Dmytro Aksonov/E+ via Getty Images

This article was co-produced with Nicholas Ward.

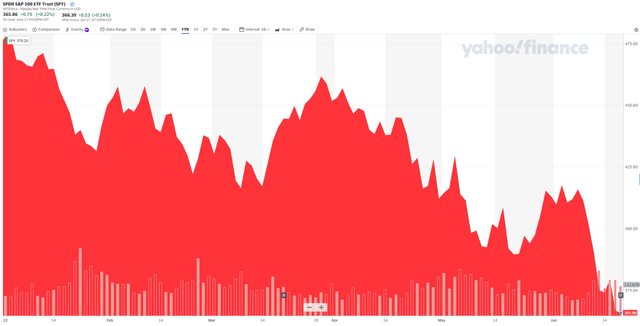

We just experienced one of the worst 5-day spans in recent memory with the S&P 500 falling by nearly double digits since last Thursday alone.

This sell-off pushed the S&P 500 down -24% from its highs on an intra-day basis. Last week when inflation data was posted, the CPI rose by 8.6% (the highest since 1981).

The Federal Reserve raised rates by 75 basis points on Wednesday, once again, marking another historical abnormality, in an attempt to cool off inflation. There are geopolitical headwinds abound. COVID-19 is still causing lockdowns in China which is wreaking havoc on the supply chain.

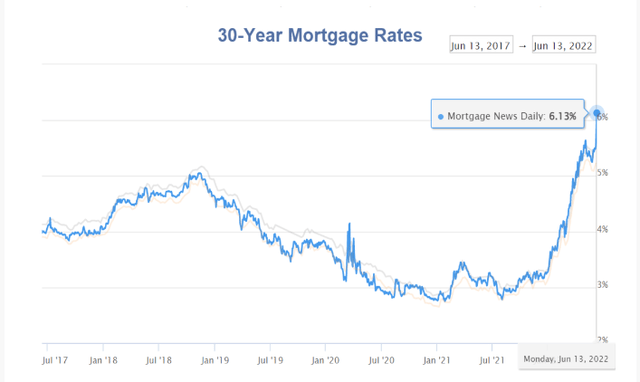

Mortgage rates have roughly doubled since the start of the year, coming in at 6.6% yesterday (on the 30-year fixed) which has investors fearing another housing crisis.

And in recent days, I’ve noted a handful of major layout announcements, largely coming from the tech sector; however, there is certainly a threat of contagion here as the economy slows.

This list could go on and on…

But, what it all points to, in my opinion anyway, is a recession.

At this point, it’s not clear how long or severe it will be (that is dependent largely on monetary policy), what I do know is that the Federal Reserve has a near impossible task ahead of it with regard to attempting to slow down the economy by raising rates and reducing the size of its balance sheet without causing a major economic issue.

The Fed has never engineered a soft landing before and the needle that Jerome Powell and crew are trying to thread here is immensely small.

At this point, most reports from credible analysts/firms that I’ve read are calling for a relatively tame, short, and shallow recession (due largely to the relative strength of the labor market). I tend to agree, but that doesn’t change the fact that to most investors, the word “recession” is a scary one.

It doesn’t take a very long memory to recall the financial destruction that the COVID-19 crash of 2020 or the Great Recession of 2008/09 caused. The dot-com boom/bust cycle lasted 3 years from 1999-2002 and investors who were involved with the market back then know how long it took for many positions to be made whole again…

…And that’s if they had the discipline and patience to hold their losers and not allow fear to inspire them to lock in losses at the bottom.

I truly sympathize with people who are fearful of recessions.

However, the fact of the matter is, I do look forward to weakness in the stock market because I love buying blue chip equities when they’re trading in the bargain barrel.

Bear markets are periods of time that can make or break investors.

People who don’t own high quality assets that will ultimately weather the economic storm and/or allow fear to cause them to make mistakes (selling low) can set themselves back years (or even decades) with regard to their journeys towards financial freedom.

