nicoletaionescu/iStock via Getty Images

A couple of weeks back, we promised to “share extracts from our weekly reviews.” This article, taken from an analysis originally published for Wheel of Fortune’s subscribers on Nov. 28, is part of that effort.

——————————————————————————–

Weak Holiday Season for Retailers

US retailers are due to face a tougher (than usual) holiday season.

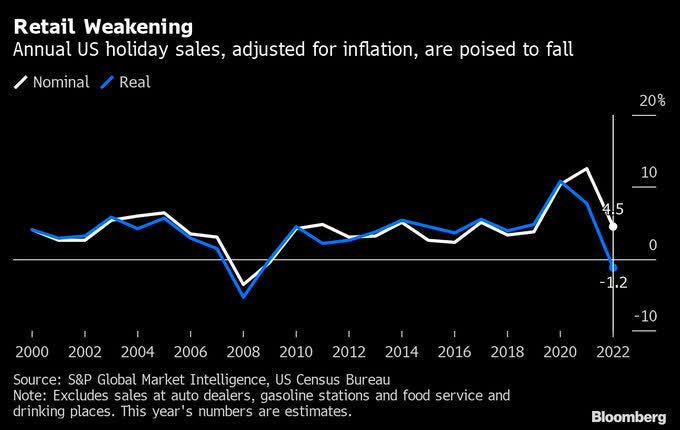

According to S&P Global Market Intelligence, seasonal sales adjusted for inflation are likely to fall 1.2% Y/Y – the first decline since 2009.

Bloomberg

This may not be the last straw that breaks the retail camel’s back (a recession might do that), but it’s certainly putting serious sticks in the retail industry’s wheels that make a big share of its annual sales during the holiday season.

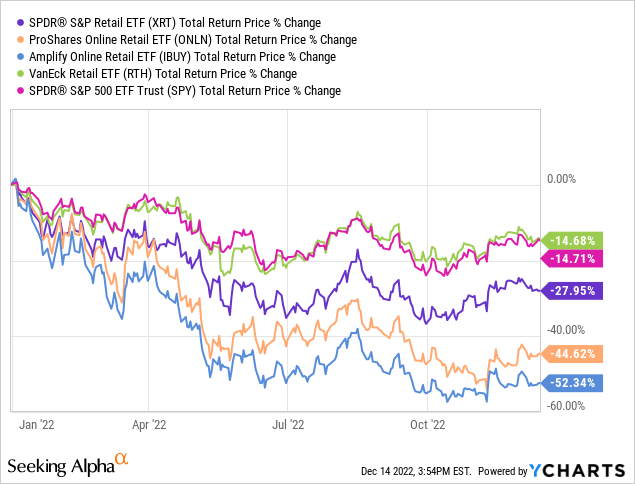

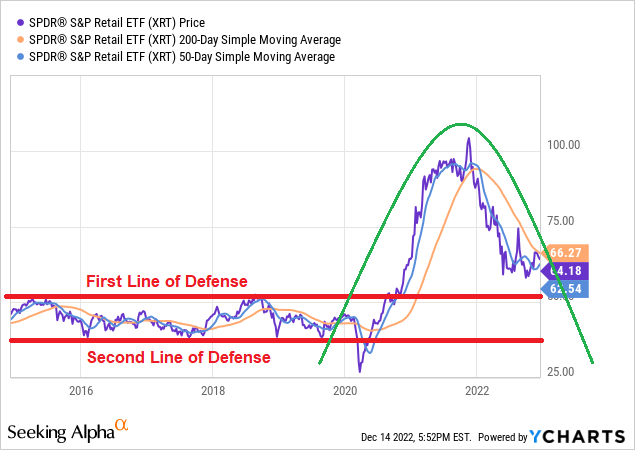

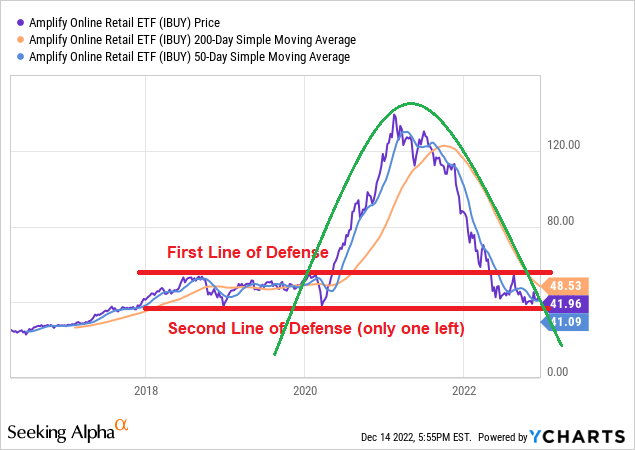

The past year has been particularly hard for retailers and this is reflected in the performance of the leading retail ETFs. Having said that, it’s important to make a difference between the general/broader ETFs – SPDR S&P Retail ETF (NYSEARCA:XRT) and VanEck Vectors Retail ETF (RTH) – to the online-focused ETFs – Amplify Online Retail ETF (NYSEARCA:IBUY) and ProShares Online Retail ETF (ONLN).

