benedek

Ian’s Million Fund, “IMF,” is a real-money portfolio that I’ve written about monthly since January 2016 here at Seeking Alpha. The portfolio is a largely buy-and-hold group of ~130 stocks. Each month, I buy 10-20 of the most compelling stocks available at then-current prices, deploying $1,000 of my capital plus accumulated dividends. If things go according to plan, this portfolio, which began when I was 27, will hit one million dollars in equity in 2041 at age 52. I intend it to serve as a model for other younger investors.

I made this past month’s purchases on August 24. The stock market had already pulled back significantly off the summer highs, offering some decent values this month. That said, stocks have continued to slump since then, so even better prices are available on many of these names today.

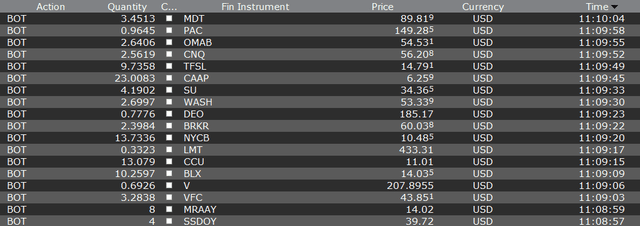

Here are the 18 stocks I purchased for August:

August Portfolio Purchases (Interactive Brokers)

I reinvested the portfolio’s dividends for the month into Medtronic (MDT) for reasons I recently discussed in Medtronic: An Undervalued Dividend Aristocrat.

Also, there was more capital than usual this month to invest. That’s because I sold Bachoco (IBA) out of the IMF portfolio at $47.15 per share. The company is being acquired at approximately $48/share by its controlling family, and I didn’t see much reason to stick around for an undetermined period of time to get the last bit of the merger arb spread, particularly when IBA stock has traded far under the takeover price at other points this summer.

Bachoco was one of the portfolio’s top 25 holdings by position size, and thus returned a fair sum of capital to be invested back into other stocks. Shares exited the portfolio with a 14% capital gain plus dividends, which is hardly the sort of upside I was looking for upon purchase of the stock, but a win is a win and I’m happy to roll that capital into fresh opportunities.

For the purchases this month, I’ll start out by linking to my recent coverage on some of these stocks. Given that I’ve just written articles on them, I don’t see a need to rehash the thesis today. Here’s my latest on:

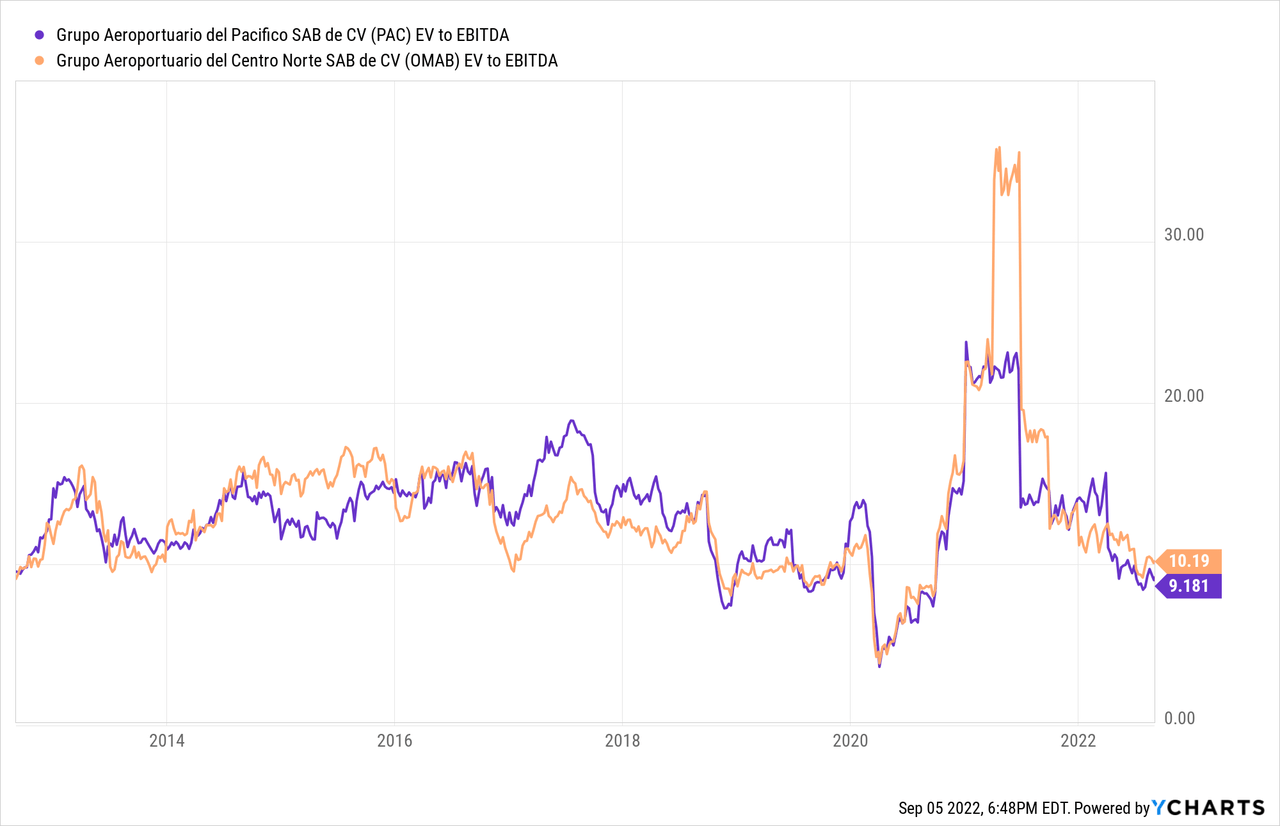

I’m once again adding to the Mexican airports, namely Centro Norte (OMAB) and Pacifico (PAC). While the stock prices are up, their earnings are up more, meaning that the stocks are actually getting cheaper on a valuation basis.

These have historically traded close to 15x EV/EBITDA instead of 10x where they are now. Just going back to a normal valuation is 50% upside from here. And EBITDA grows at a double-digit annualized rate.

Say, for example, that a company’s EBITDA starts at 100 this year and grows at 14% per year, it will hit 200 in 2027. Investors can buy at the equivalent of 67 today, given that the airport shares are a third undervalued from where they should normally be based on their historical medians.

Applying this example, shares of Pacifico and Centro Norte should, as a base case, triple over the next five years. Ideally, the companies should be worth more than 15x EV/EBITDA and could very well get there once Mexico finally has a bull market (it’s been in a bear market since 2013). But, as a base case, I see the Mexican airport stocks tripling over the next five years simply from delivering their normal growth rates and trading at their historical valuation ratios.