However, other people who focus on quality and become greedy while others are fearful, scooping up the rare discounts that the market provides during bear markets, can accelerate the compounding that their portfolio produces and end up reaching retirement much quicker than previously imagined.

I know what group of people I want to find myself in.

Therefore, I do a lot of work which helps to prepare me for an eventual downturn in the market, and this is why I say that “I’m rooting for a recession”.

In short, I hope to capitalize on the moment and set myself (and my portfolio) up to be stronger than ever coming out of the other side.

Buying the Highest Quality Stocks at the Lowest Prices

Generally speaking, the old saying that “there is always something on sale in the market” is correct.

Regardless of whether or not the major averages are sitting at all-time highs, or down -24% like they are today, I can usually find an intriguing value to buy.

However, during bear market periods, opportunities arise that are rarely seen, and this is exactly what gets me so excited about the prospects of a significant stock market sell-off.

Ultimately, I want to be accumulating shares of the very highest quality companies at fair (or better) prices.

Over the long-term, I believe that quality wins out (and produces outperformance); however, I also firmly believe that investors should not chase irrational momentum and buy stocks, no matter how wonderful they are, if they are overpriced.

Note: one good example is to buy stocks that are now yielding 11% or higher (working on a detailed article this weekend).

When it comes to the bluest of the blue chips, oftentimes, these shares can trade at high premiums for years and years on end. This makes it very difficult to accumulate them (for a value-oriented investor like myself).

But, that all changes when fears of recessions arise.

Right now, I’m beginning to see discounts from around the highest quality REITs that I track at iREIT that are unique to recessionary/bear market environments. And, those discounts are what I wanted to talk about in today’s article…

These are the types of stocks I’m most excited about accumulating moving forward and hopefully, by discussing the rarity of these sell-offs, you’ll see that recessions aren’t necessarily something to fear, but instead, something to get excited for (as a long-term investor).

100/100 Quality Stocks

Right now, there are only 3 stocks within the iREIT on Alpha coverage spectrum that receive a perfect, 100/100 iREIT IQ (our quality ranking metric) score. These 3 companies are:

And, lo and behold… all 3 stocks are now trading at attractive discounts to my fair value estimates.