The former have been performing better than the latter, likely thanks to many people who are still looking to pay a (physical) visit to brick-and-mortar (“B&M”) retail stores, following the long period of COVID lockdowns and supply-chain disruptions.

So much so that RTH is performing in-line with the broader market (SPY), which is quite remarkable taking into consideration how quickly the economy has shifted from record growth to recession fears.

Even XRT, though delivering twice as negative return as RTH does, is comfortably outperforming ONLN and IBUY by ~17% and 24%, respectively.

Y-Charts, Author

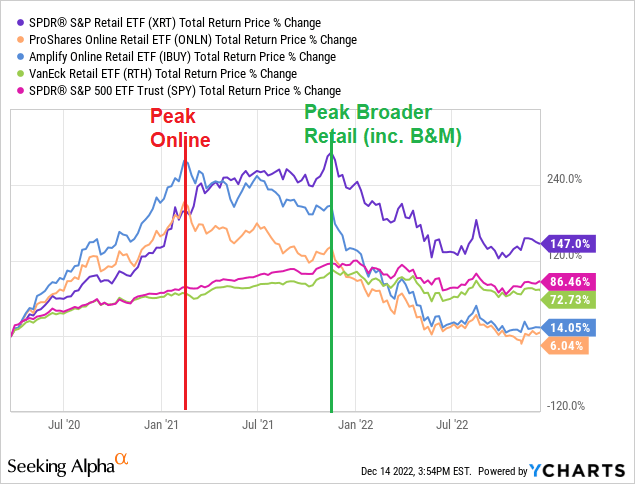

Similarly to economic growth, the shift from “only online” shopping back to “let’s get physical” shopping is also stunning. More accurately, it wasn’t a “shift” per-se rather the loss of the “online mojo” that shined so brightly in 2020 and early 2021 at the expense of B&M.

While ONLN and IBUY peaked in the middle of the first quarter of 2021, XRT and RTH kept on going until the middle of the fourth quarter of 2021 before they surrendered to the deteriorating economy, as well as to the entire stock market.

Y-Charts, Author

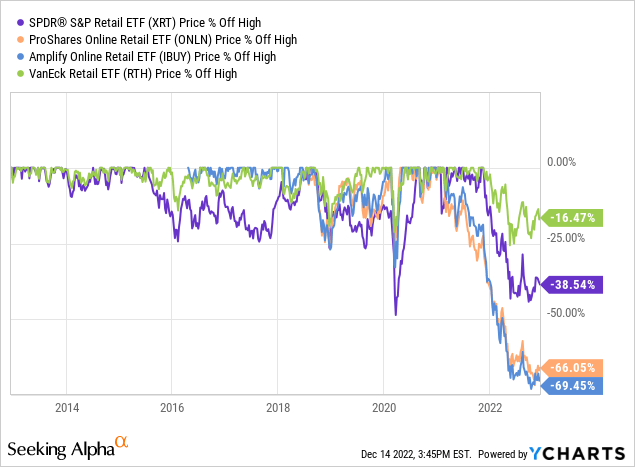

Recession fears, fueled by the fastest and most brutal monetary policy tightening we’ve ever seen, are doing no favor to retailers either.

Weak sales, higher rates, consumer sentiment at record lows, and a general feeling that it’s going to get (a lot) worse before it gets better are taking a significant toll from retail ETFs.

So much so that they’re all trading nowadays with the largest drawdowns they’ve ever (or at least since the GFC; only XRT goes back that far) experienced.

Y-Charts

Just as consumers fear, the main problem is that the worst might still be ahead for the retail industry.

