RHJ/iStock via Getty Images

Introduction

The Johannesburg-based Impala Platinum Holdings Ltd. (OTCQX:IMPUY) announced its H1 2022 interim results ending December 31, 2021, on March 1, 2022.

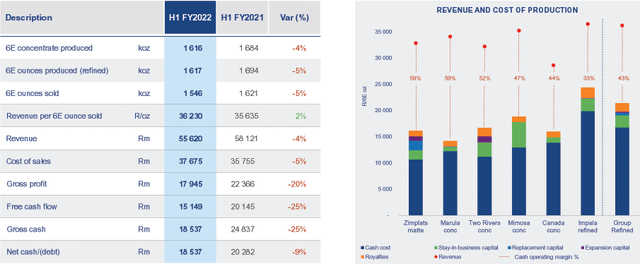

H1 2022 Results Snapshot

Impala Platinum posted a net income of $870.77 million or $1.06 per share in H1 2022. The company is still benefiting from a solid PGM basket price of $2,200 per 6E oz and has declared an interim dividend of $0.3546 per share for H1 2022.

IMPUY: Financial H1 2022 Presentation (Impala Platinum Holdings Ltd.)

Stock Performance

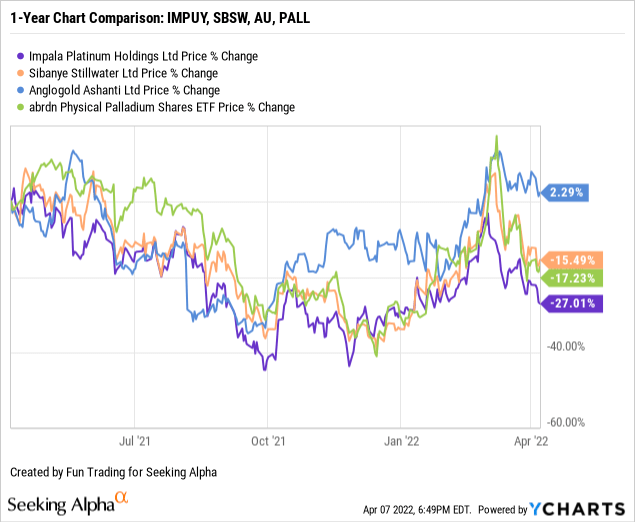

Impala Platinum Holding has underperformed two of its peers, AngloGold Ashanti (NYSE: AU) and Sibanye Stillwater (SBSW). One ETF that could be great to follow in this platinum/palladium segment is the Aberdeen Standard Physical Palladium Shares ETF (NYSEARCA: PALL).

IMPUY dropped significantly in October 2021 due to a painful slide in palladium price that extended through January 2022. IMPUY is down 27% on a one-year basis, slightly underperforming SBSW.

The Investment Thesis

IMPUY is a good PGM company that I recommend investing in for the long term.

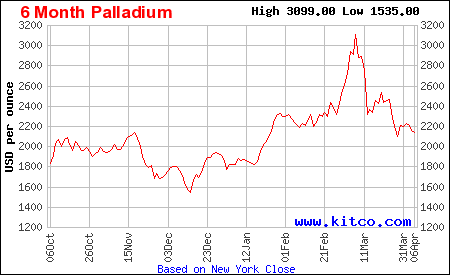

However, the sector is highly volatile following the PGM prices, notably Palladium, Rhodium, and Platinum, weakening lately. Furthermore, mining in South Africa is not easy and presents issues (e.g., unreliable power grid, labor instability…).

IMPUY: 6-month Chart Palladium from Kitco (Kitco.com)

Thus, while MPUY is an outstanding stock with good growth prospects for a long-term investment, I recommend trading LIFO for about 30-40% of your long-term position.

Doing so will lower any downside risks and allow you to add on weaknesses.

CEO Nico Muller said in the press release:

The financial consequences of a series of operational challenges were compounded by softening rand PGM pricing. The ongoing impact of the Covid-19 pandemic continues to be felt in constrained labour and skills availability, elevated absenteeism and heightened community dissatisfaction… Inflationary pressures were compounded by the strategic decision to increase labour to facilitate mining development rates and the payment of discretionary employee bonus in recognition of the Group’s strong financial performance in FY2021.

