SeventyFour

It’s been a mixed Q2 Earnings Season thus far for the Gold Miners Index (GDX), with Equinox (EQX) seeing one of the worst reports – missing on output, pulling costs higher, but fortunately, reaffirming construction capex. It was the opposite for IAMGOLD (NYSE:IAG), with production beating plans and costs in line, but the company outlined a huge miss on capex at their Ontario project.

This is becoming the neverending story of capex revision for IAMGOLD, and while this project will improve the cost profile, the poor execution has led to a considerable funding gap. Given the company’s razor-thin margins, which provide no defense against weaker gold prices, and the risk of significant share dilution to address the funding gap, I continue to see IAG as an Avoid.

Cote Mine Construction (Company Presentation)

While some analysts have recommended “accumulating” IAMGOLD between US$2.00 and US$3.25, I have continually warned against owning the stock, reiterating that it’s an inferior way to buy the dip. This is because the company has a history of being unable to meet targets, with only one strong operating mine (Essakane) and continued capex blowouts at its construction-stage cote Project. Since my last update in May, IAMGOLD has seen a further increase in capex at Cote partially related to strikes, and its margins have become thinner than Paulie Cicero’s garlic slices (Goodfellas) following the recent gold price weakness. The result is a considerable funding gap at Cote and another year of significant margin compression. Let’s take a closer look below:

IAMGOLD Article – May 2022 (Seeking Alpha Premium)

Q2 Production & Costs

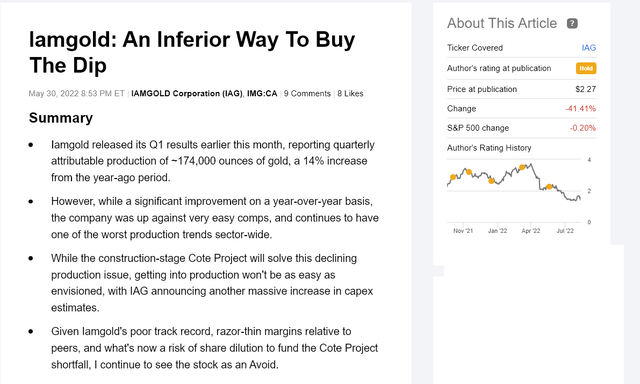

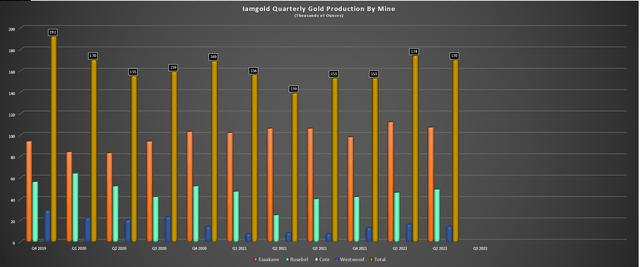

IAMGOLD released its Q2 results last week, reporting quarterly production of ~170,000 ounces. This was helped by a better quarter at Rosebel, a decent quarter at Essakane, and improved production at Westwood year-over-year. That said, Rosebel and Westwood were up against very easy year-over-year comps, combining for less than 40,000 ounces in the year-ago period. Last year’s softness was related to COVID-19-related headwinds, a temporary blockade of the site, and an unusually severe rainy season, limiting access to higher-grade benches. At Westwood, the asset relied on low-grade feed with limited underground tonnes mined in Q2 2021.

IAMGOLD – Quarterly Production by Mine (Company Filings, Author’s Chart)

Fortunately, these assets bounced back in Q2 2022, with Rosebel producing ~49,000 ounces and Westwood contributing ~14,000 ounces. That said, all-in sustaining costs [AISC] at the two assets came in at $1,874/oz and $3,147/oz, respectively, which certainly didn’t translate to any free cash flow at these assets. Elsewhere, Essakane had a decent quarter in Africa, producing ~107,000 ounces at all-in sustaining costs of $1,124/oz. This translated to a 1% increase in production year-over-year at the asset but at 7% higher costs, related to higher sustaining capital. Overall, Essakkane continues to be consistent for IAMGOLD, but you can’t do much with two marginal assets and one great asset from an overall profitability standpoint.