Yield-Curve Spells Recession

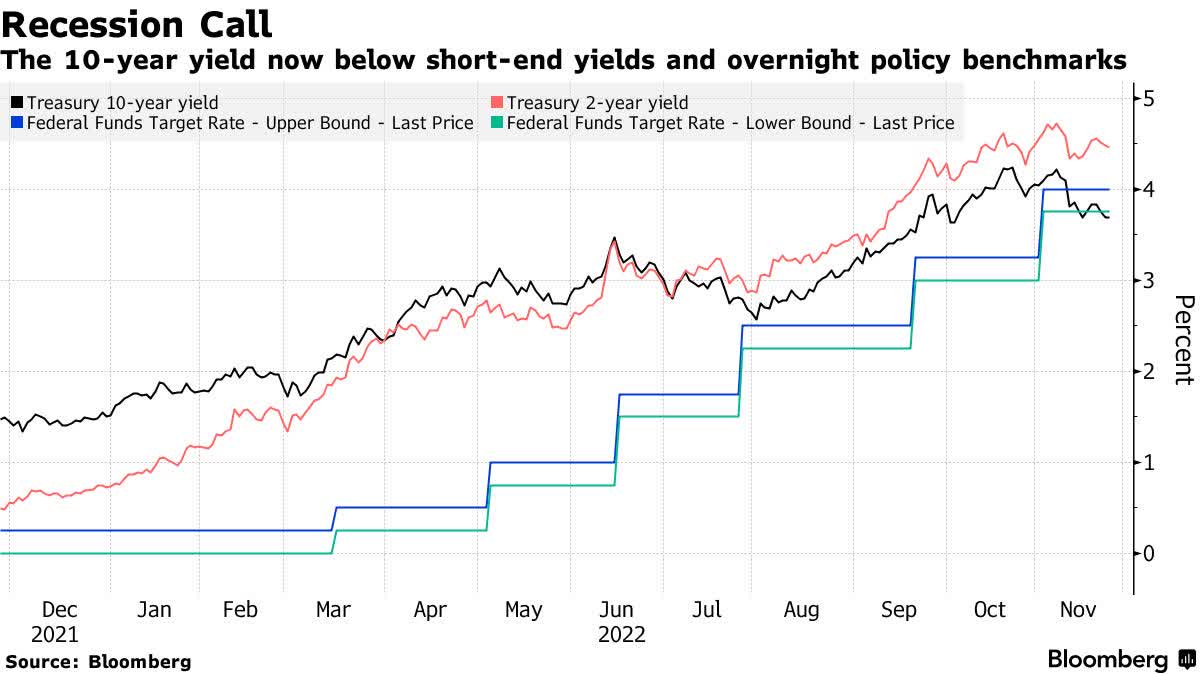

The yield-curve keeps sending recessionary signals.

Not only that the 10-2 spread is digging multi-year lows almost every day nowadays, but the UST10Y is now lower even than the Fed Funds Rate (“FFR”)!

Bloomberg

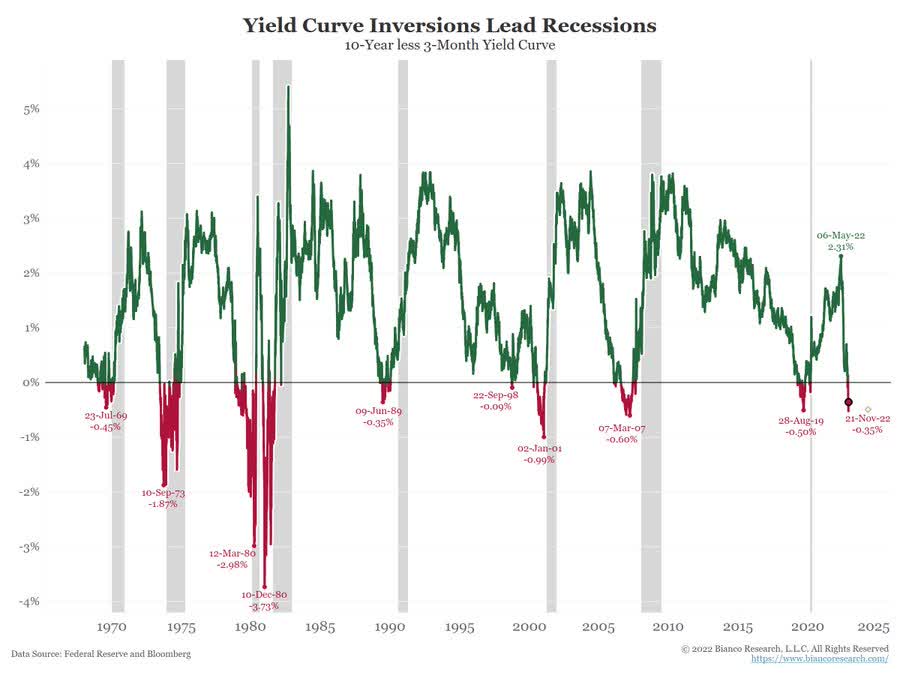

Here is a chart of the 10-year/3-month spread.

Shaded areas = recessions. Red = inversion.

Inversion of this spread (for more than a couple of days*) has historically led to a recession, without ever failing.

*In Sep. 1998, the spread inverted on only 2 different days, and a recession didn’t follow.

We’re now at an inversion streak of 10 consecutive days .

Bianco Research

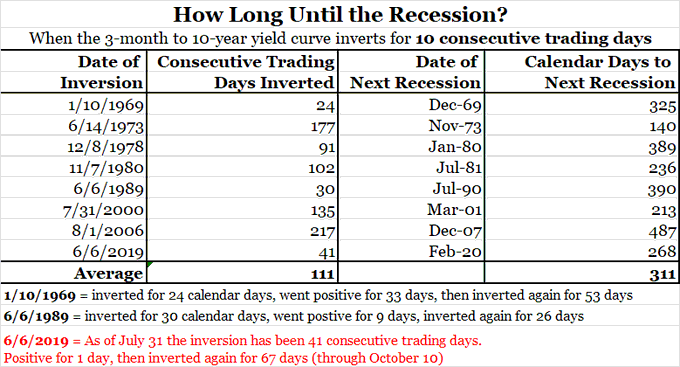

And as this table shows, over the last 50+ years when the 3-month/10-year yield curve inverted for 10 consecutive days, we had a perfect score (8 for 8) in predicting recessions.

