Pgiam

Investment Thesis

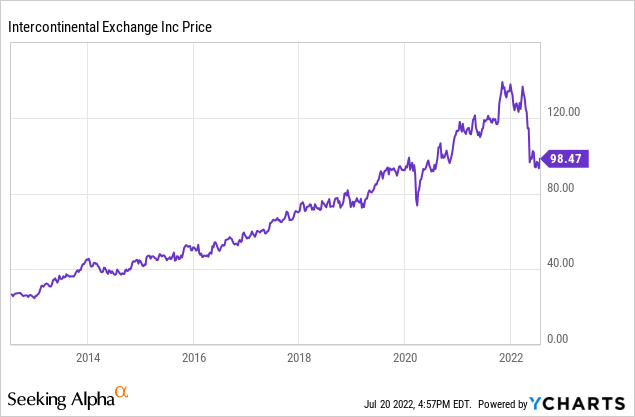

After falling 30% from its highs in October 2021, Intercontinental Exchange (NYSE:ICE) represents an opportunity for investors to buy shares in a high-quality business that is uniquely positioned in the financial ecosystem. It essentially operates as a quasi-monopoly that benefits from network effects, scalability, and has embedded optionality. It operates under-the-radar and has consistently grown revenue, earnings and free cash flow over the years. This is a good time for investors to pick up shares in a wonderful business at a fair price.

Company Description

Intercontinental Exchange is a provider of market infrastructure, data services and technology for financial institutions, corporations and government entities. It operates 3 main business segments:

- Exchanges: operates regulated marketplaces for the listing, trading and clearing of an array of derivatives contracts (major asset classes include energy, agriculture, financial, cash, etc.) and financial securities (e.g. commodities, interest rates, foreign exchange and equities, ETFs); operates 13 regulated exchanges and 6 clearing houses (including the NYSE); accounted for 54% of 2021 revenues

- Fixed Income/Data Services: provides fixed income pricing, reference data, indices, analytics and execution services as well as global credit default swaps (or CDS), clearing and multi-asset class data delivery solutions; accounted for 26% of 2021 revenues

- Mortgage Technology: provides technology platform that offers customers digital workflow tools to address the inefficiencies that exist in the US residential mortgage market; accounted for 20% of 2021 revenues

In short, ICE is mainly in the financial exchange business; products are traded via the exchange (e.g. futures and options) and ICE takes a small percentage (basically acting as a toll booth). The more volume that goes through the exchange, the more money the toll booths will collect. Over the years, ICE has expanded its percentage of recurring revenues and now estimates that 49% of revenues are recurring (mainly attributable to its data services / mortgage technology). To put it in context, recurring revenues in 2011 was ~9%.

From a business perspective, ICE is a fantastic and fascinating business (along with other financial exchanges and businesses that operate as two-sided marketplaces). Financial exchanges are virtual monopolies that benefit from network effects, scalability and optionality.

- Virtual Monopolies: there are only a handful of exchanges now and it’s pretty difficult to start a successful exchange from scratch (good time to mention that exchanges require government licenses); its quasi-monopolistic status is reflected by its 40% operating margins and 30% FCF margins (and the following characteristics help keep its status intact)

- Network Effects: as exchanges grow larger, more market makers are willing to provide liquidity, which attracts more even more trading volume, which then attracts more market makers, and so on; liquidity begets liquidity

- Scalability: revenues can increase without a commensurate increase in capital expenditures; once the infrastructure is in place, the cost to adding more products and the ability to process more transactions is marginal, which means additional revenue essentially gets converted straight into free cash flow

- Optionality: building off the scalability point, exchanges are able to add new products (e.g. Bitcoin futures) at essentially zero-cost; in other words, exchanges have near unlimited call options on all future products that have yet to be invented and listed yet

Valuation Analysis

With ~564m shares outstanding and with a price of $98.44, the market cap is currently $55.5 billion.

