Joecho-16/iStock via Getty Images

Illinois Tool Works Inc. (NYSE:ITW) is one of the quality dividend growth stocks investors can buy during the current volatility. Its strong business model, global footprint, and diversified product portfolio have enabled it to grow dividends for 26 consecutive years. However, it’s crucial to buy a stock at the right time if you want to earn lofty returns from investment. This is because price appreciation plays a critical role in overall returns on a long-term basis.

I believe investors should keep ITW stock on their watchlist and buy it once economic data improves. Additionally, the stock currently looks a bit expensive and a further decline would ease its valuation and put them in the buying zone.

Illinois Tool Works is a Solid Pick for a Dividend Growth Portfolio

Illinois Tool Works has all the characteristics of a pure dividend growth stock. Its dividends have grown at an average annual rate of 14% since 2011. The company’s potential to sustain a double-digit dividend growth is attributable to its product portfolio and solid business model, which helps it generate enough profits and cash flows to support lofty shareholder returns.

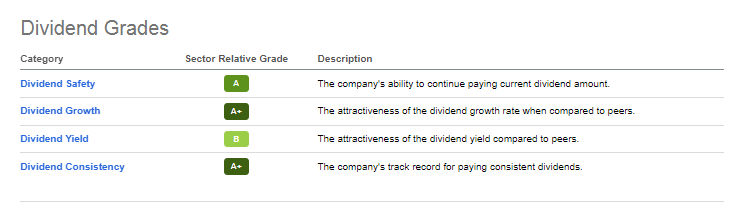

Dividend grades (Seeking Alpha)

With Seeking Alpha’s A+ qualitative grade for dividend consistency and growth, ITW’s dividends seem like a great option for investors seeking a steady stream of income. Moreover, the company’s ability to maintain its dividend even during tail events, which only a few other Wall Street companies (dividend aristocrats) have shown, also makes it a good pick for retirees with low-risk tolerance. The company has demonstrated this potential in bear markets and recessionary periods of 2008-09 and 2020. Even in bearish stock market conditions combined with a threat of stagflation, I do not see any risk to its dividends in 2022 and beyond, thanks to its diversified product line and healthy free cash flow generation.

Financial Growth Backs Dividends

The company’s 10% year-over-year organic revenue growth for the second quarter along with a forecast of 8.5% organic growth for the full year reflects that its top line is strong enough to support profits and cash flows. In addition, this displays its robust product line and strong demand from end markets even in tough economic conditions. Organic growth also implies that the company does not need to spend heavily on growth opportunities such as acquisitions to support revenue growth, leaving a large room to return cash flow to investors.

The company expects record earnings per share between $9 and $9.40 for 2022, which represents an increase of 14% year-over-year at a mid-point guidance. The company’s cash flow would also increase significantly due to earnings growth. ITW estimates that its free cash flow will grow by 10% to 20% year-over-year in 2022. This means the company has room to raise its dividend in the September quarter by a high single-digit to a double-digit percentage. Its strategy of repurchasing shares worth $1.5 billion will increase its earnings and dividend payout ratio in the years to come.

Is it the Right Time to Buy ITW?

A simple formula for wealth generation from the stock market involves buying the right stock at the right time and holding it for some time to realize multifold growth. The S&P 500’s retreat in the past six months presents one of the best opportunities to build both short- and long-term positions. ITW is among those opportunities that can help investors make big gains in the long run. While that may be true, finding the bottom or close to the bottom of the marker cycle is crucial to success. Illinois Tool Works stock has already plunged around 16% so far in 2022 amid broader market selling due to inflation, higher rates, and looming stagflation fears, a combination of inflation and low economic growth. Despite the recent share price run and solid financial numbers, I believe its shares could experience more pain in the coming months as concerns that have pushed S&P 500 into a bear market remain unresolved.

Slowing economic growth and stagflation are normally bad for industrial companies like ITW. Currently, the risk of stagflation increased significantly, as the U.S. economy is likely to contract for a second consecutive quarter in 2022 while inflation is lingering around 40 years high. According to the Bureau of Economic Analysis, the real U.S. GDP dropped at an annual rate of 0.9% in the second quarter of 2022 after a 1.5% contraction in the first quarter. Moreover, growth forecasts for the second half aren’t optimistic for economy-sensitive companies. There is a high likelihood that a slow economic and earnings growth forecast would again push S&P 500 and industrial stocks like ITW into bearish territory.

In fact, compared to the first half, ITW’s second half organic revenue growth forecast indicates a slower growth. The company posted organic revenue growth of 11% in the first quarter, but that fell to 10% in the second quarter, and organic growth expectations suggest it will drop to a mid-single-digit percentage in the coming quarters. As far as dividend stability is concerned, these numbers seem fine, but slowing growth could have a significant impact on share prices.

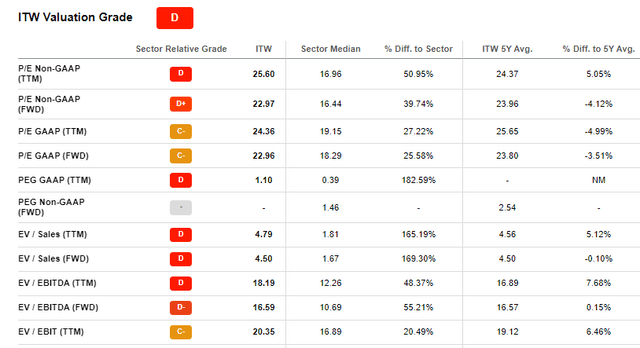

A high valuation is another factor that makes ITW a bit pricey at the moment. Compared with the sector median of 18.29 times forward earnings and S&P 500’s average of nearly 17% times, its shares are trading at 22 times earnings. Similarly, ITW’s forward book and sales ratios suggest that the stock is expensive.

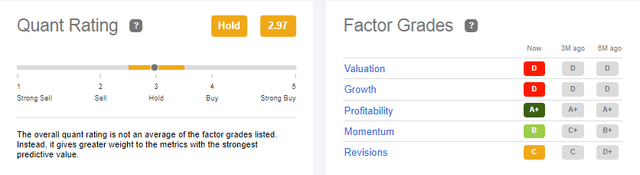

Seeking Alpha’s quant grading system, which is composed of five factors, provides a hold rating on ITW stock with a quant score of 2.97. High valuations and lower growth compared to peers are negatively impacting its overall score. Moreover, as I stated earlier, a C grade for revisions suggests that analysts are revising their financial forecasts due to economic vows. According to Seeking Alpha data, its earnings per share estimates have seen only 2 upward revisions and 9 downward.

In Conclusion

ITW is an excellent dividend growth stock, and its business model seems strong enough to sustain growth for many years to come. However, broader market conditions may cause the stock price to fall further in the near future. Additionally, it appears pricey based on valuations. Therefore, it’s prudent to keep this stock on the watchlist and buy it when economic data and market sentiments improve.

Be the first to comment