ismagilov/iStock via Getty Images

Thesis

Voya Global Advantage and Premium Opportunity Fund (NYSE:IGA) is a closed end fund that invests in global equities. The fund:

- Seeks to maximize total returns and maintain lower volatility relative to the benchmark over a full market cycle. Stock selection is model driven.

- Hedges major currency exposure to help reduce volatility of returns.

- Sells call options on selected security indexes and/or ETFs, on an amount equal to approximately 50-100% of the total underlying value of the portfolio.

Source: Fund Fact Sheet

The notable aspects for this fund are its currency hedged approach and its buy-write strategy. Currently 48.99% of the portfolio has covered calls written against it. The fund writes at the money calls, which means the delta of the options is high, which provides a very good buffer in down markets. Basically, high delta options have higher premiums which get realized when the market moves down and the options expire without getting triggered. The fund is down only -11.4% year-to-date versus an almost -20% performance for the Vanguard Total World Stock Index Fund ETF (VT). We expect the fund to continue to outperform this year due to the high implied volatility in the option chain which translates into high premiums for written calls.

The vehicle has long term annualized returns which come in at 7.4% on a 10-year basis and a standard deviation of 12.32 which is lower than the S&P 500. The fund has an 8.72% dividend yield which represents the transformation of equity returns into dividends from a CEF structural perspective. The fund is currently priced at an attractive -11.29% discount to NAV but has always traded at a discount to its assets. We feel this discount would narrow if the fund manager would take a more active approach in adjusting the written call percentage based on active market views.

IGA is an attractive vehicle to gain exposure to global equities markets, especially during range bound or down markets, given its aggressive at the money written calls strategy. The CEF structure allows the fund to pay quarterly dividends which represent the transformation of equity capital gains and options premiums into cash income streams.

Analytics

AUM: $0.15 billion

Sharpe Ratio: 0.38 (5Y)

St Deviation: 12.32 (5Y)

Yield: 8.72%

5-year Annualized TR: 5.4%

10-year Annualized TR: 7.4%

Expense Ratio: 0.97%

Premium/Discount to NAV: -11.29%

Z-Stat: -1.12

Leverage Ratio: 0%

Holdings

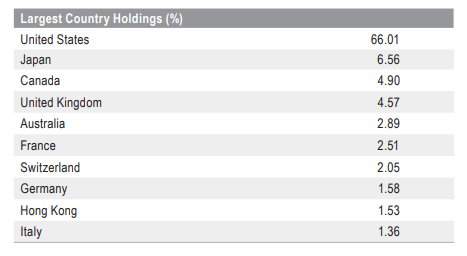

The fund counts U.S. equities as its largest concentration:

Country Holdings (Fund Fact Sheet)

We can observe that the CEF also has a sizable position in Japanese equities which account for over 6% of the portfolio. As a reminder the vehicle hedges its foreign currency exposure. Purchasing foreign currency equities always introduces an additional risk factor since both the FX hedges as well as the underlying equity can lose value.

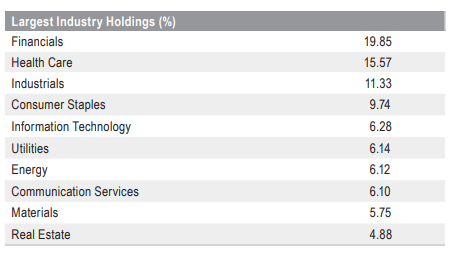

From a sector standpoint financials and health care are the most heavily weighted industries:

Sectors (Fund Fact Sheet)

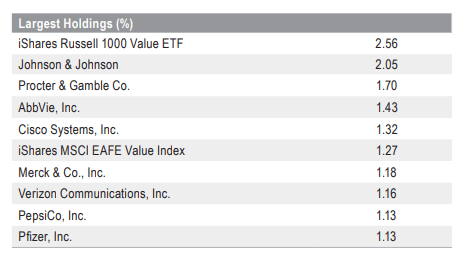

Financials clocks in at almost 20%, closely followed by Health Care at 15.57%. From an individual security standpoint the largest holding is an index ETF:

Issuer Concentration (fund fact sheet)