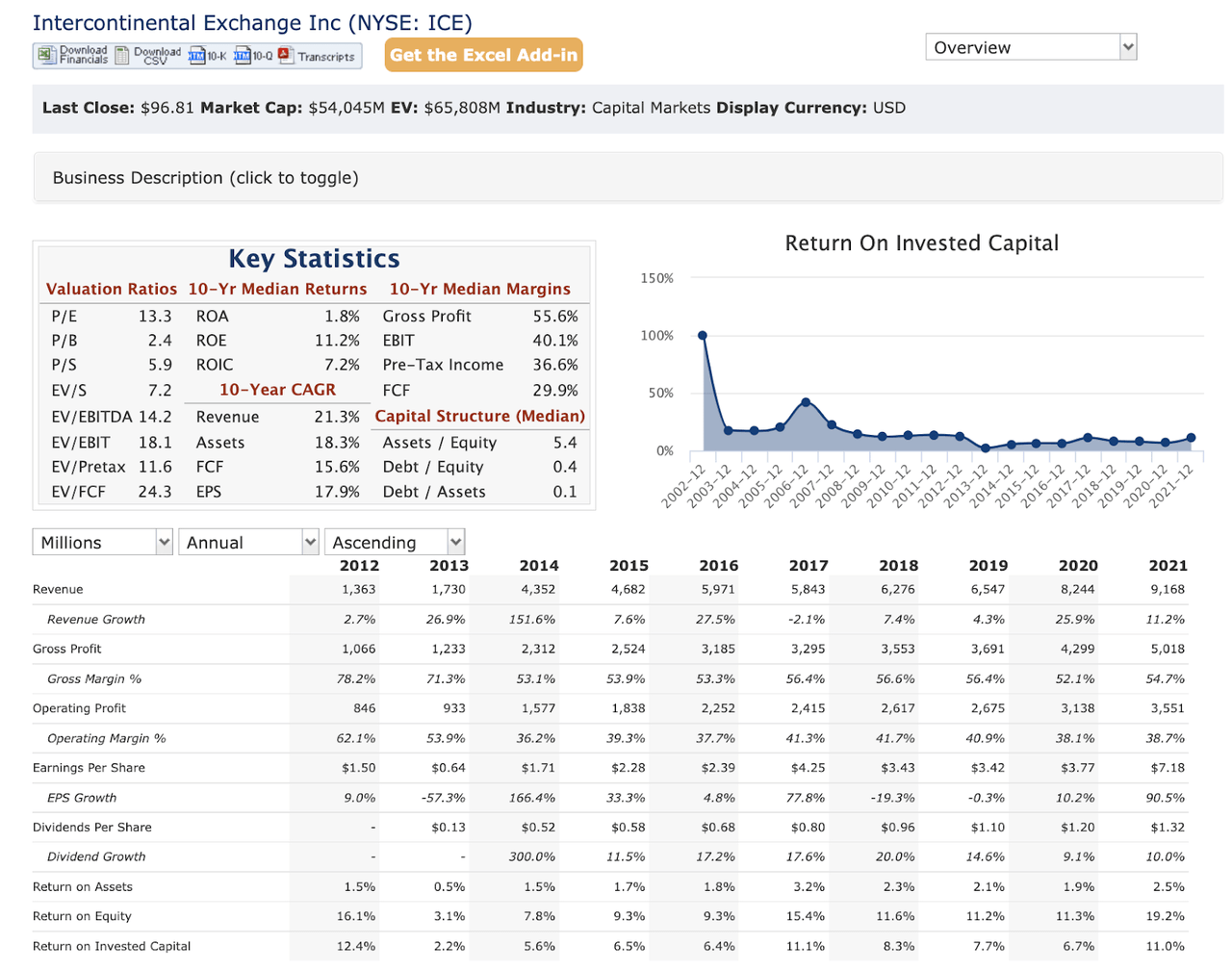

QuickFS

A quick glance at ICE’s financial on QuickFS should suffice in convincing any investor that they should aspire to own some:

- Revenue, assets, FCF and EPS have all grown at a 16-22% CAGR for the last 10 years

- ROE of 10-20%, ROIC of 6-12%

- It sports fantastic margins: 30% FCF margins, 55.6% gross profit margins

- Operates pretty unlevered, with a debt/equity of 0.4x

At current valuations, investors aren’t even paying a high price for this business:

- P/E: 13.3x

- EV/EBITDA: 14.2x

- EV/FCF: 24.3x

- Those who like GARP, the PEG is less than 1 (13.3 / 17.9 = 0.74)

Based on the valuation above, I would argue that Mr. Market is overly pessimistic about ICE’s future and is offering the business up at an attractive valuation.