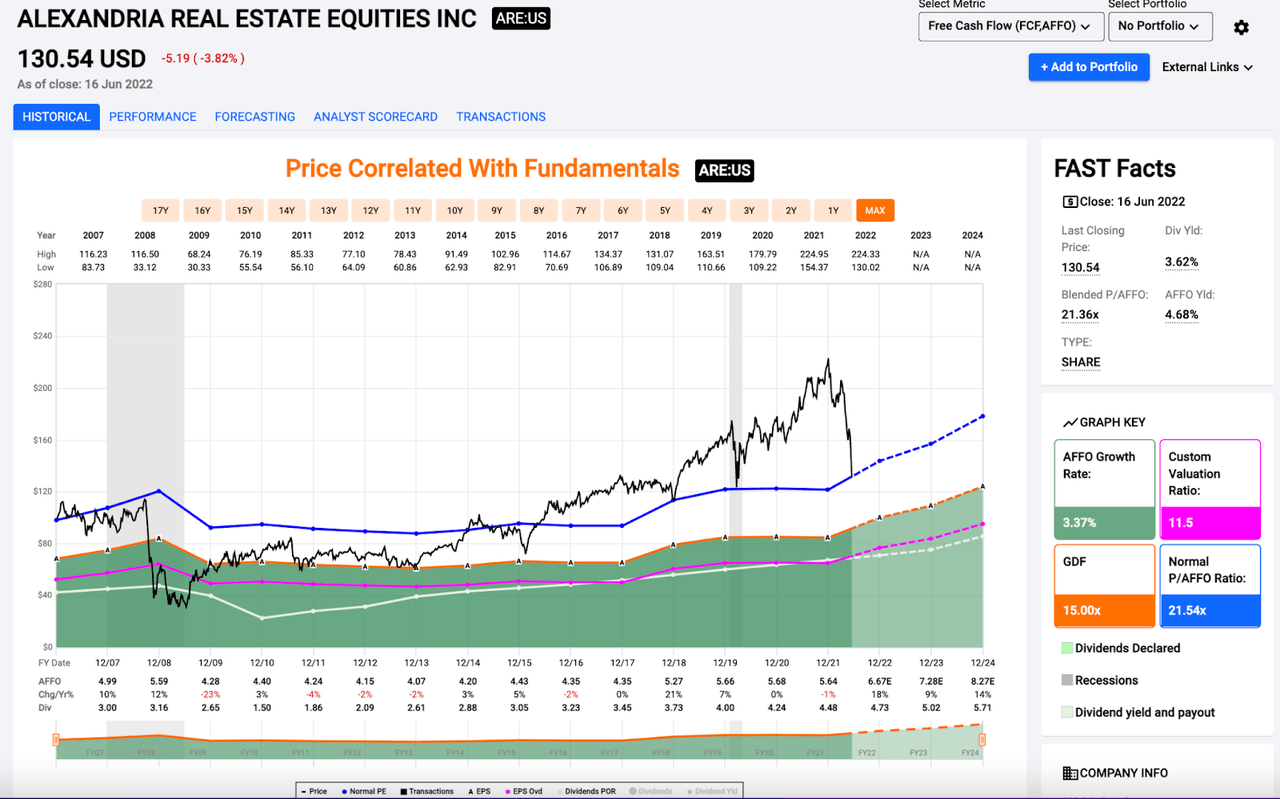

Looking at the chart below, you can clearly see that ARE shares have traded at a premium to their long-term average P/AFFO multiple for years now. The stock bounced off of the 21.5x support level several times recently (during the COVID-19 crash of 2020 and during the taper tantrum in late 2018).

You have to go back all the way to mid-2016 to find ARE shares trading with a blended AFFO multiple below 21.5x.

Well… that’s exactly where we sit today. And, on a forward basis, looking at expected 2022 AFFO results, ARE shares are now well cheaper than their long-term average. Analysts expect to see ARE post AFFO growth of 18% this year.

Assuming the consensus estimate is correct, ARE’s year-end AFFO will total $6.67/share. Today, shares trade for ~$130.50. Therefore, on a forward basis (looking just 6 months down the road), ARE’s P/AFFO multiple is just 19.6x.

Fast Graphs

Right now, iREIT’s “Buy Below” threshold on ARE shares is $170.00.

Therefore, after their recent sell-off (ARE is down more than 40% on a year-to-date basis), the shares offer an attractive ~27% margin of safety. This is exactly the type of dip that I’m looking to buy here on a 100/100 rated stock.

Prologis shares have also experienced significant weakness recently (due largely to inflation concerns hurting the retail industry and fears of demand slowdown in the warehousing/logistics space).

PLD is down by 31.1% on a year-to-date basis; however, I believe this sell-off is largely irrational because I don’t see any significant changes to the secular growth outlook that Prologis benefits from.

Also, as we informed our members, we’re bullish with regard to the recently announced (PLD)/(DRE) merger, valuing DRE at $26 billion, in an all-stock transaction. As I explained to our members:

“PLD provided some additional details of potential earnings accretion, with the majority of Year 1 accretion ($275M at midpoint of range) derived from accounting (lease and debt fair value adjustments), and another $65M from G&A savings. PLD estimated another $387M of future accretion, including $80M from incremental property cash flows and Essentials, and $300M from development value creation.”