Global Presentation

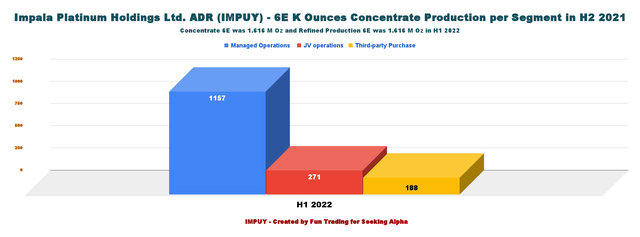

To simplify the company’s profile, the 6E production (concentrate) comes from three distinct groups:

- Managed mining Operations: Impala, Zimplats, Marula, and, more recently, Impala Canada (Take over of the North American Palladium on Dec. 19, 2019, which I have covered extensively in the past). H1 2022, production was 1,157K oz.

- Joint Venture operations: Mimosa and Two Rivers. H1 2022 production was 271Koz.

- Third-party Purchased: H1 2022 production was 188Koz.

Note: Production of concentrate was 1,616K oz.

IMPUY: 6-month Chart 6E Production per segment in H1 2022 (Fun Trading)

Royal Bafokeng Platinum Acquisition Coming In June

Note: Impala already owns 35.3% shareholding in RBPlat

Impala Platinum intends to acquire 100% of Royal Bafokeng Platinum, paving the way to create one of the world’s biggest platinum group metals miners. Royal Bafokeng’s shareholders gave the green light, and Impala Platinum will ask its shareholders to decide in June 2022.

Should Royal Bafokeng shareholders accept Impala’s offer, the blended miner will produce about 3.45 million ounces of PGMs a year, overtaking both Sibanye Stillwater and Anglo American Platinum in terms of output, and rivaling Russian giant MMC Norilsk Nickel (MCX: GMKN).

The company said that this future acquisition “will secure a Western Limb production base, enhance and entrench the region’s position as the most significant source of global primary PGM production, and deliver tangible socio-economic benefits for the region.”

The offer consideration for every RBPlat share consists of R90 cash and 0.30 Implats shares.

If this transaction is completed, I expect IMPUY to go down for a while. It is often the case in such a significant transaction.

Impala Platinum Holdings Ltd. – Balance Sheet And Production History For H1 2022: The Raw Numbers

Note: As for most South African gold and PGM miners, full results end in December. The recent results are the interim results for H1 2022.

Note: The data indicated have been translated into $US using the $US/ZAR ratio of 15.89. The ratio between Implats ordinary South African (ZAR denominated) shares and the ADR is 1:1. Implats shares trade on OTCQX, the premier tier of the Over-the-Counter (OTC) market in the USA, as ADRs.

| IMPUY | 6/2020 | 12/2020 | 6/2021 | 12/2021 |

| Total Revenues in $ Million | 2,441.43 | 3,905.51 | 5,135.74 | 3,499.96 |

| Net income in $ Million | 738.41 | 1,685.15 | 1,577.94 | 870.77 |

| EBITDA $ Million | 1,242.84 | 2,623.27 | 2,537.32 | 1,462.91 |

| EPS diluted in $/share | 0.87 | 2.02 | 1.99 | 1.06 |

| Cash from operating activities in $ Million | 649.99 | 1,462.66 | 1,442.31 | 1,107.06 |

| Capital Expenditure in $ Million | 140.95 | 171.22 | 267.16 | 215.85 |

| Free Cash Flow in $ Million | 509.04 | 1,291.44 | 1,175.15 | 889.21 |

| Total Cash $ Million | 778.21 | 1,669.15 | 1,759.49 | 1,231.28 |

| LT Debt (incl. current) In $ Million | 442.51 | 11.69 | 0.07 | 0 |

| Share outstanding diluted in million | 858.80 | 840.62 | 790.41 | 819.99 |

| Dividend $/ share | 0.2348 | 0.6772 | 0.8015 | 0.3546 |

| $US/ZAR ratio | 18.66 | 14.88 | 14.32 | 15.00 |

| PGM Production | 6/2020 | 12/2020 | 6/2021 | 12/2021 |

| Concentrate Production 6E Koz | 1,311 | 1,684 | 1,608 | 1,616 |

| Refined Production 6E Koz | 1,496 | 1,694 | 1,577 | 1,617 |

| Group Unit Cost Rand/Oz/6E | – | 879 | 1,066 | 1,054 |

| Platinum price $/oz | – | 915 | 1,043 | 1,022 |

| Palladium price $/oz | – | 2,265 | 2,419 | 2,200 |

| Basket price 6E in $/oz | 1,624 | 2,197 | 2,587 | 2,280 |

Source: The company booklets and Fun Trading.