Capital Allocation

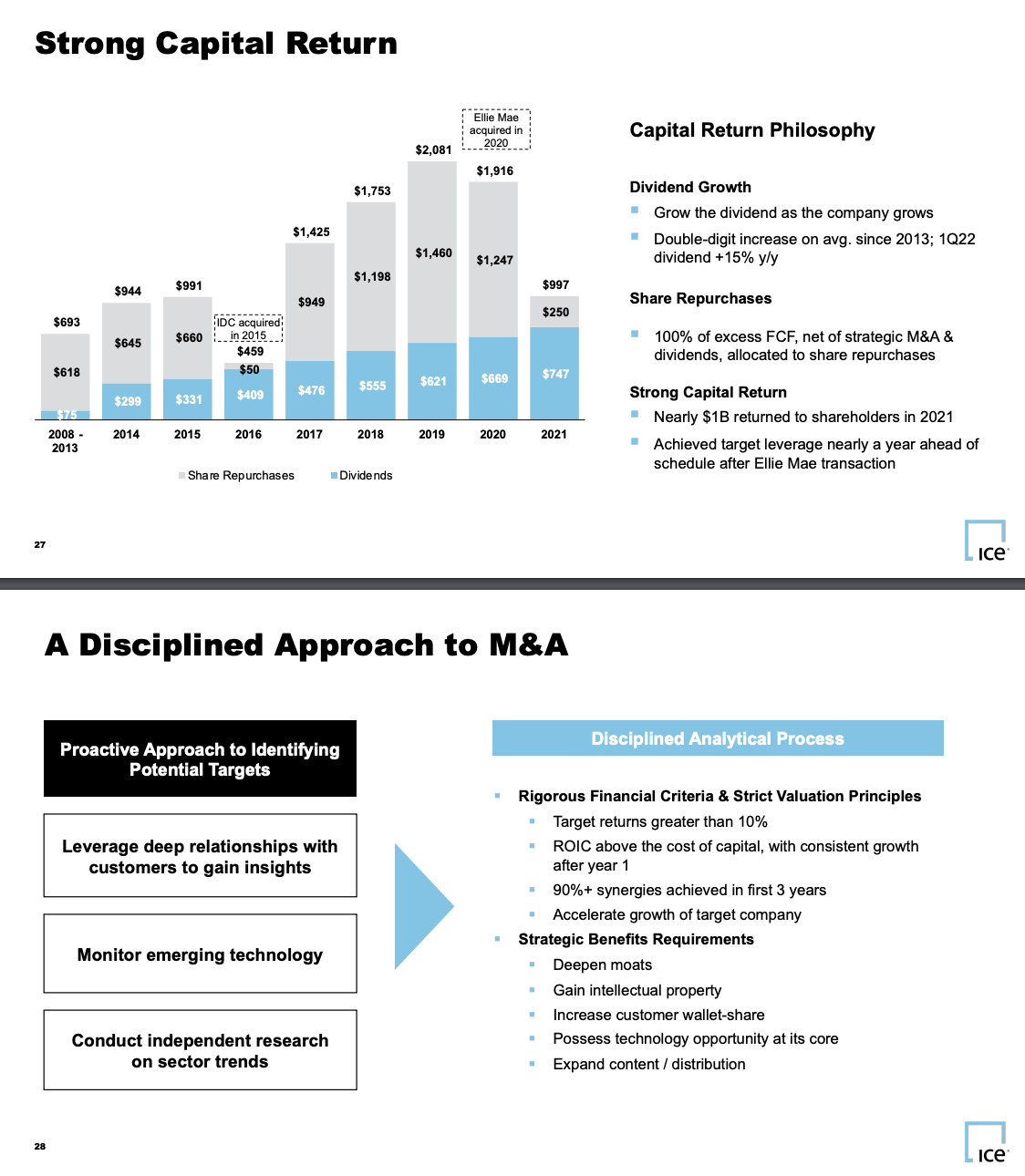

Creating a separate section to discuss ICE’s capital allocation strategy:

- Dividend Growth: grow the dividend as the company grows (double-digit increase on average since 2013)

- Share Repurchases: 100% of excess FCF (net of strategic M&A and dividends) will be allocated to share repurchases

- Approach to M&A: based on certain financial criteria and valuation principles

- Target returns greater than 10%

- ROIC above the cost of capital (with consistent growth after year 1)

- 90% synergies achieved in first 3 years

- Help accelerate growth of target company and

- Provides strategic benefits requirements (deepen moats, gain intellectual property, expand content/distribution, etc.)

