ismagilov

I’ve been in the mood to take a walk down memory lane lately, and that has prompted me to review some of the earliest articles I wrote on this platform. As I reread these I’m struck by how mind numbingly boring I was (am?). Anyway, I want to write about one of the stocks that “got away”, so I’m going to put my thoughts about IDEXX Laboratories Inc. (NASDAQ:IDXX) to virtual ink. Way back in February 2018, I wrote a piece where I recommended investors avoid this name because it was very expensive. Right on time, the shares went on a tear, and are up about 130% against a gain of about 53% for the S&P 500 since then. I thought I’d revisit the name to try to work out whether or not it makes sense to buy. I’ll make that determination by looking at the most recent financial performance, and by looking at the stock as a thing distinct from the underlying business.

Welcome to my “thesis statement” paragraph. As you may recall, I put one of these near the beginning of each of my articles because reading 1,500-2,000 of my words can be a trial for some people. You’re welcome. I am of the view that IDEXX Laboratories is a bad investment at the moment. Although the company’s financial performance is (mostly) good, the shares are very expensive, and are priced for near perfection. This is never a great sign in my view. You may complain that this is the exact same advice I gave years ago, and had you followed it, you would have missed out on a great return. You would be right to remind me that even then I was admitting that the company’s segments (Animal Companion and Veterinary etc.) had great tailwinds behind them, and that this was a great company that I couldn’t “pull the trigger” on. That’s all true, but consider the following. First, ask yourself if the next four years of market returns will resemble the past? If so, then maybe the optimism fueled crowd may continue to drive these shares higher. Also, we’re not seeking “returns”, we’re seeking “risk adjusted returns”, and if the valuation is stretched, sooner or later chickens come home to roost. That’s a bad hair day when it happens. In a world where you can buy many, many other profitable stocks at far more reasonable valuations, I would avoid the shares of this great business until they drop to a more reasonable level.

IDEXX Laboratories Financial Snapshot

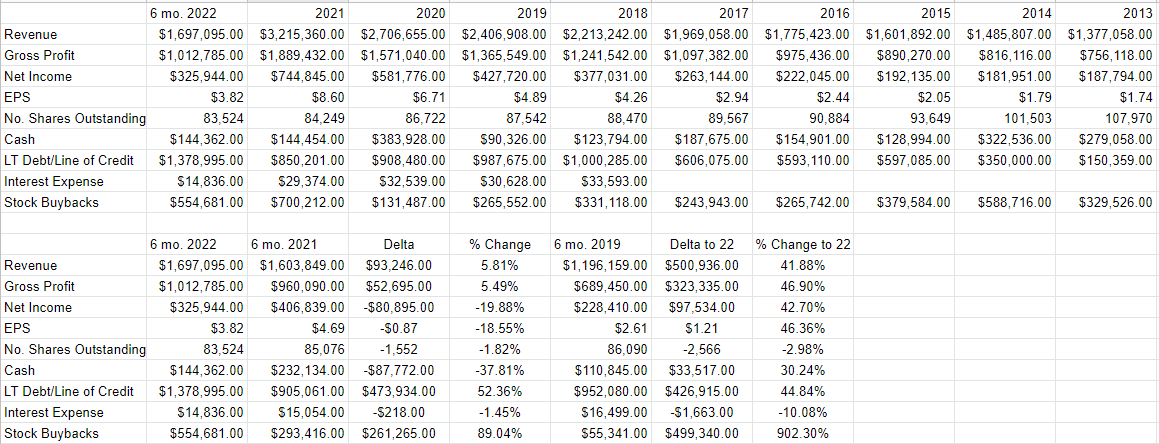

Since I last wrote about it, this company has had a spectacularly good financial result in many ways. Specifically, relative to when I last reviewed the name, annual revenue is up by about 63%, and net income has climbed an eye watering 182%. I think this gives some sense for why the shares have done so very well from early 2018. Things look slightly less good when we compare the first six months of 2022 with the same period a year ago. Although revenue in 2022 is about 5.8% higher than it was this time last year, net income is about 20% lower. All expenses are higher in 2022 than they were in 2021, but the 117% uptick in R&D expenses is the standout reason for the drop in profits. This isn’t the end of the world, but it’s noteworthy, and I think we should keep an eye on the R&D expensive going forward in order to determine whether or not we’re in a “new normal.”

