“Risk comes from not knowing what you’re doing.” – Warren Buffett

In biotech investing, whenever a company gained FDA approval for its lead medicine, you have to analyze the event to see if there are further upsides. Typically, a stock tends to run up toward its approval. Therefore, the share price can be baked into the approval itself. From the fundamental viewpoint, you have to assess if the drug can generate blockbuster sales results. After all, sales results would determine the long-term share price of your investment.

That being said, ImmunoGen (NASDAQ:IMGN) recently gained FDA approval for its lead medicine (mirvetuximab) as a treatment for resistant ovarian cancer. In this research, I’ll feature a fundamental analysis of ImmunoGen while focusing on the aforesaid approval. Moreover, I’ll share with you my expectation of this equity.

Figure 1: ImmunoGen chart

About The Company

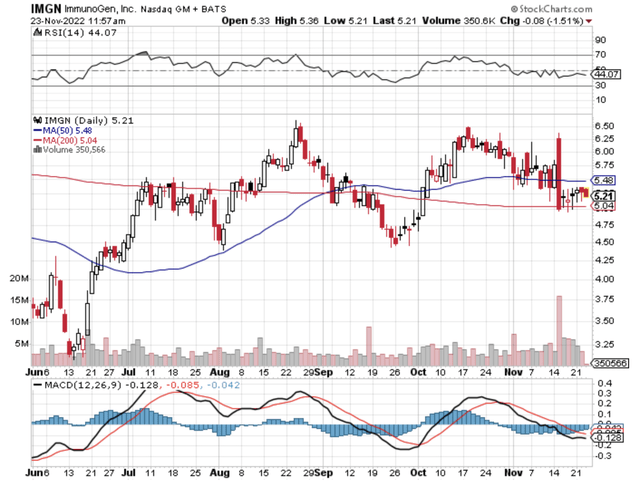

As usual, I’ll present a brief corporate overview for new investors. If you are familiar with the firm, I recommend that you skip to the subsequent section. Headquartered in Waltham Massachusetts, ImmunoGen dedicated its efforts to the innovation and commercialization of antibody-drug conjugate (“ADC”) to fulfill the unmet needs in various cancer indications. I noted in the prior article,

… the firm is brewing an intriguing pipeline of “smart medicines.” Among various molecules, you can see that mirvetuximab (i.e., Mirve) is the crown jewel. Accordingly, ImmunoGen is investigating its use as monotherapy (i.e., stand-alone drug) and in combo with other medicines for various cancers. That aside, ImmunoGen is advancing other intriguing molecules such as IMGN-632 (i.e., pivekimab), IMGC-9326, and IMGN-151 for both solid tumors and blood cancers.

Figure 2: Therapeutic Pipeline

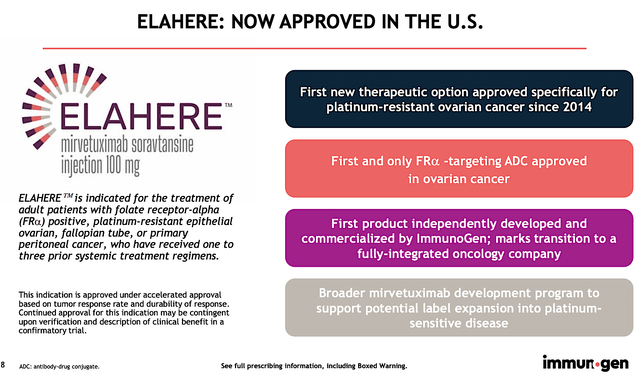

Elahere Accelerated Approval – Pros

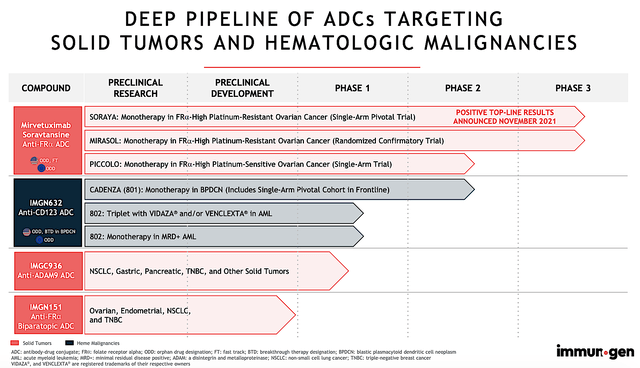

Shifting gears, let us take a deep dive into the latest regulatory victory for ImmunoGen. As follows, the company announced on November 14 that the FDA has granted the approval of Mirve for patients afflicted by ovarian cancers with high FRA expression and having failed platinum therapy. Accordingly, Mirve will be marketed under the brand, Elahere.