Note: The Dividend paid is reduced by a 25.6% haircut, representing the foreign tax withheld and costs.

Impala Platinum Holdings: Balance Sheet Details

1 – Revenues And Trend

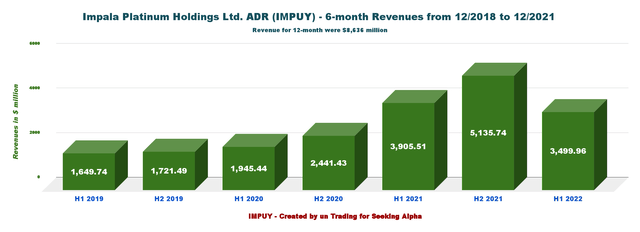

IMPUY: 6-month chart Revenues history (Fun Trading)

Impala Platinum revenues for H2 2022 were $3,499.96 million, down significantly from the preceding 6-month period. Net income was $870.77 million, down from $1,577.94 million in H2 2021. Please look at the table above.

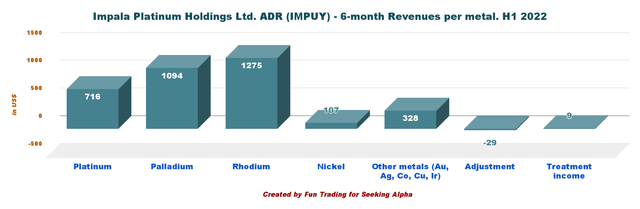

As we can see below, rhodium represents the lion’s share of the revenues.

IMPUY: 6-month chart Revenues per metal in H1 2022 (Fun Trading)

2 – Free Cash Flow Was $889.21 Million In H1 2022

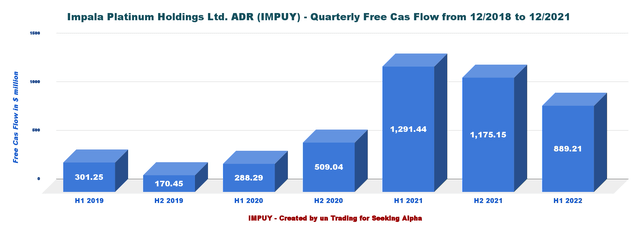

IMPUY: 6-month Chart Free cash flow history (Fun Trading)

Note: Generic free cash flow is the cash from operations minus CapEx. In some cases, the company indicates a different calculation (non-GAAP), including other components such as acquisitions.

Free cash flow for H1 2022 was $889.21 million, or a trailing 12-month free cash flow of 2,064.36 million.

The company is paying an interim dividend of $0.3546 per share. However, do not forget that you will receive approximately 74.4% of this amount after foreign tax is withheld and costs.

3 – H1 2022 Impala Platinum Holdings’ Debt Situation Is Excellent

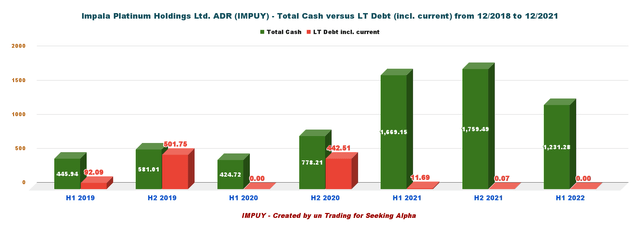

IMPUY: Chart 6-month Cash versus Debt History (Fun Trading)

The company is debt-free, with $1,231.28 million in cash. Liquidity is now R26.5 billion or $1,670 million. In the booklet:

Implats closed the period debt free, with a closing net cash position, excluding finance leases, of R18.5 billion and liquidity headroom of R26.5 billion.

