CIPhotos

This monthly article series shows a dashboard with aggregate industry metrics in healthcare. It may also serve as a top-down analysis of sector ETFs like the iShares U.S. Healthcare ETF (IYH) and the Health Care Select Sector SPDR ETF (XLV), whose largest holdings are used to calculate these metrics.

Shortcut

The next two paragraphs in italic describe the dashboard methodology. They are necessary for new readers to understand the metrics. If you are used to this series or if you are short of time, you can skip them and go to the charts.

Base Metrics

I calculate the median value of five fundamental ratios for each industry: Earnings Yield (“EY”), Sales Yield (“SY”), Free Cash Flow Yield (“FY”), Return on Equity (“ROE”), Gross Margin (“GM”). The reference universe includes large companies in the U.S. stock market. The five base metrics are calculated on trailing 12 months. For all of them, higher is better. EY, SY and FY are medians of the inverse of Price/Earnings, Price/Sales and Price/Free Cash Flow. They are better for statistical studies than price-to-something ratios, which are unusable or non available when the “something” is close to zero or negative (for example, companies with negative earnings). I also look at two momentum metrics for each group: the median monthly return (RetM) and the median annual return (RetY).

I prefer medians to averages because a median splits a set in a good half and a bad half. A capital-weighted average is skewed by extreme values and the largest companies. My metrics are designed for stock-picking rather than index investing.

Value and Quality Scores

I calculate historical baselines for all metrics. They are noted respectively EYh, SYh, FYh, ROEh, GMh, and they are calculated as the averages on a look-back period of 11 years. For example, the value of EYh for healthcare providers in the table below is the 11-year average of the median Earnings Yield in this industry.

The Value Score (“VS”) is defined as the average difference in % between the three valuation ratios (EY, SY, FY) and their baselines (EYh, SYh, FYh). The same way, the Quality Score (“QS”) is the average difference between the two quality ratios (ROE, GM) and their baselines (ROEh, GMh).

The scores are in percentage points. VS may be interpreted as the percentage of undervaluation or overvaluation relative to the baseline (positive is good, negative is bad). This interpretation must be taken with caution: the baseline is an arbitrary reference, not a supposed fair value. The formula assumes that the three valuation metrics are of equal importance.

Current Data

The next table shows the metrics and scores as of last week’s closing. Columns stand for all the data named and defined above.

|

VS |

QS |

EY |

SY |

FY |

ROE |

GM |

EYh |

SYh |

FYh |

ROEh |

GMh |

RetM |

RetY |

|

|

HC Equipment |

-31.62 |

2.69 |

0.0251 |

0.2026 |

0.0192 |

13.93 |

66.88 |

0.0335 |

0.2806 |

0.0331 |

14.02 |

63.09 |

12.03% |

-13.20% |

|

HC Providers |

10.88 |

-0.43 |

0.0578 |

1.4956 |

0.0747 |

18.89 |

19.59 |

0.0526 |

1.4486 |

0.0625 |

15.90 |

24.39 |

8.04% |

6.59% |

|

Pharma/Biotech |

24.28 |

33.29 |

0.0521 |

0.2264 |

0.0496 |

34.62 |

80.78 |

0.0375 |

0.2523 |

0.0344 |

20.81 |

80.59 |

1.93% |

10.83% |

|

Life Science Tools |

-26.17 |

8.35 |

0.0288 |

0.1529 |

0.0229 |

17.26 |

59.36 |

0.0300 |

0.2922 |

0.0313 |

15.79 |

55.28 |

15.01% |

-16.77% |

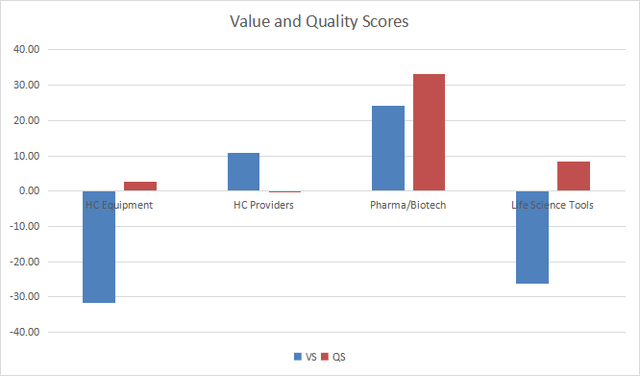

Value and Quality Chart

The next chart plots the Value and Quality Scores by industry (higher is better).

Value and quality in healthcare (Chart: author; data: Portfolio123)

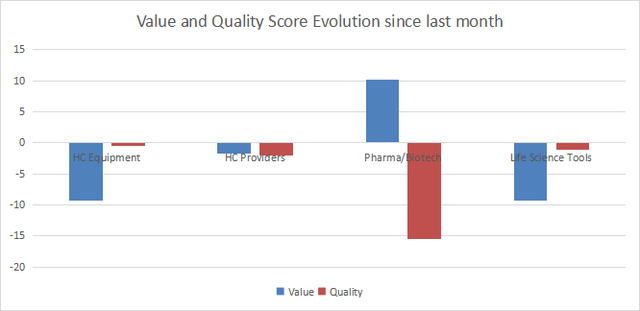

Evolution Since Last Month

The value score has improved in pharma/biotech and deteriorated in healthcare equipment and life science tools. Quality has deteriorated in pharma/biotech.