Figure 3: Elahere approval

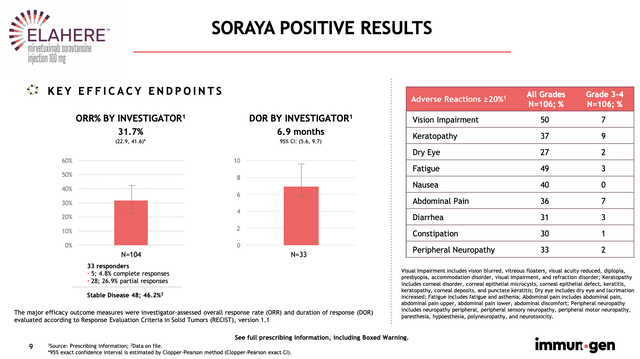

This is an interesting development because it’s an “accelerated approval.” Precisely speaking, the accelerated approval was based on the strong data of the single-arm SORAYA trial that assesses the efficacy and safety of Mirve in 106 patients. In the said trial, patients treated with Mirve enjoyed the 31.7% Objective Response Rate (i.e., ORR) and 6.9 months Duration of Response (i.e., DOR).

Figure 4: Strong SORAYA outcomes

Since it’s an accelerated approval, ImmunoGen would have to supply the FDA data from the larger and higher quality (MIRASOL) trial for full approval. As you can appreciate, the early approval enables ImmunoGen to launch Elahere to start generating revenues. In the launch, a couple of months can translate into hundreds of millions of dollars in profits. More importantly, early approval would deliver hope to patients in seemingly hopeless situations.

That aside, the fact that Elahere is the “first of its kind” (i.e., an ADC for patients afflicted by ovarian cancer with high FRA expression) would increase its chances of marketing success. Generally speaking, the “first of something” tends to get the most dominant market shares and gain the most market traction. Commenting on the approval, the President and CEO (Mark Enyedy) remarked,

With an indication for use regardless of prior treatment with Avastin, we believe Elahere is positioned to become the new standard of care for patients with FRα-positive platinum-resistant ovarian cancer. Elahere’s accelerated approval is a testament to the decades of work dedicated to developing the next generation of ADCs and marks ImmunoGen’s transition to a fully-integrated oncology company and the start of an exciting new chapter for us as a leader in the development and commercialization of innovative oncology products. With a highly experienced commercial and medical team in place, we are well prepared to support a successful launch and deliver ELAHERE rapidly to patients across the US.

Elahere – Cons

Despite Mr. Enyedy’s optimism, you can see that there are significant hurdles against Elahere’s launch success. Though there is increased demand for the “first of its kind,” there is only a limited number of patients having high FRA expression.

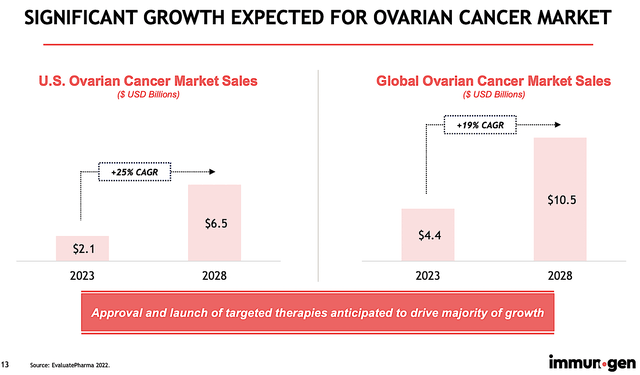

That is to say, despite the 19% CAGR growth rate for the $10.5B global ovarian cancer, I believe that the market for high FRA expression is much lower. As such, that lowered the upside to Elahere’s revenue. To enjoy a significant revenue increase and sizeable profit margin, ImmunoGen would have to price Elahere at a substantial premium.

Figure 5: Ovarian cancer market

Asides from the small market size, these patients are very sick. As such, they have already been treated with one to three prior therapies. As a rule of thumb, you can expect that sales for a second, third, or fourth-line drug like Elahere won’t be significant. Only first-line medicine is likely to become a blockbuster (i.e., a drug that generates at least $1B in annual sales).

That aside, Elahere will be used in conjunction with a companion diagnostic known as VENTANA FOLR1 (FOLR1-2.1) RxDx Assay that is concurrently approved with the drug. You can argue that a companion diagnostic would boost sales. Nevertheless, it would create another layer of complexity to deter prescription.