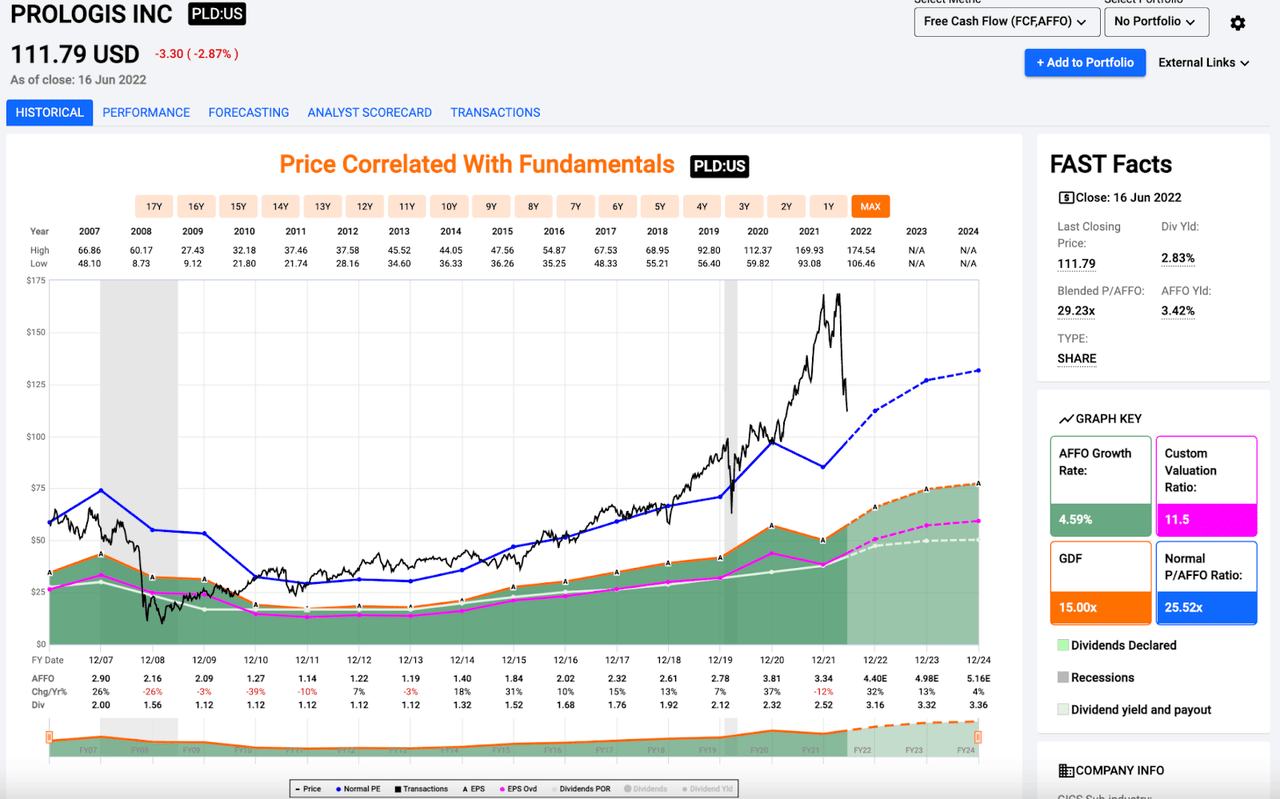

Like ARE, PLD has historically traded with a very high quality premium (and especially during the last 5 years or so when the eCommerce trend really took off).

But, as you can see on the F.A.S.T. Graph below, PLD’s recent share price weakness, alongside continued fundamental growth, has pushed its valuation down to attractive levels (especially on a forward basis).

FAST Graphs

It wasn’t long ago that PLD shares carried a ~50x P/AFFO multiple.

Frankly, I believed that shares were grossly overvalued at those levels, but, after its 2022 sell-off, shares trade for ~29x blended AFFO and just 25.5x 2022 expectations, meaning that PLD’s forward P/AFFO multiple is now below its long-term historical average.

What’s more, PLD’s double-digit growth isn’t expected to stop in 2022.

Right now, the consensus analyst estimate for PLD’s 2023 AFFO is $4.98, which would represent 13% growth on top of the expected 32% growth that Wall Street expects to see the company produce this year.

With that 2023 AFFO figure in mind, we’re looking at a ~22.5x forward multiple 18 months out, which is a very low premium on these shares (historically speaking).

