline going over the coming quarters. Launching a migraine drug against competition like AbbVie (ABBV), Eli Lilly (LLY), Biohaven Pharmaceutical (expected to be acquired by Pfizer (PFE)), Teva Pharmaceutical (TEVA) and Amgen (AMGN) is going to be expensive. If the company fails to start closing this gap, the Street is going to have to adjust its outlook as the likelihood of multiple secondary offerings or taking on substantial debt increases. Secondary offerings will result in shareholder dilution, which will most likely have a negative impact on the share price and also potentially cut price targets.

As a result, I am looking to add IMPL in the Compounding Healthcare “Bio Boom” speculative portfolio at this time.

Getting There Ahead Of The Crowd

I believe IMPL is trading at a significant discount for its long-term growth prospects and current cash value. Yet, the ticker is trading under low volume and appears to be mostly unknown compared to its peers. In fact, IMPL has a 3-month average trading volume of around 74K shares. What is more, the company only had 590 followers on Seeking Alpha on June 23rd, 2022. I believe this is due to the company being a relatively fresh ticker that IPO’d last year and has had a limited amount of catalysts to bring eyes to the company. As a result, I’m looking to establish a position in the immediate term in order to get in ahead of the crowd and will build that position over the remainder of 2022.

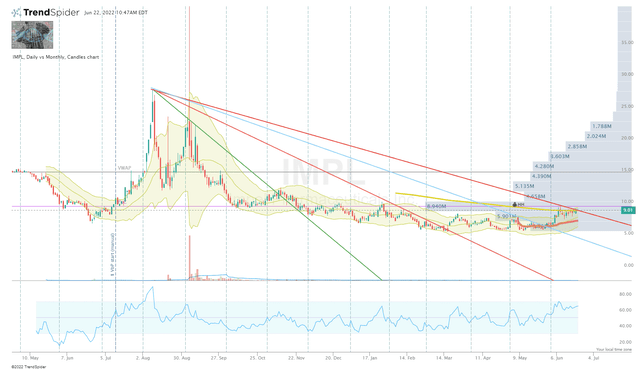

Looking at the Daily Chart, we can see that IMPL has pulled up off the lows over the past month after nearly a year of selling and sideways movement.

IMPL Daily Chart (TrendSpider)

I am looking to pull the trigger on a starter position under $9 per share and will make periodic investments over the remainder of the year. My goal is to have a half-sized position by the end of this year or into the first quarter of next year. Admittedly, I am looking to book profits on IMPL in order to compound in my bioreactor growth portfolio or healthy dividend portfolio or reapply those profits to IMPL at a later time.

Long term, I am looking to maintain a core position for at least 5 years in anticipation the company can maximize Trudhesa’s commercial potential and get its other pipeline programs across the finish line.

Be the first to comment