Investor Presentation (Q1 2022)

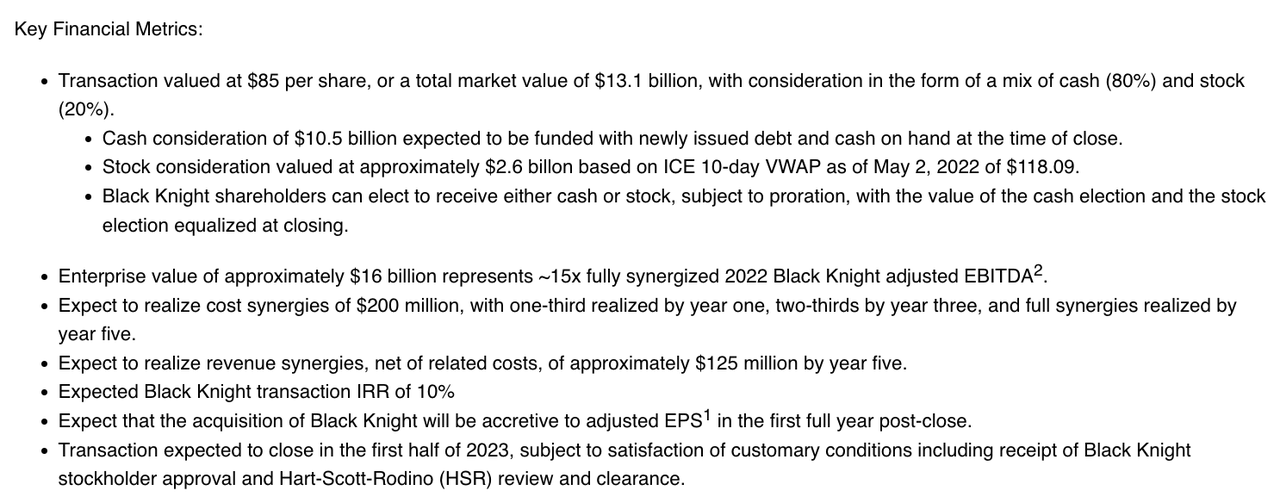

Very few companies have such clear guidelines toward capital allocation. As a result, I trust management to adhere to the above guidelines and be intelligent about their acquisitions… which brings us to ICE’s definitive agreement to acquire Black Knight (NYSE: BKI), a software and data analytics company serving the real estate and housing finance markets, for $85 / share (market value of $13.1B). Frankly, based on the financial metrics below, the acquisition makes sense and will certainly help bolster ICE’s position in the data services / mortgage technology space, as well complement ICE’s offerings.

Press Release

The main risk here is antitrust issues and the market evidently agrees: BKI is currently trading at $65 / share (offer of $85 / share). However, I would argue that either way, investors will be rewarded for holding ICE in the long-run:

- If the deal goes through, ICE will have made a synergistic acquisition that meets its M&A guidelines.

- If the deal doesn’t go through, ICE gets to keep its cash/stock for hunting other elephants down the road.

Either way, investors will be buying into a fantastic business with intelligent capital allocators.