IAMGOLD Quarterly Production (Company Filings, Author’s Chart)

While the company remains on track to beat its guidance mid-point of 570,000 to 640,000 ounces with ~344,000 ounces produced year-to-date, we can see that quarterly production and production growth per share continue to trend lower. While Cote will help with this once online (Q1 2024), it may not help as much from a production standpoint as expected. This is because we could see the sale of some of IAMGOLD’s development pipeline to fund the current ~$600 million funding gap at Cote, or even Rosebel, shaving 200,000 ounces off its annual production profile.

Of course, this would be offset by Cote at ~321,000 attributable ounces for the first six years, but the investment thesis continues to deteriorate due to the cost blowouts. The reason is that the company touted it would become a 1.0+ million-ounce producer with Cote with further growth in the wings from its development assets (Africa, Canada). However, under the current outlook that everything except for Cote/Essakane is under review, the company would come in considerably below the 1.0 million-ounce mark in the case of a Rosebel sale and could also see its development pipeline cut down in size. So, although Cote is a phenomenal asset, it could come at an enormous cost, given the cost blowouts.

Finally, it’s important to note that things have become more challenging at its one solid operating asset (Essakane), with the security situation deteriorating, impacting the in-land supply chain. This resulted in delays in the delivery of consumables, and while actions have been taken, this is not an ideal development at all, potentially impacting future production. Meanwhile, at Rosebel, the collective bargaining agreement expires this month, potentially disrupting operations if no deal is reached promptly. Finally, Westwood’s collective bargaining agreement ends in November, which is likely to pull labor costs higher here as well, at an asset already struggling to get costs below $2,000/oz.

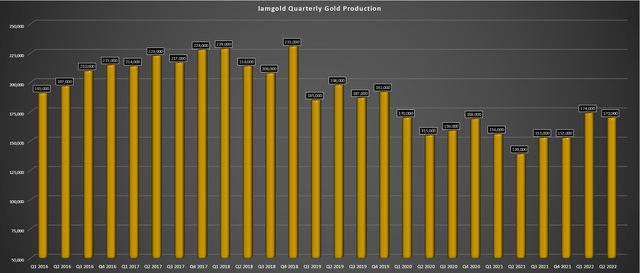

IAMGOLD – Quarterly All-in Sustaining Costs (Company Filings, Author’s Chart)

Overall, this was a decent quarter operationally for IAMGOLD, at least considering how bad its quarterly numbers were in 2021, but even with an increase in production, costs are rising rapidly. IAMGOLD’s all-in sustaining costs came in at $1,604/oz in Q2 2022, up from $1,422/oz in the year-ago period. Meanwhile, cash costs came in at $1,119/oz, more than 25% above the industry average as well. Not surprisingly, this has led to continued margin compression, which we’ll look at below:

Margins & Financial Results

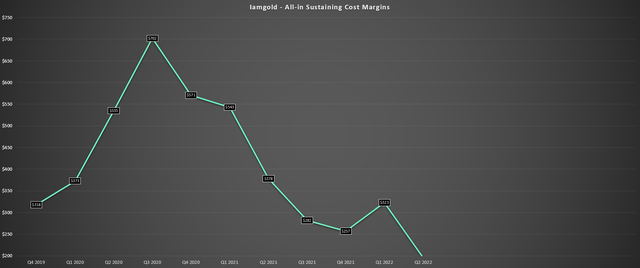

Moving over to margins, IAMGOLD’s leaves a lot to be desired. As shown in the chart below, AISC margins sunk to just $195/oz in Q2 2022, declining from $378/oz in the year-ago period, despite a flat gold price. Given that we’ll likely see a weaker average realized gold price in H2 2022 (sub $1,800/oz), we could see further margin compression sequentially. On a full-year basis, and assuming IAMGOLD meets the low end of guidance ($1,670/oz), all-in sustaining cost margins are likely to come in below $150/oz, a significant deterioration from FY2021 levels ($364/oz). This leaves little room for margins on an all-in cost basis (typically at least 10% higher than AISC for producers).