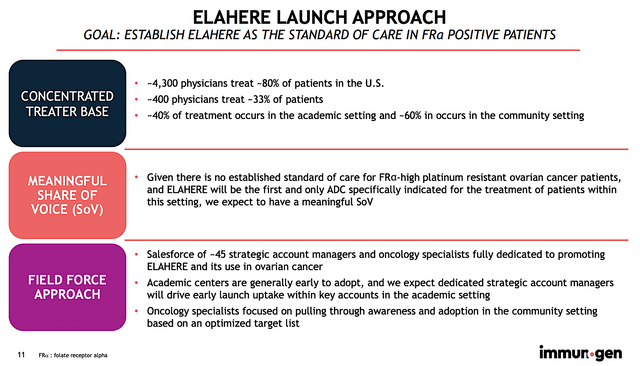

Most importantly, ImmunoGen would be launching the drug in-house (i.e., going at it alone) which deter its marketing success. As you know, a small company like ImmunoGen has limited resources (both financials and human capital) to deliver its drug to the most number of patients possible. It also takes time for professional sales reps to build relationships with physicians. Hence, you should not expect a quick sales ramp-up. I’d say that it’s generous to give the company around three years to see significant sales traction.

Figure 6: Elahere launch strategy

Financial Assessment

Just as you would get an annual physical for your well-being, it’s important to check the financial health of your stock. For instance, your health is affected by “blood flow” as your stock’s viability is dependent on the “cash flow.” With that in mind, I’ll analyze the 3Q2022 earnings report for the period that ended on September 30.

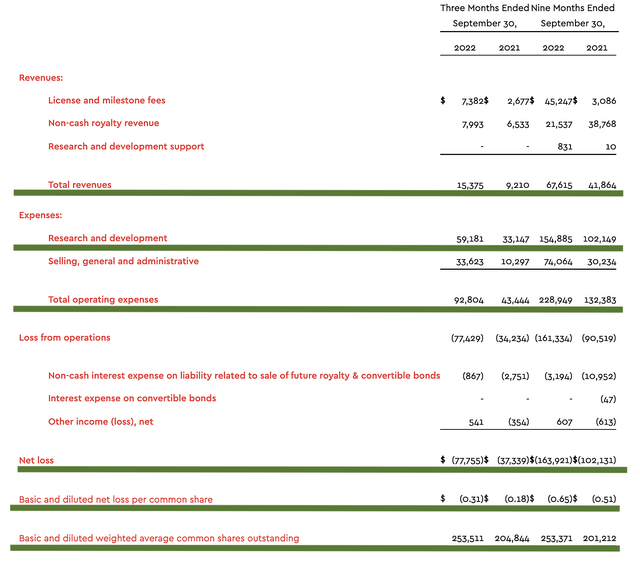

As follows, ImmunoGen procured $15.3M in revenue compared to $9.2M for the same period a year prior. As such, the company enjoys a 66.3% year-over-year (YOY) revenue increase. That aside, the research and development (R&D) for the respective periods registered at $59.1M and $33.1M. I viewed the 78.5% R&D increase positively because the money invested today can turn into blockbuster profits.

Additionally, there were $77.7M ($0.31 per share) net losses compared to $37.3M ($0.18 per share) declines for the same comparison. As you can see, the company encountered a higher bottom-line depreciation because it invested more in R&D.

Figure 7: Key financial metrics

About the balance, sheet, there were $309.5M in cash and equivalents. Against the $92.8M quarterly OpEx and on top of the $15.3M quarterly revenue, there should be adequate capital to fund operations into 3Q2023. Simply put, the cash position is a bit weak relative to the burn rate. As such, I believe that ImmunoGen would do a public offering either this quarter or the next.

While on the balance sheet, you should check if ImmunoGen is a “serial diluter.” After all, a company that is serially diluted will render an investment essentially worthless. Given that the shares outstanding increased from 204M to 253M, my math revealed a 24.0% annual dilution. At this rate, ImmunoGen cleared my 30% cut-off for a profitable investment.

Potential Risks

Since investment research is an imperfect science, there are always risks associated with your stock regardless of its fundamental strengths. More importantly, the risks are “growth-cycle dependent.” At this point in its life cycle, the main concern for ImmunoGen is whether Mirve would clear its MIRASOL trial by early next year to gain full approval.

That aside, there are risks that other pipeline drugs might not deliver positive data. Moreover, a turnaround play entails tremendous risks. Furthermore, the cash burn is a bit high relative to the cash position which can cause cash flow constraints.

Final Remarks

In all, I reduced my recommendation of ImmunoGen, from a strong buy to a buy. ImmunoGen is an interesting stock with excellent potential. As a turnaround play, the company recently gained the FDA approval of Elahere for resistant ovarian cancer with high FRA expression. The approval is the easier part. The tougher challenge is to ramp up sales. Due to the fact that ImmunoGen is launching Elahere alone, you should not expect aggressive sales increases. There are also other factors like small market size and the fact that Elahere is a fourth-line drug which would deter launch success. Nevertheless, the key to ImmunoGen’s success is the upcoming full approval and more importantly various label expansion.

Of various catalysts, you can expect that the most important one is the upcoming MIRASOL data release that would determine whether ImmunoGen is indeed a growth biotech or still a turnaround play. If ImmunoGen can demonstrate full approval next year and gain some market traction, then the company is likely to become a growth stock.

Be the first to comment