rarrarorro/iStock via Getty Images

Co-produced with Treading Softly

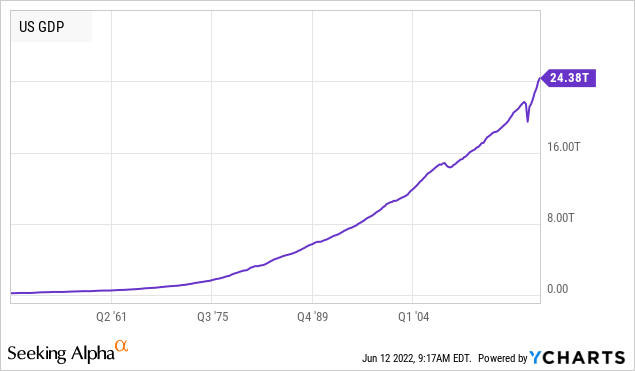

As the market continues to be volatile, I am placing my bets not on the short-sightedness of Summer traders, but on the long-term history found within the economic framework in which the market lives.

What do I mean by this?

I primarily invest in the U.S. market and the U.S. economy. While the economy is potentially careening towards a recession, this often is a purging of low-profit or no-profit companies. These are often referred to as zombie companies.

I have a fire pit in my backyard. I have mentioned before we do weekly fires with my family. We love the time to socialize and bond together. Over time, it gets clogged and fires are harder to start and keep going. Why? Ashes. They build up from the previously burned wood and need to be cleared out.

When the market and economy are hot, the ashes from the fire build up. Recessions are when the economy cools off, and it is time for those ashes to be removed. They get cleaned out and wiped away. Creating room for successful companies to once again expand and thrive. The economy can once again get back to going hot and being on fire.

Recessions are a needed part of the equation to make an economy healthy for the long run. The Federal Reserve tries to keep the economy running as strongly and smoothly as possible. Often pouring in liquidity to keep the economy burning, like pouring gasoline on a fire. However, over time, it still needs to be cleaned out. A recession can be delayed, but will never be prevented indefinitely. Every rate cut. Every Quantitative easing. Every measure to stop the economy from going through those needed catharsis delays the inevitable.

As investors, should we panic over this inevitable cycle? No. In the long run, the U.S. economy is perhaps the brightest fire in the history of mankind. The downturns that feel like the end of the world, end up looking like a blip in history.

One of the major forces in the U.S. economy is privately owned businesses. These are the companies that often step in as we see the giants of the past wane. Fueled by hard-working Americans and good old-fashioned American ingenuity, these are small to medium-sized businesses that solve everyday problems and provide services.

As investors, this segment can be difficult to invest in compared to the publicly traded behemoths. Yet they can be very rewarding as well. I choose to invest in the wider privately run middle market via business development companies, BDCs. These firms provide management advice, lending, and other specialized services to thousands of middle-market firms all over the U.S. economy. They do heavy underwriting to ensure the health of the BDCs’ portfolio.

I enjoy their pass-thru nature – providing high levels of income for my ownership of the BDC itself. It also allows me to participate in the raw strength of the U.S. economy with debt investments that provide regular recurring income and equity investments that provide substantial upside potential. Both of which are passed along to me through the BDC as dividends.

While many fear that the U.S. will go into a recession, I believe that it is much more likely that a recession will be delayed a good while longer. The market’s fear has created a buying opportunity to invest at lower prices and higher yields. Whether a recession comes or not, the U.S. economy will rebound even stronger. Investors who invest with a clear head and focus on investing in solid, high-cash flow companies will benefit.

Let’s dive into two excellent income generators.

Pick# 1: SLRC – Yield 10.5%

SLR Investment Corp. (SLRC) is trading near 52-week lows after its recent earnings report. NAV came in at $19.56, and net investment income at $0.35/share.

The elephant in the room is that SLRC merged with SUNS on April 1st. This merger resulted in a significant increase in SLRC’s portfolio from around $2 billion to $2.6 billion. Q1 earnings only reflect SLRCs pre-merger assets, this greatly reduces the usefulness of the headline metrics.

For example, immediately upon closing, management reduced the base fee for SLRC. If this reduction had been in place in Q1, it would have reduced management fees by a little over $1 million, or $0.024/share. Additionally, SLRC has $100 million in 4.6% bonds that they were not allowed to prepay, maturing on May 8th. That is $1.15 million in quarterly interest expense that SLRC had to pay, even though they had the cash on hand to pay it off in Q1. That is another $0.027/quarter that goes right to the bottom line, when you adjust for these two recurring expense savings, suddenly SLRC’s pro forma NII goes from $0.35 to over $0.40. The dividend goes from uncovered to being covered.

This doesn’t factor in other less certain tailwinds for NII (net investment income), like rising interest rates – a 100 bps rise in LIBOR would add $0.04/year to NII. More leveraging up, SLRC’s leverage remains below 1.0x and post-merger is at only 0.9x. This gives SLRC plenty of room to originate new investments and drive NII higher.

We believe that the primary reason for the sell-off is that SLRC failed to cover its dividend. However, the headline numbers are not reflective of SLRCs cash flow today. When the merger closed, SLRC decided to maintain the current dividend and switch to a monthly payout schedule. They did so because management is confident that the dividend will be covered going forward. When you dig into the numbers, they support management’s optimism.