Insider Ownership & Transactions

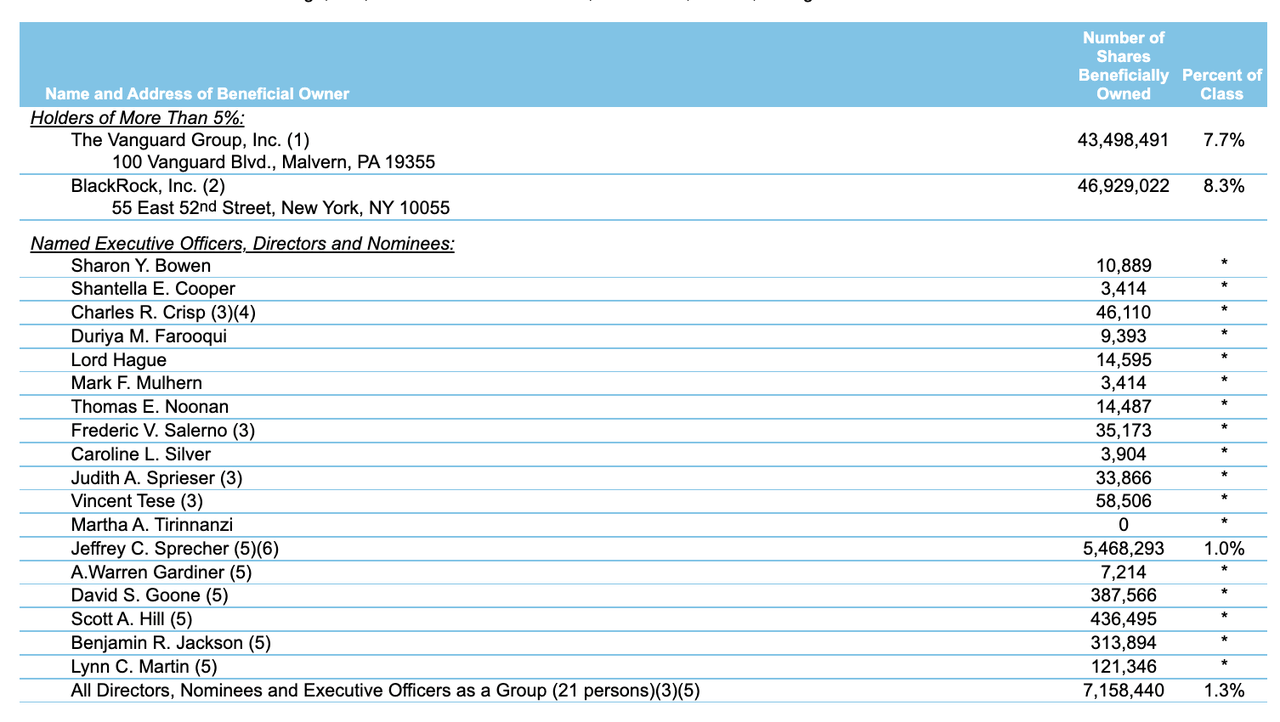

DEF 14A (2022)

Insiders own ~1.3% of the shares outstanding. Normally I would like to see a higher percentage, but I think the quality of the business model outweighs the low insider ownership (and 1.3% still amounts to ~$720M, which is quite a significant sum).