The average lead time is 311 days, or about 10 months, so don’t assume that the US economy will be out of the woods by mid-2023.

Bianco Research

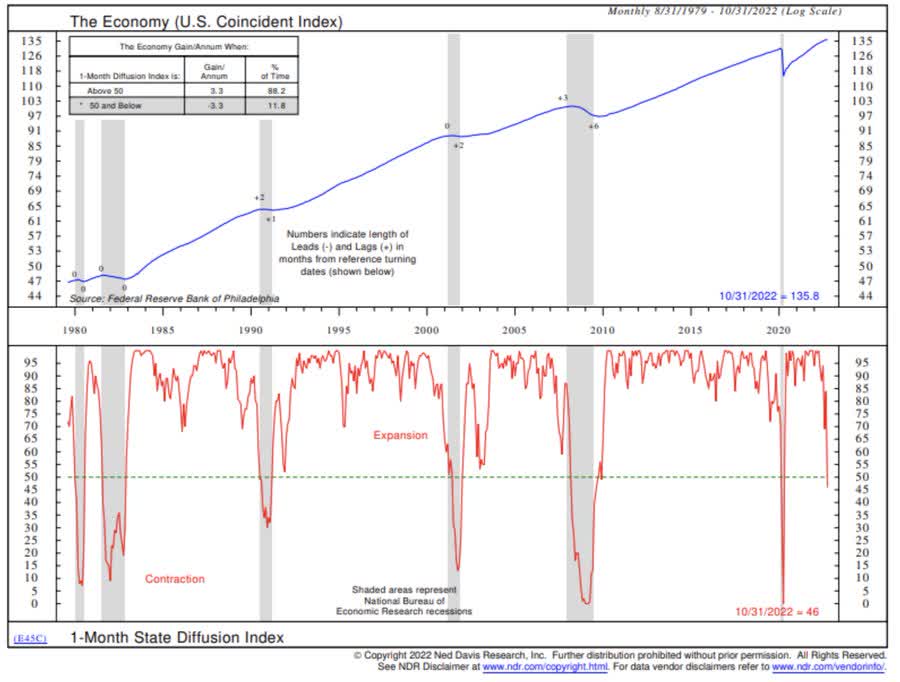

Another reliable gauge that has never issued a false signal before (since its inception in 1979), is the Ned Davis Research US Coincident Index.

Last week, the index flashed a recession warning, so based on history, a US recession is on its way (and not too far ahead).

Ned Davis Research

Stocks May Still Climb The Wall (Street) of (Recession) Worry

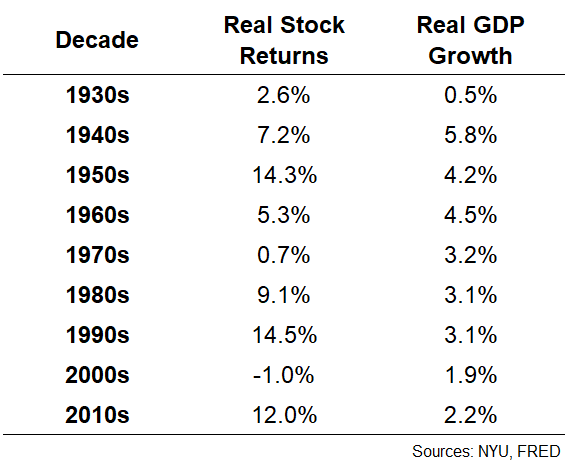

On the other hand, as we all know, even if the economy isn’t doing so well, stocks can still perform well.

The stock market isn’t the economy.

NYU, FRED

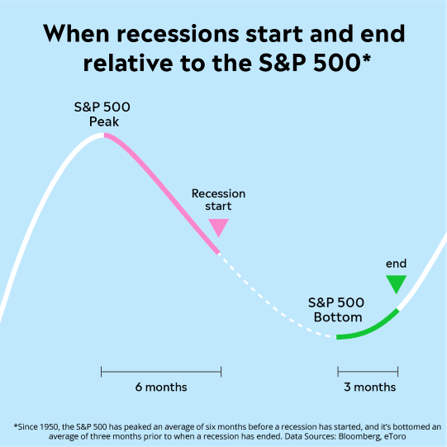

Since 1950, the S&P 500 has peaked (on average) 6 months before a recession has started, and it has bottomed (on average) 3 months prior to when a recession has ended.