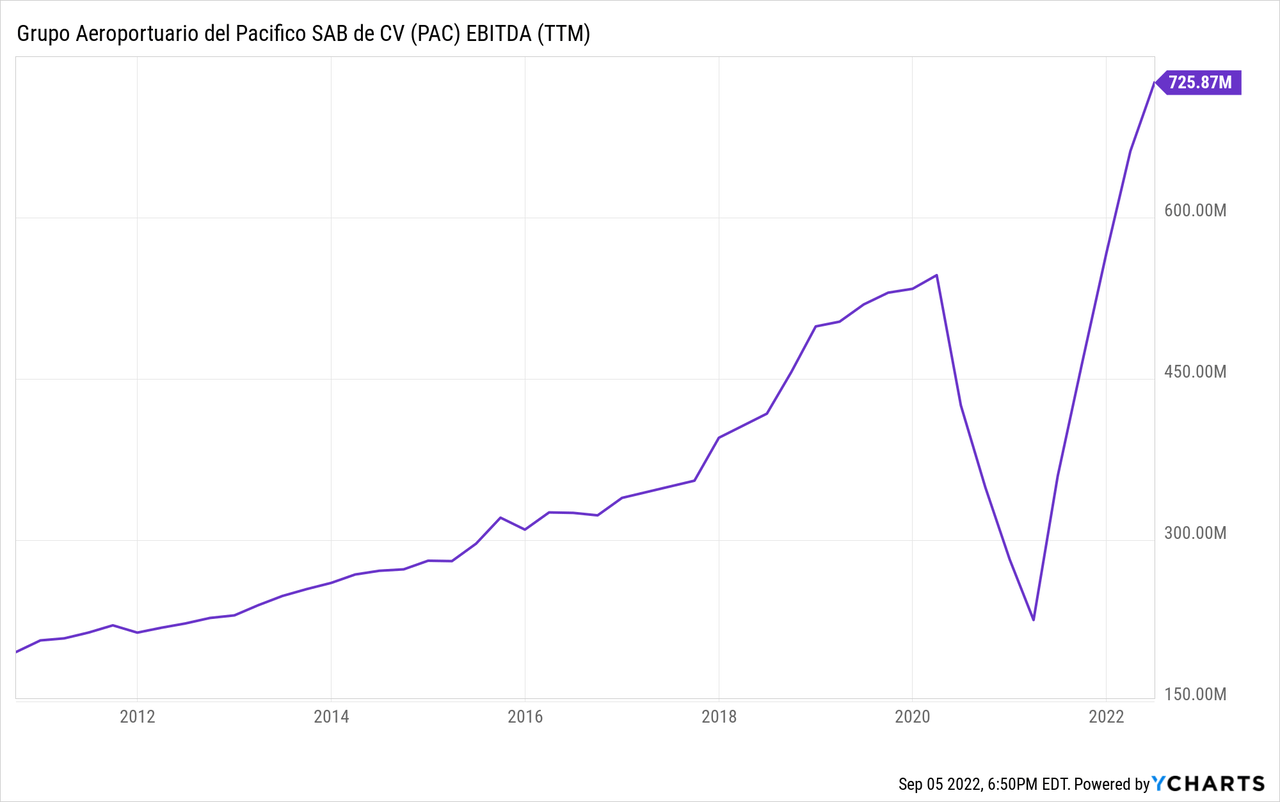

Throw in the dividend yields, starting at 4% or greater, and these are among my best high-upside low-risk ideas going forward right now. It’s easy to look at the stock prices, which are already up a lot, and think the opportunity has passed. However, the companies operating results have already dramatically surpassed 2019 levels of results and are rapidly trending upward. Here’s Pacifico’s EBITDA, for example:

Investors simply haven’t appreciated just how much stronger this business is today than it was before the pandemic. Since January 2020, the stock price is up just 10% or so while EBITDA is already up 30%. And with the expanded Guadalajara airport coming in 2024, the next leg up for growth is already in the works.

High-Yield Banks

Turning to banks, TFS Financial (TFSL) remains attractive today. Sure, the stock has advanced a bit off the recent lows. However, it’s still selling for 10x earnings, less than half of book value, and a 7.5% dividend yield (numbers adjusted for the phantom mutual holding company shares to reflect TFS’ true economic earnings). It’s inexplicable that TFSL stock traded down below $13 earlier this summer. Regardless, it’s still a bargain at $14 and should easily be worth $20 or more today.

Banco Latinoamericano de Comercio Exterior (BLX), or “Bladex” for short, is another undervalued high-yield bank. The Latin American commerce bank is selling for less than 8x trough earnings while paying a 7% dividend yield.

With commodity prices being favorable, Latin America is set for a period of accelerating economic growth. Colombia, for example, just reported 13% GDP growth in Q2. This is a fruitful environment for Bladex to put capital to work. Improving earnings growth off a starting 8x P/E and 7% dividend yield tends to lead to outstanding shareholder returns.