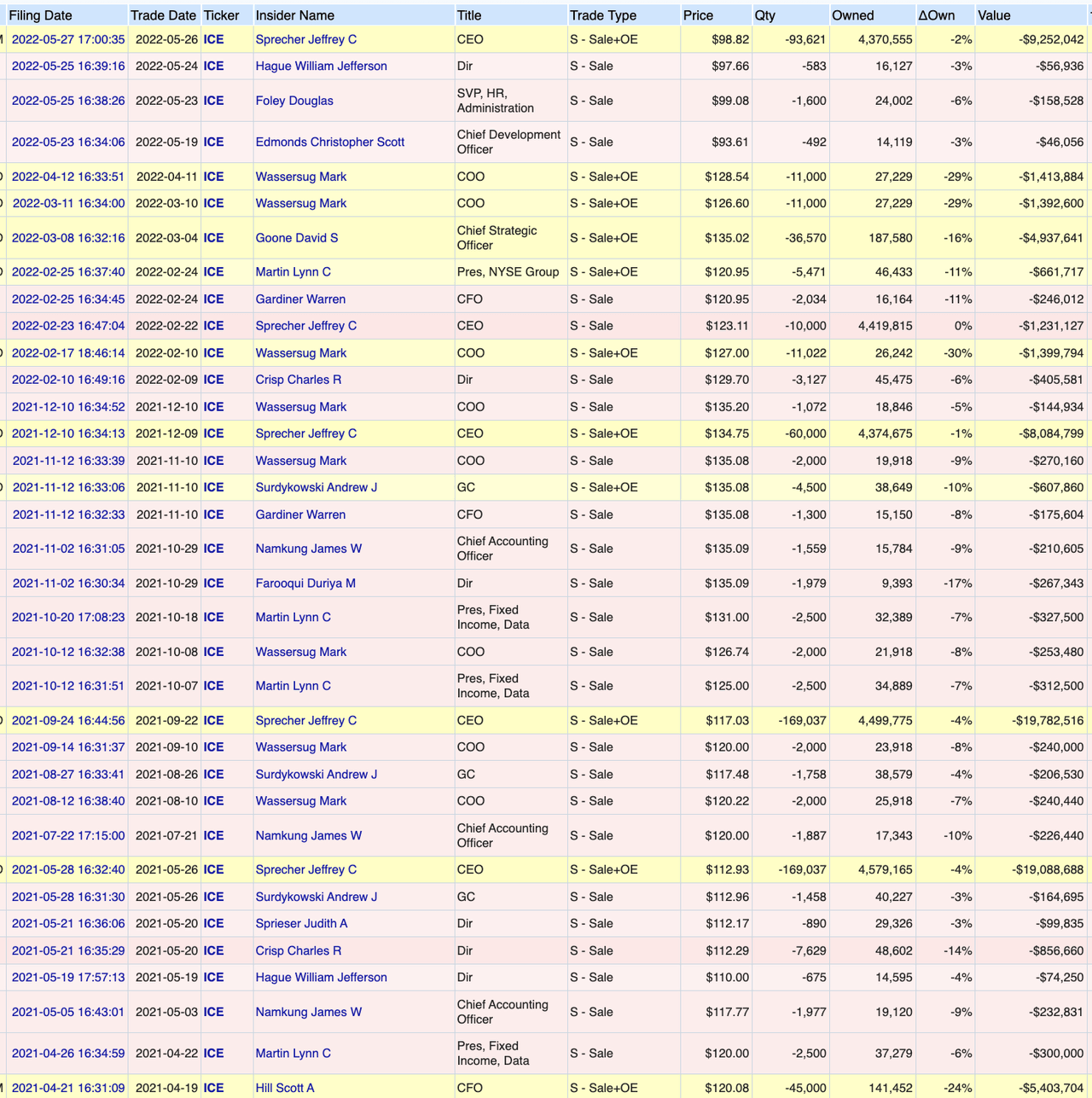

Insiders have also been consistent sellers of the stock. As much as I would like them to be net buyers instead of net sellers, large and successful companies often have consistent insider selling.

OpenInsider

Catalysts

- Continued execution, organic/inorganic growth and disciplined capital allocation will continue to help the business grow and expand, which will increase both the dividends and amount of share repurchases

- Inflation: Horizon Kinetics has argued that higher inflation would lead to a re-pricing of assets (interest rates, commodities, currencies, etc.), which would lead to an increase in trading volume from both speculation and hedging (which directly benefits financial exchanges like ICE)

Risks

- Low Insider Ownership: insiders own ~1.3% of the shares outstanding; I would normally like to see a higher percentage, but I think the quality of the business model outweighs the low insider ownership

- Deviation From Capital Allocation: any deviation from the outlined capital allocation plan should be a red flag for investors

Investment Summary

The best business is a royalty on the growth of others, requiring little capital itself. – Warren Buffett (1997 Email Exchange on Microsoft)

ICE is uniquely positioned to benefit from the growth in both trading volume and newly listed products on financial exchanges. In other words, the company benefits as a royalty on the growth of others (without taking on much risk) and satisfies Buffett’s criteria for a “best business”; in this case, the continued growth of capital/financial markets, continual listing of new products, and increased demand for data services. In addition, in inflationary periods, ICE could also act as an inflation beneficiary.

Similar to my write-ups on high-quality companies like CRL and CBRE, ICE operates quietly in the background with little need for advertising and is integral in the financial system. These are the high-quality businesses that one should yearn to own at a fair (or ideally, cheap) price.

Based on the analysis above, I recommend a long position in ICE with a holding period of a few years (maybe even forever). I have no idea what the stock price will do in the short term, but I would look to add more if it continues to decline, as I see the company having the ability to compound for many years to come.

Be the first to comment