[This time is different I guess, because the S&P 500 peaked in late Dec. 2021 (we’re now 11 months since that, and counting). That, of course, unless the index intends to peak soon, ahead of a recession in 2023…]

Bloomberg, eToro

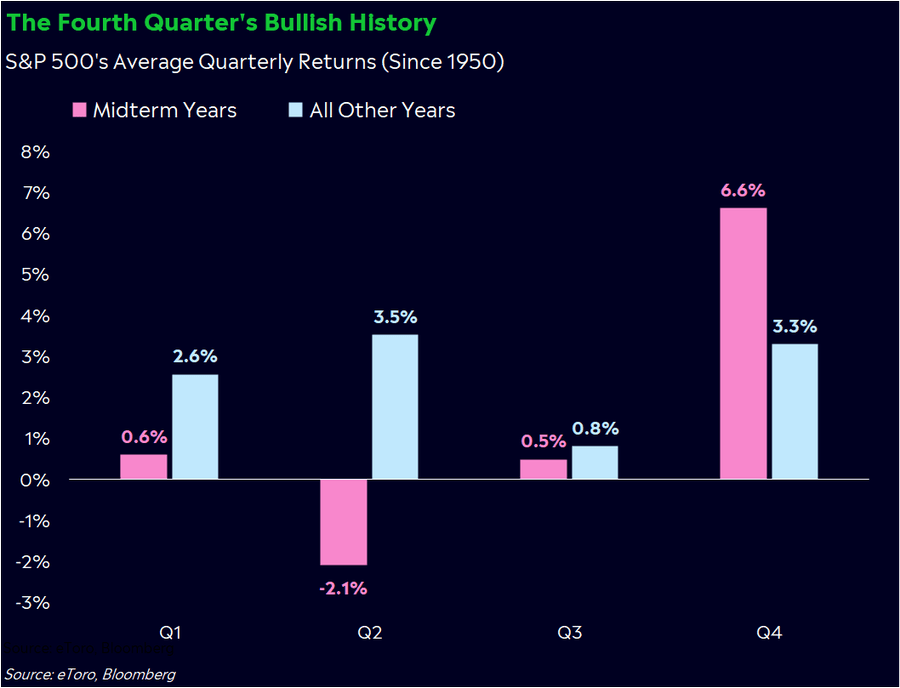

But there’s still some hope after all.

Since 1950, Q4 has been the S&P 500’s strongest quarter (+3.3% on average), especially true in midterm election years (+6.6% on average).

Bloomberg, eToro

Monetary Policy

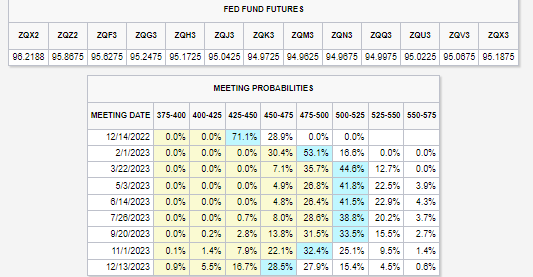

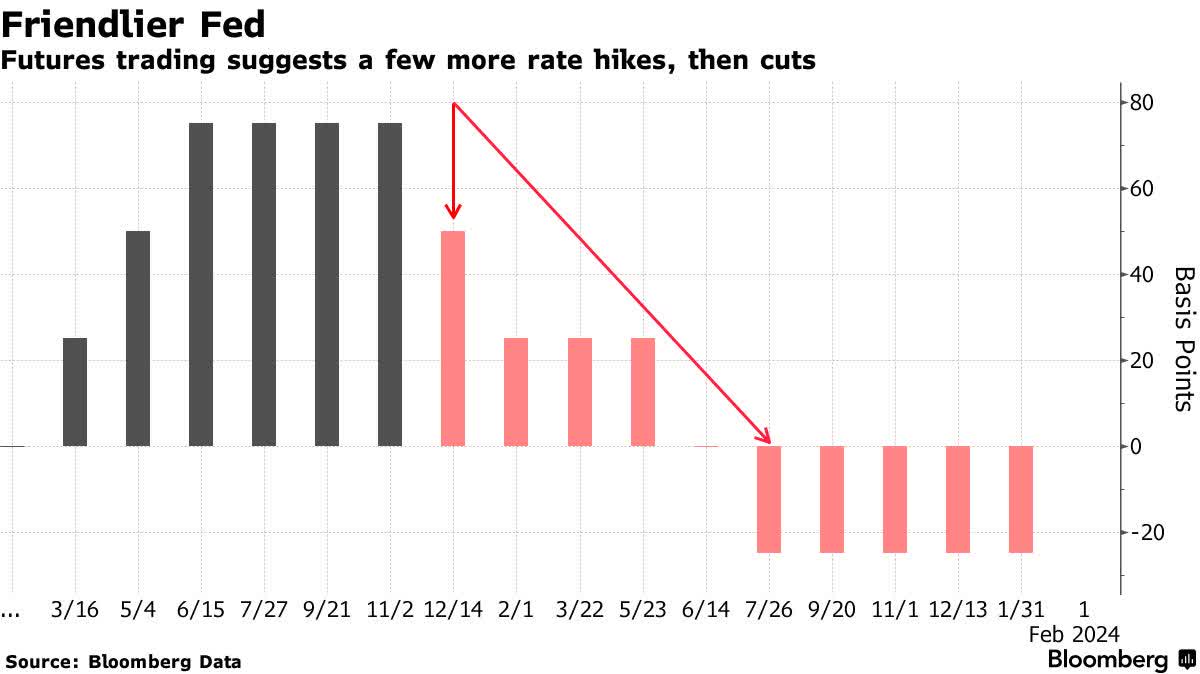

Futures are now pricing a terminal FFR greater than 5%.

