sefa ozel

It’s a recession when your neighbor loses his job; it’s a depression when you lose your own.” – Harry S. Truman

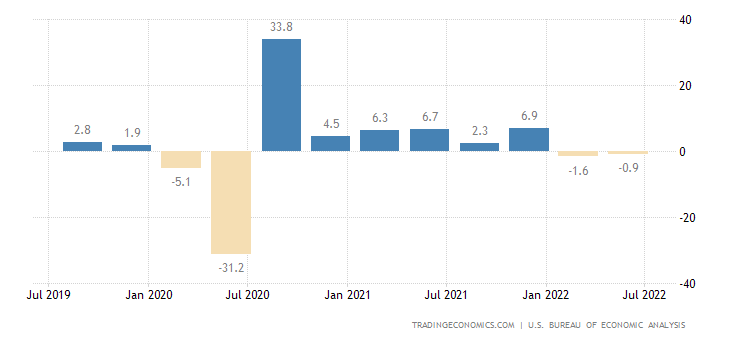

Ever since the initial reading for second quarter GDP came out with a contraction of .9% late in July, there has been a battle waged by the financial media, the administration and pundits whether this constitutes a recession given it followed a contraction in the GDP of 1.6% in the first quarter. The negative economic performance in the first quarter was chalked up largely to inventory adjustments.

TradingEconomics.com

Two straight quarters of negative GDP growth has been the historical classification of a recession since the National Bureau of Economic Research or NBER was founded in 1920. However, the administration and its supporters in the press have pushed back on classifying the first half of 2022 as an ‘official‘ recession. Given the president’s historically low approval ratings and the fast approaching mid-terms, where the economy and inflation are the number one topic on voters’ minds according to polling, this is certainly understandable.

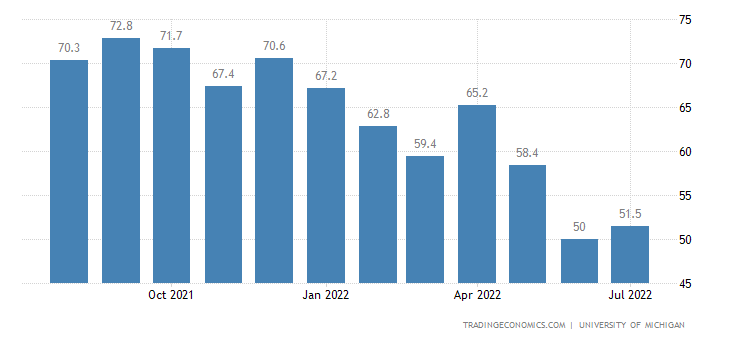

There are clear signs the country is in a recession already or soon will be. Inflation still is running at 40 year highs. Consumer sentiment is right near historical lows and the housing market is starting to feel the impacts of higher interest rates in a major way. Consumers are tapped out as evidenced by a personal savings rate (5.1%) that has fallen to levels unseen since the Great Financial Recession a decade and a half ago. Revolving debt just rose 14.6% on a year-over-year basis to $1.13 trillion.

TradingEconomics.com

Those denying the country is in a recession primarily point to the strong jobs market. Indeed, we got a print of 528,000 news jobs created in July on Friday. This was much, much higher than expectations. However, if one digs under the surface, the Jobs Report is full of details that undermines the strength of job markets and that of the consumer.

Let’s start with the labor participation rate which fell .1% to 62.1% even as the ‘official‘ unemployment rate dropped to a historically low 3.5%. The labor participation rate continues to refuse to budge despite over 10 million job openings. Notably, if we had the same pre-pandemic labor participation rate, the unemployment rate would be closer to 5.5%, not the 3.5% rate currently being touted.