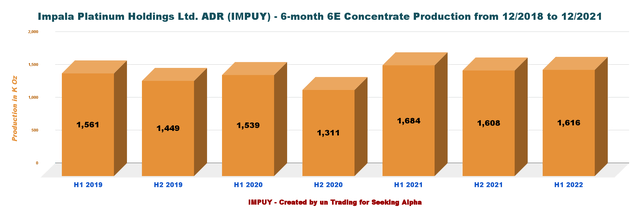

4 – H1 2022 6E Concentrate Production Analysis

IMPUY: 6-month Chart Production 6E history (Fun Trading)

Group refined 6E production was 1,616K ounces, a decrease of 4% (including commercial production from Impala Canada) from 1,684K ounces in the prior comparable period.

The company said in the booklet:

It was a challenging period for Implats. The financial consequences of a series of operational challenges were compounded by softening rand PGM pricing, which came off the record highs reached in late FY2021. The ongoing impact of the Covid-19 pandemic continues to be felt in constrained labour and skills availability, elevated absenteeism and heightened community dissatisfaction and lawlessness.

Conditions in South Africa are not ideal, and it is one factor that we should factor in when investing in this segment. A few recurring issues are

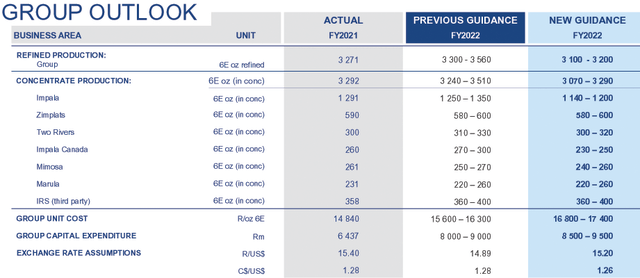

5 – 2022 Guidance Revised

Production expected has been revised to 3100-3200K 6E oz from 3300-3560K 6E oz. It is a haircut of 6.8%.

IMPUY – 2022 Guidance revised Presentation (Impala Platinum Holdings)

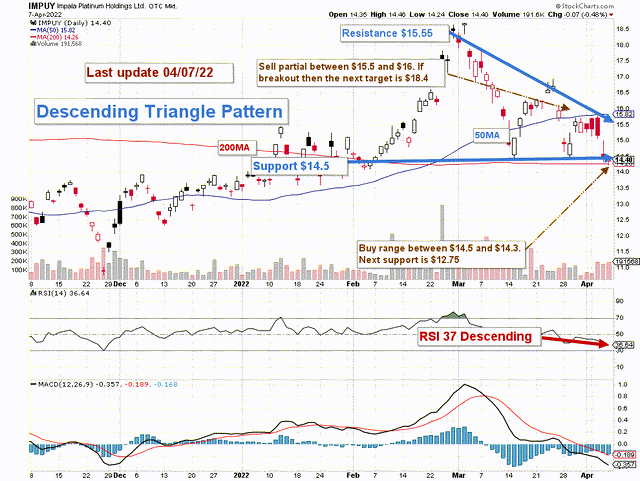

Technical Analysis And Commentary

IMPUY: TA Chart short-term (Fun Trading)

Note: The chart is adjusted for the dividend.

IMPUY forms a descending triangle pattern with resistance at $15.55 and support at $14.50. I suggest that the trading strategy is to take profits (about 25%) between $15.5 and $16. I recommend accumulating again between $14.5 and $14.3.

IMPUY is correlated to the price of PGM, especially palladium and rhodium. Thus, watch those prices like a hawk.

If Palladium and Rhodium turn bullish, which has not been the case since early March, IMPUY could breakout and retest $18.4. Conversely, if those metals turn bearish, IMPUY could quickly drop below $13.

Note: We should expect some weakness in June or July after the merger with Royal Bafokeng is completed.

Warning: The TA chart must be updated frequently to be relevant. It is what I am doing in my stock tracker. The chart above has a possible validity of about a week. Remember, the TA chart is a tool only to help you adopt the right strategy. It is not a way to foresee the future. No one and nothing can.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support.

Be the first to comment