CME

However, they’re also predicting a rate cut as early as in July 2023.

Bloomberg

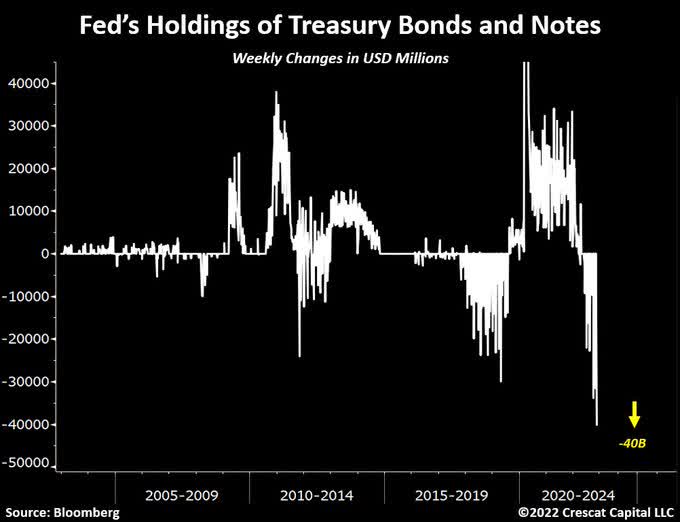

And while everyone is focused on the tightening cycle while the Fed continues to shrink its holdings of Treasury bonds and notes at the steepest pace in history.

Bloomberg, Crescat Capital

Top-10 Retailers

Per the National Retail Federation here are the top-10 US retailers according to their last FY US retail sales:

| Rank | Company | 2021 US retail sales ($B) |

|---|---|---|

| 1 | Walmart (WMT) | $459.51 |

| 2 | Amazon.com (AMZN) | $217.79 |

| 3 | Costco Wholesale (COST) | $140.41 |

| 4 | The Home Depot (HD) | $140.06 |

| 5 | The Kroger Co. (KR) | $136.49 |

| 6 | Walgreens Boots Alliance (WBA) | $108.34 |

| 7 | Target (TGT) | $104.62 |

| 8 | CVS Health Corporation (CVS) | $93.36 |

| 9 | Lowe’s Companies (LOW) | $87.73 |

| 10 | Albertsons Companies (ACI) | $71.87 |

With the exception of Amazon (100% online since day 1), all of these retailers are legacy chains that started operating way before anyone knew what “online shopping” is.

Obviously, they’ve evolved over time and now their online legs are just as strong and meaningful as their B&M legs, if not more.

Nonetheless, by and large they fit the “old school” category that theoretically should have allowed them to be more immune to the recent slump.

Is this indeed the case?

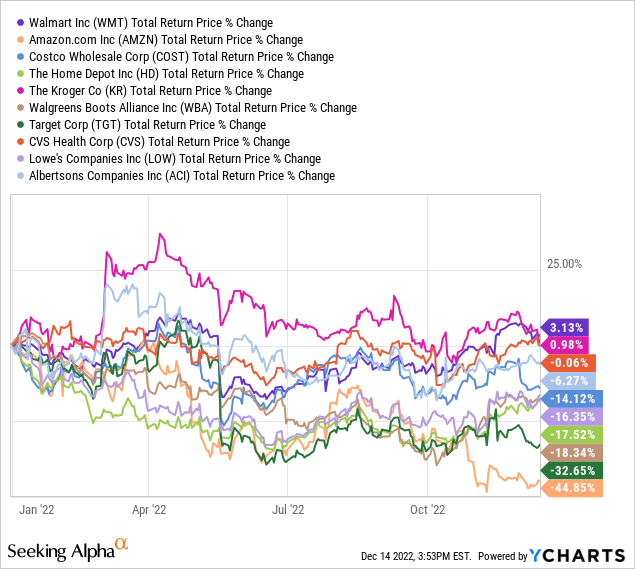

The average top-10 retailer is down -14.6% YTD, near perfectly aligned with the total return of RTH (-14.7% YTD).

However, if we exclude AMZN, the average top-10 retailer is down only -11.2% YTD – better by ~3.5% than RTH (=cutting about 1/4 of the negative total return), surely any of the other retail ETFs for that matter.