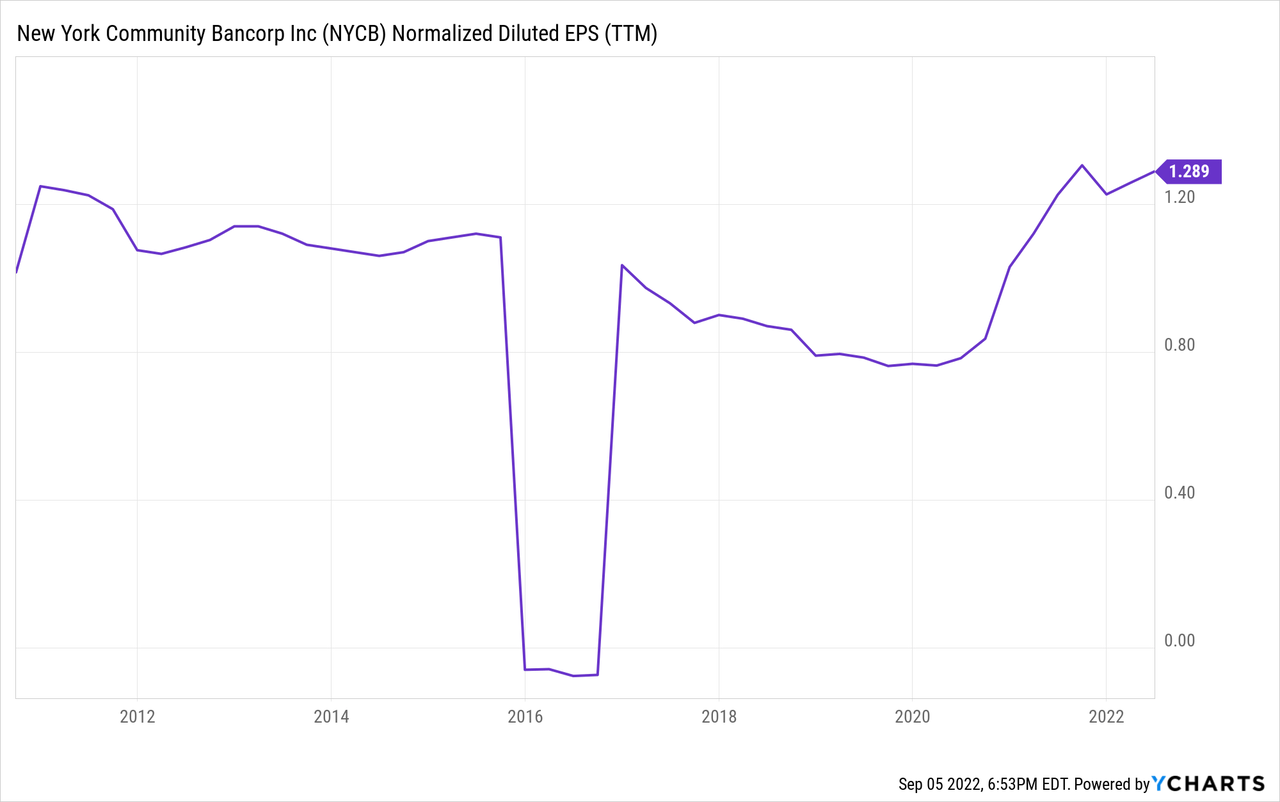

Rounding out the high-yield banks, New York Community Bancorp (NYCB) remains undervalued and underappreciated. The company’s earnings have increased significantly since 2020 and are now at decade highs and yet shares haven’t appreciated at all:

Earnings are projected to rise past $1.50 per share once the Flagstar (FBC) merger closes. Clearly, New York Community’s $0.68 dividend is easily covered out of earnings. That dividend, I’d note, currently amounts to a greater than 6% yield with room for growth going forward.

Given NYCB’s strong operating metrics such as its enviable efficiency ratio, rapidly rising profits and exceptionally conservative loan book, it hardly seem ambitious to believe shares should be worth 9x earnings.

Even at just 9x earnings, that gets to a fair value of $11.61 today, and $13.50 on what the bank will be earning in 2023. Maybe that doesn’t seem like a ton of upside from today’s $10 price. However, you’re getting a starting 7% dividend yield from here. NYCB is a bond alternative that also happens to have an improving fundamental picture.

It’s not unreasonable to think the stock could eventually trade at 12x earnings, which would get us an $18 stock price. That’d be wonderful. However, Wall Street has absolutely loathed this bank and management team for ages so I’ve really stopped expecting much in the way of capital gains.