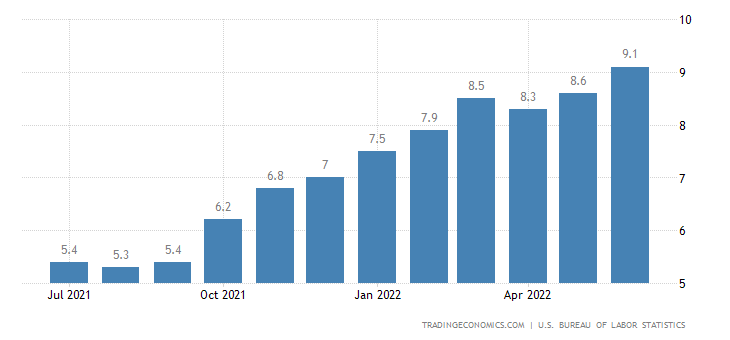

TradingEconomics.com

The July Jobs Reports showed an average 12 month wage gain of 5.2%. That would be impressive except for high inflation levels as the last CPI print showed a rise of 9.1%. The CPI has now been above 8% since March and above 7% since December of last year. This means the average consumer has lost nearly four percent of their buying power over the past year, something that never happened even during the depth of the financial crisis. And that if you believe the official figures. Truth be told, if the CPI was calculated in the same way it was before it was ‘reformulated‘ in the 1990s, the inflation rate would be at least 50% higher.

The pain of inflation is particularly being felt by non-home owners, typically the lower and middle income segments because of a massive surge in rents as well as gasoline. Apartment rents across the U.S. are rising significantly in almost 400 cities, with the average price for a 1-bedroom having shot up more than 25% since June 2021, according to a recent report from Rent.com. The typical cost for a two-bedroom unit is up 26.5% over that period.

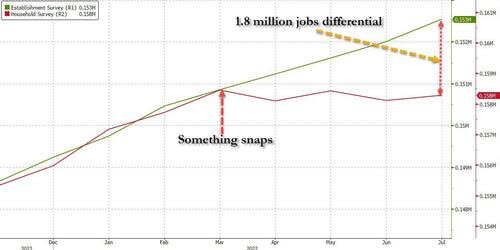

Zero Hedge

There are also some other items which are irksome about this latest Jobs Report, which is always a lagging economic indicator. Since March, the Establishment Survey or BLS shows a gain of 1.68 million jobs while the Household Survey shows an employment loss of 168,000. The number of people holding two jobs has soared to a post-pandemic high of 7.54 million. In addition, the number of multiple jobholders whose primary and secondary jobs are both full-time just hit a record high as more and more consumers struggle to make ends meet.

Bloomberg Finance

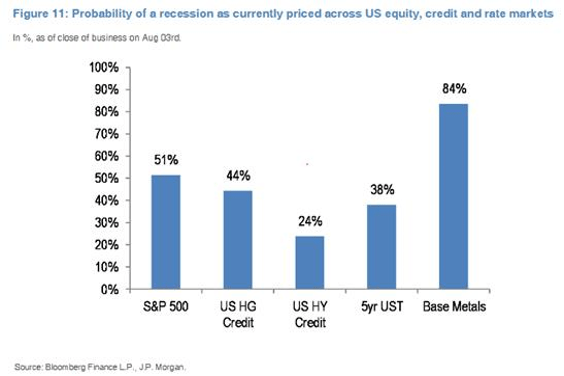

All of this points for me to a high likelihood of a consumer led recession by the end of 2022, if we are not already in one. Not a hard prediction to make given the extreme stress right now on the consumer, that makes up roughly 70% of economic activity. Other markets are pricing in an increasing likelihood of this scenario as well (above). Ironically, the strong Jobs report on Friday might have made this more likely. Goldman Sachs noted that the probability of a 75 bps move by the Federal Reserve in September tripled to 75% soon after the jobs numbers came out in the treasury market.

Investors are in no man’s land to a large extent. When was the last time the Federal Reserve was hiking rates into a significant economic slowdown? Add in the new taxes within the soon to be passed and deceptively named ‘Inflation Reduction Act‘ and it looks like a couple of major policy errors could be in the offing.

This portends for me a high likelihood of another leg down in the market in the next few months. As my late father always said ‘If it looks like a duck, quacks like a duck, it’s a duck‘. So it matters little whether the country is in recession or soon will be. Therefore, my stance within my portfolio is one of caution. Most of my open positions are within covered calls for the additional downside risk mitigation. I also am maintaining a 20% to 25% cash allocation in my portfolio as a cushion to act upon lower entry points in the months ahead.

Ending on a brighter note, the country is at least in a much better position than Europe which looks headed towards a long, cold winter. That will be the topic of my column for next week.

During recession greed dies, frugality survives.” – Amit Kalantri

Be the first to comment