Variations in value and quality (Chart: author; data: Portfolio123)

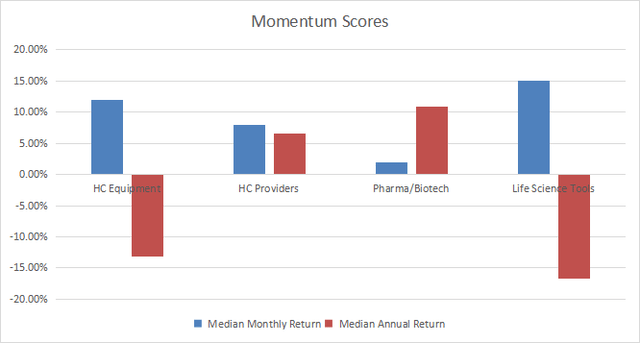

Momentum

The next chart plots momentum data.

Momentum in healthcare (Chart: author; data: Portfolio123)

Interpretation

Pharma/biotech is still the best-ranked healthcare industry in both value and quality scores. It is undervalued by about 24% relative to 11-year averages and it is far above the quality baseline. Healthcare providers are undervalued by about 11% and they are close to their quality baseline. Life science tools and healthcare equipment are overvalued by more than 25% relative to the baseline. Their quality scores are good, but not high enough to offset such overvaluation.

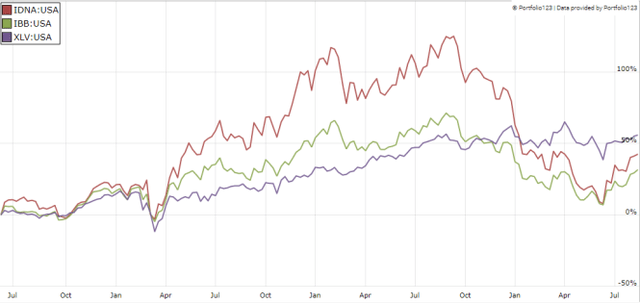

Fast Facts on IDNA

Genomics is one of the most promising fields in the pharma/biotech industry. The iShares Genomics Immunology and Healthcare ETF (NYSEARCA:IDNA) provides exposure to innovative companies in genomics, immunology and bioengineering. Its total expense ratio is similar to the iShares Nasdaq Biotechnology ETF (IBB): 0.47% vs. 0.44%. Both are significantly above XLV (0.10%).

As defined in the prospectus by iShares,

The Fund seeks to track the investment results of the NYSE® FactSet® Global Genomics and Immuno Biopharma IndexTM (the “Underlying Index”), which measures the performance of equity securities issued by companies in the biopharmaceutical and healthcare equipment and services industries that could benefit from the long-term growth and innovation in genomics, immunology and bioengineering (…). Companies must have equal to or greater than 50% of their revenue from one or more selected Level 6 industries, as defined by the FactSet Revere Business Industry Classification System (“RBICS”).

IDNA holds 49 stocks: 65.5% of asset value is in the U.S., 20.6% in Europe and 13.9% in Asia. The portfolio is quite concentrated: the aggregate weight of the top 10 holdings is 42% (list below).

|

Name |

Ticker |

Weight (%) |

Location |

|

BEAM THERAPEUTICS INC |

5.75 |

United States |

|

|

FATE THERAPEUTICS INC |

4.7 |

United States |

|

|

INTELLIA THERAPEUTICS INC |

4.63 |

United States |

|

|

BEIGENE LTD |

BGNE* |

4.37 |

China |

|

MODERNA INC |

4.22 |

United States |

|

|

GENMAB |

3.99 |

Denmark |

|

|

TWIST BIOSCIENCE CORP |

3.96 |

United States |

|

|

BLUEPRINT MEDICINES CORP |

3.86 |

United States |

|

|

GILEAD SCIENCES INC |

3.42 |

United States |

|

|

BIONTECH SE ADR |

3.38 |

Germany |

*U.S. ticker for convenience. The fund holds shares in Hong Kong.

Since inception (06/11/2019), IDNA has slightly underperformed the sector benchmark XLV and is much more volatile than the industry benchmark IBB (see next chart). However, price history is too short to assess the strategy on past performance.

IDNA vs XLV vs IBB (Chart: Portfolio123)

Dashboard List

I use the first table to calculate value and quality scores. It may also be used in a stock-picking process to check how companies stand among their peers. For example, the EY column tells us that a large pharma/biotech company with an Earnings Yield above 0.0521 (or price/earnings below 19.19) is in the better half of the industry regarding this metric. A Dashboard List is sent every month to Quantitative Risk & Value subscribers with the most profitable companies standing in the better half among their peers regarding the three valuation metrics at the same time. The list below was sent to subscribers several weeks ago based on data available at this time.

|

Vir Biotechnology Inc |

|

|

Moderna Inc |

|

|

iTeos Therapeutics Inc |

|

|

Organon & Co |

|

|

Ironwood Pharmaceuticals Inc |

|

|

uniQure NV |

|

|

QuidelOrtho Corporation |

|

|

AMERISOURCEBERGEN CORPORATION |

|

|

DaVita Inc |

|

|

Tenet Healthcare Corp |

It is a rotating list with a statistical bias toward excess returns on the long-term, not the result of an analysis of each stock.

Be the first to comment