As troubling in my estimation is the deterioration of the capital structure. Specifically, long term debt and the line of credit are about 37% higher than in 2018. Borrowings are currently just under $1.4 billion. If I were an investor here, I would have preferred they pay down some of this debt over the past six months, rather than buy back $554 million worth of stock. I would prefer that unless management repurchased these shares at a nice discount.

Idexx Financials (Idexx investor relations)

The Stock

That question of whether or not management spent half a billion dollars buying back shares at a reasonable price is of critical importance, and highlights the fact that the business and the stock are distinct things, though are connected, obviously. They’re connected, but I think the stock is often a very poor proxy for the business that it supposedly represents. A business buys a number of inputs, adds value to them, and then sells the results at a profit. The stock, on the other hand, is a traded instrument that reflects the crowd’s aggregate belief about the long-term prospects for the company, and may also be influenced by management using owner’s capital to buy owner’s shares. Given stock volatility, it seems that the crowd is capricious and changes its views about the company relatively frequently, which is what drives the share price up and down. Added to that is the volatility induced by the crowd’s views about “the market” in general. “Stocks” become more or less attractive, and the shares of a given company get taken along for the ride.

This leads me to a significant point that I want to drive home: the only way to consistently make money in stocks is to spot the discrepancies between the current assumptions embedded in price and subsequent returns. So, if our approach involves investing based on something we read in The Journal, we’re going to do badly over time. This is because by the time the information hits our screens, it’s been priced into the stock price. If we want to make money, we need to spot discrepancies. In particular, if we want to go long a stock, we should only ever do so when the crowd is feeling pessimistic. That’s my point in a nutshell.