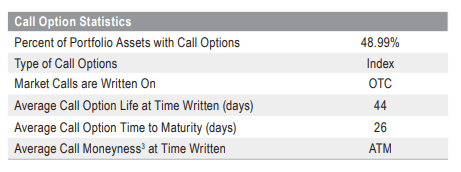

The fund falls in the “buy-write” category by writing covered calls on equity indices. The current proportion of the portfolio covered by sold calls is 48.99%:

Statistics (Fund Fact Sheet)

We can see from the above statistics that the written options have roughly a 44-day maturity profile when written and they are done at-the-money (ATM). An at the money written call option basically gives up all upside in an increasing market, but is more appropriate for maximizing income in range bound or down markets. In today’s environment when a global slowdown is anticipated by all market participants this options layering strategy might be more appropriate than OTM written call options in terms of maximining income. To that end we can see that the CEF has outperformed year-to-date the Vanguard Total World Stock Index Fund ETF by almost 8%, specifically because of the large proportion of the portfolio that benefits from ATM written options.

Performance

The fund is down only -11.4% year-to-date versus a global stock benchmark, outperforming the index:

YTD Performance (Seeking Alpha)

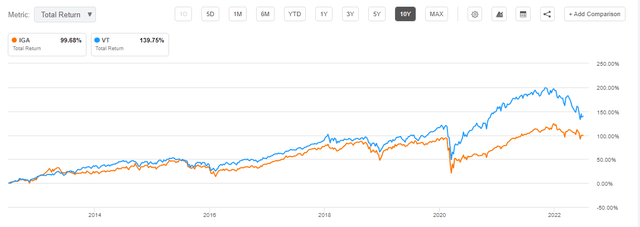

On a 5-year basis however IGA severely underperforms:

5-Year Performance (Seeking Alpha)

We can see the same underperformance on a ten-year chart:

10-Year Performance (Seeking Alpha)

The CEF closely matched the index performance until the Covid drawdown in 2020 after which its portfolio severely underperformed the rebound in the global markets.

Buy-Write Strategy

It is worth noting that writing at the money calls is a more aggressive strategy versus slightly out of the money calls. This is due to the fact that all the upside (100%) is automatically given up, which translates into underperformance as the market moves up. Basically in an up market, the fund gets compensated by just the option premium until the call expires, with the upside between the option premium adjusted strike and where the market ends up being entirely given up. This is one of the reasons the fund underperformed VT during the upswing in 2020 and 2021.

Conversely as the market moves down, writing covered calls with a very high delta (at the money call options have higher deltas than out of the money options with higher strikes) is beneficial to the fund since it results in an overall lower portfolio long position in equities. We believe this CEF is well suited to weather much better than an outright index a down market, especially a slowing moving down market. Continuously receiving call premiums for options expiring without getting triggered while the underlying equities do not fall down a cliff is ultimately a good NAV proposition.

Premium/Discount to NAV

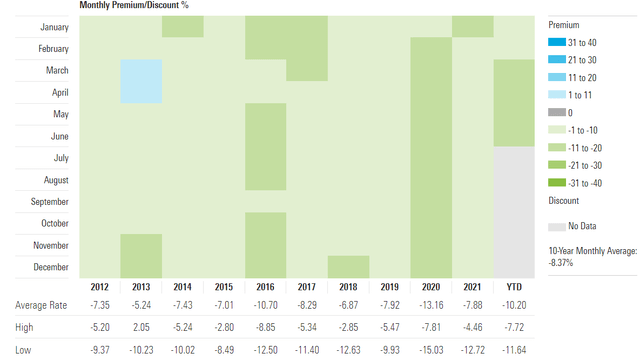

The fund is currently trading at a large discount to net asset value of -11.29%:

Premium/Discount to NAV (Morningstar)

We can see that historically IGA trades at a discount to NAV. The average discount is in the -7% to -10% range. It is interesting to note that even during the height of investor clamoring for yield in 2021 the CEF did not trade at a premium to NAV.

Conclusion

IGA is a global equities CEF with an aggressive buy-write strategy via at the money calls. The vehicle has outperformed a global equities ETF year-to-date due to the buffer provided by the written calls. The fund has an annualized long term total return that clocks in at 7.4% on a 10-year basis and a standard deviation of 12.32. We expect the fund to outperform the index this year as volatility stays high and the fund is able to buffer negative equities performance with high realized options premiums.

Be the first to comment