Y-Charts

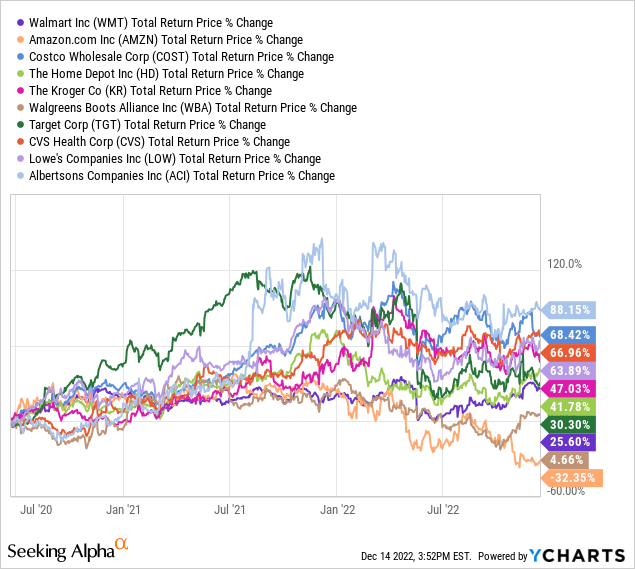

Running the same drill when looking at the performance since March 23, 2020 (market bottom during the COVID era) we get some interesting, different, results:

First and foremost, it’s worthwhile noting that AMZN is the only name with negative performance (-32.4%). All other 9 names are up, and if we put WBA’s +4.7% aside, all remaining 8 names have returned at least 25%.

Not great maybe, but surely not bad.

The average top-10 retailer is up +40.4% during that period, way lower than XRT (+147.0%) and RTH (+72.7%), but way higher than IBUY (+14.1%) and ONLN (+6.0%).

If we exclude AMZN, the average top-10 retailer is improving to +48.5% during that period.

Y-Charts

Very Different Retail ETFs

Per the fund’s website (emphases mine), XRT “seeks to provide investment results that, before fees and expenses, correspond generally to the total return performance of the S&P Retail Select Industry Index… Seeks to provide exposure the retail segment of the S&P TMI, which comprises the following sub-industries: Apparel Retail, Automotive Retail, Computer & Electronic Retail, Department Stores, Drug Retail, Food Retailers, General Merchandise Stores, Hypermarkets & Super Centers, Internet & Direct Marketing Retail, and Specialty Stores“

Classic B&M-oriented.

Per the fund’s website (emphases mine), IBUY “seeks to provide investment results that, before fees and expenses, correspond generally to the price performance of the EQM Online Retail Index. The Index is a globally-diverse basket of publicly-traded companies that obtain 70% or more of revenue from online or virtual sales.”

Classic online-oriented.

Interestingly, none of the top-10 retailers has found its way into the top-10 holdings of IBUY (unsurprisingly, taking into consideration it’s an online retail ETF) or XRT (which is quite a surprise).

When we compared the top-10 holdings of the two funds, there’s only one name (Chewy (CHWY)) that appears in both.

Here are the top-10 holdings of XRT [Source]:

| Name (Ticker) | Weight-XRT |

|---|---|

| American Eagle Outfitters Inc. (AEO) | 1.67% |

| Abercrombie & Fitch Co. Class A (ANF) | 1.65% |

| Gap Inc. (GPS) | 1.62% |

| Burlington Stores Inc. (BURL) | 1.52% |

| Buckle Inc. (BKE) | 1.49% |

| ODP Corporation (ODP) | 1.45% |

| Five Below Inc. (FIVE) | 1.45% |

| Ross Stores Inc. (ROST) | 1.45% |

| Chewy Inc. Class A (CHWY) | 1.43% |

| Urban Outfitters Inc. (URBN) | 1.41% |

Here are the top-10 holdings of IBUY [Source]:

| Name (Ticker) | Weight-IBUY |

| ETSY INC (ETSY) | 3.01% |

| CHEWY INC (CHWY) | 2.87% |

| PELOTON INTERACTIVE INC (PTON) | 2.87% |

| DOORDASH INC (DASH) | 2.80% |

| NETFLIX INC (NFLX) | 2.72% |

| EBAY INC. (EBAY) | 2.58% |

| BOOKING HOLDINGS INC (BKNG) | 2.56% |

| SHUTTERSTOCK INC (SSTK) | 2.54% |

| COPART INC (CPRT) | 2.53% |

| REVOLVE GROUP INC (RVLV) | 2.53% |

IBUY is clearly more concentrated than XRT, another factor that may have played in favor of the latter during the recent slump.

View Into 2023

We’re predominantly fundamental investors.

As such, and taking into consideration how bad things are looking for the US and global economy, there’s no way we can give our blessing for the retail industry as a whole.

Truth is, retail ETFs are a SELL in our book, even after losing so much of their value already.

XRT still has two significant lines of defense underneath the current price.

Nevertheless, the first line of defense (at the low 50s) still represents a downside of about 20% – not something we would wish to put ourselves into right now.

And if a 20% downside doesn’t sound too appealing, how about low-mid 30s, where the second line of defense is. That’s halving from here, and a good reminder for us all that a stock can still halve even after going through halving beforehand.

It also looks as if the 200-DMA is forming a steady and consistent resistance (throughout 2022), implying that XRT has very little upside to offer.

Y-Charts, Author

Unlike XRT, IBUY has only one line of defense left (underneath the current price), because the fund has already broken the first line of defense (which has now turned into resistance, above the current price).

The good news is that there’s more upside potential for IBUY than for XRT.

