Sundry Photography

Introduction

The last time I wrote about IDEXX Laboratories (NASDAQ:IDXX) was in late May 2022. Back then, I concluded with the following:

While IDXX is an outstanding business, the valuation has probably priced in all of the future growth prospects for the near future. For long-term investors already holding IDXX, I see no reason to sell since the company’s overall story is still intact. For investors looking to initiate a position, I would advise keeping IDXX on their watchlist in case a further drop opens a buying opportunity.

I would consider buying IDXX for the long term at a P/E of around 35 or an FCF-Yield of above 2.6%, as such a premium seems reasonable for such a quality business. This would translate into an entry price of around $275 to $300. At the current price of $372.23, I rate IDEXX a hold.

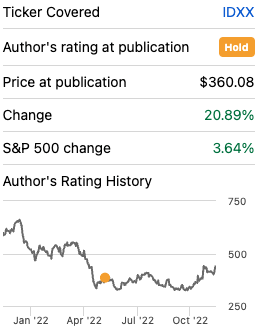

IDXX is up 20.89% since that article, while the S&P 500 is up 3.64%, as can be seen in the snippet below.

Seeking Alpha

IDXX traded sideways for quite some time. The 52-Week low according to Seeking Alpha is $317.06, a bit above the upper limit of my mentioned entry price range of $300.

In this update article, I want to review my initial thesis on IDXX and give an overall update on the current state of the company.

Earnings Update

Regarding the business model and the general tailwinds of the animal companion market, especially the diagnostics space, my last article is still up-to-date, so I will just refer to it for more information on this.

In this update, I will focus on the current earnings and management commentary in the recent earnings call.

In the latest earnings release for the third quarter of FY22, IDXX reported revenue of $841.6 million for 4% YoY growth from $810.4 million. Excluding currency effects, organic growth came in at 8% YoY.

Reported net income grew from $175.2 million to $180.9 million (3% YoY growth) while EPS grew around 6% YoY from $2.03 to $2.15 due to share repurchases. Excluding currency effects, EPS grew from $2.03 to $2.23 for 10% YoY growth.

These are decent growth numbers, but nowhere near the kind of growth rates IDXX achieved in the past. This is due to lower clinical visits, an issue that I mentioned in my last article. Lower clinical visits were the main reason for the guidance cut in the first quarter of this year. Back then, IDXX cut EPS guidance from $9.27-$9.59 to $8.11-$8.35. IDXX cut guidance again to $7.77-$8.05 in the second quarter earnings release and yet again to $7.74.-$7.98 in the third quarter earnings release. IDXX did not give any guidance for FY23 at this point.

In the first quarter earnings call, management stated that the reason for lower clinical visits is vet capacity, not a decline in demand. While this assures me that the long-term tailwinds for IDXX are still in place (demand side not being a problem), the main question is: will clinical visits/vet capacity start to stabilize/expand again? And if so, when will this happen?

Earnings Call

Regarding clinical visit levels, management stated in the latest third quarter earnings call that they were down 2.4% in the third quarter. They also anticipate that the visit level headwinds will continue into the fourth quarter. I guess that this was the reason for the latest guidance cut. My main problem is that IDXX didn’t give an outlook for 2023 regarding clinical visits. One analyst asked how management thinks about clinical visit growth in 2023. CEO Jay Mazelsky stated the following without giving any guidance:

The overall clinic visit growth, as you indicated in the outlook, it still remains fairly dynamic. There’s a lot of external factors like macro impacts, the labor supply dynamics that we’ve talked about and even potential impacts from further COVID outbreak. So we’ll be monitoring those macro impacts as a pet owner behavior and really factor that into our outlook.

Regarding the reasons for the decline in clinical visits, he added:

We think that, from an overall dynamic standpoint, Europe is a little bit different. But in the U.S., capacity constraints are the primary factor affecting clinical visits versus end customer demand. In Europe, we’re seeing some impacts from just the back row factors, and we’ll see how that plays out and whether that continues going forward.

This is in-line with the commentary in the first quarter earnings call. The main reason for declining clinical visits is not on the demand-side, but on the supply side. As a personal note, I spoke with my sister a few weeks after my first article. She manages a small vet clinic here in Germany. She told me the same things management states in their earnings calls. The main problem is that there are just not enough veterinaries to take on all the patients. Some clinics even reduce opening hours, since the veterinaries can’t handle the workload anymore.

