Win McNamee/Getty Images News

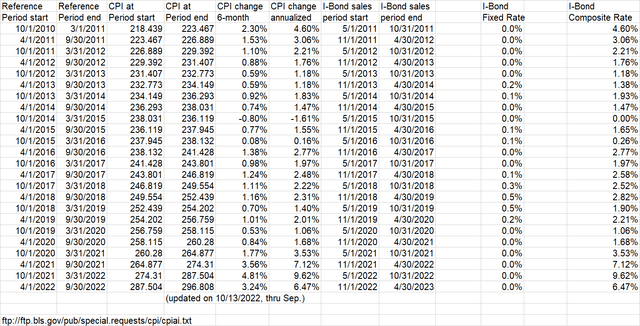

The Reset Is Coming

Series I savings bonds hardly need an introduction anymore since the high inflation of the past year has resulted in returns far exceeding other safe cash investments like Treasury Bills, CDs, and money market accounts. This relative outperformance has been available since May 2021 after my first I-Bond article, back when 3.53% was an attractive rate. Once higher inflation set in, rates on new bonds increased to 7.12% from 11/2021 to 4/2022, and 9.62% from 5/2022 to 10/2022.

Many articles on Seeking Alpha have discussed the specifics of I-Bonds this year, including my second article in April 2022. I won’t repeat all the details here, but these are the key points about the interest rates on I-Bonds:

- I-Bonds have a variable rate which changes every 6 months based on the change in CPI (consumer price index) over the most recent reference period. (either April to September or October to March) The initial rate on bonds sold changes on May 1 and November 1, but the variable rate paid on your bond doesn’t change until 6 months after your purchase and every 6 months thereafter no matter when you bought it.

- I-Bonds also have a fixed rate which adds to the variable rate. The fixed rate is announced by the Treasury department on May 1 and November 1 at the same time the initial variable rates reset. The fixed rate in effect when you buy your bond stays constant for the life of the bond.

- Interest is always credited on the first of the month, regardless of how late in the month you made your actual purchase.

Other details, including the annual purchase limits, tax treatment, and minimum holding periods are discussed in my other articles. The informational pages on TreasuryDirect also contain this information. The website has been updated in the last few months to make it more readable and user-friendly.

The latest CPI release has now set the initial variable rate at 6.47% on I-Bonds that will be sold from 11/1/2022 to 4/30/2023. Therefore, any investor who has not yet maxed out their purchases for calendar year 2022 should do so by the end of October to lock in the current 9.62% rate for 6 months. The TreasuryDirect website offers this helpful suggestion:

Complete the purchase of this bond in TreasuryDirect by October 28, 2022 to ensure issuance by October 31, 2022.

While the 6.47% rate is a step down from the current 9.62%, it still beats other safe cash investments. With compounding, bonds bought by the end of October will earn an average return of 8.21% in the first year.

(1+0.0962/2)*(1+0.0647/2) = 1.0821

With the possibility of inflation moderating later in 2023, I would strongly consider maxing out annual I-Bond purchases for 2023 by the end of January if you can, or the end of April at the very latest. That timing also allows investors to have their income tax refunds issued as paper I-Bonds up to $5000. The paper bonds are incremental to the $10,000 per Social Security number you can buy through TreasuryDirect. This will get you a still attractive 6.47% minimum return for the first 6 months, however there is also the possibility of a nonzero fixed rate on these bonds.

Thoughts On The Fixed Rate

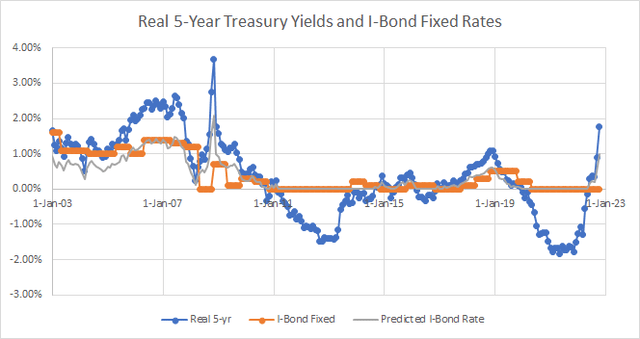

The fixed rate has been an afterthought in I-Bond discussions in recent years. Although it exceeded 3% from the introduction of I-Bonds in 1998 through 2001, it’s been below 1% since November 2010 with more than half of that time at zero. The Treasury Department does not disclose how it sets the fixed rate. I have read speculations that it depends on the real 5-year interest rate. Looking at historical data, the I-Bond fixed rate matched the real 5-year rate well through 2005 but has diverged since then.

Author Spreadsheet (Data Source: US Treasury)

We see that since 2005, when real rates got above 1%, the I-Bond fixed rate did not follow them higher. We have also had 2 significant periods of negative real rates since then, but I-Bond fixed rates by rule go no lower than zero. A regression analysis of the nonzero I-Bond fixed rates with real 5-year rates over this period predicts that the I-Bond rate would be around 0.56 times the real 5-year rate. Based on current real 5-year rates of around 1.78%, the fixed rate announced on November 1 would be as high as 1%.

Still, the fixed rate is officially at the discretion of the Treasury. They may very well decide that with the variable rate already far higher than the yield on competing cash investments and the current popularity of I-Bonds, there is no need to offer more than zero on the fixed rate to attract investors.

Whatever the Treasury decides, 6.47% is an attractive rate that should continue to draw investment in I-Bonds. Any fixed rate on top of that could incentivize investors to continue holding I-Bonds longer in the future if inflation declines. Remember that I-Bonds can be redeemed at any time after 1 year of holding. If redeemed before 5 years, the last 3 months of interest is forfeited.

Conclusion

Investors who have not yet maximized their purchase of I-Bonds in 2022 should consider doing so before the rate on new bonds changes on November 1. After that date, the variable rate on new I-Bonds drops to 6.47%. This is still much higher than alternative safe cash investments like money market savings accounts, CDs, and T-Bills, as long as you are comfortable locking your finds up for 1 year. New bonds sold after November 1 may also come with a nonzero fixed rate that stays constant for the life of the bond no matter what inflation does. 2023 will be another good year to maximize I-Bond purchases. Consider buying up to $10,000 per individual in January in TreasuryDirect and applying up to $5,000 of income tax refunds toward paper I-Bonds by the end of April.

Be the first to comment