Even using exceptionally modest inputs, such as 9x earnings, there’s still upside from this price along with said dividend. It should beat municipal bonds or investment grade corporate bonds.

Energy Stocks

On energy stocks, the oil sands names remain my favorites. Suncor (SU) and Canadian Natural Resources (CNQ) have moved back up from their summer lows, but still remain dirt cheap on an absolute basis and should enjoy a strong finish to the year as their capital return stories continue to accelerate.

More generally, the next story for energy producers should be the winter rush for natural gas or alternatives in Europe. Nat gas and electricity prices continue to soar to even higher levels in Europe and are up five- and even tenfold for some products in some markets. There simply isn’t enough liquified natural gas “LNG” capacity to meet the demand, and some folks will have to go without.

As an alternative, look for people to start swapping in good old petroleum — namely heating oil — for natural gas out of desperation. It’s dirtier and a step back on the technology curve, but when people are shivering this winter, it will happen, nonetheless. That, in turn, should be a big driver for ensuring that oil stabilizes at or above current levels.

As it is, stocks like Canadian Natural and Suncor are still priced as though oil were at $60 or $70 rather than where it is today. The stocks are absolute cash flow machines at the current energy price deck, to say nothing of the higher prices we saw at the start of the Russian invasion this spring. Suncor, since it owns refining capacity as well, is in a particularly advantaged position today.

I’ll highlight that the market still believes oil won’t stay at decent prices for long. Looking at the futures curve, the price of oil drops back under $70, according to the current futures structure, over the next few years.

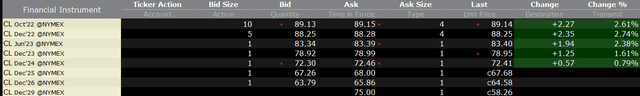

Crude oil futures / Sept. 5, 2022 (Interactive Brokers)

Here’s various crude prices throughout the 2020s. These are all traded on the NYMEX and are widely used by both speculators and energy industry participants such as producers, refiners, airlines, industrial companies and so on to hedge their exposure to future prices.

As of September 5th, oil for the rest of 2022 is priced around $88-$89 per barrel. Good so far. For next June, however, oil is at just $83.40, and the price slides to just $79 per barrel at the end of 2023. For 2024, the price is $72.50 and by 2025, the futures price of oil drops to below $70. The futures market currently forecasts an oil price of just $58/barrel at the end of the decade.

Clearly, market participants still think the oil shortage is only a transitory feature. The real money will be made as folks figure out that companies like Canadian Natural and Suncor will be minting money for, say, the next five or seven years instead of just the next couple quarters.

Sure, the current energy boom won’t last forever. But when buying well-run companies at 15% free cash flow yields, you don’t need all that many bountiful years to multiply your initial investment. And, over time, the longer-term price of oil is much more likely to settle at $80 or $100 per barrel than $58 as people are currently forecasting. The value of long-life production assets, such as the oil sands, increases tremendously when you assume even modestly higher oil prices than the current projections.

Final Picks

To round out the month, V.F. Corp. (VFC) remains a buy as a Dividend Aristocrat that has been sold off way too hard on temporary headwinds.

Shiseido (OTCPK:SSDOY) is attractive thanks to the plunge in the Japanese yen improving its competitive position. Cosmetics are one of the world’s most stable and profitable industries and we’re getting quite the discounted price on Shiseido due to factors almost wholly unrelated to its core business.

And, in spirits, I’ve returned to buying Diageo (DEO) instead of Brown-Forman (BF.A) since the latter has rallied over the past three months. You can rarely go wrong buying whichever of the spirits companies is closest to its 52-week lows at the moment. Over time, they all tend to go up and to the right, so buying relative weakness is a good dollar cost averaging approach.

As things stand today, DEO is at 20x forward earnings, whereas the S&P 500 is at 22x current earnings. I’d much rather own a high-quality defensive company like Diageo than the S&P 500 at the same earnings multiple, let alone a slight discount for the higher-quality option.

Be the first to comment