IAMGOLD – All-in Sustaining Cost Margins (Company Filings, Author’s Chart)

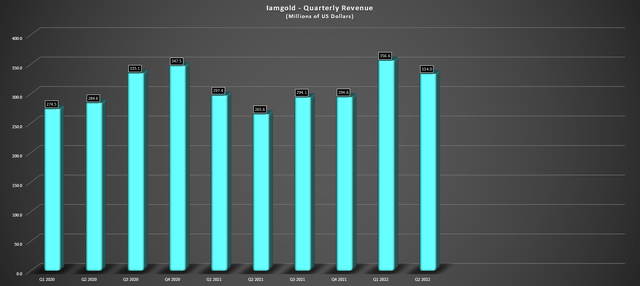

IAMGOLD’s revenue came in at $334 million, a significant improvement from $265.6 million in the year-ago period. This was related to an increase in gold sales volume, but similar to production, the company was up against very easy year-over-year comps. From a cash flow standpoint, mine-site free cash flow came in at $42.8 million, up from $1.9 million in the year-ago period. However, this figure was much lower than Q1 2022 due to the lower gold price, higher operating costs, and higher capex at Rosebel. Year-to-date, mine site free cash flow is sitting at $130.3 million. Still, no cash flow is being generated company-wide due to heavy capex spending at Cote ($70+ million per month).

IAMGOLD – Quarterly Revenue (Company Filings, Author’s Chart)

Given the lack of free cash flow generation on a company-wide basis, IAMGOLD’s cash balance slid to $453 million (Q1 2022: ~$525 million), and net debt increased to $225 million from $6.5 million in Q1 2022. The company has over $800 million in liquidity, but this won’t be nearly enough to fund its revised capex figure at Cote, which now sits close to $1.2 billion. Let’s take a closer look below:

Cote Project Construction

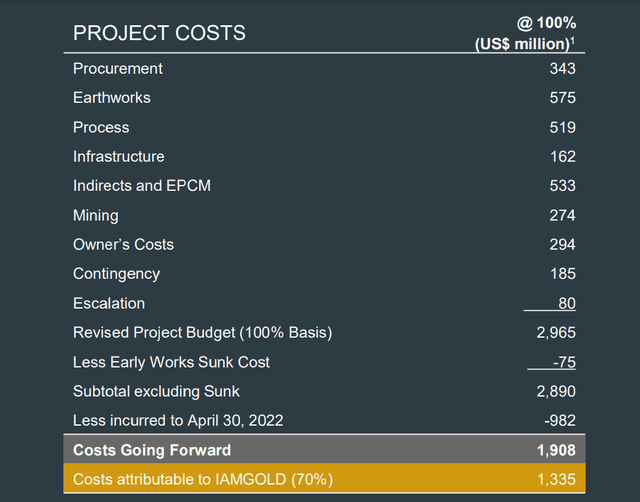

Concurrent with its Q2 results, IAMGOLD released another update on Cote, which overshadowed the better quarter at its operations. The updated attributable capex figure is just over $1.3 billion, which includes $185 million in contingency, a relatively high figure for a project that’s this advanced 7% complete, 99% engineering complete). This was similar to the estimate provided in May, but despite two months of spending on the project. IAMGOLD attributed some of the increase to the strike action by crane operators and construction laborers. While understandable, Equinox didn’t see nearly as much impact and hasn’t adjusted upfront capex even with this disruption (both projects in Ontario).

IAMGOLD Cote Project Capex (Company Presentation)

The good news is that even with these continued increases, the project is still robust, though there’s been a considerable degradation in the After-Tax NPV (5%). As it stands, After-Tax NPV (5%) at a $1,700/oz gold price assumption sits at $1,345 million or ~$870 million for IAMGOLD’s share in the project. Meanwhile, operating costs did creep up but are still below $900/oz over the life of mine. Overall, this is a negative update, but this will still be a massive low-cost mine with 300,000+ ounces coming to IAMGOLD between 2025-2030, assuming it operates the mine better than it’s done managing construction.

That said, the elephant in the room is the remaining capex bill. The reason is that IAMGOLD must fund $1.1+ billion in capex in a best-case scenario but had just $700 million in liquidity as it entered August. This means that after accounting for costs at other mines, and the fact that it must maintain a minimum cash balance of $200 million, its funding gap could come in above $600 million. The company noted that some options to fill this funding gap are as follows:

- Secured debt

- Unsecured debt/convertible notes

- Sale of common shares

- Asset sales (ex-Essakane)

As discussed, this has degraded the investment thesis, given that IAMGOLD’s operating or non-operating portfolio could be stripped down to fund this capex blowout. Let’s take a look at the valuation to see whether the stock is finally offering a low-risk buying opportunity:

Valuation

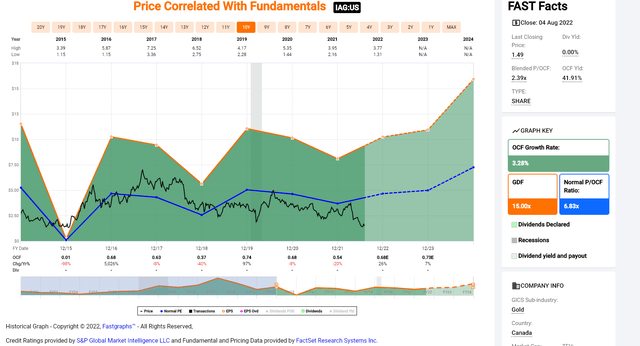

Based on ~484 million fully diluted shares and a share price of US$1.40, IAMGOLD trades at a market cap of less than $700 million, which is less than Cote’s estimated attributable NPV (5%) at a $1,700/oz gold price. Given that the company has a portfolio of exploration assets plus three other operating mines, this would suggest that the stock is a steal at current levels. The same is true from a cash flow standpoint, with FY2023 cash flow per share estimates sitting at $0.73 (IAMGOLD trades at ~2x cash flow). However, this does not factor in the considerable funding gap ($600+ million) to realize this cash flow at Cote, and it assumes zero share dilution.

As discussed in my prior article, I think it would be a mistake to assume zero equity dilution for a company in dire need of capital that wants to avoid stopping/starting construction (which can make things much more expensive). In fact, given the further capex increase since May and the decline in the share price (impact capital raised per share sold), I think it’s better to model a minimum of 30% share dilution or ~630 million shares fully diluted. Based on this assumption, IAMGOLD’s market cap increases to ~$882 million at US$1.40, and cash flow per share figures dive to $0.52 per share, leaving IAG trading at 2.70x cash flow.

IAMGOLD – Historical Cash Flow Multiple (FASTGraphs.com)

Although this is a massive discount to the peer group, I think this is mostly justified. The reason is that we have significant uncertainty about the current exploration portfolio that could be up for divestment and IAG has one of the weakest margin profiles in its peer group. So, even if we assume a fair multiple of 3.5x cash flow, in line with higher-cost peers like Equinox Gold but which have had much more success in their construction phase, fair value for IAMGOLD would come in at US$1.82 per share (3.5x FY2023 estimates of $0.52). I believe a 30% upside isn’t nearly enough to justify being long. Hence, I continue to see it as an Avoid.

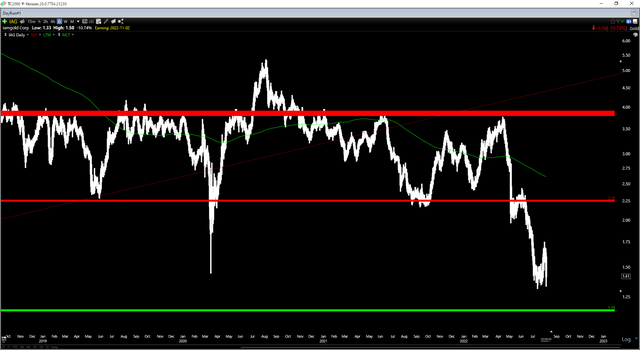

Technical Picture

Finally, looking at the technical picture, IAMGOLD has broken below critical support at US$2.25, which isn’t all that surprising given its poor management of Cote to date and continued margin compression. Often, major support levels become major resistance levels once broken, and I would now expect this to be a new ceiling for the stock. Meanwhile, with support no longer in place, IAMGOLD has no support until $1.15, more than 15% below current levels. So, investors looking at buying the stock today are working with a stock with funding uncertainty, the potential for significant equity dilution, and momentum that remains to the downside. This paints a bleak picture, suggesting the stock is best avoided.

Summary

IAMGOLD has had a decent year operationally and is on track to meet guidance. That said, the bar was set so low for FY2022 that it could be stepped over with ease, and even if IAMGOLD meets guidance, it will still have some of the weakest margins within its peer group. Unfortunately, this was overshadowed by the company staring down a considerable funding gap, creating additional uncertainty and less appetite for its shares at a time when it will likely need to raise additional capital through equity. The result is a stock that continues to be cheap for a reason, and I continue to see dozens of better ways to get exposure to gold, with IAG being one of the sector’s worst buy-the-dip candidates.

Be the first to comment