The problem is that clinical visits growth is one of the most important growth drivers for IDXX business. Without growth in visits, the only ways for IDXX to grow are (1) by taking market share in a stagnating market or (2) increasing prices.

Regarding price increases, CFO Brian McKeon stated that IDXX is in line for price increases of around 5% for the full year. TTM reported revenue sits 3.8% higher than the FY21 revenue. Assuming some more revenue growth in the fourth quarter, the revenue growth in FY22 will be solely derived from price increases.

Valuation

The TTM net income stands at $669.6 million. With 84,113,000 shares outstanding at the current price of $435.30 per share, the market capitalization amounts to $36.6 billion so that IDXX currently trades at a P/E of close to 55.

IDXX cash-conversion (free cash flow/net income) hovered around 80% in the past. Note that I adjust the free cash flow and count stock-based compensation as a cash expense. Assuming a normalized cash-conversion of 80%, IDXX trades at an FCF-yield of around 1.5%.

DCF-Valuation

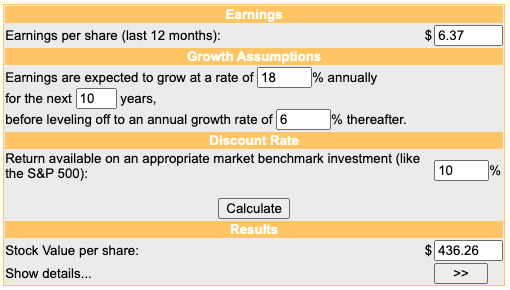

Without further visibility regarding the future of clinical visits growth, I don’t feel confident running a DCF-valuation. Instead, I tried to gauge what kind of growth would be needed to justify the current valuation.

Assuming a cash-conversion of 80% would result in a normalized FCF of $669.6 million x 80% = $535.7 million. Divided by the 84,113,000 shares outstanding, this would result in $6.37 FCF per share at the moment. Assuming a discount rate of 10% and 6% growth into perpetuity, IDXX would need to grow with 18% CAGR for the next 10 years. This scenario would put the implied value of one share at $436.26, as can be seen in the snippet below, vs. the current price of $435.30.

DCF-Valuation (moneychimp.com)

Can IDXX achieve these growth rates? Assuming the cash conversion stays at 80% so that FCF per share grows in line with EPS, I think they actually can.

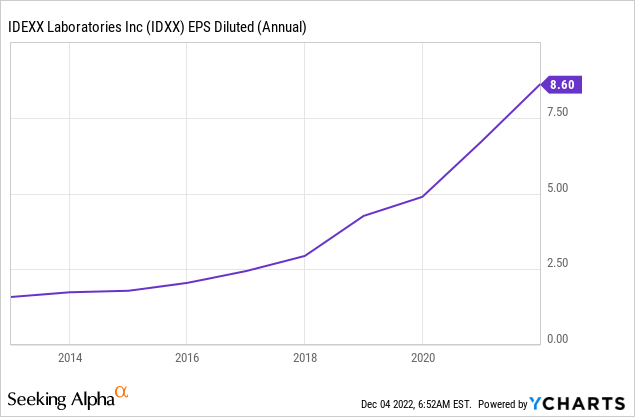

The chart below shows the diluted EPS over the past 10 years. Assuming the starting point at $2.0, the CAGR over the last ten years would be around 17.6%.

However, there is no margin of safety, we don’t know when clinical visits will return to growth, and we have to factor in that IDXX is a far bigger business than 10 years ago, so growth rates should start to slow down naturally in the future. The risk-reward balance is not great.

What to watch out for

The main thing to watch out for will be management commentary regarding the future development of clinical visits. The return to clinical visits growth will be crucial to justify the current valuation. Management will give guidance for FY23 on the year-end earnings call.

Conclusion

IDXX outperformed the S&P 500 since my last article in May. Since then, TTM net income declined from $734.500 million to $669.653 million. The price increase was not supported by fundamental performance, but is solely a result of a multiple increase from a P/E of 43.36 (May article) to 54.68 (this article) and the effect of share repurchases.

Without further visibility regarding the return to growth of clinical visits, I can’t gauge if the current valuation can be justified. However, a reverse DCF-valuation shows that IDXX would need to grow with 18% CAGR over the next ten years and 6% into perpetuity to justify the current price. There is no margin of safety and the risk-reward balance is not great.

Since the long-term story is still intact and IDXX is, as I outlined in my initial article, an outstanding business, I keep rating IDXX a hold at the current price of $435.30.

Be the first to comment