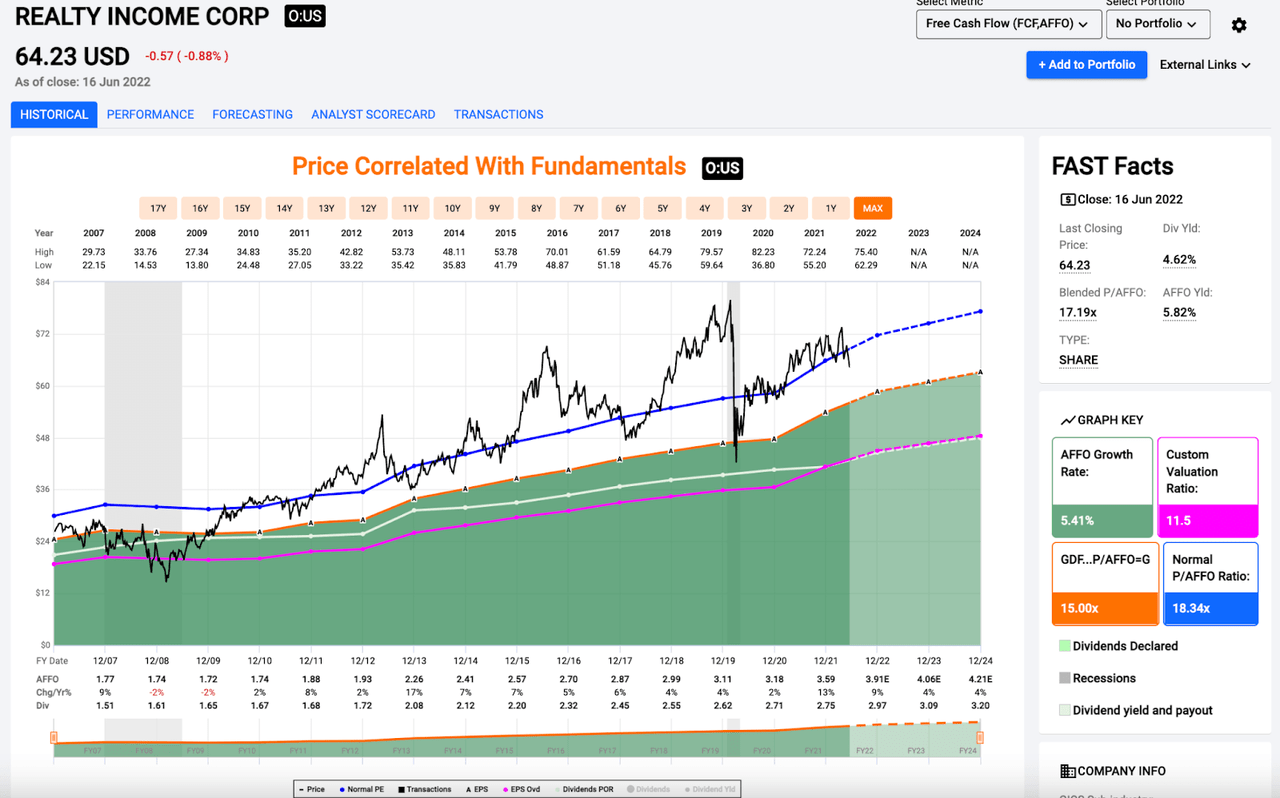

As you all know, I’m a big fan of Realty Income.

I’ve written many articles on the “Monthly Dividend Company” with a bullish pen and that opinion hasn’t changed.

What has changed, however, is Realty Income’s valuation in recent weeks as O has traded down from the $75 area down to the $65 area in recent weeks, and yet, the stock’s fundamentals continue to hold strong.

Once again, you’ll see that O’s blended AFFO premium has fallen below its long-term average. And, like ARE and PLD, because of O’s positive forward growth expectations, the stock is even cheaper on a forward basis.

Fast Graphs

O traded with a massive premium prior to the COVID-19 recession; however, these days, with trades trading in the ~17x blended (and 16.5x forward) AFFO areas, this blue chip is priced at levels that I feel very comfortable with.

It’s also important to note that O’s recent dip has pushed its yield up from the 4% level to the 4.5% level, making the stock even more attractive to income oriented investors.