The bad news is that the IBUY is currently almost sitting on its second line of defense, so breaking down from here means there’s nothing in the way.

IBUY is also trading only ~2% above its 50-DMA, adding another layer to the anyhow-shaky ground this fund walks on.

Do you want to look at the half-full of the “IBUY glass” and bet on the fund finding support right here and right now, or do you want to look at the half-empty of the “IBUY glass” and fear of the fund breaking down soon with nothing on the way to stop the price from falling a lot more?

For us, this is a “No-Go” type of risk/reward, even though we believe IBUY is more interesting than XRT at this point in time.

Y-Charts, Author

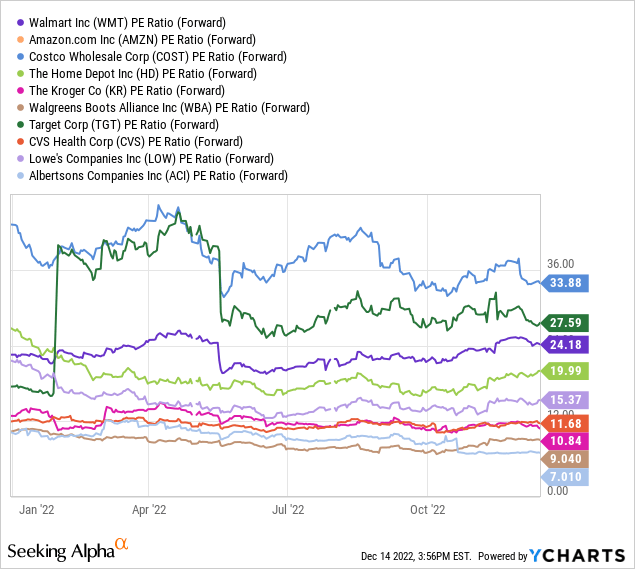

Yet, even with all this retail doom and gloom, we believe that some of the big, legacy, retailers are worthwhile having a closer look at current valuations.

Forward P/E ratios in the single-digit, or even low-mid doubt-digit, area are quite attractive multiples for this industry.

Y-Charts

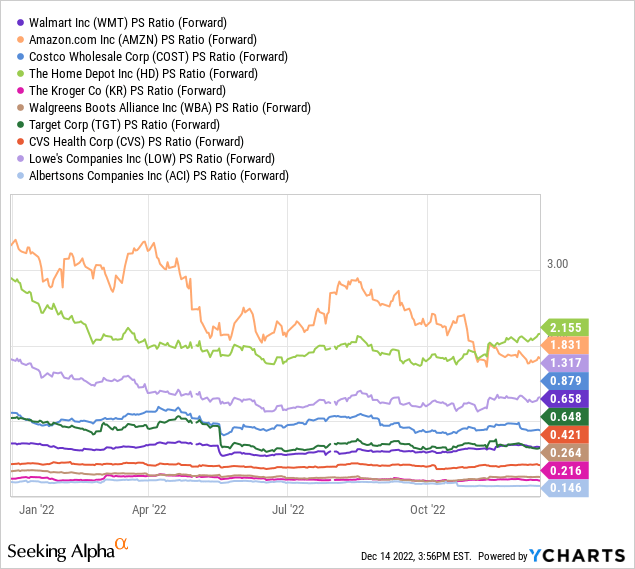

Same goes to forward P/S ratios that are ridiculously low, and if not for the lousy economic outlook would have made many of these names a crying buy.

Y-Charts

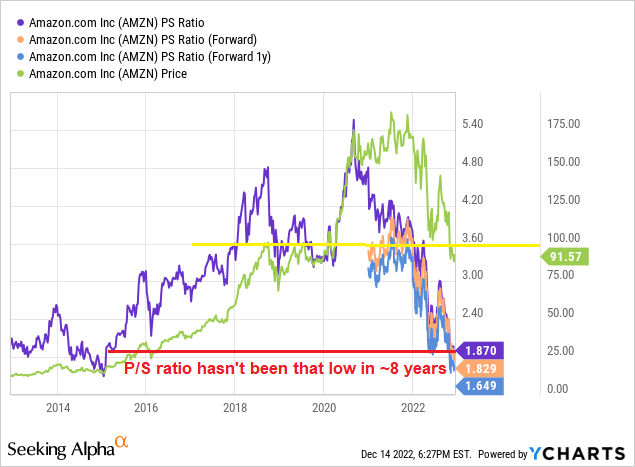

I mean, when was the last time you could have bought AMZN with a P/S ratio < 2? The answer is about 8 years ago, and it’s unreal to get Amazon today for a similar multiple, regardless of anything else you might wish to say in favor/against the stock/company.

Y-Charts, Author

Of course, there’s this tiny thing called recession that (if and when) is going to cut both top and bottom lines of these retailers massively, turning all these multiples upside (and not) down.

For that reason, we don’t think this is a good time to push money into the retail industry, surely not into retail ETFs.

Having said that, there are more than a handful names that deserve a closer look only a couple of months down the (economic downturn) road.

Be the first to comment