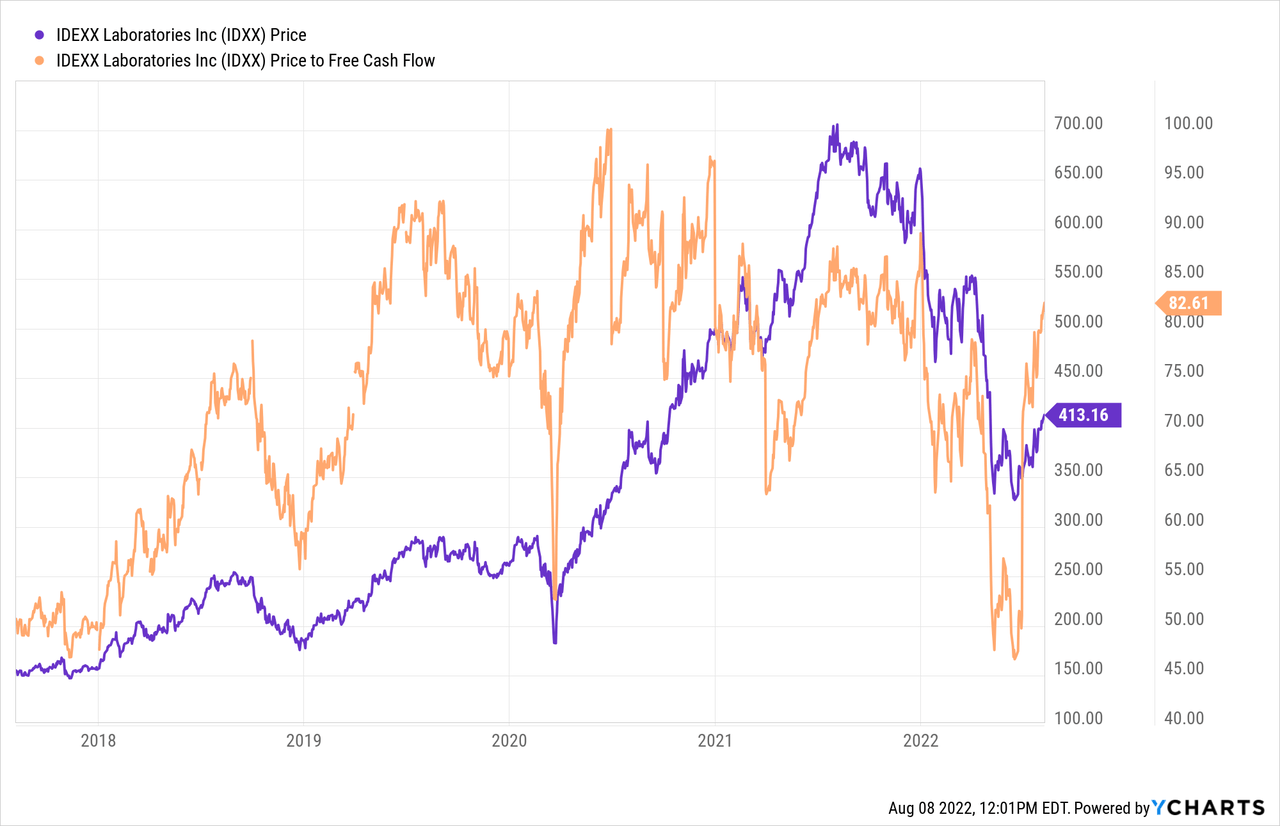

It’s typically the case that the lower the price paid for a given stock, the greater the investor’s future returns. In order to buy at these cheap prices, you need to buy when the crowd is feeling particularly down in the dumps about a given name. As my regulars know, I measure the relative cheapness of a stock in a few ways ranging from the simple to the more complex. On the simple side, I like to look at the ratio of price to some measure of economic value, like earnings, sales, free cash, and the like. Once again, cheaper wins. Given all of the above, I don’t think we should be surprised by the fact that I blanched at this stock years ago when it was trading at a price to free cash flow ratio of about 52.5 times. Fast forward several years and things look even more expensive, per the following:

In addition to looking at simple ratios, I want to try to understand what the market is currently “assuming” about the future of a given company. If you read me regularly, you know that I rely on the work of Professor Stephen Penman and his book “Accounting for Value” for this. In this book, Penman walks investors through how they can apply the magic of high school algebra to a standard finance formula in order to work out what the market is “thinking” about a given company’s future growth. This involves isolating the “g” (growth) variable in a fairly standard finance formula. Additionally, I’ve heard the complaint that Penman’s stuff may not be the most accessible book ever written. So, if you want an alternative to Penman, you could try Mauboussin and Rappaport. These two have recently updated their classic “Expectations Investing”, and it is excellent in my estimation.

Anyway, applying this approach to IDEXX at the moment suggests the market is assuming that this company will grow at a perpetual rate of ~8%, which I consider to be very optimistic. Given all of the above, I have to continue to recommend avoiding these shares.

Conclusion

I know what many of you must be thinking, and it’s a fair criticism. If we listened to you 4 ½ years ago, we’d have missed out on a great stock return. That’s a fair point, and I want to offer a few counter points. First, I would ask if you think the next four years will resemble the last? More specifically, will the S&P 500 continue to grow at a CAGR of about 9.3% over the next four years? Additionally, I’d remind investors that the path to wealth is found by pursuing risk adjusted returns, and not just returns. If it’s returns you’re after, at some point lottery tickets make sense. I’m of the view that an investor’s return is over time driven by the price paid for a stock. The more the investor pays, the lower will be their subsequent returns. Given that, I think the risk here is too great, and I think investors would be wise to continue to avoid the stock.

Be the first to comment