naphtalina/iStock via Getty Images

Immutep (NASDAQ:IMMP) develops LAG-3 based immunotherapies targeting autoimmune and oncology diseases. They have 4 self-owned and outlicensed product candidates – eftilagimod alpha (efti or IMP321), IMP761, IMP701 (LAG525) and GSK781.

The company has a late stage Phase IIb trial called TACTI-003 for efti in patients with head & neck cancer, which is partnered with Merck (MRK). They have other late stage trials around the corner, and partnerships with major players like Novartis (NVS), GSK (GSK) and others. In an earlier trial, efti was able to double the response rate of Keytruda in 1st line NSCLC and 2nd line HNSCC (TACTI-002 trial). That is, in a nutshell, what the company tells us about itself.

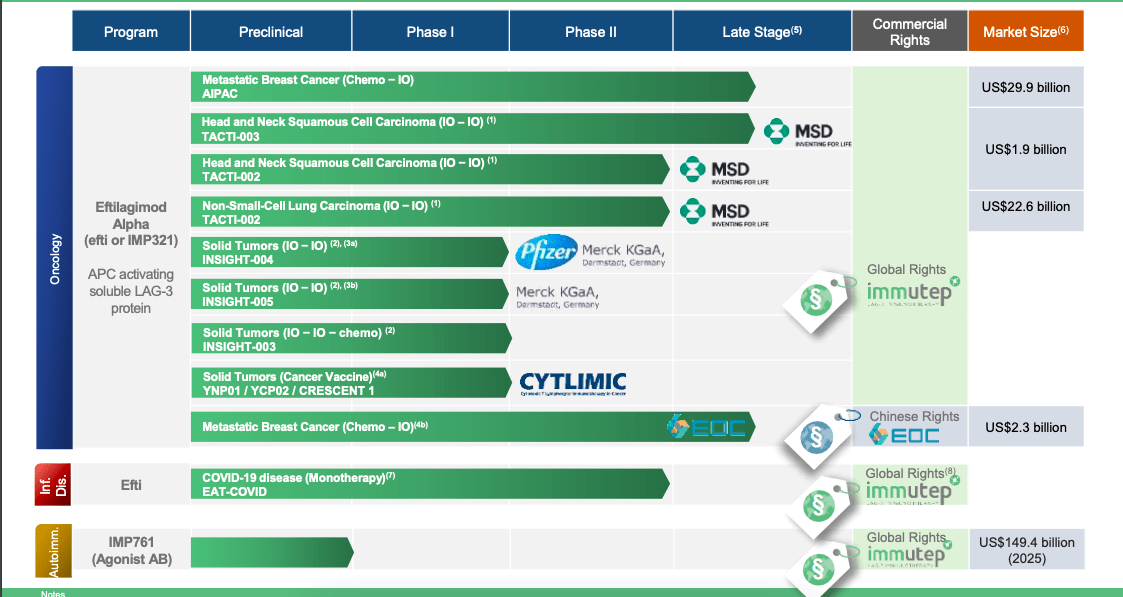

Here’s how the company’s pipeline looks like:

Immutep pipeline (Immutep website)

Lead product candidate is eftilagimod. It is a soluble recombinant LAG-3Ig fusion protein and an APC or antigen presenting cell whose primary function is to improve the immune response of the body. A number of trials have been or are being conducted for the asset.

A second asset, LAG525, is currently owned by Novartis who are running a number of trials on it. Another molecule, IMP731 (GSK`781), is licensed to GSK for a small sum of money. This last program had some hiccups last year – see here.

The company recently presented data from the TACTI-002 trial at ASCO, just last week. The trial met the primary endpoint in 114 1st line non-small cell lung cancer (NSCLC) patients.

TACTI-002 has met its primary objective for 1st line non-small cell lung cancer (NSCLC) patients in a PD-L1 all-comer Phase II clinical trial conducted in collaboration with MSD (N=114). The efti plus keytruda combo showed favorable anti-tumor activity, improving ORR by 38.6% in the intent-to-treat population. According to Immutep CSO and CMO, Dr. Frederic Triebel, this compares favorably with historical results in similar settings where ORR has been “typically around 20%.” In PD-L1 negative (TPS < 1%) and PD-L1 low (TPS 1-49%) patients expressing tumors, response was observed as well – and these are patients who are less likely to respond to anti-PD-1 monotherapy. The drug was safe and well-tolerated, with low patient discontinuation rates.

In Part C of this trial, which focused on HNSCC, there were 5 CRs and 6 PRs, with an ORR of 29.7%. 12-month OS was above 50%. There was sustained duration of response, with median DOR not yet reached, and sustained responses lasting 9+ months for all ongoing responses. Critically, when benchmarked against keytruda alone, ORR was “clearly higher” (≥ factor 2) in all PD-L1 subgroups and overall; as was PFS and OS.

Financials

IMMP has a market cap of USD 222mn and a cash balance of A$87mn (these are in Australian dollars). Because this is a foreign reporter, they publish financial data differently. Here’s what I found from their form 6F – “The net cash used in G&A activities in the quarter was $1.6 million… The net cash used in Research and Development activities in the quarter was $8.13 million… The Company’s cash and cash equivalent balance as at 31 March 2022 was $87.20 million compared to a balance of $99.66 million as at 31 December 2021. Immutep’s higher than planned cash balance puts the company in a strong financial position with an expected cash reach based on current estimates of early 2024.”

Bottomline

IMMP is doing interesting work in a new field of immunotherapy. I called it new because LAG3 is less known, however there are over a dozen large and many other small companies doing work in the area. Data available is too early, and competition is strong and from big pharma – recently, Bristol Myers (BMY) anti-LAG3 Opdualag/relatlimab was approved by the FDA for advanced melanoma. Reporting standards are also different in Australia, and US trading volume is very low. Given all that, while I will continue watching this company, I am not going to invest right now.

About the TPT service

Thanks for reading. At the Total Pharma Tracker, we offer the following:-

Our Android app and website features a set of tools for DIY investors, including a work-in-progress software where you can enter any ticker and get extensive curated research material.

For investors requiring hands-on support, our in-house experts go through our tools and find the best investible stocks, complete with buy/sell strategies and alerts.

Sign up now for our free trial, request access to our tools, and find out, at no cost to you, what we can do for you.

Be the first to comment