SLRC is trading at a strong discount to NAV. This is a case of the market not reading past the headlines. SLRC is a strong buy at these prices.

Pick #2: ORCC – Yield 9.3%

Owl Rock Capital‘s (ORCC) book value ticked down slightly to $14.88. NII came in at $0.31, right at the dividend and lower than last quarter. This is another case where the market doesn’t seem to be looking past the headlines.

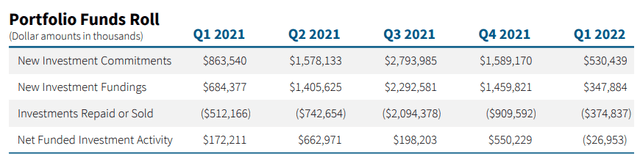

The major driver was very low payoffs at approximately $375 million compared to ranges of $512 million to $2.1 billion each quarter last year. (Source: ORCC Q1 2022 Earnings)

ORCC Q1 2022 Earnings

How does this impact NII? Payoffs usually trigger higher revenue recognition for things like prepayment fees. New investment fundings were relatively low as well, resulting in lower origination fees, which ORCC records as “other income”.

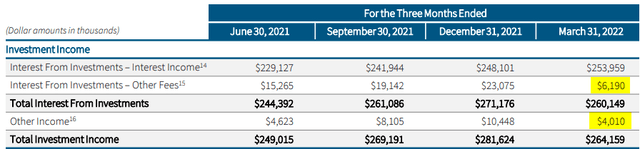

ORCC Q1 2022 Earnings

So compared to Q4, ORCCs interest income was up $6 million (2%), but “other fees” were only at $6 million compared to $15 million in Q1 last year and $23 million in Q4. Meanwhile, “other income” which includes structuring, syndication, and origination fees was at $4 million compared to $10.5 million in Q4.

These sources of revenue are going to be variable quarter to quarter as ORCC can’t control when borrowers decide to prepay a loan and origination will vary quarter to quarter.

It is great progress that ORCC is covering its dividend even when “other income” is at rock bottom. Throughout most of last year, that variable income was needed to cover the dividend. Now they are covering the dividend with just recurring interest income, and the variable income is just the cherry on top.

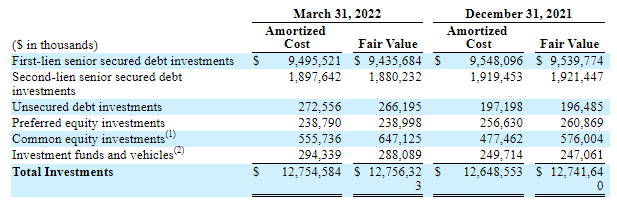

With regard to the decline in NAV, ORCC’s NAV is reflecting a $0.20 decline due to unrealized losses. Here is a comparison of Q4 2021 to Q1 2022:

ORCC Q1 2022 10-Q

You can see the largest decline was in preferred equity, which is now valued very close to cost basis instead of a 1.5% premium. Similarly, their second-lien and unsecured debt is now valued at a discount. These changes are due to rising interest rates, which have impacted fixed-rate investments more.

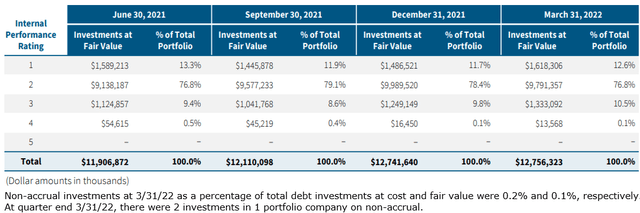

Credit quality on ORCCs portfolio remains strong, with only a single company with two investments on “non-accrual” status. (Source: ORCC Q1 Earnings)

ORCC Q1 2022 Earnings

ORCC is selling off hard after earnings, and there is no good reason. ORCC is covering its dividend, and its credit quality is strong. The only real issue is that it was a slow quarter for payoffs and originations – which go hand in hand because BDCs usually fund originations with the proceeds of loans that were paid off!

The way we look at it is that Q1 was a great test of ORCC’s ability to cover the dividend with recurring income. It passed. Prepayment and origination fees are great, but they are not recurring. Some quarters will be great, others not. ORCC proved that its dividend is secure and future quarters will see higher levels of “other” income. We are very happy to be buying any dips in price!

Shutterstock

Conclusion

I have long learned it’s foolish to bet against the U.S. economy. So I invest in it as much as possible. The U.S. economy is extremely resilient, and the entrepreneurial spirit remains a key aspect of it.

I invest in top-notch, well-run BDCs which provide liquidity and expertise to middle-market firms. In return, I receive monthly and quarterly dividend payments from the revenue generated by the BDCs’ services and loans. It’s a win-win arrangement.

My retirement is one covered under a constant shower of income from various companies, funds, and firms providing me exposure to all aspects of the U.S. economy. I flip a switch in my house and I think about how utilities provide me dividends via a fund High Dividend Opportunities invested into in our Model Portfolio. I go to the doctor or buy gasoline, even more sources I draw income from. BDCs allow me to gain even more income from other aspects of the economy.

You can experience the same benefit and joy. That’s the beauty of income investing.

Be the first to comment