The market is clearly not giving O any credit whatsoever for its successful integration with Vereit, an $11 billion transaction that has moved O’s enterprise value north of $55 billion. Read my latest WACC (weighted average cost of capital article here).

Other Opportunities Abound

Although ARE, PLD, and O are the only 100/100 stocks that I track, they’re not the only blue chips that I’d like to buy into weakness.

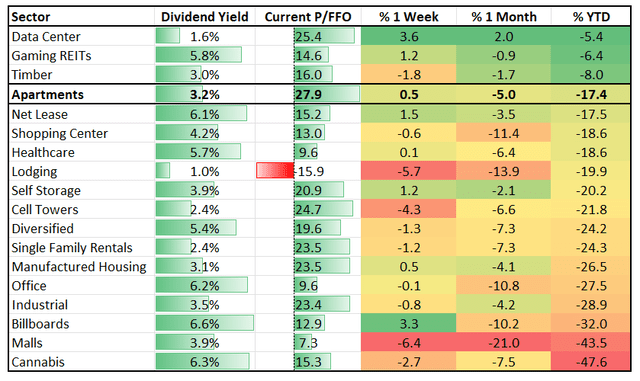

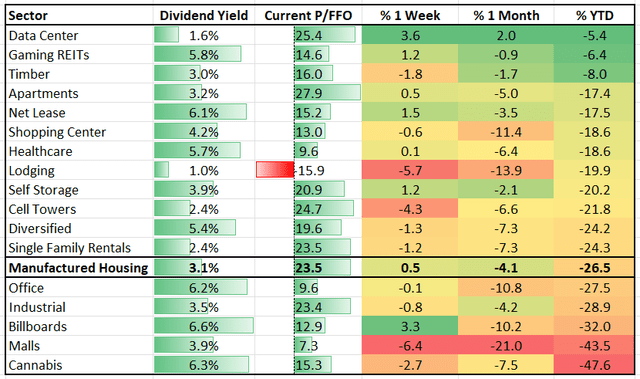

I’m starting to see the multi-family REITs, for instance, break down and historically speaking, these stocks have been difficult to accumulate because of the high premiums that they’ve traded with as well.

Once again, the weakness that I’m seeing in stocks like Essex Property Trust (ESS), AvalonBay Communities (AVB), Mid-America Apartment (MAA), and Camden Property Trust (CPT) seems irrational to me.

Sure, higher mortgage rates are causing a slowdown in the housing space; however, home prices continue to rise. A slowdown in buying has the potential to result in a slowdown in construction and therefore, the supply/demand issues that created such high home prices in the first place are unlikely to abate in the near-term.

Higher costs associated with home ownership bode well for the rental market, and I suspect that rent growth will remain robust in this industry and therefore, the weakness that has recently occurred in the apartment space looks like a buying opportunity to me.

The same thing can be said when it comes to other areas of REITdom which benefit from secular growth tailwinds such as the data centers and the cell towers.

When I see manufacturing housing REITs like Equity LifeStyle (ELS), Sun Communities (SUI), and UMH Properties (UMH) become cheaper.

And that’s the point of this piece…

Recessions don’t have to bring only fear, they can bring excitement, and even joy, to those with the right mindset, the discipline, and the patience to capitalize on the bargains bear markets create.

Plus, keep in mind that interest rates typically decline during recessions as loan demand slows. During recent recessions, the Federal Reserve has cut short-term rates and eased credit access for municipal and corporate borrowers.

Interest rates arguably drive the business cycle of expansion and contraction. Market rates reflect credit demand from borrowers and the available credit supply, which in turn reflects preference shifts between savings and consumption.

Remember… it’s during moments like these that the very best stocks begin to present attractive margins of safety and over the long-term, buying best-in-breed companies below fair value is a wonderful way to generate wealth in the stock market.

Recession?

Bring it on!!!

Author’s Note: Brad Thomas is a Wall Street writer, which means he’s not always right with his predictions or recommendations. Since that also applies to his grammar, please excuse any typos you may find. Also, this article is free: written and distributed only to assist in research while providing a forum for second-level thinking.

Be the first to comment